Understanding Invoice Numbers

An invoice number is a unique identifier mentioned on an invoice that helps in payment processing and tracking and efficient record-keeping.

An effective invoice numbering system provides numerous benefits. It assists in accurately tracking payments, expedites the reconciliation of invoices, and aids in identifying any discrepancies in financial transactions.

Employing an effective numbering system helps avoid confusion, making it easier to find specific invoices when needed.

Microsoft Excel, a commonly used tool by small business owners, can help manage these numbers, making it even more convenient for businesses to maintain their records.

While the specifics of assigning invoice numbers can vary between businesses, the underlying principle remains constant: every invoice number should be unique.

An invoice number is a powerful tool that facilitates smoother business operations, ensuring the generation of future invoices is as seamless as possible.

Need for an Invoice Numbering System

An invoice numbering system’s need lies in its ability to streamline financial processes, enhance professional communication, facilitate tax and accounting compliance, and improve overall business efficiency. It helps small business owners in managing their accounting systems effectively.

A well-devised system simplifies the payment processing cycle. An invoice number system can serve both digital and paper invoices, as it helps distinguish each financial document, ensuring accurate and prompt payment.

For small business owners dealing with a multitude of transactions, a clear and logical system is instrumental in avoiding errors and confusion.

The numbering system plays a vital role in tracking payments by facilitating the identification of paid, due, or unpaid invoices. It also helps identify any discrepancies, allowing for timely resolution.

Assigning invoice IDs aids in complying with tax and accounting purposes, as an organized and traceable record of financial transactions is paramount to meeting tax obligations and adhering to accounting standards.

Invoice numbers offer a simple yet effective way of maintaining such records, ensuring that each transaction, from the first invoice to the most recent one, is accounted for.

Using an invoice generator or invoicing software significantly simplifies the process of assigning invoice numbers. It automates the numbering process, ensuring each invoice ID is unique and follows the desired numbering pattern, be it sequential or alphanumeric invoice numbers, thus reducing the margin of error and saving valuable time and resources.

