What is Cost Accounting?

Cost accounting is a subset of managerial accounting, which includes recording, analyzing, and reporting the cost of production and analyzing cost structure.

Detailed cost information aids management in optimizing manufacturing processes and improving profit margins.

The cost accounting system is not just linked to costing methods; its scope also extends to financial accounting. Cost accounting incorporates standard accounting features, generating records and inputs for decision-making.

Cost accounting measures the cost related to the production of goods and services, thereby measuring the expenditure and income at the unit and aggregate levels.

A company’s internal management utilizes cost accounting reports to analyze cost structures and optimize production costs. Cost accounting gives inputs for cost volume profit analysis and break-even analysis.

Cost accounting is for the internal use of the company’s management. It is not a part of final statements, so they are not needed to comply withВ GAAPВ (Generally Accepted Accounting Principles) given by theВ Financial Accounting Standards BoardВ (FASB). Cost accounting assesses various types of costs, like direct costs, fixed costs, actual costs, etc., to comprehensively assess operational efficiency.

Detailed Explanation

Cost accounting looks at the costs and expenditures of every step of production, with the sole objective of cost efficiency and capability. It helps identify areas of weakness, eradicate them, and gain more profit with the same input.

Importance of Cost Accounting

Businesses adopt cost accounting because it gives a clear idea of expenditure. It also helps them understand if there is any sudden overcharging by the vendors by providing various statistical analyses and financial revelations.

Conducting cost accounting audits is not just an option for a business owner; it is crucial for a company’s survival. An Insights West survey revealed that cash flow management and cost-intensive issues are business owners’ biggest stress sources. A professional cost accounting report can help keep the finances, transactions, production costs, and unnecessary burdens in check.

Cost accounting helps a business in the following ways :

- Help Make Budget: Once a business knows the money distribution against each stage, it becomes easier to make a budget. The accountants can learn from past spending and allot future expenditures. Cost accounting tracks and estimates these costs for producing financial statements. It ensures that the business turns a profit instead of a loss.

- Increase Efficiency: The overall results will improve drastically by removing deficiencies in the system and streamlining the processes. If a machine working 10 hours doesn’t churn the desired results, a red flag is raised. Or, if a production stage requires only two laborers instead of 3, one can be removed.

Cost accounting is how you discover ways and solutions to cost-intensive problems. According to a study by Jessie Hagan, 82% of small businesses go down due to mismanaged cash flow.

- Higher Profits: The business will turn an evident profit by increasing efficiency. That is, producing the same output at a lower cost.

Quicker Decisions: The accounting method enables accountants to respond quickly to market changes and make decisions. Due to the rise in the cost of raw materials, the cost sheet will reflect it. The managers can then decide to replace or reduce it.

Cost Accounting Objectives

The main objective of cost accounting is to give the business a comprehensive overview of its overall costs. It evaluates the cost associated with producing and delivering. The cost is then broken down into specific products.

- Cost accounting analysis and reports help decide a selling price that generates revenue and is accessible to the maximum target buyers.

- It helps attain the organizational mission of reducing costs of labor, raw material, management, etc., while keeping up with the standards.

- Cost accounting systems facilitate the management’s decision-making regarding whether to manufacture or buy a component, whether it is worth spending on advanced and economical machines, etc.

- Regular cost accounting analyses keep a record of finances, which then helps with financial statements and official audits.

Cost Accounting vs. Financial Accounting Methods

| Category | Cost Accounting | Financial Accounting |

| Purpose | Analyzes cost to promote cost control and increase efficiency. | Records the business transactions. |

| End-user | Internal management | Stakeholders, investors, federal regulators (including tax agencies), creditors, and external analysts |

| Format | It can be customized according to the needs of the business and management’s regulations. | It needs to follow the accounting standards set by GAAP and IFRS. |

| Statement Periods | It can be conducted and released according to the business’s wishes. | At a particular time, usually at the end of the reporting period. |

| Objective | Works with cost-related data to allocate fair expenses. | Presents the true view of the business’s financials. |

Type of Costs

When producing and distributing products, you’ll deal with various costs. You must understand and implement them in the cost accounting calculations. They’re integral to drawing up a successful cost accounting report.

The cost classifications are:

Direct Costs

Costs related directly to specific goods, for example, consumables, commissions, freight charges, equipment and facilities, traveling, relocation and training, etc.

Indirect Costs

Costs are not directly linked to specific goods or services, for example, personnel, administrative, warehousing, overhead, procurement, IT, contracting, accounting, etc.

Operating Costs

Operating costs are associated with production. However, they aren’t directly part of the service or the product. These indirect costs can be electricity, heating, equipment, etc. The operating costs for manufacturing enterprises may include heavy machinery and transportation devices. While for businesses in the service industry, such as hair salons, it will be scissors, hairdryers, etc.

