Introduction: What is a Sales Invoice?

A sales invoice is an accounting document requesting payment for goods or services in a business transaction.

Sales invoices are crucial for businesses to record sales transactions. These invoices are created by businesses to request payment from customers and track sales.

Apart from facilitating payment, sales invoices establish a legal agreement between the parties involved and serve as a formal transaction record. They play a significant role in accurately documenting a sales transaction and managing accounts receivable.

Businesses create invoices to keep track of the goods or services sold, the amount owed by the customer, and the payment due date. This helps the accounting department and sales team stay organized and ensures timely customer payment.

In the case of businesses selling physical products, sales invoices are especially important for inventory management. They provide a clear record of the goods sold, allowing businesses to track their stock levels accurately. Additionally, sales invoices are used for calculating and remitting taxes based on the goods or services provided.

Overall, sales invoices are vital for businesses as they facilitate transactions, record financial obligations and aid in managing accounts receivable and inventory.

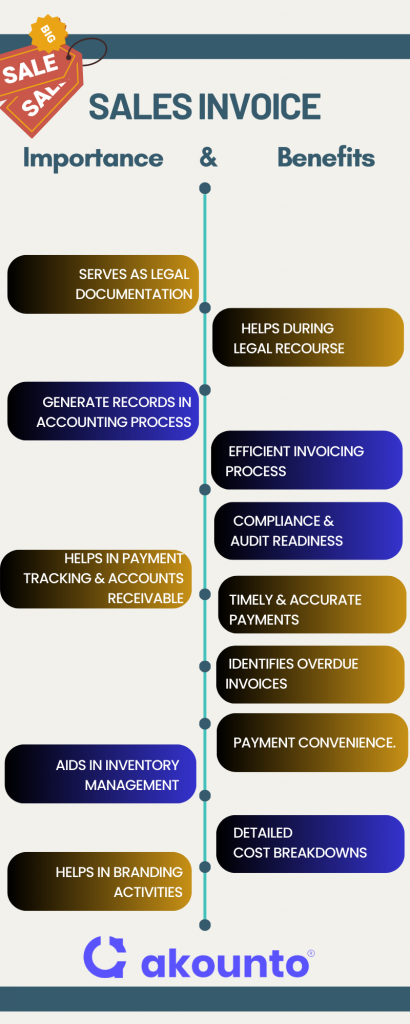

Importance and Benefits

Importance

- Legal Document: Sales invoice serves as a legal document that establishes a formal agreement between the seller and the buyer, making sales invoices important for businesses.

- Accounting Purposes: They are crucial in maintaining accurate financial records and supporting accounting processes, making them essential for accounting purposes.

- Payment Tracking and Accounts Receivable: Sales invoices are necessary for tracking payments and managing accounts receivable. They contain information about the amount owed, payment due dates, and payment terms, making them vital for payment tracking.

- Inventory Management: Sales invoices are crucial for inventory management in businesses primarily selling physical products. They record the number of products sold or services provided, helping companies to monitor stock levels and replenishment plans and ensure efficient supply chain management.

- Professional Image: Utilizing well-designed sales invoices with company branding and contact information helps project a professional image to customers.

Benefits

- Efficient Invoicing Process: Sales invoices streamline the invoicing process and improve operational efficiency, making them beneficial for businesses looking to optimize their sales process.

- Request Payment: They ensure timely and accurate payment processing by requesting payment from customers for goods or services.

- Overdue Invoices and Late Fees: Sales invoices help identify unpaid invoices, enabling businesses to apply late fees or follow up with customers for payment.

- Pro Forma Invoice: Sales invoices can also serve as pro forma invoices, offering detailed cost breakdowns for future transactions or business plans.

- Free Templates and Invoicing Software: Businesses can use free sales invoice templates or invoicing software to streamline creating and managing sales invoices, saving time and effort.

- Legal Recourse: In payment disputes or legal issues, sales invoices provide essential documentation to support the business’s legal recourse.

- Payment Options: Sales invoices can include various payment options such as electronic payment methods, like Google Pay, enhancing customer convenience.

- Recurring Invoices: For regular or subscription-based services, sales invoices can be set up as recurring invoices, simplifying the billing process.

- Compliance and Audit Readiness: Properly documented sales invoices ensure compliance with tax regulations and facilitate smooth audits. They provide a comprehensive record of sales transactions, making it easier to reconcile financial statements, substantiate revenue figures, and demonstrate compliance during audits or tax assessments.

