Understanding Business Expenses

Every small business owner should understand and use expense monitoring efficiently since it helps them find cost savings opportunities and maintain a healthy cash flow.

The costs incurred during the regular business operation are known as business expenses. These can include larger expenses like rent, utilities, and salaries, as well as more modest ones like office supplies or business trips.

One of the key aspects of small business expense tracking is distinguishing between personal and business expenses. This distinction is crucial for accurate financial records and effective expense management.

Using a business bank account for all the expenses related to the business can help segregate business transactions from personal ones, simplifying the tracking process.

Moreover, business expenses play a significant role during tax season. They can often be deducted from your business income, reducing the overall tax liability. However, small business owners must meticulously record all relevant expenses, including paper and digital receipts, to claim these tax deductions.

Challenges for Small Businesses in Expense Tracking

Small businesses often need help with expense tracking. These challenges can impact the business’s cash flow and overall financial health if not addressed promptly.

- Lack of Separation Between Personal and Business Expenses: Many small business owners use the same bank account for business and personal transactions. This can blur the line between personal and business expenses, making it difficult to track business expenses accurately.

- Inadequate Record Keeping: Keeping track of every business purchase, whether it’s a major equipment investment or minor office supplies, can take time and effort. Failing to maintain comprehensive records of all business expenses can lead to inaccuracies during tax time and missed opportunities for tax deductions.

- Manual Expense Management: Manual methods of tracking expenses, such as spreadsheets or paper receipts, can be time-consuming and prone to errors. They also make it challenging to generate and review expense reports, which are crucial for understanding spending patterns and identifying cost savings.

- Lack of Financial Expertise: Not all small business owners have a background in finance or accounting. The lack of expertise can make it challenging to choose the best expense tracking software, understand cash basis accounting versus accrual basis accounting, or effectively manage monthly expenses.

- Failure to Leverage Technology: Despite the availability of numerous business expense tracker apps and accounting software, some small businesses still need to rely on outdated methods for tracking expenses. This can lead to inefficiencies and missed opportunities for automation and integration with other financial systems.

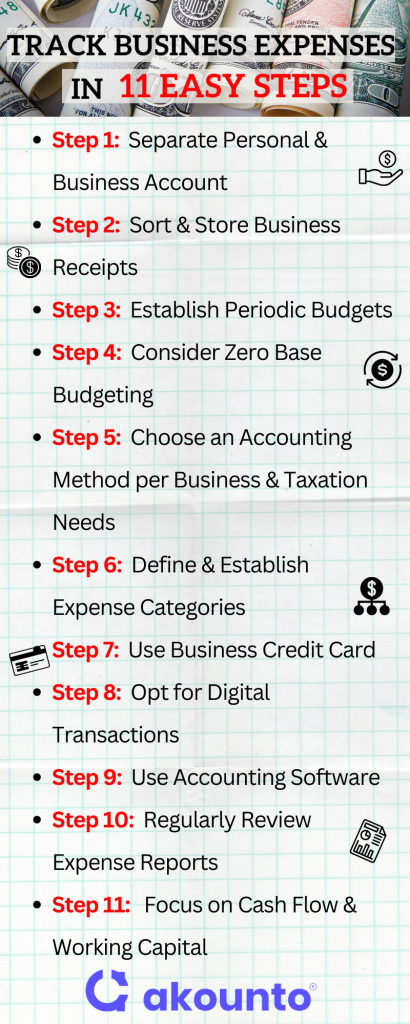

11 Easy Steps for Effective Expense Tracking by Small Businesses

Step 1: Separate Personal and Business Accounts

Separating personal and business accounts simplifies the process of tracking expenses.

When all business transactions are conducted through a dedicated business bank account, it becomes easier to monitor where the money goes and track all business-related expenses. This eliminates the confusion when personal and business expenses are mixed, ensuring that your financial records are accurate and clear.

Having a separate business bank account enhances the professionalism of your small business.

A separate account aids in effective expense management. It allows business owners to see how much their business is spending and earning, which is crucial for managing cash flow and making informed financial decisions.

Choosing the right bank for the business bank account is also important. Consider fees, accessibility, customer service, and any additional services that might benefit your small business.

Step 2: Store and Sort Receipts

Every paper or digital receipt records business transactions and provides detailed information about your spending habits.