Fixed Costs

Fixed costs do not change and remain the same regardless of any change in production volume, for example, lease, rent, license fee, utility bills, etc.

Variable Costs

Variable cost change directly with the changes in the production volume. Some examples of variable costs are hourly wages, piece rate wages, cost of raw materials, etc.

Overhead Costs

Overhead costs are those expenses that are incurred to keep the business going. They are not directly related to the production of a product or service. Examples of overhead costs include rent, utility bills, insurance, selling expenses, etc.

Unit Cost

Unit cost is the amount the company spends in producing, storing, and selling a single unit of a product.

Total Cost

Total cost is the amount expended by the company in producing a certain quantity of output.

Elements of Cost Accounting

Three key elements come under cost accounting. They include:

Material

- Direct Materials: Directly used in the production process and are a part of the final product. These can include raw materials like cotton, plastic, steel, or wood.

- Indirect Materials: These are the overhead costs that weren’t directly a part of the product line. They are usually the tools, machines, gloves, cleaning supplies, etc. The indirect costs are not part of the cost sheet.

Labor

Labor includes people involved in the production or distribution of goods. Labour gets paid directly via wages or a salary-based system. Their overall income includes overtime, bonuses, benefits, etc.

Expenses/Overhead costs

These are the ongoing costs of the business. Expenses are not attributed to the goods and services. The overhead costs are:

- Production equipment like machinery (maintenance and replacement).

- Utilities (water, electricity, sewage).

- Payroll taxes.

- Fixed assets depreciation.

- Mortgage, rent.

- Interest payment.

Types of Cost Accounting

The best part of cost accounting is its flexibility. You can achieve the perfect combination for your business needs by combining different cost accounting methods.

The different types of cost accounting methods are:

Standard Costing

The standard costing method is a traditional way of tracking the costs of a business. Labor, raw materials, and overhead costs are taken evenly. Then, the average price is assigned to every element. Small companies usually use this standard cost accounting method as it is easy to understand and manage.

Activity-Based Costing

Activity-based costing method (ABC) works with the overhead costs incurred. It identifies and calculates the cost through activity and effort undertaken during production.

Consider a company that develops two types of rugs – machine and manual. A machine rug is entirely automated and takes less time, while the manual is time-consuming and requires more resources. ABC will allocate proportionate costs to both to avoid under or over-stating them.

Cost accounting accounts for variable and fixed costs and benefits big businesses with diverse products.

Lean Accounting

Lean accounting is a method that concentrates on eliminating useless resources. It tries to decrease costs and maximize profit at stages of production. It works on the philosophy of meeting customer demands instead of production goals. Lean accounting incorporates fixed and variable costs to deliver quality products that meet the pricing value.

Marginal Costing

Marginal costing adds the value of each additional unit during production to calculate the actual cost. That is the point at which the production is maximum while the costs are minimal. It is an essential tool for finding the optimal points.

Environmental Accounting

This cost accounting method raises social consciousness about the critical environmental conditions amongst the manufacturers. It factors in the costs of regulatory fines and environmental regulation costs.

Target Costing

Target costing is used by businesses that wish to gain constant profit and control costs. They research and evaluate the production costs before starting the process. It defines the maximum production amount a company should pay by subtracting the profit margin from the product price.

If the manufacturing cost exceeds the profit turnover, the project will be dropped. However, it’ll be continued if the cost accounting shows a positive incline. This method is best pursued during the planning or pre-production stage.

Life-cycle Costing

Life-cycle costing tracks the production cost of any product throughout its entire life. Its evaluation is spread across an extended period. This implies that life cycle accounting lasts more years than other accounting methods.

The life-cycle cost accounting is often used against manufacturing equipment. The machinery has acquisition, maintenance, repair, and depreciation costs. These expenses are added to the cost accounting of the product until it is finally disposed of.

Throughput Accounting

Throughput accounting helps eliminate all aspects that bring the company losses and help achieve its goals. It can include items on monetary and non-monetary factors. The cost accounting figures measure the required to resolve production issues and improve productivity.

Project Accounting

Project accounting’s primary focus is on calculating the financial transactions of a particular project. This includes its costs, bills, revenue, and raw materials. The prices are estimated at the beginning of the project, and additional charges are added later.

The initial estimation should culminate every project cost – materials, labor, equipment acquisition, review & cleanup, and dissemination.

