What is a Balance Sheet?

A balance sheet is one of the crucial financial statements of a company that gives a snapshot of the company’s financial health at a specific point in time.

The balance sheet provides information about the company’s assets, liabilities, and equity, which are the resources the company has available to use, its obligations, and the residual interest that belongs to its owners.

A well-prepared balance sheet can be used to evaluate a company’s solvency, liquidity, and profitability. A balance sheet is an essential tool in financial reporting and decision-making.

One of the key benefits of the balance sheet is that it allows companies to evaluate their financial position relative to their competitors. By comparing their balance sheets to their peers, businesses can identify strengths and weaknesses and make informed decisions about future investments.

For example, if a company has a higher level of debt than its competitors, then it may be more vulnerable to economic downturns and may need to adjust its borrowing practices accordingly.

The balance sheet provides important information for internal decision-making. For example, a company’s management team may use the balance sheet to evaluate the effectiveness of its financial strategies and make adjustments as needed.

Investors use the balance sheet to evaluate a company’s financial performance and assess whether it is a good investment.

Lenders use the balance sheet to evaluate:

- How much financial risk is the company exposed to?

- How much cash is maintained to ensure working capital requirements?

- How much leverage is maintained from most liquid assets to total assets, so lenders can ensure that money will be paid back?

How Does It Work?

The balance sheet is arranged according to the balance sheet equation (accounting equation):

Assets = Liabilities + Shareholders’ Equity (for publicly traded companies) or

Assets = Liabilities + Owners’ Equity (for small businesses).

The formula is intuitive, as a business must fund its assets through borrowing (liabilities) or investor funding (equity).

A balance sheet should always balance, with assets equaling liabilities plus equity and equity equaling assets minus liabilities.

If a balance sheet does not balance, the document was prepared incorrectly. Errors can result from inaccurately entered transactions, inaccurate currency exchange rates, inaccurate stock levels, incorrectly calculated equity, incorrectly calculated depreciation, or amortization.

Incomplete or misplaced data can lead to inaccurate balance sheets and incorrectly entered transactions.

Balance sheets and other financial statements are read to analyze a comprehensive picture of the company’s finances. Other financial statements include:

- Cash flow statement

- Income statement

- Statement of Shareholders’ equity or Owner’s equity

Components of Balance Sheet

A balance sheet consists of three main components:

- Assets

- Liabilities, and

- Equity

Each component plays a vital role in presenting the financial position of a business at a specific point in time.

Assets

The assets on the company’s balance sheet include everything the business owns, such as cash, property, and equipment. Assets are divided into two categories: current assets and non-current assets.

- Current Assets: These are short-term assets that are easily cash convertible, sold, or consumed within one accounting year. Examples of current assets (liquid assets) include cash accounts, accounts receivable, inventory, and prepaid expenses.

- Non-current Assets: These are not converted into cash or consumed within a year or the operating cycle. Examples of non-current assets include property, plant, and equipment (PP&E), long-term investments, doubtful accounts, and intangible assets like patents, copyrights, and other intellectual property.

Liabilities

Liabilities represent the financial obligations and debts that a company owes to others. Like assets, the company’s liabilities are also categorized into current and non-current liabilities.

- Current Liabilities: These are short-term obligations expected to be settled within a year or the company’s operating cycle, whichever is longer. Examples of current liabilities include short-term loans, accounts payable, and accrued expenses.

- Non-current Liabilities: These are long-term liabilities or obligations that are not settled within a year or the operating cycle. Examples of non-current liabilities include long-term debt, bonds payable, and deferred tax liabilities.

Equity

Equity, also referred to as shareholders’ equity or owners’ equity, represents the residual interest in the company’s assets after deducting liabilities.

Equity is the portion of the total assets belonging to its owners or shareholders; in the balance sheet equation, shareholder equity always equals assets minus liabilities.

Equity is primarily composed of two elements:

- Capital Stock: This represents the initial investment made by the company’s owners or shareholders in exchange for company shares. Capital stock may include common stock and preferred stock.

- Retained Earnings: These are the accumulated profits that the company has earned over time, which have not been distributed as dividends to shareholders. Retained earnings are used to reinvest in the company or pay off debt.

Balance Sheet Format

The SEC and IRS do not specifically require a vertical or horizontal format for the balance sheet. Both forms can be used as long as the balance sheet clearly and accurately represents the company’s financial position and complies with the relevant accounting standards.

As per prevailing industry practice, the vertical format is used for reporting and filing and also issued as information for investor relations. The horizontal layout is used in academic circles and in-house management.

