A flat rate payment system refers to a set price the client pays for goods or services rendered, while the hourly rate payment is based on the number of hours worked.

Understanding: Flat Rate vs. Hourly Rate

Flat Rate

The flat rate pricing model charges a fixed fee for particular goods or services regardless of the tasks, resources, or hours spent to complete the work.

The payment system is ideal for projects and jobs with finite deliverables and a well-defined scope of work. For example, in shipping, a flat rate might be applied for packages of a certain weight or size, regardless of their destination. Clients can make payments based on the work done.

Flat rate appeals to clients and small businesses by offering a predictable and simple pricing structure where customers know what they will be charged upfront. It also eliminates complex calculations and streamlines the billing process. A flat rate can be calculated by multiplying the hours needed to complete a project with the hourly rate.

However, this billing method may not always accurately reflect the actual costs involved for the service providers – freelance writers, plumbers, or electricians. In other cases, customers may end up paying more or less than the value they receive.

Hourly Rate

Hourly rate pay system refers to an hourly pay a business or service provider charges its client at the end of the project or an agreed-upon cycle.

The billing method tracks the time spent on a particular task or project and then invoices the client based on the hours worked. It is effective for long-term projects prone to changes. It offers flexibility as the hourly rates can be adjusted based on the complexity and urgency of the work, allowing for a fair compensation structure.

Hourly rates can also vary depending on factors such as the nature of the work, required skill level, experience of the service provider, and market conditions. The pay rate works best for businesses with in-house clients. Hourly billing can be challenging if you’re working remotely.

It is important to note that hourly rates do not include additional expenses or costs incurred during the work, such as materials, equipment, or travel expenses. These are billed or incorporated separately into the overall project cost based on the service provider and client agreement.

Overall, hourly rates provide a transparent and measurable approach to pricing services based on the time and effort invested by the service provider or business.

Importance of the Right Pay System

Choosing the right payment system is important for small businesses due to their unique characteristics and resource limitations. Here are some vital reasons that highlight its importance.

Budget Constraints and Cost-effectiveness

Choosing the right compensation system helps maintain financial stability and prevents overspending, ensuring expenses align with the available budget. It also allows for strategic planning and allocation of resources while ensuring that the compensation structure aligns with the organization’s financial capabilities and is cost-effective.

Motivating Employee Performance

A well-designed pay system can motivate employees to perform at their best. By aligning compensation with performance and providing incentives for achieving targets, small businesses can foster a culture of high performance, increased engagement, productivity, and commitment to achieving organizational goals.

Attracting and Retaining Talent

Small businesses often compete with larger organizations for top talent. Offering competitive compensation packages can help attract qualified candidates, retain skilled employees, and increase employee loyalty and job satisfaction within limited resources.

Ensures Fairness and Equity

Employees value transparency and fairness in compensation, and a well-designed compensation structure helps minimize disparities, biases, and perceptions of favoritism and boosts employee morale which can significantly impact their productivity and teamwork.

Employee Engagement and Retention

A good pay system contributes to employee engagement by providing fair compensation and rewarding employees for their contributions which, in turn, improves employee retention, reduces turnover costs, and creates a stable workforce.

Legal Compliance

Small businesses may have limited resources for legal and HR support, so selecting a compensation system that ensures compliance with minimum wage requirements, overtime regulations, and other legal obligations is important to avoid legal disputes, penalties, and damage to the organization’s reputation.

By carefully considering these factors, organizations can establish a pay system that supports their strategic objectives and creates a positive and productive workplace while effectively managing their limited resources.

Use Cases

Here are some use cases of flat rate vs. hourly rate billing methods.

Flat Rate Pay System

- Home Cleaning Services: Cleaning companies often use a flat rate system to price their services. They offer fixed rates based on the house size, the number of rooms, and the cleaning tasks required. It provides customers transparency and lets them know the upfront cost without worrying about the hourly pay rate.

- Auto Mechanic Services: Automotive technicians can offer fixed prices for common repairs like tire rotations, brake replacements, oil changes, and other routine maintenance tasks. Flat rate pricing can simplify the customer experience, making it easier to compare prices of different auto mechanics.Flat rates are also beneficial for auto techs as it serves as a source of constant employee income. The technicians know each task’s flat rate and can plan their work accordingly. It incentivizes the auto technician to complete as many jobs as possible without compromising quality within a given timeframe.

