Introduction to the Accounting Equation

The accounting equation, also called the basic accounting equation or balance sheet equation, is a critical concept in accounting that serves as a fundamental rule that sets the groundwork for understanding a company’s financial position and its balance sheet.

The accounting equation maintains that a company’s total assets are equal to the combined value of its liabilities and shareholders’ equity. The accounting equation forms the foundation of double-entry bookkeeping, a system where each business transaction impacts at least two accounts.

In the double-entry accounting system, the basic accounting equation formula is structured such that assets are equivalent to the sum of liabilities plus equity. This equation provides a snapshot of the company’s financial position, indicating how its assets, liabilities, and equity interrelate. It also illustrates how changes in one component often lead to corresponding changes in another.

Companies employ the accounting equation when preparing their balance sheet. It serves as a check to ensure that the financial statements balance and that the double-entry accounting system functions as intended. The equation’s equality underscores that the company’s total assets must match the total value of its liabilities and equity.

Thus, the accounting equation is not just a simple mathematical formula but a foundational principle of accounting. It enables a systematic approach to recording business transactions and ensures an accurate reflection of the company’s financial position.

Formula

The fundamental accounting equation formula forms the backbone of accounting practices. It is structured as follows:

Assets = Liabilities + Shareholders’ Equity

This equation remains in balance after each business transaction, ensuring that all financial activities are accurately reflected in a company’s accounts.

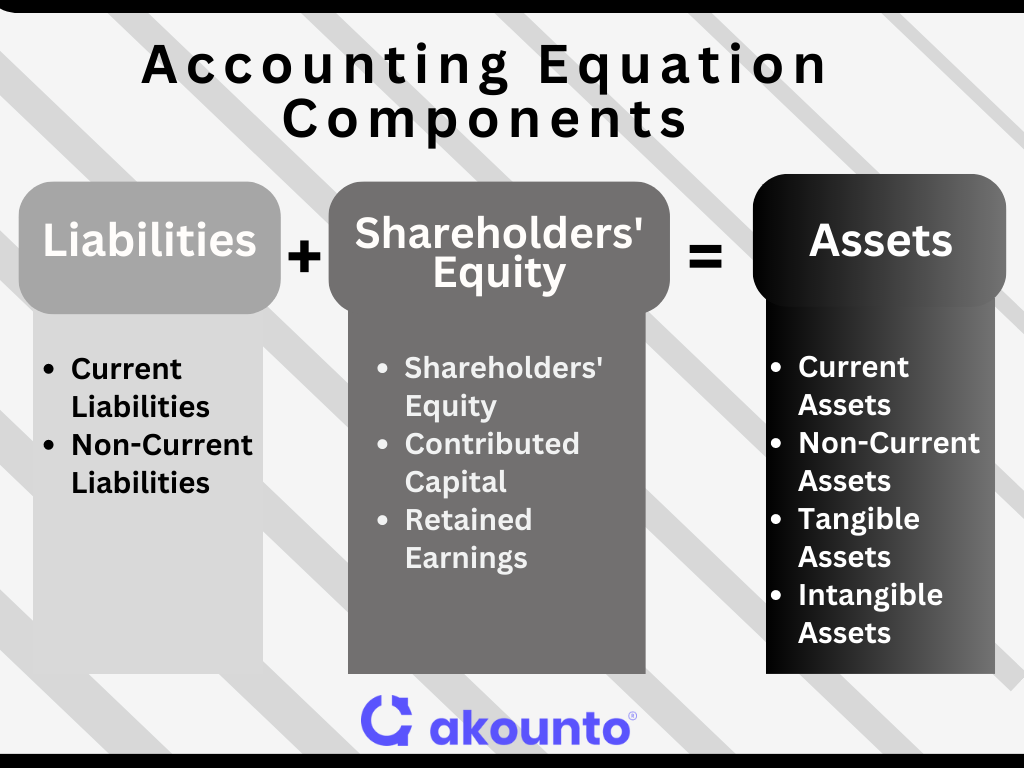

Components

The accounting equation consists of three primary components: assets, liabilities, and shareholders’ equity. Each plays a crucial role in maintaining the balance of the equation, which directly represents a company’s financial position.