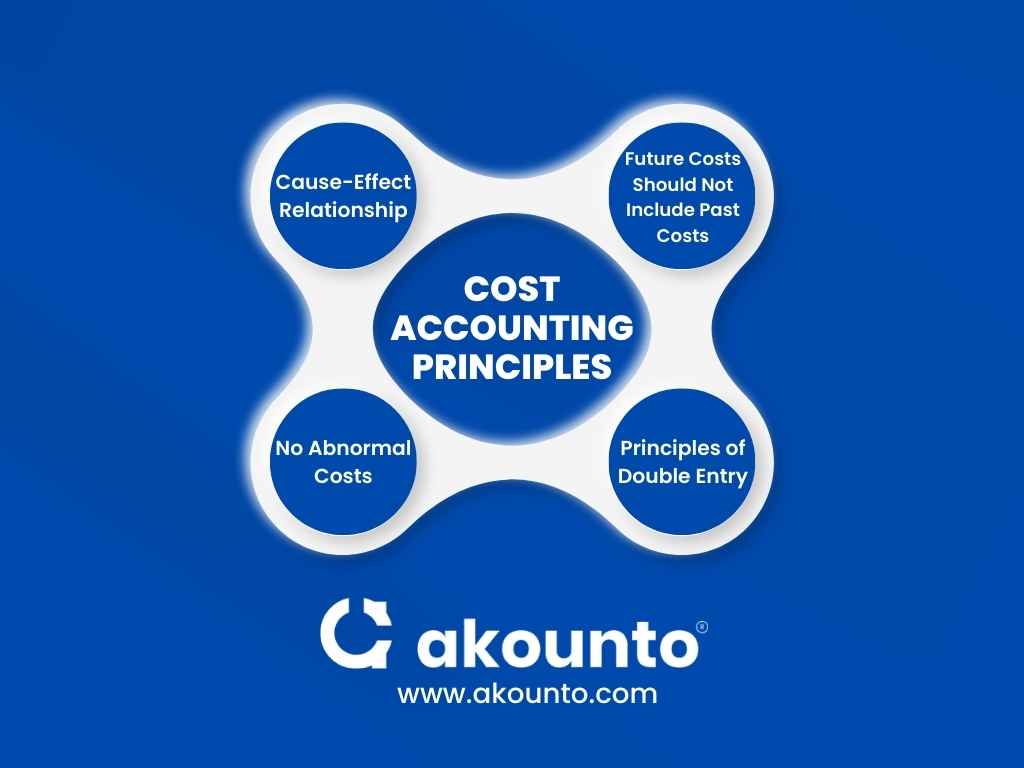

Cost Accounting Principles

The main principles of cost accounting are:

Cause-Effect Relationship

A cause-effect relationship should always exist between different items of cost. Every article should establish a minute relationship with its cause. Further, its effect should be reflected in various business departments.

Charge of Cost Only after its Incurrence

A cost should only be charged and made part of the cost sheet after it has been incurred. For example, the cost account should exclude packaging costs if it’s still in production.

Future Costs Should Not Include Past Costs

Future costs should not hold the past costs that weren’t recovered before. This ensures that the past statements remain intact and do not affect future production results.

No Abnormal Costs

Any abnormal costs (like theft and negligence) should not be computed in unit cost. If included, they’ll distort the actual prices of the unit. Hence, the business management into wrong decisions.

Principles of Double Entry

It is advised to use double entry principles to cost ledgers and control accounts. This helps keep cost sheets and statements used for cost ascertainment. It minimizes the chances of errors and faults.

Cost Accounting Formulas

Cost accounting includes several calculations and formulas to determine accurate information. You can use accounting software to complete this difficult task, leaving the management department to make decisions using this information.

Break-Even Formula

At the break-even point, the company’s sales overlap its total production costs (fixed and variable costs). The business can determine the product’s profit through this formula.

Formula:

Break even (in units) = Total Fixed Costs / Contribution Margin

Contribution Margin

The contribution margin can be understood as the difference between the per unit charge and the variable costs per unit. It calculates the incremental profit earned by each unit after subtracting the variable expenses.

Formula:

Contribution Margin = Sales Revenue – Variable Costs.

Target net income

A business with a set profit goal for an accounting year can determine its products’ required sales through target net income. It is, in other words, the amount of profit the business wishes to earn.

Formula:

Unit volume to achieve target net income = (fixed costs + target net income) / (contribution margin per unit).

Gross margin

Gross margin is used to calculate the amount business is left with. It deducts the cost of goods or services (COGS) from the net sales. The method helps in assessing production costs against sales revenue. A higher margin implies better sales and profits and vice versa.

Formula:

Gross margin = (net sales revenue – COGS) / net sales revenue.

Pre-tax dollars are needed for purchase.

The business purchases are made from an income already taxed and declared during the accounting year. Hence, the business must earn enough to cover the purchase cost and the income tax. The method helps calculate that amount.

Formula:

Pre-tax dollars needed for purchase = cost of the item / (1 – tax rate).

Price variance

A price variance formula is an essential tool for budgeting. It helps calculate the difference between the cost of a product or service and its actual cost. If the variance is positive, it is favorable; otherwise unfavorable.

Formula:

Price variance = (actual unit cost – standard unit cost) x number of items purchased.