- Landscaping & Lawn Care: Companies can offer fixed rates using a flat rate system based on the yard size and specific tasks involved, such as mowing, trimming, seasonal maintenance, etc. It enables efficient job planning, cost estimation and clarifies employee compensation for the business, streamlining operations and enhancing customer satisfaction.

- Courier & Delivery Services: Flat rate pricing can be utilized for delivery services to specific routes or packages of a particular weight or size. By offering fixed rates for delivery services, customers can accurately estimate their shipping costs without worrying about additional charges based on time or distance.

- Graphic Design or Web Development: Freelancers or agencies in the creative industry can employ flat rate systems for specific designs or development projects based on the project scope, required deliverables, or milestones to cover, allowing clients to clearly understand the costs associated with the project.

- Pet Grooming: Pet grooming salons can use flat rate pricing to determine grooming costs for different breeds and set up specific service packages.

Hourly Pay Rate System

- Professional Services: Businesses that providelawyers, accountants, consultants, or architects, use the hourly rate system to bill clients based on the actual hours worked by the professionals. It allows for flexibility in billing and allows businesses to account for the expertise, experience, and time required for their services.

- Freelancers & Independent Contractors: typically charge clients an hourly rate in creative industries of graphic design, photography, web development, writing, and marketing. Hourly rate allows them to track their billable hours, account for deliverables of each project, and invoice clients accordingly. It also provides transparency and a clear understanding of the services provided and the associated costs.

- Retail & Hospitality Industries: Businesses in the retail and hospitality sectors often use the hourly rate pay system for their employees, such as sales associates, waitstaff, or customer service representatives. Hourly rates enable accurate tracking of working hours and compliance with labor laws of overtime payments and shift differentials.

- Construction & Trades: Construction companies, contractors, or tradespeople, such as plumbers, electricians, or carpenters, often charge hourly rates. It is due to the varying nature and complexity of construction projects. Hourly rates account for the specific tasks performed, materials used, and the time required to complete the work.

- Personal Services: Companies offering personal services like home healthcare, housesitting, and personal training can implement an hourly fee system to bill clients for service hours. The approach ensures fair compensation for the time and personalized attention dedicated to each client, whether for one, two hours, or more.

- Event or Production Staffing: Hourly rates allow for flexibility in staffing levels based on the specific needs of each event or production. This includes activities and roles such as event setup, event planner, stagehand, lighting technician, and production assistant.

Flat Rate vs. Hourly Rate Pay Systems

| Basis | Flat Rate | Hourly Rate |

| Compensation | Sets a fixed rate for a specific product, service, or project. | Hourly wage is based on the number of hours worked. |

| Billing | Serves as a predictable income source for businesses and upfront cost for customers. | Potential for inconsistent income due to variations in actual hours worked, leading to fluctuations in billing. |

| Transparency | Offers transparency and eliminates ambiguity in pricing. | Provides transparency in terms of time worked and hourly rates. |

| Flexibility | Limited flexibility for adjusting pricing based on variations in effort. | Provides flexibility for scheduling and adjusting staffing levels. |

| Cost Estimation | Easier for cost estimation and client budgeting. | May be challenging to provide precise cost estimates due to variations in hours worked. |

| Administrative | Simplifies billing and accounting processes. | Requires accurate time tracking and record-keeping, which creates administrative overhead. |

| Overtime Costs | Are not applicable in the flat rate pay system. | Overtime pay is required for hours worked beyond the standard weekly wages. |

| Performance Metrics | Limited alignment with performance metrics or output-based incentives. | Provides opportunities for pay-for-performance structures. |

