Defining Bank Reconciliation

Bank reconciliation is matching cash account records with the bank statement to ensure accuracy and detect discrepancies in financial transactions.

It involves comparing the bank statement of an entity with its records of cash transactions, typically found in the general ledger or cash book.

The objective of bank reconciliation is to ensure that the company’s and bank’s records agree with each other and to identify any errors or discrepancies that may have occurred.

The process involves reviewing and reconciling various transactions, including deposits, withdrawals, checks issued, electronic transfers, service charges, and interest earned or charged.

Bank Reconciliation Statement

A bank reconciliation statement presents a detailed comparison between an individual or company’s cash book (or cash account) and the bank statement provided by the bank.

It aims to identify and explain any discrepancies or differences between the two sets of records, ensuring the accuracy and completeness of financial information.

Bank reconciliation statements help reconcile the balances, considering outstanding checks, deposits in transit, bank charges, errors, and other adjustments, ultimately arriving at a reconciled or adjusted cash balance that aligns with the bank statement.

Need

Bank reconciliation plays a vital role in detecting and rectifying errors that may occur in both the company’s and the bank’s records.

The bank reconciliation process maintains accurate and dependable financial records by promptly identifying and correcting data entry mistakes, incorrect bank charges, or missed transactions.

Another important aspect of bank reconciliation is preventing and detecting fraud activities. It scrutinizes the bank statement to identify unauthorized transactions, enabling timely investigation and appropriate action to protect the company’s financial well-being.

Bank reconciliation is crucial for regulatory compliance and financial reporting. It provides documented evidence of the company’s efforts to reconcile and verify financial records, ensuring adherence to applicable laws and regulations.

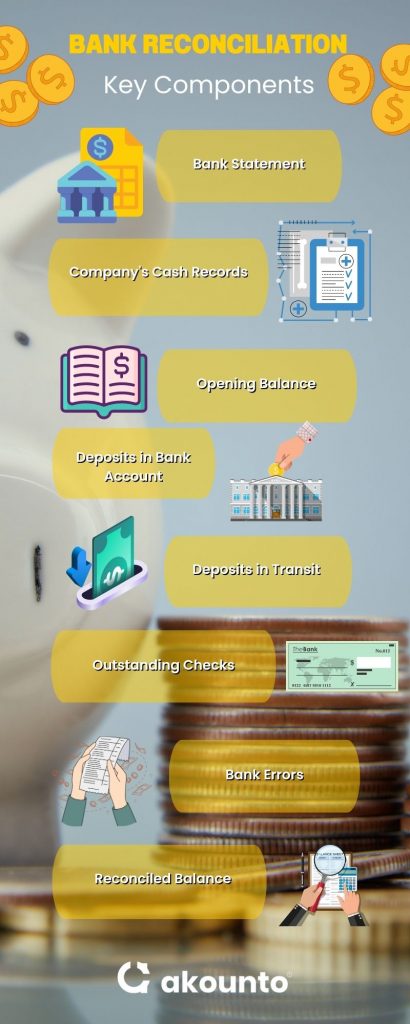

Key Components

- Bank Statement: The bank statement that shows the transactions, balances, and activity in the business bank account for a specific period.

- Company’s Cash Records: The internal accounting records of the company that captures cash transactions, deposits, withdrawals, and other related activities.

- Opening Balance: The starting balance of the company’s cash account at the beginning of the reconciliation period.

- Deposits: The amount of money the company deposited into its bank account during the reconciliation period.

- Deposits in Transit: Deposits made by the company that have not yet been recorded or processed by the bank.

- Outstanding Checks: Checks issued by the company that have been recorded but have not yet cleared the bank.

- Bank Errors: Errors or discrepancies found in the bank statement, such as incorrect charges or missing transactions.

- Reconciled Balance: After accounting for the above components, the final adjusted balance reflects the accurate cash position.

Process

Here is a step-by-step guide for the bank reconciliation process:

Step 1: Gather the necessary documents

Collect the company’s cash records, including the cash book or cash account statements and the bank statement for the corresponding period.

Step 2: Compare opening balances

Compare the opening account balance of the company’s cash account and bank statement. Note any discrepancies between the two.

Step 3: Reconcile deposits

Compare the deposits in the cash records with those in the bank statement. Then, identify any transit deposits and add these to the statement balance to account for them.

Step 4: Reconcile checks

Compare the checks issued and recorded in the company’s cash records with the cleared checks listed in the bank statement. Then, check for any outstanding checks, and deduct the respective amounts from the bank statement balance.

Step 5: Account for bank charges and interest

Consider any bank charges, fees, or interest earned listed in the bank statement but not reflected in the business records. Then, adjust the cash balance to account for these charges or interest.