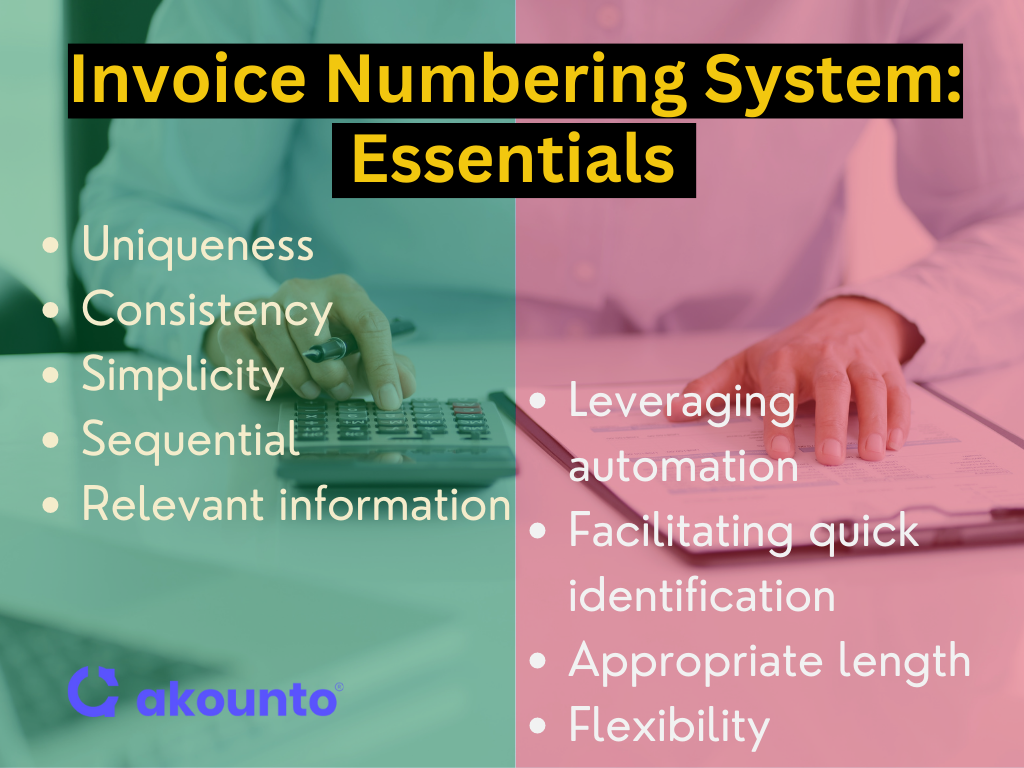

- Uniqueness: Avoiding duplications is essential to prevent confusion and ensure each transaction is distinctly identifiable. Unique invoice IDs are generated and assigned to each invoice to maintain uniqueness.

- Consistency: Maintaining uniformity in the invoice number format allows easy decoding and reference. Once the user sets the standard, the invoicing system follows a particular invoice number format.

- Simplicity: A straightforward format without unnecessary complexities enhances the invoice’s readability for all stakeholders.

- Sequence: Following a logical sequence, invoice numbers aid in organized record-keeping and help to track payments.

- Detailed: Embedding relevant information, like the accounting period, contact details like phone number and email, detailed transaction records, etc., can help generate comprehensive reports.

- Automation: Leveraging automated tools or invoice templates can prevent errors and save time by assigning sequential invoice numbers.

- Clarity: The invoice number’s prominence on the invoice document facilitates quick identification.

- Length: Planning for an appropriate length, sufficient to accommodate business growth, ensures you are prepared for scaling.

- Flexibility: Adaptability in your numbering method allows it to evolve with changes in business operations.

By adhering to these essentials, invoice numbering can contribute significantly to smooth business operations, proving a vital tool for effective financial management.

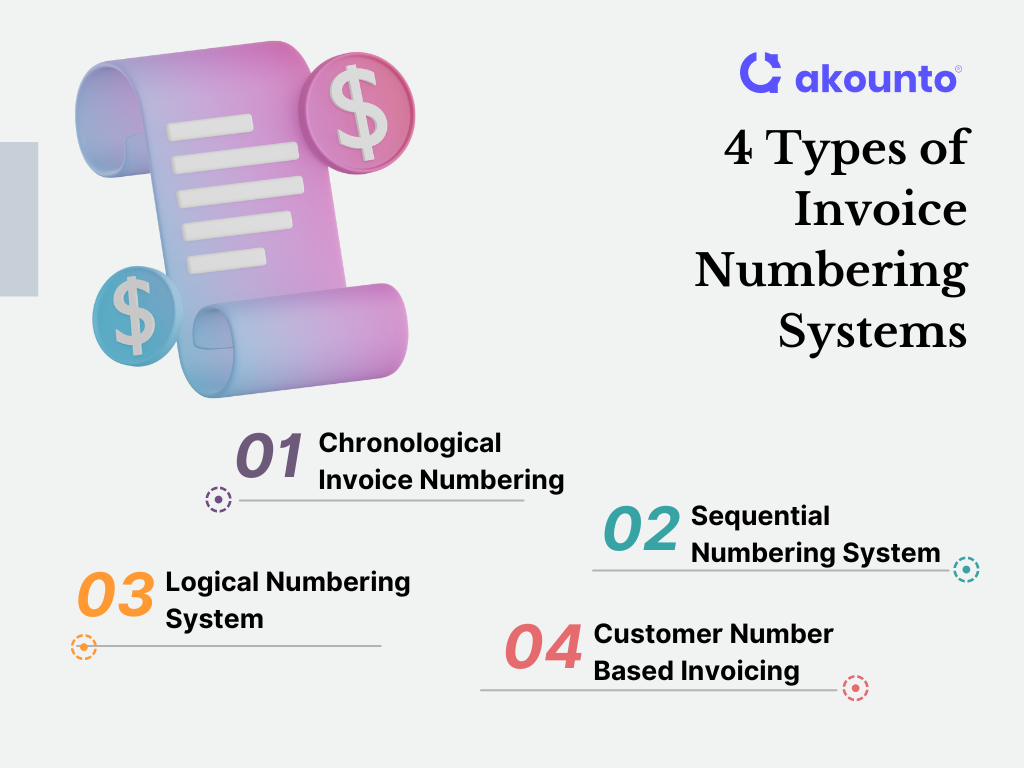

Types of Invoice Numbering Systems

Chronological Invoice Numbering

Chronological invoice numbering is a method where invoice numbers are assigned based on the invoice’s date. This system benefits from readily identifying when an invoice was issued, aiding in tracking and payment processing.