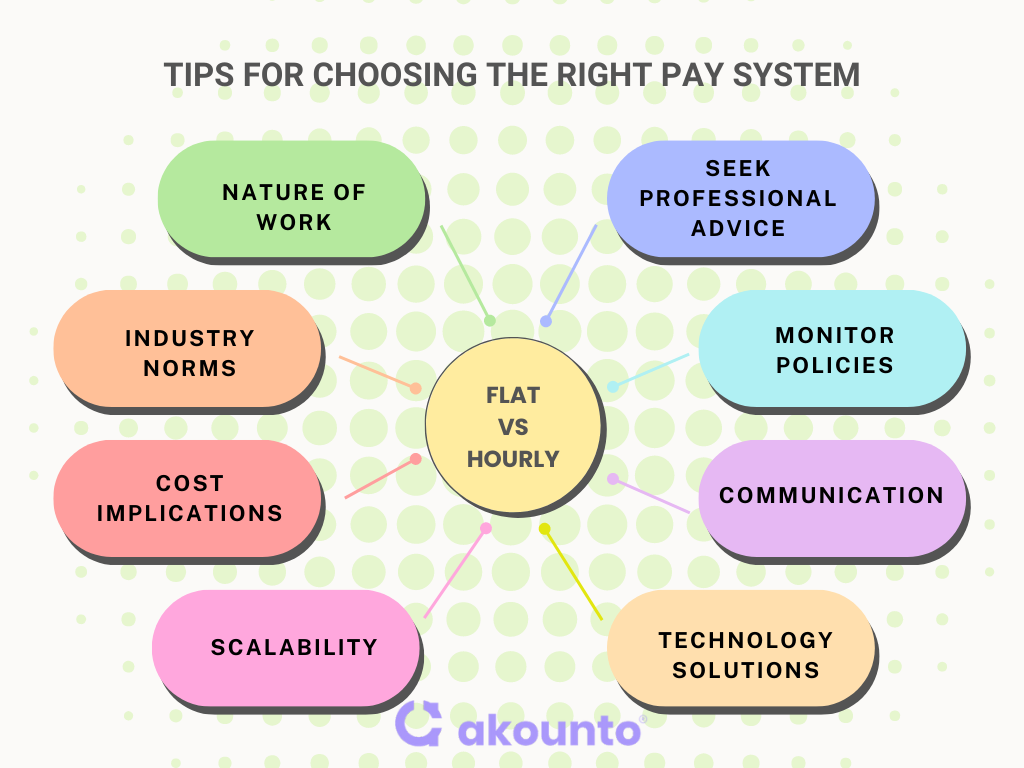

Practical Tips for Choosing the Right Pay System

- Nature of Work: Asses the nature of work, employee roles, and job descriptions to determine the compensation system. Flat rate suits projects or services with well-defined deliverables, while the hourly rate is useful for tasks requiring time tracking and flexibility.

- Industry Norms: Research industry standards and practices of the sector, such as labor laws, minimum payment requirements, and overtime rules. Ensure that the chosen pay system complies with these regulations to avoid legal complications and financial penalties and remain competitive.

- Cost Implications: Evaluate the costs associated with flat rate and hourly rate compensation models. Consider factors like employee productivity, benefits, overtime costs, administrative overheads, etc., to choose a system that aligns with the budget while still attracting and retaining quality talent.

- Scalability: Choose a pay system that can accommodate future changes for business expansion, workforce size, or the introduction of new roles and services. A flat rate pay system may offer less flexibility for adjusting pay based on variations in effort, while an hourly rate system provides more adaptability.

- Technology Solutions: Payroll software or online pay platforms can automate calculations, track time, and keep records, reducing administrative burdens for small businesses.

- Transparency & Communication: A small business must clearly communicate the chosen pay system to its employees and ensure they understand how their compensation is determined. Whether the business follows a flat rate or hourly rate, transparency promotes trust and reduces misunderstandings.

- Monitor & Adjust: Regularly monitor the effectiveness of the chosen compensation system. Request feedback from employees and managers to assess its impact on morale, productivity, and retention. Be prepared to make adjustments where needed to address any issues.

- Seek Professional Advice: If you feel uncertain or overwhelmed, consider seeking guidance from HR consultants or payroll specialists. They help the business navigate the complexities of choosing the right payment system based on its specific circumstances, industry practices, and legal requirements.

Conclusion

Considerations such as the scope of work, budget, workforce dynamics, industry norms, and legal obligations are crucial in selecting a pay system that aligns with financial health, employee satisfaction, and long-term growth.

A flat-rate pay system promotes efficiency by charging a set price for the project, while an hourly pay system accounts for variable project factors. Choosing between a flat-rate pay system and an hourly pay system depends on the business’s priorities.