Step 6: Adjust for errors

Identify and rectify any errors, discrepancies, or omissions between the company’s cash records and the bank statement—correct data entry errors or bank errors to ensure accurate bank reconciliation.

Step 7: Calculate the final reconciled balance

Add or subtract the adjustments made from the adjusted bank account statement balance during the bank reconciliation process.

Calculate the final reconciled balance, which reflects the accurate cash position after accounting for all adjustments.

Step 8: Prepare a bank reconciliation statement

Summarize the findings of the reconciliation process in a bank reconciliation statement.

Include details such as the opening balance, adjustments, outstanding checks, deposits in transit, and the final reconciled balance.

Step 9: Maintain documentation

Keep a record of all the bank reconciliation statements and supporting documents as part of the company’s financial records. It may be necessary for auditing purposes and regulatory compliance.

Reasons for Differences

Some of the common reasons for differences are:

- Outstanding Checks: When the company issues checks that haven’t been cleared by the bank yet, it creates a difference between the bank statement and the company’s accounting records.

- Deposits in Transit: If the company has made deposits that the bank is still recording, it will cause a difference between the bank statement and the company’s accounting records.

- Bank Charges: Banks may deduct fees, service charges, or other expenses, which might not be immediately reflected in the company’s accounting records, resulting in differences.

- NSF (Not Sufficient Funds): NSF means the payment made by a customer or another entity has bounced or been rejected due to insufficient funds. An NSF transaction affects the company’s cash balances and may require adjustments in the bank reconciliation process.

- Timing Differences: Transactions recorded by the company may have different timing than when they are processed by the bank, leading to differences in the timing of deposits and withdrawals between the bank account statement and the company’s accounting records.

- Bank Adjustments: The bank may adjust the company’s account by correcting errors or reversing transactions. These adjustments can cause differences between the bank statement and the company’s accounting records.

Examples

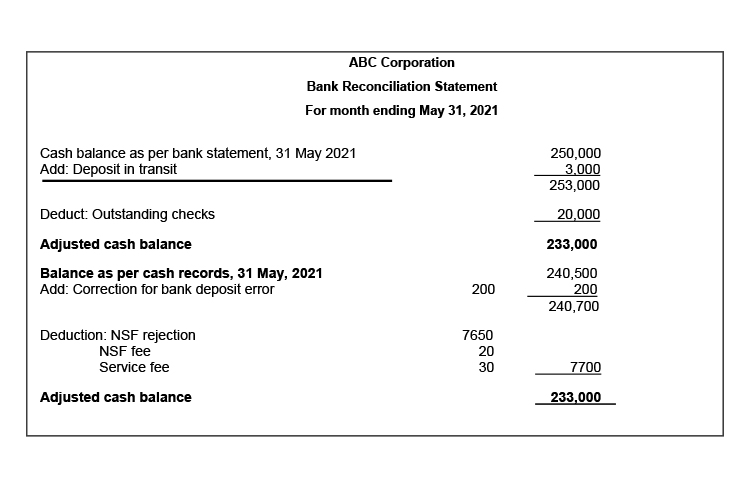

Example 1:

ABC Corporation is reconciling bank statements and company records, considering the following items:

- The bank account statement shows an ending balance of $250,000 on May 31, 2021, while the company’s ledger indicates an ending balance of $240,500.

- The bank statement includes $30 as bank fees for services.

- ABC Corp issued checks totaling $20,000 that have not yet cleared the bank.

- ABC Corp recorded a deposit of $3,000, but it doesn’t appear on the bank statement.

- The bank records include a $7650 deposit rejection due to not sufficient funds and imposed $20 as bank fees.

- The bank mistakenly deposited $200 into the company’s bank account.

Adjustment to Books

| Amount ($) | Adjustment to Books | |

| Ending bank balance | 250000 | |

| – Service fee | – 30 | debit expense, credit cash |

| – Outstanding checks | – 20000 | |

| + Deposit in transit | + 3000 | |

| – NSF deposit rejected | – 7650 | Debit receivable, credit cash |

| – NSF fee | – 20 | Debit expense, credit cash |

| + Correction for bank deposit error | + 200 | debit cash, credit bank error adjustment |

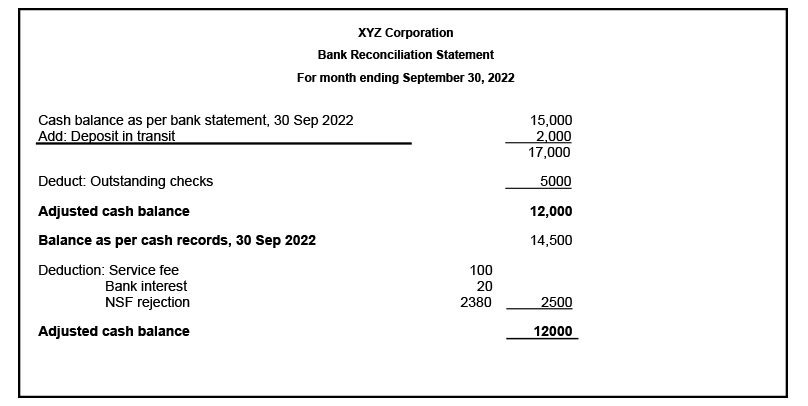

Example 2:

XYZ Corporation has a bank balance of $15,000 as of September 30, 2022. However, their cash book balance for the same period is $14,500.