Examples

Example 1: Consider an invoice issued on the 1st of July, 2023. The invoice number could be ‘20230701-001’, where ‘2023’ represents the year, ’07’ is the month, ’01’ is the day, and ‘001’ is the sequence number for that day. This format helps businesses understand how many invoices are issued each day.

Example 2: For an invoice issued on the 31st of December 2023, the invoice number could be ‘20231231-045’. In this case, ‘045’ indicates that it’s the 45th invoice generated that day, aiding in tracking the invoice details more efficiently.

The chronological numbering method ensures smooth financial management while aiding in record-keeping for each accounting period.

Sequential Numbering System

The sequential numbering system is an invoicing system where each new invoice is assigned a unique invoice number, one increment higher than the previous one. This approach provides a clear invoice number sequence, making it easier to track invoices and manage payments.

Examples

Example 1: For a new business, the first invoice issued could have the invoice number ‘INV-001’. The next invoice issued would then be ‘INV-002’, followed by ‘INV-003’, and so on.

Example 2: If a business has already issued 50 invoices, the next invoice number in the sequence would be ‘INV-051’. This pattern continues, ensuring each new invoice has a unique and sequential number.

Logical Numbering System

A logical invoice number system employs a more tailored approach to numbering invoices, often incorporating client numbers or project codes within the invoice number.

A logical invoice numbering system enables businesses to incorporate additional information within the alphanumeric invoice numbers, providing extra layers of organization and functionality.

Examples

Example 1: A business working with Client ‘A’ on Project ‘X’ could issue an invoice with the number ‘A-X-001’. The next invoice for the same client and project would be ‘A-X-002’.

Example 2: If a business wants to differentiate between departments, an invoice issued by the sales department could start with ‘S-,’ followed by a sequential number. An invoice issued by the marketing department could start with ‘M-,’ again followed by a sequential number. This could result in invoice numbers like ‘S-001’ and ‘M-001’.

Customer Number Based Invoicing

Customer number-based invoicing is a method that uses a client number within invoice numbers. Each client is assigned a unique identifier, which is incorporated into their invoices. This helps the business owner track payments more efficiently, making it easier to manage separate invoices for a particular client.

Examples

Example 1: A client with the identifier ‘C123’ can receive invoices with numbers ‘C123-001’, ‘C123-002’, and so forth. This way, the invoice-generating software can systematically assign invoice numbers, simplifying tracking and payment reconciliation.

Example 2: If a client with the number ‘B456’ has multiple projects, each project could have its invoice numbers, such as ‘B456-P1-001’ for Project 1 and ‘B456-P2-001’ for Project 2. In this manner, even within a single client’s transactions, the invoice number is a unique identifier, providing greater clarity for financial management.

Using Accounting Software to Create Invoices

Integrating accounting software in managing invoice numbers can greatly enhance business efficiency by ensuring an error-free invoice number sequence while creating professional invoices, leading to better financial control and brand integration.

Accounting software simplifies the task of generating professional invoices and helps in assigning unique invoice numbers.

The software’s ability to generate a unique number for each invoice is an important feature. As a result, businesses can maintain a sequential invoice numbering system that prevents duplicate payments or invoice number errors. Each unique record number assigned to an invoice becomes a part of the financial record, facilitating easy tracking and management.

Using accounting/invoicing software also ensures consistency in invoice number sequence, where a unique number is generated for every invoice whenever small business owners create an invoice. Accounting software maintains the invoice number sequence without any interruption. This prevents gaps or overlaps in the sequence, providing a smooth invoicing experience.