Efficiency variance

Cost accounting calculates the efficiency variance of all inputs – material, labor, and overhead. They’re each calculated separately to determine operational effectiveness.

Formula:

- Material yield variance = (actual unit usage – budgeted unit usage) x budgeted cost per unit.

- Labor efficiency variance = (actual per-unit labor hours – budgeted per-unit labor hours) x budgeted hourly labor cost.

- Overhead efficiency variance = (actual per-unit labor hours – budgeted per-unit labor hours) x budgeted overhead rate per unit.

Variable overhead variance

This formula allows businesses to track the overhead expenses incurred and determine their profit. Variable overhead variance consists of two parts – efficiency and overhead expenses.

Formula:

Variable overhead efficiency variance = (actual labor hours – budgeted labor hours) x budgeted overhead labor rate.

Ending inventory

Ending inventory specifies the value of all finished goods that are a part of the inventory at the end of the accounting year. The stock may also include raw materials, labor, and overhead charges. All of them appear as current assets.

Formula:

Ending inventory = beginning inventory + net purchases – the cost of goods sold

History of Cost Accounting

Cost accounting has been used to keep transactional tracks and maximize profits. It was established due to western countries’ industrialization during the late 19th century. The rapidly growing factories required a method to maintain records to increase efficiency.

The establishment of cost accounting fulfilled this demand. Steel and railroad industries benefited greatly and became more efficient. They were able to manage their fixed and variable costs. By the 20th century, cost accounting was common in all big industries.

Examples of Cost Accounting

We’ll take an example of a small firm called “Atypical Industries.” They produce many goods with similar production costing. Their overhead costs are attached to the production cycle. Hence, they use the standard costing method.

Here’s their cost card:

| Cost category | $000s |

| Direct materials | 400 |

| Direct labor | 1,000 |

| Indirect materials | 100 |

| Overhead: | |

| Sales & Marketing | 100 |

| Non-production staff costs | 600 |

| Payroll taxes & pension contributions | 200 |

| Utilities | 100 |

| Premises costs | 450 |

| Depreciation | 100 |

| Interest cost | 50 |

| Total overhead | 1,600 |

| TOTAL COST | 3,100 |

Atypical Industries also wants to find its estimates’ accuracy. They can do so by calculating through variance analysis and comparing actual costs to budgeted costs.

| Cost category | Budget ($000s) | Actual ($000s) | Variance (%) |

| Direct materials | 500 | 400 | 20% |

| Direct labor | 1,000 | 1,000 | 0% |

| Indirect materials | 50 | 100 | -100% |

| Overhead: | |||

| Sales & Marketing | 150 | 100 | 33.3% |

| Non-production staff costs | 500 | 600 | -20% |

| Payroll taxes & pension contributions | 150 | 200 | -33.3% |

| Utilities | 100 | 100 | 0% |

| Premises costs | 450 | 450 | 0% |

| Depreciation | 100 | 100 | 0% |

| Interest cost | 50 | 50 | 0% |

| Total overhead | 1,500 | 1,600 | -6.66% |

| TOTAL COST | 3050 | 3,100 | -1.63% |

Atypical industries successfully saved money on direct materials. However, the overhead charges offset the saving. Through the production and sales data, we can understand where the company is affected by the cost change. The sales figures and other data are as follows:

| Product | Unit price ($) | No. produced | No. sold | Sales revenue ($000s) | Inventory ($000s) |

| Product A | 5.00 | 300,000 | 250,000 | 1,250 | 250 |

| Product B | 7.50 | 300,000 | 290,000 | 2,175 | 75 |

| Product C | 9.00 | 150,000 | 150,000 | 1,350 | 0 |

| Product D | 13.00 | 100,000 | 80,000 | 1,300 | 260 |

| TOTAL | 850,000 | 770,000 | 6,075 | 585 |

We can determine whether Atypical Industries is profitable by a simple cost formula.

Profit = sales – fixed and variable costs. In this case, Profit = $6,075,000 – $1,900,000 (actual variable cost) – $2,400,000 (actual fixed cost). This showcases a profit of $1,775,000.

Here is your shortcut to all the calculations!

Manually calculating all these variances and profits is tedious and time-consuming. You can save your organizational resources for policy making by investing in the best accounting software, Akounto.

Akounto is a one-stop destination for all accounting requirements of small businesses. Akounto’s highly versatile and intuitive accounting software will give you a gist of your business health, track taxes, and automate transactions.

Final Words

No matter the industry, cost accounting is an integral part of the business. It helps keep track of all the direct, operating, fixed, and variable costs. Further, it analyzes them to ensure smooth business practices.

The accounting method shouldn’t just be utilized as a tracking method. Its benefits can be extended to maximizing profit and eradicating any business holdback. For small businesses, especially, cost accounting might seem exhaustive, but its advantages exceed the initial investments.