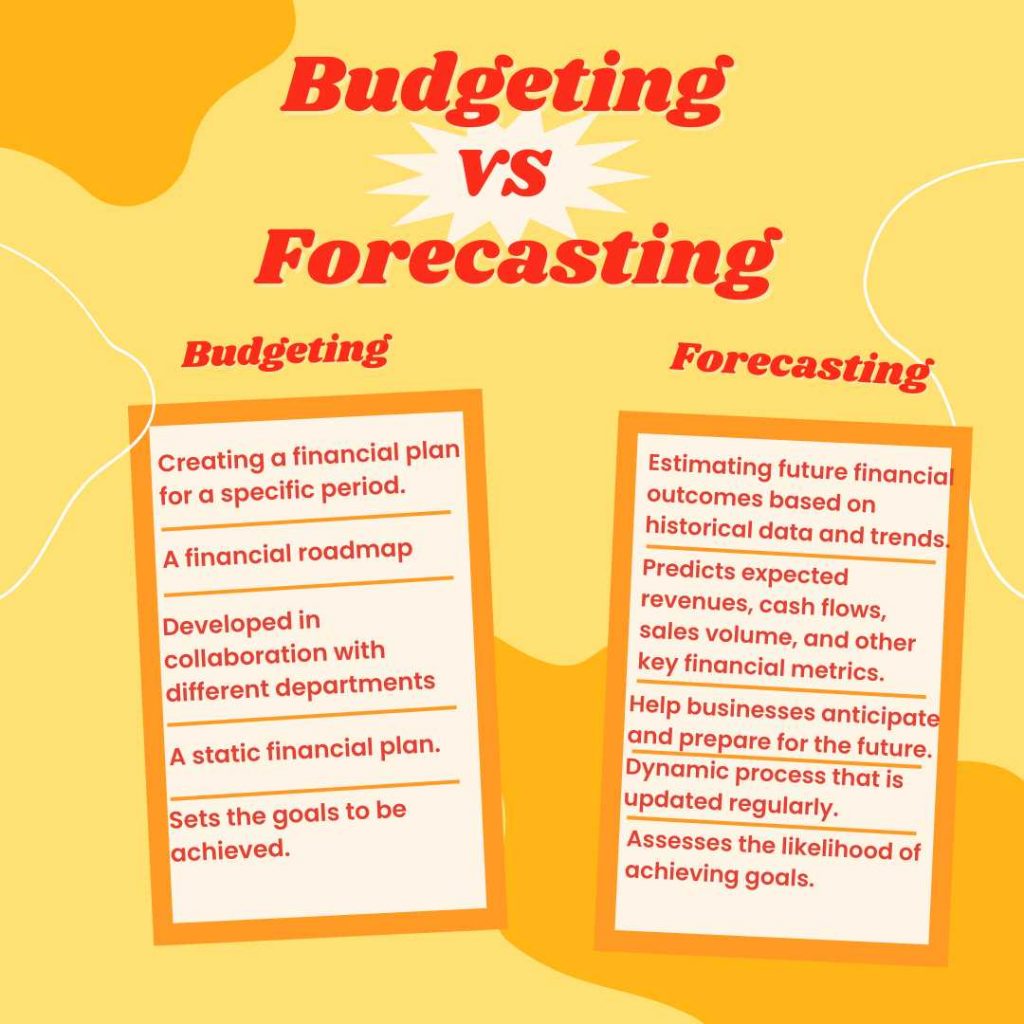

Budgeting refers to creating a financial plan for a specific period, while forecasting includes estimating future financial outcomes based on historical data and trends.

Defining Budgeting and Forecasting

Budgeting and forecasting are crucial financial management processes that help businesses strategize, allocate resources, and evaluate their financial well-being. While interconnected, these processes have distinct purposes and employ different methodologies.

Budgeting

Budgeting involves creating a comprehensive financial plan for a particular fiscal year period. This plan outlines the company’s expected income, expenses, cash flow, and financial performance, relying on past data and trend lines.

The budget serves as a financial roadmap, guiding the company’s financial decisions and helping it achieve its financial goals. The process entails setting targets for various expense line items, such as salaries, marketing, and inventory expenses.

Budgeting is usually developed in collaboration with different departments within the organization.

Forecasting

Forecasting includes estimating future financial outcomes based on past trends, current data, and market conditions. Unlike budgeting, which is a static financial plan, forecasting is a more dynamic process that is updated regularly to consider changes in the business environment.

Financial forecasting predicts expected revenues, cash flows, sales volume, and other key financial metrics. These predictions help businesses anticipate and prepare for future challenges and opportunities.

While a budget focuses on setting financial goals and allocating resources, a financial forecast assesses the likelihood of achieving those goals and identifying potential risks and uncertainties.

Importance of Budgeting vs Forecasting in Financial Planning

Budgeting and forecasting are vital components of financial planning, enabling businesses to manage their resources and achieve their financial goals effectively.

Though each process serves a different purpose, their combined use can help companies maintain a strong financial position, adapt to market conditions, and ensure long-term success. Some of the key aspects are:

Achieving Financial Goals

By creating a detailed financial plan based on past data, previous experience and knowledge, statistical models, and defined outcomes, budgets provide a foundation for businesses to set realistic financial targets.