Creating an invoice using a predefined invoice template is another advantage offered by most accounting/ invoicing software, as there is an option to customize templates according to the needs, including specifying how many digits the invoice number should contain.

Advantages

Organizing and Tracking Invoices

Invoice numbers are pivotal in organizing and tracking multiple invoices. For instance, a unique invoice number assigned to a new invoice simplifies the identification process, ensuring the invoicing process runs smoothly.

Logical Invoice Numbering Systems

Logical invoice numbering systems can encode specific details within the invoice numbers, facilitating the identification of invoices linked to a particular client or project. This system creates a smooth path for business owners to identify invoices, aiding the invoicing process.

Useful for Accounting Purposes

Recording invoice numbers is crucial for maintaining accurate accounting records. These unique identifiers streamline the process of tracking financial transactions, making it easier to keep the business running smoothly.

Payment Processing

Assign invoice numbers to all the transactions. They help the buyer and seller quickly identify the invoices due for payment, ensuring every transaction is accounted for.

Ensuring Accurate and Timely Payments

A distinct invoice number can ensure accurate and timely payments. If a client has to pay multiple invoices, referencing the correct invoice number helps apply the payment to the correct invoice, eliminating potential confusion.

Preventing Duplicate Payments

Each invoice number is unique, safeguarding to avoid duplicate payments. Distinct numbering prevents financial errors, thus enhancing the accuracy of the invoicing process.

Enhancing Communication with Clients

Invoice numbers facilitate more effective communication with clients. During any financial discussion, referring to the specific invoice number brings clarity and speeds up the resolution, proving how invoice numbers are important in keeping client interactions efficient and productive.

Best Practices: How to Number Invoices?

- Prefix or Suffix: Use a prefix or suffix to add additional information to the invoice number, such as a code or abbreviation.

- Unique Number Generated Every Time: Assign a unique invoice number to each invoice generated to avoid confusion and maintain accurate records.

- Clear and Consistent Format: Use a clear and consistent format for the invoice number, making it easy to understand and identify.

- Mapped to Accounts: Align the invoice number with specific accounts or departments to streamline financial tracking and record-keeping.

- Avoid Special Characters: Avoid using special characters in the invoice number to prevent technical issues or formatting errors.

- Incorporating Client or Business Identifiers: Consider incorporating client or business identifiers within the invoice number for easier identification and categorization.

- Date-Based Elements: Include date-based elements in the invoice number, such as the year or month, to denote when the invoice was generated.

- Based on the Accounting System in Use: Customize the invoice system to align with the specific accounting needs or software used by the business.

Assigning IDs in Practice

Utilizing Accounting and Invoicing Software

Utilizing software streamlines the process of assigning invoice numbers. These software solutions provide automated features that generate unique and sequential invoice numbers, ensuring accuracy and efficiency in the invoicing process.

Invoice Numbering Capabilities of Digitization

Invoicing-generating software offers specific functionalities for managing invoice numbering. It allows customization of invoice number formats, enabling businesses to incorporate elements such as prefixes, suffixes, or client identifiers. This flexibility ensures alignment with the unique requirements of the business.

Creating Invoice Templates

Creating invoice templates within the software simplifies the process of assigning invoice numbers. These templates can be customized to include predefined numbering sequences, specific formats, and necessary information, enabling consistent and professional invoice generation.

Tailoring Invoice Numbering to Business Needs

Tailoring the invoice numbering to business needs ensures the process aligns with specific requirements. This may include incorporating additional information, such as project codes or department identifiers, to enhance tracking and categorization.

Balancing Flexibility and Consistency

Balancing flexibility and consistency is crucial in invoice numbering. While flexibility allows for customization and adaptation to changing business needs, maintaining consistency ensures a standardized approach across invoices, enabling easier identification and tracking.

Conclusion

Invoice number is important for businesses to meticulously record invoice numbers, aiding in the creation of organized invoices and facilitating seamless financial operations. The process of creating invoices becomes simpler and more accurate, underscoring the importance of robust invoice numbering.

Use Akounto’s inbuilt invoicing software to number invoices automatically and integrate with your accounting system and get paid fast.