Components: What to Include?

When creating a sales invoice, including specific components to ensure accuracy and effectiveness is crucial. Most sales invoices commonly include the following:

- Brief Description: Provide a concise description of the goods or services sold to provide clarity to the customer.

- Invoice Number: Assign a unique identification number to each invoice for easy tracking and reference.

- Date: Include the invoice date when the invoice is issued to establish a clear timeline.

- Business Sells Physical Products: Specify if the company primarily sells physical products to differentiate from service-based transactions.

- Purchase Orders: If applicable, reference any associated purchase orders to link the invoice with the customer’s order.

- Payment Due Date: Clearly state the date by which payment is expected from the customer to avoid confusion and encourage timely payment.

- Unit Price: Indicate the unit price for each item or service provided to detail the cost breakdown for the customer.

- Applicable Taxes: Include any relevant taxes that must be applied to the invoice based on the jurisdiction and transaction.

- Contact Information: Provide accurate contact information, including the business name, corporate address, and contact details like phone number, email, etc., to facilitate communication with the customer.

- Company Logo: Incorporate the company logo on the invoice for brand recognition and a professional appearance.

- Sales Order: Reference any associated sales order number to link the invoice to the specific order placed by the customer.

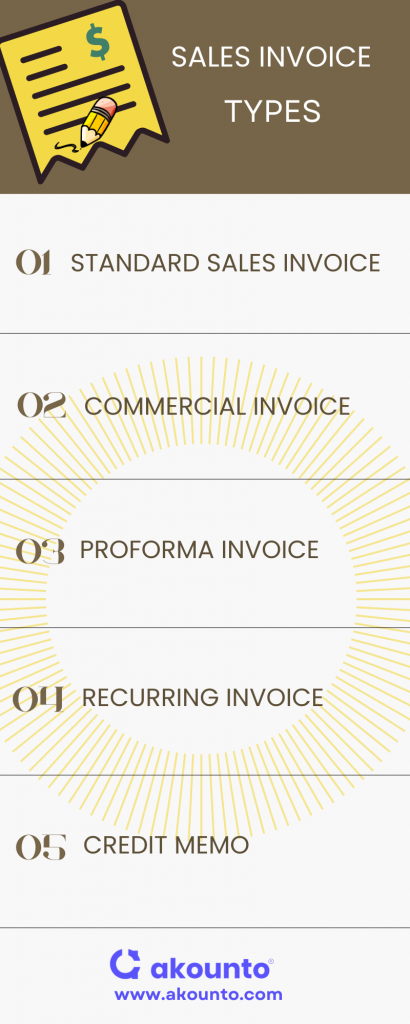

Types of Sales Invoice

Standard Sales Invoice

A standard Sales Invoice is the most common type detailing goods or services, quantities, unit prices, total amounts, and payment terms. For instance, a clothing retailer would issue this for a dress sale, specifying the type, size, price, and due date.

Commercial Invoice

A commercial sales invoice is used in international trade; it includes additional information for customs clearance, like the shipment’s value, country of origin, harmonized system code, and applicable customs duties or taxes. An exporter would issue this to a customer in another country.

Proforma Invoice

A preliminary sales invoice outlines estimated costs, quantities, and terms before the final sale. Often used for initial negotiations or future orders reference. A software company, for example, would issue this to a potential client, outlining software features, pricing, and payment terms.

Recurring Invoice

A recurring sales invoice is automatically generated and sent at predetermined intervals for regular transactions like monthly subscriptions or service agreements. An example would be the monthly subscription fee for a software-as-a-service (SaaS) platform.

Credit Memo

Issued to provide a refund or credit to a customer, reflecting a negative amount to offset a previously issued sales invoice. A credit memo will be issued if a customer returns a defective product and is eligible for a refund.

Create Sales Invoices

- Identify the Transaction: Determine the goods or services provided, their quantities, and unit prices.

- Use Accounting Software: Utilize accounting software to automate the generation of sales invoices and ensure accurate financial records.

- Include Essential Details: Include payment terms, due dates, and applicable taxes or fees.

Using Sales Invoice Template

- Access Templates: Most accounting software provides free sales invoice formats.

- Customize the Template: Adjust the template to include your company logo, contact information, and specific payment terms.

- Maintain Consistency: Using a template ensures all your sales invoices have a consistent, professional look.

- Improve Communication: Clear, detailed sales invoices facilitate customer communication, promoting timely payment and improved cash flow.

