Double-entry bookkeeping records all financial transactions in at least two different accounts to ensure the accuracy and completeness of financial records.

The double-entry accounting system is a cornerstone of modern accounting practices, which was developed in the 15th Century by Luca Pacioli (Italian mathematician). The double-entry system has become a standard of accounting used globally.

The modern record-keeping system emphasizes providing clear, accurate financial records for informed decision-making. The interpretation and analysis of financial records by various stakeholders demand a very integral, error-proof, and methodical bookkeeping and accounting system, i.e., a double-entry system.

The double entry bookkeeping works around an accounting equation written as:

Assets = Liabilities + Equity

The transactions are recorded twice as debit and credit entries to keep the accounting equation balanced.

The systematic recording under the double-entry accounting system ensures that errors are highlighted at the stage of recording transactions. Any discrepancy, misreporting, errors of commission, and omission will be highlighted as the total of debits and credits will not match.

A small business can utilize modern accounting with digital technology and implement powerful accounting software where data is recorded, synthesized, sorted, and presented understandably. The various tools for data analysis and presentation empower decision-making.

Principles of Double Entry Bookkeeping

The Accounting Equation

The accounting equation represents the relationship between assets, liabilities, and equities in an equation form which is written as:

Assets = Liabilities + Equity

The above equation stands true and balanced for all a company’s ledger accounts, including its balance sheet.

Debits and Credits

The double-entry method records a business transaction twice using debit and credit entries, ensuring that the accounting equation remains balanced.

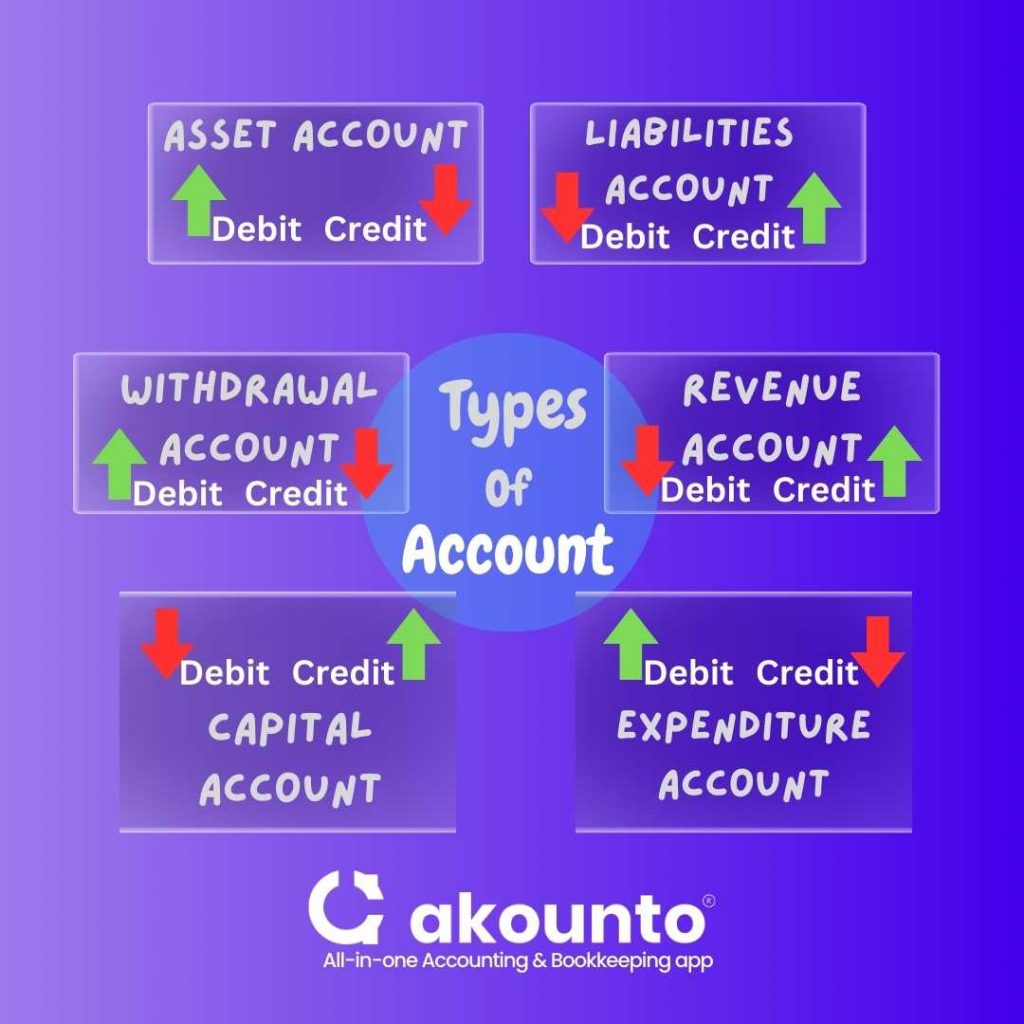

First, all the business transactions are classified into the following accounts:

- Asset account

- Liabilities account

- Revenue account

- Expenditure account

- Capital account

- Withdrawal account

There are rules for debit and credit for account types, for example:

- When asset accounts increase, the debit entry increases, and when asset accounts decrease, the credit entry is done to decrease it. The asset accounts have a debit balance.

- A similar treatment is for expenditure and withdrawal accounts.

- When liability accounts increase, the credit entry increases, and when liability accounts decrease, the debit entry is done to decrease it. The liability accounts have a credit balance.

- A similar treatment is for revenue accounts and capital accounts.

Read about “journal entries” to learn and implement these rules.

Rules of debit and credit are also used in doing ledger entries and making t-shaped accounts.

