Overview of Invoices, Receipts, and Bills

Invoice

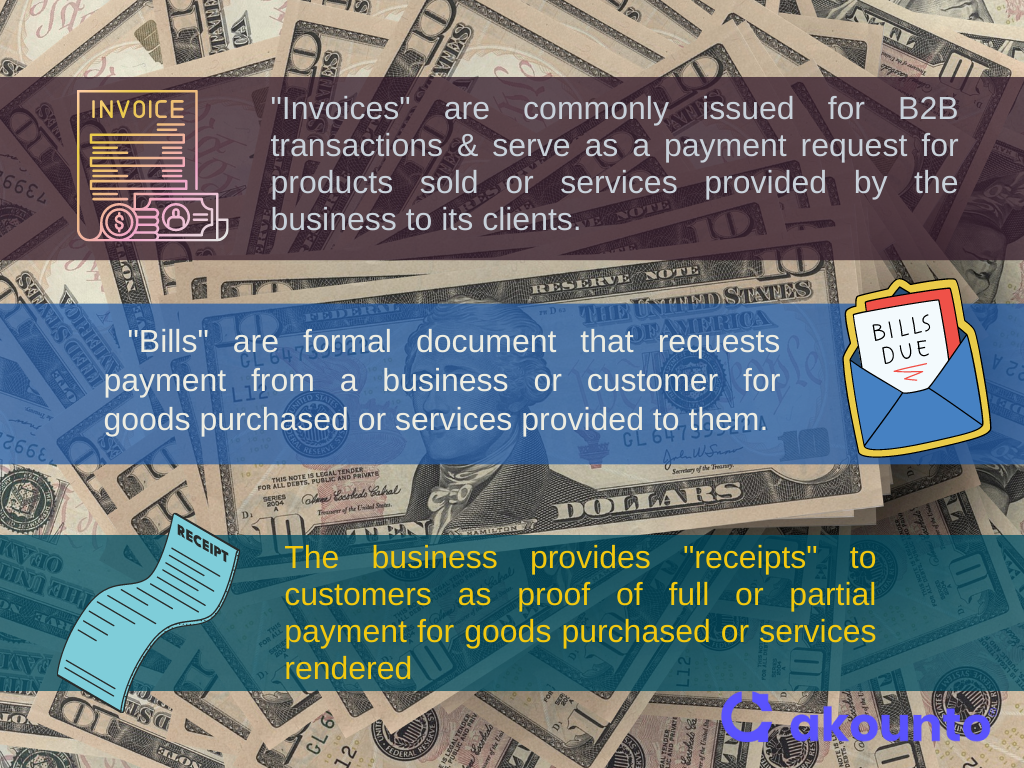

Invoice Definition: An invoice serves as a payment request for products sold or services provided by the business to its clients.

Functions of Invoice

- Invoices are commonly issued for business-to-business transactions (B2B).

- A formal invoice outlines the terms and conditions of the business transaction, including the payment due date, accepted payment methods, money owed, and any applicable discounts or penalties, ensuring that both parties are aware of their obligations.

- An invoice document also provides the business with a clear record of the services or products sold for recordkeeping purposes.

Receipt

Receipt Definition: A receipt serves as an accounting document a business provides to customers as proof of full or partial payment for goods purchased or services rendered.

Functions of receipt

- Receipts provide documentation for both the buyer and the seller, serving as a reference for future plans, inquiries, and disputes.

- The receipt can help verify the purchase date and establish a client as the original purchaser of the item to process warranty claims or obtain service for the product.

- Receipts also provide supporting documentation for a business transaction, ensuring transparency and accountability of the business’s finances.

- Businesses can issue receipts in paper and electronic formats via email as PDF, accounting software, or can be generated through point-of-sale (POS) systems.

Bill

Bill Definition: A bill is a formal document that requests payment from a business or customer for goods purchased or services provided to them.

Functions of bill

- Bills serve as a record of the amount customers owe and their payment details. They are issued to collect money for business-to-consumer transactions (B2C) such as medical bills, credit card bills, utility bills, etc.

- The purpose of a bill is to facilitate the payment process and ensure that the seller receives the agreed-upon compensation for their products or services rendered.

- By issuing bills and tracking payment amounts and their due date, businesses can anticipate the incoming cash flow, track accounts receivable, plan for expenses, and ensure a healthier financial position.

- Bills serve as evidence of the agreed-upon transaction and can be used in case of disputes or disagreements regarding payment.

Use cases

Invoices

Small businesses can issue invoices requesting payment when they provide goods or services on credit or per agreed payment terms to the client. Invoices are used to establish a formal record of the transaction and initiate the billing and accounts receivable process. Some of its use cases are as follows.

- Product Sales: A small business can issue an invoice to sell goods on credit. It specifies the items sold, their quantity, prices, and payment date. Businesses can follow up on unpaid invoices to ensure timely payment.