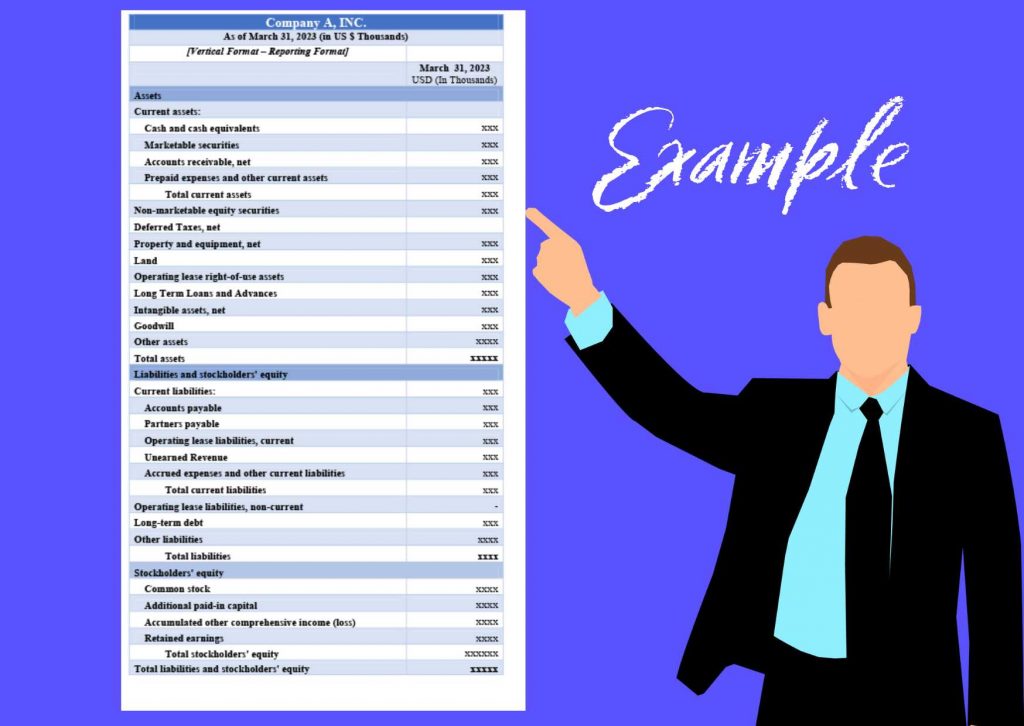

The vertical format, also known as the report format or the account form, is more commonly used. It presents the assets, liabilities, and equity in a single column, making it easier to read and understand. This format is particularly popular among small and medium-sized businesses and in computer-generated financial statements.

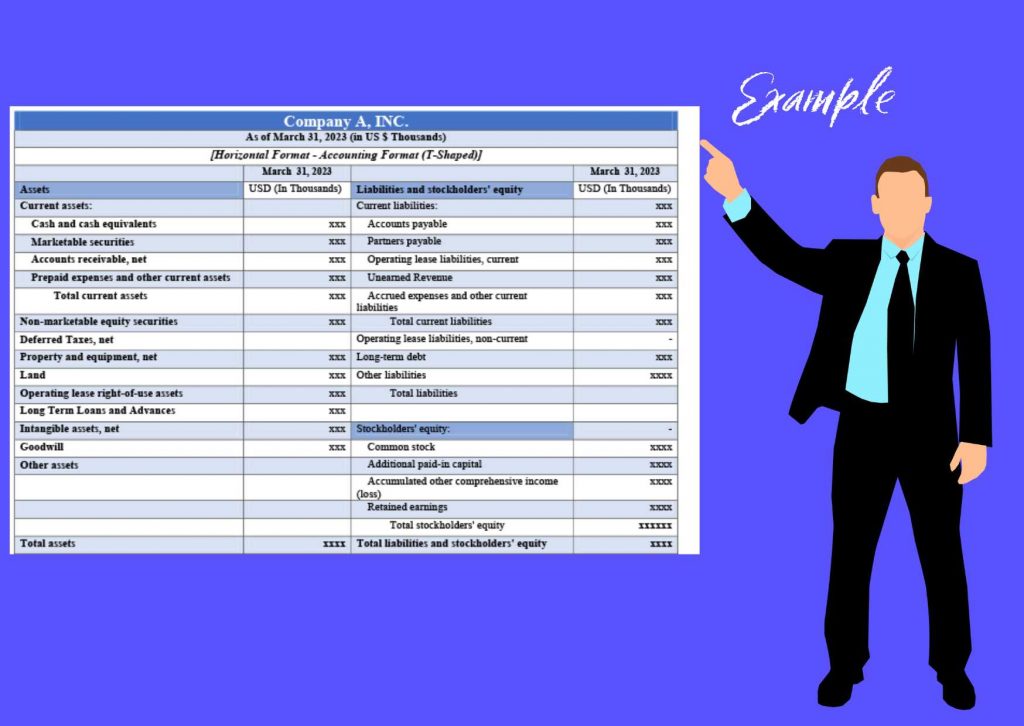

The horizontal format, also known as the T-account format, presents the assets on the left side, while the liabilities and equity on the right side, resembling a T-shape. This format is more traditional and often used in manual bookkeeping systems or for educational purposes to illustrate the accounting equation (Assets = Liabilities + Equity).

Vertical Format Balance Sheet Example

Horizontal Format Balance Sheet Example

Balance Sheet Guidelines

The United States has no single prescribed format for a balance sheet. However, U.S. companies must follow the Generally Accepted Accounting Principles (GAAP) when preparing their financial statements, including balance sheets.