Assets

Assets are economic resources owned by the company. They are items of positive economic value that the company owns or controls, with the expectation of yielding benefits in the future. Assets can be classified into various categories, including:

- Current Assets: These are assets that can be converted into cash or used up within one year. Examples of current assets include cash, accounts receivable, inventory, prepaid insurance, etc.

- Non-Current Assets: These are long-term investments or obligations to receive that cannot be easily converted into cash. Its examples include plant, property, equipment, intangible assets, and long-term investments.

- Tangible Assets: These are physical assets like buildings, equipment, vehicles, and inventory.

- Intangible Assets: Non-physical assets such as patents, copyrights, brand names, and trademarks.

Liabilities

Liabilities represent the company’s financial obligations or debts. These are amounts that the company owes to others, including lenders, suppliers, employees, and other creditors. Like assets, liabilities can be categorized into:

- Current Liabilities: These are obligations expected to be paid within one year, such as accounts payable, accrued expenses, and short-term loans.

- Non-Current Liabilities: These are long-term financial obligations due beyond one year, such as bonds payable, long-term loans, and deferred tax liabilities.

Shareholders’ Equity

Shareholders’ equity, also known as owner’s equity or stockholders’ equity, represents the residual interest in the assets of the entity after deducting liabilities. In other words, the amount would be returned to the shareholders if all the company’s assets were liquidated and all debts paid off. It consists of the following:

- Contributed Capital: Money contributed by shareholders in exchange for shares.

- Retained Earnings: Cumulative net income of the company that has been retained for reinvestment rather than distributed to shareholders as dividends.

By understanding these components of the accounting equation formula, one can gain better insights into a company’s financial health and make informed business decisions.

The double-entry bookkeeping system is the key to maintaining the balance in the accounting equation. This system ensures that every business transaction impacts at least two of a company’s accounts.

For instance, when a company borrows money from a bank, its assets (cash) and liabilities (money owed) increase by the same amount, keeping the equation in balance. Similarly, when a company purchases inventory for cash, one asset (inventory) increases, and another asset (cash) decreases—again, maintaining the balance.

Calculation and Examples

The accounting equation serves as the underlying structure of the company’s balance sheet and represents every business transaction. Let’s explore this through ten hypothetical transactions and see how they influence the accounting equation.

| Transaction | Assets (A) | Liabilities (L) | Owner’s Equity (E) | Equation Balance (A = L + E) |

| 1. Owner invests $100,000 in the company | +$100,000 | +$100,000 | Yes | |

| 2. The company borrows $50,000 from a bank | +$50,000 | +$50,000 | Yes | |

| 3. Company purchases equipment for $30,000 cash | +$30,000 | – $30,000 | Yes | |

| 4. The company purchases inventory for $20,000 on credit | +$20,000 | +$20,000 | Yes | |

| 5. Company makes sales on credit for $25,000 | +$25,000 | +$25,000 | Yes | |

| 6. Company pays off $10,000 of its accounts payable | -$10,000 | -$10,000 | Yes | |

| 7. Company pays $5,000 in salaries | -$5,000 | -$5,000 | Yes | |

| 8. Company receives $15,000 cash from accounts receivable | +$15,000 | -$15,000 | Yes | |

| 9. Company makes a loan payment of $7,000 | -$7,000 | -$7,000 | Yes | |

| 10. Company pays $3,000 dividends to owners | -$3,000 | -$3,000 | Yes |

Explanation:

- The owner’s equity increases because of the owner’s investment, and the company’s cash assets increase by the same amount.

- The company borrows money, so its cash assets increase, but it also incurs a liability in the form of a loan.

- The company purchases equipment, increasing its assets. However, this is balanced by a decrease in another asset (cash).

- The inventory purchase increases assets, but since it’s on credit, the company owes money, increasing liabilities.

- The company’s assets increase when a sale is made on credit, increasing accounts receivable. Simultaneously, the owner’s equity is also increased by the same sales amount reflecting the profit from the sale.

- Paying off accounts payable reduces both assets (cash) and liabilities (accounts payable), maintaining the balance.

- The payment of salaries reduces assets (cash) and reduces the owner’s equity by reducing retained earnings.

- When the company receives cash from accounts receivable, one asset (cash) increases while another asset (accounts receivable) decreases, keeping the equation in balance.

- Making a loan payment decreases both the assets (cash) and the liabilities (loan payable), keeping the equation balanced.

- Paying dividends reduces the assets (cash) and also reduces the owner’s equity (retained earnings), keeping the accounting equation balanced.