In our example:

- A check of $2000 was deposited but is pending to be processed by the bank.

- The bank records show bank charges of $100, but they are not recorded in the cash book.

- XYZ Corporation issued checks worth $5000 but has not yet presented them to the bank.

- The bank records reflect $50 in bank interest, not recorded in the cash book.

- The bank records include a $2380 deposit rejection due to insufficient funds.

Adjustment to Books

| Amount ($) | Adjustment to Books | |

| Ending bank balance | 15000 | |

| + Deposit in transit | + 2000 | |

| – Service fee | – 100 | debit expense, credit cash |

| – Outstanding checks | – 5000 | |

| – Bank interest | – 50 | Debit receivable, credit cash |

| – NSF deposit rejected | – 2380 | Debit receivable, credit cash |

Accounting Software or Bookkeeping Services

Businesses can simplify their bank reconciliation process by using accounting software or hiring bookkeeping services.

Accounting software offers an automated approach by seamlessly integrating with a company’s financial systems. It takes charge of matching transactions, reducing the need for manual effort and minimizing errors.

With the convenience of bank feeds, real-time transaction data is imported, ensuring up-to-date reconciliation. The software also generates comprehensive reports providing valuable insights into any discrepancies, ensuring accuracy and reliability.

Alternatively, businesses can hire bookkeeping services. Professional bookkeepers handle the bank reconciliation manually, leveraging their expertise to ensure accuracy and compliance. It’s a good option for personalized attention and frees up internal resources for core business activities.

Consider your needs, budget, and transaction complexity when choosing between accounting software and bookkeeping services. Both streamline bank reconciliation, ensuring accurate financial records and enabling business growth.

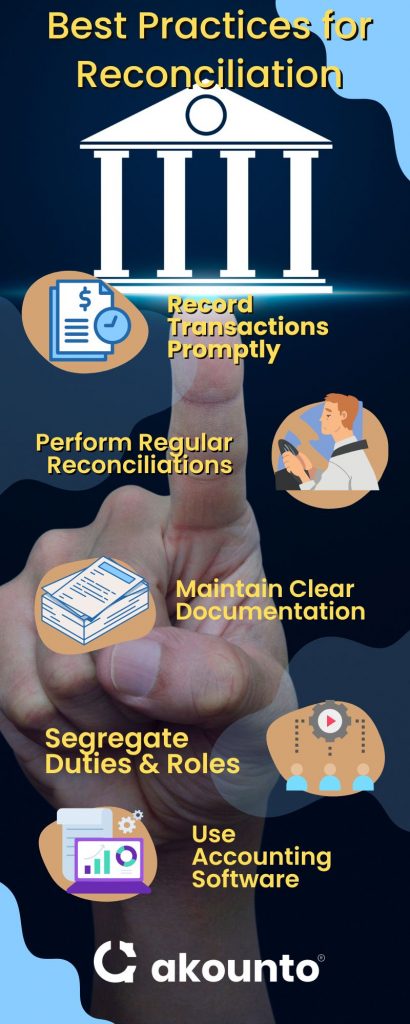

Best Practices

Record Transactions Immediately

Record financial transactions promptly to maintain up-to-date and reliable financial records.

Regular Reconciliation

Perform bank reconciliations on a timely basis, ideally monthly or as frequently as necessary, to ensure discrepancies are quickly identified and resolved.

Maintain Clear Documentation

Keep organized records of bank statements, canceled checks, deposit slips, and other relevant documents for easy reference during the bank reconciliation process.

Segregate the Duties & Roles

Assign different individuals to handle the reconciliation process and the accounting records. It helps ensure a checks-and-balances system and reduces the risk of errors or fraudulent activities.

Use Accounting Software

Accounting software automates the reconciliation process, streamlining the workflow and reducing the chance of manual errors.

Conclusion

Bank reconciliations are useful check-and-balance tools that can be used to check bank transactions and bank accounts to identify errors, omissions, uncleared checks, and fraud. When done at regular intervals, they help companies thwart potential frauds before serious damage occurs and can prevent errors from compounding the business.

Businesses can employ accounting software to match and categorize their bank statements at the click of a button.

Akounto offers a range of informative articles on various accounting concepts. Head over to the Akounto blog to learn more!