Financial Accounting Standards Board (FASB) guides the presentation and disclosure of financial information, including the balance sheet. FASB’s Accounting Standards Codification (ASC) outlines the requirements for presenting financial statements, including the balance sheet.

Most companies in the U.S. follow a standard format (vertical) for their balance sheets, including listing assets in order of liquidity, liabilities in order of maturity, and equity last. Companies must provide sufficient disclosures to ensure the information presented is complete, accurate, and compliant with relevant accounting standards.

ASC 210, Balance Sheet, includes two subtopics that guide the presentation and classification of current assets and liabilities, as well as certain contracts and repurchase agreements, including collateralized borrowings.

In the U.S., companies follow the Generally Accepted Accounting Principles (GAAP) set forth by Financial Accounting Standards Board (FASB) and the International Financial Reporting Standards (IFRS) when preparing their balance sheets.

Under GAAP, companies list their assets in decreasing order of liquidity, with current assets appearing before non-current assets. The most liquid assets are listed first. At the same time, IFRS mandates companies to report their assets in increasing order of liquidity.

GAAP and IFRS require companies to list their liabilities and equity in a specific order, with current liabilities first, followed by non-current liabilities, and equity last.

GAAP and IFRS guide the recognition and measurement of assets and liabilities, including how to value inventory or account for long-term debt. They also require companies to disclose their accounting policies, related party transactions, and contingency provisions.

Steps to Prepare a Basic Balance Sheet

- First, determine the reporting date and period. It is the date that the balance sheet will represent; it is typically the last day of the accounting period.

- Next, identify your assets as of that date. Assets are typically categorized into current and non-current assets. For example, cash and cash equivalents, marketable securities, property, and intangible assets.

- After identifying assets, identify your liabilities. Liabilities are also categorized into current and non-current, including accounts payable, accrued expenses, and long-term debt.

- The final step is to calculate shareholders’ equity. This balance sheet section includes common shares, preferred shares, treasury stock, and retained earnings.

- To ensure the balance sheet is balanced, add the total liabilities to the total shareholders’ equity, and compare the sum to the total assets. If the two numbers are equal, then the balance sheet is balanced.

Even if some or all of the process is automated using an accounting system or software, understanding how a balance sheet is prepared is important. It will enable you to spot potential errors so that they can be resolved before they cause lasting damage.

Frequency of Preparing Balance Sheets

Per the company’s accounting practices and regulatory requirements, balance sheets are generally prepared at the end of every accounting period, whether monthly, quarterly, or annually.

Larger companies with more complex financial operations may prepare balance sheets more frequently, perhaps monthly or quarterly, to ensure they have current financial information.

The frequency of balance sheet preparation may also vary depending on internal reporting needs, such as for management or board meetings and external regulatory requirements.

Public companies, in particular, usually prepare their balance sheet reports quarterly, with the reporting date typically falling on the quarter’s final day. Businesses operating on a calendar year can prepare balance sheets on the 31st of March; the 30th of June; the 30th of September, and the 31st of December.

Companies that report annually may select any date they prefer as their reporting date, although many opt for the 31st of December.

Limitations of a Balance Sheet

- Historical outlook: The balance sheet is an important financial statement prepared at a specific point to reflect the financial position of a business and does not reflect the company’s financial performance over time.

- Not exhaustive: The balance sheet reports the value of a company’s total assets. Other factors like accounting systems, policies, and standards are discretionary decisions that can lead to net asset misreporting, the current portion of accumulated depreciation, etc.

- Not current valuation: The balance sheet values a company’s assets based on historical costs or estimated market values, which may not reflect the true value of the assets, as they may have appreciated or depreciated since their acquisition.

- Not forward-looking: The balance sheet does not provide information on a company’s cash flows or prospects, limiting its usefulness in evaluating its financial health.

- Limited Scope: The balance sheet may not include contingent liabilities or off-balance sheet items, leading to an incomplete picture of a company’s debt obligations and financial risk.

- Assumptions: The balance sheet relies on assumptions and estimates, such as an asset’s useful life or the accounts receivable collectability, which may not always be accurate.

- Lack of comparability: The balance sheets of different companies may not be directly comparable, as they may use other accounting methods or have different levels of disclosure.

- Risk of window dressing: Companies may artificially manipulate their balance sheets to improve their financial position through creative accounting or off-balance sheet financing, making it difficult to accurately evaluate a company’s health.

Conclusion

The balance sheet provides an overall picture of a company’s financial situation at a specific date. By breaking down a business’s assets, liabilities, and equity, a balance sheet helps analysts and investors better understand how the company generates and manages cash flow and testifies to the accuracy of the accounting system.

The balance sheet serves as a focal point during external audits, as auditors meticulously examine its accuracy and reliability to ensure compliance with accounting standards and financial reporting regulations.

Use powerful accounting software from Akounto and experience a host of features that are helpful in recordkeeping and make accounting hassle-free.