For every purchase made for business purposes, obtain a receipt, thus everything from major equipment purchases to minor monthly expenses like office supplies or business meals. The receipts prove business expenses and are essential during tax season.

Storing receipts can be done physically or digitally. For paper receipts, consider using a dedicated folder or filing system. However, paper receipts can be easily lost or damaged, so it’s advisable to digitize them.

Sorting receipts is equally important. Organize receipts based on categories such as date, expense type, or vendor. This will make it easier to track transactions when needed.

By diligently storing and sorting receipts, a business owner can gain a comprehensive view of small business expenses, aiding in effective expense management and ensuring your business’s financial health.

Step 3: Establish Periodic Budgets

Establishing periodic budgets is a key step in effective small business expense tracking. A well-planned budget provides a roadmap for business finances, guiding spending and helping to manage cash flow effectively.

Start by analyzing past business transactions and identifying regular monthly expenses, including rent, salaries, utilities, and any recurring expenses. Next, allocate funds for variable costs, such as marketing campaigns or seasonal inventory.

Review and adjust the budget periodically to reflect business income and expense changes.

Step 4: Consider Zero Base Budgeting

Unlike traditional budgeting methods that adjust the previous year’s budget, zero-base budgeting starts from ‘zero’ for each new period.

In zero-base budgeting, every single expense must be justified and approved before it’s included in the budget. This means that each cost is scrutinized, regardless of whether it was part of the previous period’s budget. This approach encourages business owners to critically evaluate their expenses, leading to more efficient use of resources.

Implementing zero-base budgeting can be made easier with the use of accounting software.

Accounting software can help track expenses, manage financial transactions, and create detailed budgets. It can also provide valuable insights into spending patterns, helping to identify areas where cost savings can be achieved.

While zero-base budgeting may require more time and effort than traditional budgeting methods, it promotes financial discipline, encourages efficient use of resources, and can lead to substantial cost savings, all of which are crucial for the financial health of small businesses.

Step 5: Choose an Accounting Method that is Tax Compliant

It’s important to choose an accounting method that suits business operations and complies with tax laws. The two most common methods are cash basis accounting and accrual basis accounting.

In cash basis accounting, income and expenses are recorded when money changes hands. This method is straightforward and ideal for small businesses with simple transactions. However, it may not accurately reflect the financial position if there’s a time lag between when services are provided and when payment is received.

Accrual basis accounting records income and expenses when they are earned or incurred, regardless of when the money is received or paid, providing a more accurate picture of the business’s financial health, but it can be more complex to implement.

The Internal Revenue Service (IRS) permits small businesses to choose either method, but there are rules and restrictions to consider. For example, if a business has sales exceeding $25 million, the IRS requires the business to use the accrual method.

Step 6: Define and Establish Expense Categories

Defining and establishing expense categories is crucial in effective small business expense tracking. By categorizing business expenses, businesses can better understand where the money is going, which can help businesses identify cost savings and make informed financial decisions.

Start by listing all business purchases and expenses. These could include rent, salaries, utilities, office supplies, marketing costs, and other business operations expenses. Then, group these expenses into categories. Common categories include rent, payroll, utilities, office supplies, marketing, and travel.

Once the expense categories are established, record income and expenses in each category using accounting software. This will allow us to track business expenses more efficiently and see how much the business spends in each category.

For example, if the marketing expenses are higher than expected, the business owner might review marketing strategies and look for ways to reduce costs. Similarly, if office supplies expenses are lower than budgeted, the business owner might decide to invest in higher-quality supplies.

A business expense tracker app can also be a valuable tool for categorizing and tracking expenses. These apps can automatically categorize expenses based on bank accounts and credit card information, saving time and ensuring accuracy.

By defining and establishing expense categories, a business can gain a better understanding of a business’s financial position and make informed decisions regarding spending and budgeting.

Step 7: Use a Business Credit Card

Using a business credit card is another effective strategy for tracking business expenses. A dedicated credit card for a business separates personal and business expenses, making it easier to track expenses and manage business finances.

A business credit card also simplifies the process of recording expenses. Many credit card companies categorize spending, and this data can be easily imported into accounting software, saving time and minimizing potential errors in expense tracking.

Moreover, business credit cards often have additional benefits such as cash back, travel rewards, and higher credit limits. These perks can further support the financial health of a small business.