A financial forecast helps the management team anticipate future revenues, expenses, and cash flows, thus allowing business owners to gauge the likelihood of reaching their goals.

The combination of budgeting and financial forecasting enables businesses to make informed decisions, allocate resources efficiently, and adjust strategies as needed. By analyzing previous budgets and utilizing cash flow forecasts, companies can work towards their financial objectives and better position themselves for long-term success.

Informed Decision-Making

Informed decision-making is a vital aspect of the importance of budgeting and forecasting in achieving long-term goals.

Budget outlines, based on past data, help set expectations for a company’s financial performance over a specific period. These detailed financial plans guide businesses in allocating resources and prioritizing initiatives, laying a strong foundation for their business plan.

Financial forecasts, on the other hand, predict future results by analyzing past trends, current data, and market conditions. This forward-looking approach provides valuable insights into potential revenues, expenses, and cash flows, enabling business owners and management teams to make well-informed decisions.

Adaptability

Financial planning involves anticipating changes in business conditions and adjusting strategies accordingly. By budgeting and forecasting, businesses can better adapt to new market opportunities, respond to economic conditions, and manage risks associated with variable costs, sales volume, and other factors.

Resource Allocation

Budgeting and forecasting assist businesses in determining how to distribute their financial resources. By creating a budget that outlines expected cash flow and financial performance, companies can allocate funds to the most pressing needs, such as marketing efforts, inventory levels, or hiring new employees.

Performance Monitoring and Variance Analysis

Budgeting and financial forecasting processes enable companies to compare actual results with their budgeted or forecasted figures.

This comparison, called variance analysis, helps businesses identify areas where they are underperforming, allowing them to take immediate action and adjust their strategies to improve their financial position.

Strategic Planning

Budgeting and financial forecasting play a critical role in developing strategic plans. Through these processes, businesses can gain a comprehensive understanding of their financial situation, set revenue expectations, and establish a foundation for future budgets, ensuring the alignment of their financial plan with their overall business goals.

What comes first? Budgeting or Forecasting

The sequence of budgeting and forecasting can vary depending on the organization’s preference, industry, and specific circumstances.

When Budgeting Comes First?

Small businesses might begin with the budgeting process involving creating a detailed financial plan based on assumptions, expectations, and legacy data. A budget can serve as a financial roadmap by outlining the company’s expected income, expenses, cash flow, and financial performance for a specific period.

Once the budget is established, financial forecasting can predict future financial outcomes, helping the company assess the likelihood of achieving its budgetary goals and make necessary adjustments.

When Forecasting Comes First?

Some organizations may prefer to start with the financial forecasting process. By examining past trends, current data, and market conditions, businesses can develop a forecast that predicts expected revenues, cash flows, sales volume, and other key financial metrics.

With this information, the company can create a budget that reflects these forecasts, setting realistic financial goals and allocating resources accordingly.

Ultimately, the decision of which process to initiate first will depend on each organization’s specific needs and priorities. Some companies may find it beneficial to begin with budgeting, while others may prefer to start with forecasting.

Regardless of the chosen order, it is essential to regularly review and update the budget and forecast to ensure accuracy and relevancy to the ever-changing business environment.

Different Approaches

Below is a table comparing the key aspects of budgeting and forecasting, highlighting their differences in purpose, scope, and methodology.

|

В В В В В В В В В В В В В В В В В В В В В В В В В В В В В В В В В В В В В В В В В В Budgeting vs Forecasting |

||

|---|---|---|

|

Aspect |

Budgeting |

Forecasting |

|

Purpose |

To create a financial plan outlining expected income, expenses, and cash flow for a given period |

To predict future financial outcomes based on past trends, current data, and market conditions |

|

Scope |

Covers a fixed period, usually a fiscal year |

Can cover short-term or long-term periods, depending on the organization’s needs |

|

Methodology |

Uses historical data and management assumptions to set financial targets |

Analyzes past trends, current data, and market conditions to make predictions about future financial performance |

|

Flexibility |

Typically static, with adjustments made periodically |

Dynamic and updated regularly to reflect changes in the business environment |

|

Key Components |

Income, expenses, cash flow, financial performance |

Expected revenues, cash flows, sales volume, key financial metrics |

|

Focus |

Setting financial goals and allocating resources |

Assessing the likelihood of achieving financial goals and identifying potential risks and uncertainties |

|

Implementation |

Developed in collaboration with different departments within the organization |

Often performed by finance teams, with input from various departments |

|

Outcome |

Provides a financial roadmap for the company |

Helps businesses anticipate and prepare for future challenges and opportunities |

10 Key Differences

1. Purpose

Budgeting is focused on creating a detailed financial plan for a specific period, usually a fiscal year. This plan outlines the company’s expected income, expenses, cash flow, and financial performance.

Forecasting is centered on predicting future financial outcomes, such as revenues, cash flows, and key financial metrics, based on past trends, current data, and market conditions.