Chart of Accounts and Double Entry Bookkeeping

The chart of accounts (COA) is an essential component of the double-entry bookkeeping system. It is a list of accounts that a company uses to record transactions. Each account represents a category of transactions such as income, expense, asset, liability, or equity.

A well-organized COA makes it easier to prepare financial statements and analyze a company’s financial position.

Examples of Double Entry Bookkeeping

Pass the journal accounting entries:

- Purchase of furniture worth $ 20,000 with cash payment.

- A Bank loan received for $ 75,000 was deposited in the bank.

- Sale of goods for $ 10,000 and cash received and deposited in checking account.

- Sale of land for $ 175,000 and money received in bank.

- Taxes paid from a bank account for $ 8,500

|

Date |

Particulars |

Amount ($) |

|

|

Year |

|

Debit |

Credit |

|

1 Month |

Furniture Account |

20,000 |

|

|

|

To Cash Account |

|

20,000 |

|

|

(Being furniture purchased and full payment made in cash for $ 20,000) |

|

|

|

|

|

|

|

|

2 Month |

Bank (Checking Account) Account |

75,000 |

|

|

|

To Bank Loan Account |

|

75,000 |

|

|

(Bank loan worth $75,000 received and deposited in checking account) |

|

|

|

|

|

|

|

|

3 Month |

Cash Account |

10,000 |

|

|

|

To Sales Account |

|

10,000 |

|

|

(Inventory worth $ 10,000 for cash) |

|

|

|

|

|

|

|

|

4 Month |

Bank Account |

175,000 |

|

|

|

To Land Account |

|

175,000 |

|

|

(Proceeds from the sale of land) |

|

|

|

|

|

|

|

|

5 Month |

Income Tax Expense Account |

8,500 |

|

|

|

To Bank Account |

|

8,500 |

|

|

(Being tax paid for the year) |

|

|

|

|

|

|

|

|

Total |

288,500 |

288,500 |

|

Advantages

- Helps maintain accuracy: By requiring every transaction to be recorded with two entries, one debit, and one credit, the double-entry bookkeeping system ensures that every financial transaction is accurately recorded, preventing errors or misstatements.

- Supports the accounting equation: Double-entry accounting follows the accounting equation of assets = liabilities + equity, helping maintain the balance of the company’s balance sheet.

- Facilitates better decision-making: With accurate financial records generated by the system, businesses can make better decisions based on actual financial information rather than guesswork or assumptions.

- Provides insight into the company’s financial health: The system generates financial statements, including the balance sheet, income statement, and cash flow statement, which provide a true picture of the business’s financial health.

- Helps track income and expenses: By categorizing transactions into income accounts and expense accounts, the system enables businesses to keep track of their income and expenses, which helps with budgeting and forecasting.

- Helps manage bank loans and liabilities: Double-entry bookkeeping system allows companies to keep track of their bank loans and liability accounts, ensuring that payments are made on time and preventing late fees or penalties.

- Useful for small business owners: Double-entry bookkeeping system is useful for small business owners who need to keep accurate financial records to track their cash flow and ensure that their business owes are being paid on time.

- Simplifies the Audit Process: The double-entry bookkeeping system provides a clear audit trail for auditors to review and verify financial records.

- Scalability: The double-entry system can easily accommodate the growth and expansion of a business. As new transactions, accounts, and financial activities arise, the system can adapt to handle increased complexity, ensuring accurate and reliable financial record-keeping.

- Compatibility with Accounting Software: Most accounting software solutions are designed to work with double-entry accounting, streamlining the accounting process and reducing the likelihood of errors. The compatibility enables businesses to automate many aspects of their accounting, saving time and resources while improving accuracy and efficiency.

Double Entry Bookkeeping and Financial Reporting

Usually, the data entry in a bookkeeping system begins with journal entries. A financial transaction is classified under various heads, including asset and expense accounts, revenue, liabilities, etc. A transaction entry and its corresponding and opposite entries are made.

Business transactions are recorded in the general ledger using the double-entry bookkeeping system. Transactions are classified into account categories, ensuring the financial data is systematically organized.

The next step after recording journal entries is to ensure the accuracy of the recording, which is done by preparing a trial balance. The trial balance lists all the applicable accounts from the charts of accounts and verifies that all debits and credits are equal. Otherwise, the accounting equation will not balance, and the double-entry accounting system will highlight errors at the primary stage.

Financial reporting aids in decision-making by ensuring that the process of generating financial statements is reliable, dependable, accurate, and can track errors.

The double-entry accounting method can deliver accurate and reliable financial accounts, ensuring that each entry must be recorded in at least two accounts so that any mismatch can highlight errors during account closures.

Mathematical errors can be identified and corrected when the total debits and credit do not match.

Choosing between Single and Double-entry Accounting

The single-entry system, which records transactions only once, is simpler than the double-entry system and is commonly used by small businesses with fewer transactions. The single-entry method tracks cash inflows and outflows in a cash book or accounting software program.

The choice of single and double-entry accounting depends on the complexity of the business transactions and the financial reporting requirements.

The IASB (International Accounting Standards Board) and FASB (Financial Accounting Standards Board) require double-entry accounting as a fundamental principle in financial reporting. The FASB, a private-sector organization, holds the SEC-granted authority to establish financial reporting standards that apply to corporations. Its advisory council, FASAC, guides on issues influencing GAAP regulations.

Conclusion

Double-entry accounting has several advantages, including detecting errors and providing a complete financial picture of a business. As a small business grows, double-entry bookkeeping becomes quintessential due to the scale and complexity of transactions and is also recommended by regulatory bodies.

A modern accounting system is supported by cloud-based accounting software like Akounto, where a business owner can choose between double or single-entry bookkeeping and switch easily. Visit our website to know more.