Step 8: Prefer Digital Transactions

Opting for digital transactions over cash can significantly streamline tracking business expenses. Digital transactions, whether made through a business credit card, bank transfer, or online payment platform, automatically create a transaction record in digital receipts.

Invoicing software can further simplify the process of tracking income and expenses. It allows to create, sending, and track invoices digitally, ensuring that all the income is accurately recorded.

Similarly, an expense tracker app or expense tracking software can automate the process of recording and categorizing expenses. These digital tools can sync with bank accounts and credit cards, automatically importing and categorizing transactions.

Some of the best expense tracking software offers features like receipt scanning, expense report generation, and integration with accounting software.

By preferring digital transactions and leveraging digital tools, the business can make tracking business expenses more efficient, accurate, and less time-consuming.

Step 9: Use Accounting Software and Finance Automation

Accounting software and finance automation tools have become indispensable for effective expense tracking, offering a range of features that simplify and streamline tracking business expenses.

Accounting software, for instance, can automate the process of recording and categorizing expenses. It can sync with bank accounts and credit cards, automatically importing transactions and categorizing them based on predefined rules. This not only saves time but also ensures accuracy in expense tracking.

Many accounting software solutions offer features like invoice generation, payroll management, and financial reporting. These features provide a comprehensive view of a business’s financial health, aiding decision-making and strategic planning.

In addition to accounting software, business expense trackers and expense tracking apps can be valuable tools for small businesses. These apps can capture receipts, track mileage, and even generate expense reports, making managing and monitoring business expenses easier.

Step 10: Generate and Review Expense Reports

Generating and reviewing expense reports is critical to small business expense tracking. These reports provide a detailed overview of all your expenses, helping you understand where your money is going and identify potential areas for cost savings.

Accounting software can automate the process of generating expense reports. These reports can be customized to show expenses by category, vendor, or period, providing valuable insights into your spending patterns.

Regularly reviewing these reports lets you keep your expenses organized and controlled. You can identify trends, spot anomalies, and make informed decisions about your business spending. For instance, if you notice a significant increase in a particular expense category, you can investigate further to find out why and take corrective action if necessary.

Expense tracking aims to record expenses and use this information to manage your finances more effectively. Regularly generating and reviewing expense reports is a key part of this process.

Step 11: Keep Focus on Cash Flow and Working Capital

Maintaining a focus on cash flow and working capital is crucial for the financial health of small businesses. Cash flow refers to the net amount of cash moving in and out of your business, while working capital is the difference between your current assets and liabilities.

Effective expense tracking plays a key role in managing both. Keeping a close eye on your expenses ensures that outgoing cash flow is within your incoming cash flow. This helps prevent cash shortages and keeps the business running smoothly.

Similarly, managing expenses can maintain a positive working capital balance, ensuring enough resources to meet short-term obligations and invest in the business’s growth.

Advantages of Tracking Expenses

Effective expense tracking offers numerous advantages for small businesses. Here are some key benefits:

- Financial Control: By tracking expenses, you clearly understand where your money is going. This allows you to control your spending and avoid unnecessary expenses.

- Budget Management: Regular expense tracking helps you stick to your budget. You can identify areas where you’re overspending and make necessary adjustments.

- Cash Flow Management: Keeping track of expenses helps you manage your cash flow more effectively. You can ensure that your outgoing cash is within your incoming cash, preventing cash flow problems.

- Tax Deductions: If you track expenses accurately, you can use tax deductions for business expenses. This can significantly reduce your tax liability.

- Financial Planning: Expense tracking provides valuable data for financial planning. You can use this information to make informed decisions about budgeting, investing, and growing your business.

In short, tracking expenses is not just about recording numbers. It’s about gaining insights to help you manage your finances more effectively and drive business growth.

Conclusion

Effective expense tracking is a cornerstone of successful financial management for small businesses. It provides valuable insights into spending patterns, aids in budget control, facilitate tax deductions, and supports strategic financial planning.

Leveraging accounting software can significantly streamline this process, automating tasks and providing real-time financial data. By embracing these practices, small business owners can better understand their financial health, make informed decisions, and ultimately drive their businesses toward sustainable growth.

Sign-up with Akounto to outsource your accounting tasks the top industry professionals and experts.