- Faster Work: A small business owner can download templates from the internet or use Akounto’s Software, where in addition to creating sales invoices, he can also track payments in a timely manner.

Benefits of Using Accounting Software

- Streamlined Invoicing Process: Accounting software automates invoice generation, calculation, and payment terms application, enhancing the invoicing process and reducing errors.

- Customizable Templates: Small business owners can access professional and customizable, and even a free sales invoice template, ensuring consistent branding and a polished look for invoices.

- Improved Cash Flow: The software enables prompt sending of accurate sales invoices, monitoring of payment due dates, and follow-up on overdue invoices, thereby improving cash flow.

- Efficient Sales Tracking: It allows sales tracking via invoice numbers and dates, aiding in sales process monitoring, revenue trend analysis, and future sales forecasting.

- Integration with Financial Systems: Accounting software integrates with financial systems like the general ledger and accounts receivable, streamlining the accounting process and ensuring accurate financial records.

- Simplified Record-Keeping: The software creates a digital trail of sales invoices for easy organization and retrieval of past data, simplifying accounting tasks and facilitating audits.

- Enhanced Communication: It enables the inclusion of specific details in invoices, such as payment terms and purchase order references, ensuring clear communication with customers.

- Access to Free Templates: Many platforms offer to download sales invoice templates for free, which helps in customization, and saving time in designing invoices from scratch.

Common Challenges and Solutions

Managing Sales Orders

Challenge – Keeping track of sales orders and linking them to invoices.

Solution: Utilize invoicing software that integrates with sales order systems, automating invoice generation based on sales order data.

Dealing with Multiple Invoices

Challenge – Managing multiple sales invoices for different customers.

Solution: Implement invoicing software that centralizes invoice management, making it easier to track, organize, and monitor payments.

Accounts Receivable Management

Challenge – Tracking and managing accounts receivable, including overdue payments.

Solution – Leverage invoicing software with automated accounts receivable management features, such as aging reports and payment reminders.

Timely Payments

Challenge: Ensuring customers pay on time.

Solution: Communicate payment terms and due dates on invoices, send automated reminders, and offer different payment methods on a sales invoice.

Accurate Records

Challenge – Maintaining accurate invoice records, including invoice numbers, dates, and quantities supplied.

Solution: Utilize invoicing software that assigns unique invoice numbers, tracks dates, and enables easy retrieval and sorting of invoices.

Customer Relationships

Challenge – Invoicing impacting customer relationships.

Solution: Create professional invoices using customizable templates, including clear descriptions, pricing details, and contact information.

Pro Forma Invoices

Challenge – Needing to provide proforma invoices.

Solution: Leverage invoicing software that allows for creating proforma invoices, facilitating business negotiations, and planning.

Difference between Sales Receipt and Sales Invoice

Sales receipts and sales invoices are two important documents used in business transactions. While they serve similar purposes, there are key differences between them. Let’s explore the distinctions:

Definition

- Sales Receipt: It is a document provided to customers as proof of payment at the time of the transaction.

- Sales Invoice: A sales invoice is issued by the merchant to the shopper that requests payment for goods or services rendered.

Timing

- Sales Receipt: It is generated at the point of sale when the customer pays for the goods or services.

- Sales Invoice: It is issued before the payment is received and is used to request payment from the customer.

Purpose

- Sales Receipt: It serves as proof of purchase and payment for the customer and the business. It typically includes the date, items purchased, payment method, and total amount paid.

- Sales Invoice: It serves as a formal request for payment from the customer. It includes details of the goods or services provided, quantities, prices, applicable taxes, payment terms, and other relevant information.

Legal Considerations

- Sales Receipt: It is not usually legally binding but provides evidence of a completed transaction.

- Sales Invoice: A legally binding document establishes the terms of the sale and creates an obligation for the customer to make payment.

Use in Accounting:

- Sales Receipt: It is used as a record of revenue received and can be matched with corresponding sales invoices or other sales documents.

- Sales Invoice: It is used as a record of revenue owed by the customer and forms an essential part of the business’s accounts receivable.

Conclusion

A sales invoice is an indispensable tool in business transactions, serving as a legal document that requests payment for goods or services. It aids in tracking sales, managing accounts receivable, and maintaining accurate financial records. Understanding the difference between sales receipts and sales invoices further enhances transaction clarity.

Sign in to use Akounto’s accounting software and discover fast and user-friendly sales invoice generation capabilities.