2. Time Horizon

Budgeting typically covers a fixed period, often coinciding with the company’s fiscal year. Once established, budgets are periodically reviewed and adjusted.

Forecasting can cover short-term and long-term periods, depending on an organization’s requirements, and is updated more frequently to account for changes in the business environment.

3. Methodology and Detailing

Budgeting relies on past data, expected outcomes, and fixed assumptions to set financial targets and allocate resources. It involves collaboration between different departments within the organization.

Forecasting uses past trends, current data, and market conditions to predict future financial performance. While finance teams often lead the forecasting process, input from various departments is still crucial.

4. Flexibility

Budgeting is generally more static, with adjustments made periodically throughout the fiscal year.

Forecasting is a dynamic process updated regularly to reflect changing variables in the business environment, market conditions, and other influencing factors.

5. Focus

Budgeting emphasizes setting financial goals and allocating resources to different expense categories, ensuring efficient use of funds to achieve objectives.

Forecasting is concerned with assessing the likelihood of achieving those goals, identifying potential risks and uncertainties, and helping businesses prepare for future challenges and opportunities.

6. Performance Monitoring

Budgeting provides a baseline for tracking a company’s financial performance throughout the budgeted period. Comparing actual results to the budget helps identify areas of underperformance and prompts corrective action.

Forecasting is an ongoing assessment tool allowing businesses to adjust their strategies and expectations as new information and trends emerge. This ongoing evaluation helps companies remain agile and responsive to changing circumstances.

7. Financial Control

Budgeting allows businesses to exert financial control by setting spending limits for various expense categories and monitoring actual expenditures against the budget.

There are no direct financial controls in a financial forecast, but it helps companies anticipate and prepare for potential financial fluctuations and risks.

8. Decision-Making

Budgeting is essential for strategic decision-making, as it helps allocate resources to different business activities and set financial priorities.

Financial forecasting, on the other hand, supports decision-making by providing insights into potential future outcomes, enabling management to identify trends, risks, and opportunities.

9. Scope

The scope of budgeting is typically limited to the financial aspects of a business, including income, expenses, and cash flow.

In contrast, financial forecasting can extend beyond financial considerations, encompassing aspects such as sales volume, market trends, and competitive landscape, depending on the specific focus of the forecast.

10. Adjustments

Budgets are generally prepared for a specific period and may undergo occasional revisions based on changing circumstances or the company’s performance.

Forecasts are inherently adaptive and updated regularly to account for new information, market developments, and other factors that influence the business environment.

Benefits of Budgeting and Forecasting

- Financial Goal Setting: Budgeting and forecasting help businesses set realistic financial goals, allocate resources effectively, and work towards achieving these objectives.

- Informed Decision-Making: These processes provide valuable insights into the company’s financial direction, allowing management to make informed decisions based on existing data, past trends, and expected performance.

- Adaptability: Budgeting and forecasting enable businesses to adapt to new market opportunities, respond to economic conditions, and manage risks associated with variable costs, sales volume, and other factors.

- Resource Allocation: Effective budgeting and forecasting assist businesses in determining how to distribute their financial resources efficiently, ensuring that funds are allocated to the most pressing needs.

- Performance Monitoring and Variance Analysis: By comparing actual results to budgeted or forecasted figures, businesses can identify areas of underperformance and take immediate action to adjust their strategies and improve their financial position.

- Strategic Planning: These processes are critical in developing strategic plans, helping businesses align their financial plans with overall business goals, and ensuring a strong foundation for future budgets.

Limitations of Budgeting and Forecasting

- Uncertainty: Both budgeting and financial forecasting are subject to uncertainty, as they rely on assumptions, previous data, and market conditions that may change, potentially affecting the accuracy of financial plans.

- Time-Consuming Process: Preparing budgets and forecasts can be time-consuming, as it requires a thorough analysis of past trends, current data, and various business factors, which may divert management’s focus from other critical tasks.

- Rigidity: Traditional budgeting can be rigid, with fixed spending limits that may not adapt quickly to changing business conditions, making it difficult for businesses to respond to unforeseen challenges or opportunities.

- Potential for Bias: The budgeting and forecasting processes may be biased or inaccurate, especially if the assumptions are overly optimistic or pessimistic, leading to unrealistic expectations and poor decision-making.

- Short-term Focus: Budgeting, in particular, can sometimes lead to a short-term focus, where management concentrates on meeting immediate targets at the expense of long-term strategic planning and value creation.

- Limited Scope: While budgeting and forecasting are essential financial planning tools, they may not account for all aspects of a business’s operations, such as employee morale, customer satisfaction, and innovation potential, which can also impact a company’s overall performance.

Conclusion

Budgeting and forecasting are vital financial tools for businesses, with budgeting focusing on a detailed financial plan and forecasting predicting future outcomes. These processes aid finance leaders in preparing financial statements, setting budget outlines, and developing financial forecasts.

While each has its benefits and limitations, their combined use helps businesses achieve financial goals, adapt to market conditions, and plan strategically for the future.

Cloud-based accounting software like Akounto helps you generate various customized financial reports that are helpful in creating budgets or making a sound financial forecast. Visit Akounto’s website to know more.