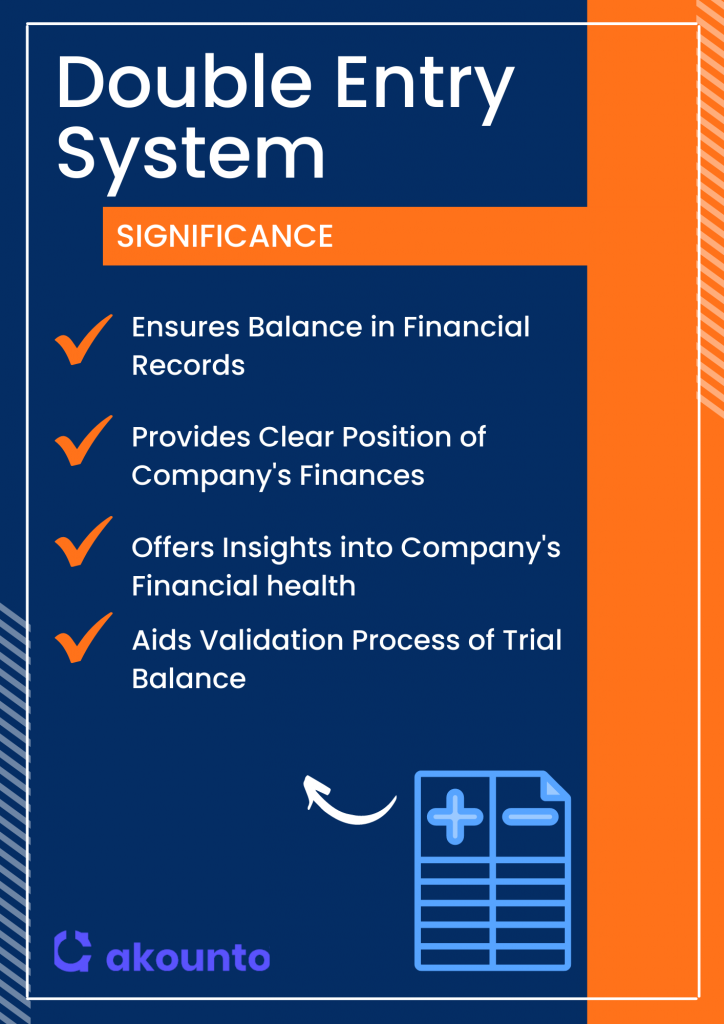

Understanding Double Entry Accounting System

The double-entry system is fundamental to financial accounting and is tied closely to the accounting equation. It asserts that each business transaction affects two or more accounts, ensuring that the company’s financial statements, which include the balance sheet and income statement, accurately depict its financial position.

Every transaction impacts the company’s assets, liabilities, and owner’s equity. The balance sheet reflects the expanded accounting equation (assets = liabilities + shareholder equity), ensuring each entry corresponds to an equal and opposite entry.

A double-entry system and the accounting equation ensure that financial records accurately reflect the state of a company’s business transactions, as evidenced by the trial balance. Understanding the double-entry system and the accounting equation is crucial for accurate financial statements and transparent business operations.

Significance of Accounting Equation

- The accounting equation forms the building block of the double entry system, ensuring that every financial transaction affects at least two accounts, maintaining balance in the financial records.

- It provides a clear position of a company’s financial position, depicting total assets, liabilities, and shareholders’ equity.

- By displaying how business transactions affect the balance sheet and income statement, the accounting equation helps in the preparation of accurate financial statements.

- The equation provides insights into the company’s financial health, impacting financial accounting and strategic decision-making.

- It aids in the validation process of the trial balance, ensuring the total debits equal total credits, thereby verifying the accuracy of financial entries.

- The accounting equation shows the relationship between what the company owns, owes, and the portion of the company held by owners.

Conclusion

The accounting equation is instrumental in understanding a company’s financial position. It not only forms the backbone of financial accounting but also shapes the structure of financial statements. The accounting equation accurately represents business transactions by reflecting the company’s assets, liabilities, and shareholders’ equity. Hence, the profound understanding and effective use of the accounting equation are indispensable for sound financial management.

Akounto, a cloud-based accounting software, allows business owners to choose and switch easily between double or single-entry accounting systems. Visit our website to know more.