- Contractual Agreements: Businesses that enter into contractual agreements with clients for long-term projects or ongoing services can send invoices upon agreed terms to collect payment. They help businesses track their billable hours and expenses, calculate the total amount due, and request payment accordingly.

- Subscription-based Service Providers: can use invoices to collect recurring payments from subscribers at regular intervals (monthly or annually), ensuring a consistent revenue stream for the business.

- Credit Notes or Adjustments: In case of an error in the original invoice or a need to refund the customer, a credit note invoice can be used to rectify the situation.

- Reimbursement of expenses: Businesses may need to invoice clients for reimbursement of expenses incurred on their behalf, such as a marketing agency printing fliers and offering promotional items on behalf of a client.

Receipts

Small businesses use receipts as proof of payment when customers make purchases and pay immediately, either in cash, by credit card, or through other forms of immediate payment. The business then provides a receipt that confirms that payment has been received. It also provides a transaction record for the business and the customer’s accounting documents.

Receipts have various use cases across industries:

- Retail store receipts: helps verify items purchased, facilitates returns, exchanges, warranty, or insurance claims.

- Online shopping: E-commerce platforms can send electronic receipts to customers post their purchase, giving customers information about the items purchased, payment confirmation, delivery, and policy for returns or refunds.

- Service Providers: Receipts for services rendered by hair salons, spas, restaurants, auto mechanics, and other businesses outline service charges for parts or materials used, taxes, gratuity, and any additional fees. They serve as evidence for warranty claims or reimbursement for covered services for dispute resolution.

- Professional Services: Receipts issued by professionals like lawyers, consultants, or freelancers gives details about their work done, project fees or hourly rates, and the total amount. They help professionals track income, provide evidence for billing clients, and support tax reporting.

- Rental Agreements: Receipts issued by rental businesses such as car rentals, equipment, property, and many other rental companies serve as records and evidence of the rental transaction, rental period, deposit amounts, and additional charges. It can be used for dispute resolution or as proof of payment.

Bills

Small businesses receive bills from their service providers or suppliers for purchases made or services received. These bills outline the amount owed, payment terms, and other relevant details. Small businesses use bills to track their accounts payable and ensure timely payment to their vendors or service providers. Here are some use cases.

- Subcontractor Bills: Businesses often work with subcontractors like construction companies who provide specialized services and issue bills for the work completed or materials supplied. Businesses can use the bills to reconcile expenses and ensure timely payment.

- Licensing & Royalties: Businesses may receive a bill for using licensed software, copyrighted material, or intellectual property. They specify licensing terms, usage rights, and payment obligations and can be used to ensure compliance with contractual obligations.

- Outsourced Services: These bills itemize services such as IT support, marketing, payroll, etc., duration or frequency of service, and associated fees. Businesses use the bills to manage outsourcing expenses and facilitate payments.

- Repair or Maintenance Services: These bills detail the services performed, parts replaced, and associated costs. Businesses use them to track maintenance expenses and budget future expenses (purchases and depreciation).

- Professional Memberships & Associations Bills: outlines membership benefits, duration, and associated fees. Businesses use them to maintain their membership status.

Differences: Invoice Vs. Receipt Vs. Bill

| Basis | Invoice | Receipt | Bill |

| Meaning | The business sends it to request payment for products or services delivered to the client. | It is provided to the customer as proof of their payment for goods or services purchased. | It is a formal record of purchase that is generally provided immediately upon the transaction completion. |

| Purpose | To request payment from a client or customer. | Acknowledges the payment received from the customer. | Notifies the amount due for payment. |

| Legal status | Not considered proof of payment. | It can serve as proof of payment for tax and accounting purposes. | It may be legally binding and can be used as evidence of a debt. |

| Components | Company Logo, seller’s and buyer’s contact details, invoice number, date, products and services sold, prices, total amount, and payment deadline. | Transaction date, payment method, item description prices, amount paid, warranty, exchange, and return policy. | Seller’s and buyer’s information, bill number, purchase date, payment method, and amount to be paid. |

| Timing | Issued before the payment is made | Provided after payment has been made. | Issued immediately after goods or services have been received. |

| Advantages | Useful for accounting and tax filing purposes and tracking inventory and sales. | Provides business evidence of taxable income on expenses. | Buyers can use it as proof of payment to initiate returns or replacements.Serves as proof of purchase between the buyer and seller and evidence for dispute resolution. |

Conclusion

Invoice vs. bill vs. receipt, each document serves a specific purpose in the financial transaction process, with an invoice and a bill being issued by the seller or service provider for goods and services delivered to the customer. Once the customer pays, a receipt is generated acknowledging the payment.

Akounto’s efficient invoicing software can help businesses reduce manual errors, create customized invoices, and streamline payment processes. Visit our website to know more.