Introduction

Opening balance equity is an account generated by accounting software to depict the difference between the debit balance and the credit balance in a company’s general ledger.

The open balance equity account is located under the equity section of the balance sheet along with the other equity accounts, such as retained earnings. It helps to offset opening balance transactions.

The opening balance account is not displayed on the balance sheet if the account balance is zero. This is a good indicator as opening balance equity account should be temporary by design.

Importance

Opening balance equity account plays a crucial role in maintaining accurate financial records. Here are some reasons why it is important:

- Starting Point: Whether it is a new or an existing business beginning a new accounting period, opening balances allow proper initialization of assets, liabilities, bank and credit cards, and equity accounts and help set the foundation for ongoing financial transactions.

- Reliable Financial Performance: By allocating balances correctly, the opening balance equity account is cleared, and the company’s income statement reflects the actual revenue, net income, and expenses. Financial statements from different periods can also be compared more effectively, allowing stakeholders to track changes, identify trends, areas of improvement, or potential concerns, and understand the company’s progress over time.

- Error Detection: If discrepancies or unallocated amounts remain in the opening balance equity account post the initial balances are recorded, it indicates potential errors in the financial data. The business can identify mistakes or omissions that must be corrected, ensuring accurate financial reporting.

- Smooth Transition: Companies switching to a new accounting software can use the opening balance equity account to reconcile their financial records. This ensures a smooth transition among the systems without distorting the financial statements or losing historical data.

- Audit Trail: Opening balance equity account provides an audit trail for the initial account balances entry and adjustments made during the setup of a new company or the transition to a new accounting system. It helps document the changes made and provides a clear record of the accounting adjustments for future reference and audit purposes.

Impact of Incorrect Opening Balance Equity on Financial Statements

- Balance Sheet Errors: Errors in the opening balance equity account can result in an imbalance between total assets and total liabilities plus equity. It can distort the company’s financial position and undermine the balance sheet’s integrity.

- Misrepresenting Financial Performance: It is important to have a zero balance in the opening balance equity account once all adjustments are made. But any data entry error or lingering balance in the account can lead to inaccurate revenue, expense, or net income figures, potentially misrepresenting the company’s financial performance.

- Misstated Equity: Equity represents the ownership interest in the company, and inaccuracies in opening balance equity can result in an incorrect representation of owner’s equity accounts, affecting financial ratios like return on equity and distorting the understanding of the company’s financial health and value.

- Inconsistent Comparative Analysis: Opening balance equity is crucial for maintaining historical continuity in financial reporting. Errors in the opening account balances can lead to inconsistencies in financial ratios, trends, and comparisons, making it difficult to assess the company’s performance and make informed decisions.

- Audit & Compliance Issues: Auditors rely on accurate opening balance equity account for procedures and assessments as their starting point. Inaccuracies in the opening account balance can result in increased scrutiny, potential adjustments, and delays in the audit process, impacting the company’s compliance with accounting standards and regulations.

- Decision-Making Implications: Financial statements are vital for decision-making by management, investors, creditors, and other stakeholders. If the opening balance equity is incorrect, it can compromise the ability to assess the company’s financial health, profitability, and viability, leading to faulty financial analysis and misinformed decisions.

Step-by-Step Guide for Correcting Opening Balance Equity

The opening balance equity account is a temporary account that records values during the initial company setup or accounting system transition. Afterward, the company should clear the balance in this account and bring it to zero to make the balance sheet accounts appear clean and professional.

Below are the journal accounting entries to close the opening balance equity and ensure presentable balance sheets.

- If the company is a corporation: Close out the balance equity to “Retained Earnings.”

- If the company is a sole proprietorship: Close out the balance equity to “Owner’s Equity.”

If there’s a positive balance, put a debit entry in the opening balance equity account and a credit entry in the owner’s equity account (or retained earnings account.)

If there’s a negative balance, put a credit entry in the opening balance equity account and a debit entry in the owner’s equity account (or retained earnings account.)

Remember that closing the balance equity to retained earnings or owner’s equity is basically the same concept. These equity accounts are just marked differently to represent the ownership or form of a business.

Opening Balance Equity vs Retained Earnings Account

| Basis | Opening Balance Equity Account | Retained Earnings Account |

| Purpose | Opening balance equity account is used during the initial setup of a company or accounting system transition to record prior account balances until they are properly allocated. | Retained Earnings account reflects the net profits or net earnings retained by the company after paying off all the costs, taxes, and shareholder dividends. |

| Nature | Temporary account created by accounting software to balance out unbalanced transactions. | Permanent account that reflects ongoing financial performance. |

| Timing | Used during the initial setup of a company or accounting system transition. | Maintained throughout the life of the company. |

| Presentation on Financial Statements | Opening balance equity does not appear on the financial statements once all the balances have been correctly allocated and the account balance is zero. | Retained earnings are presented under the equity section on the balance sheet. |

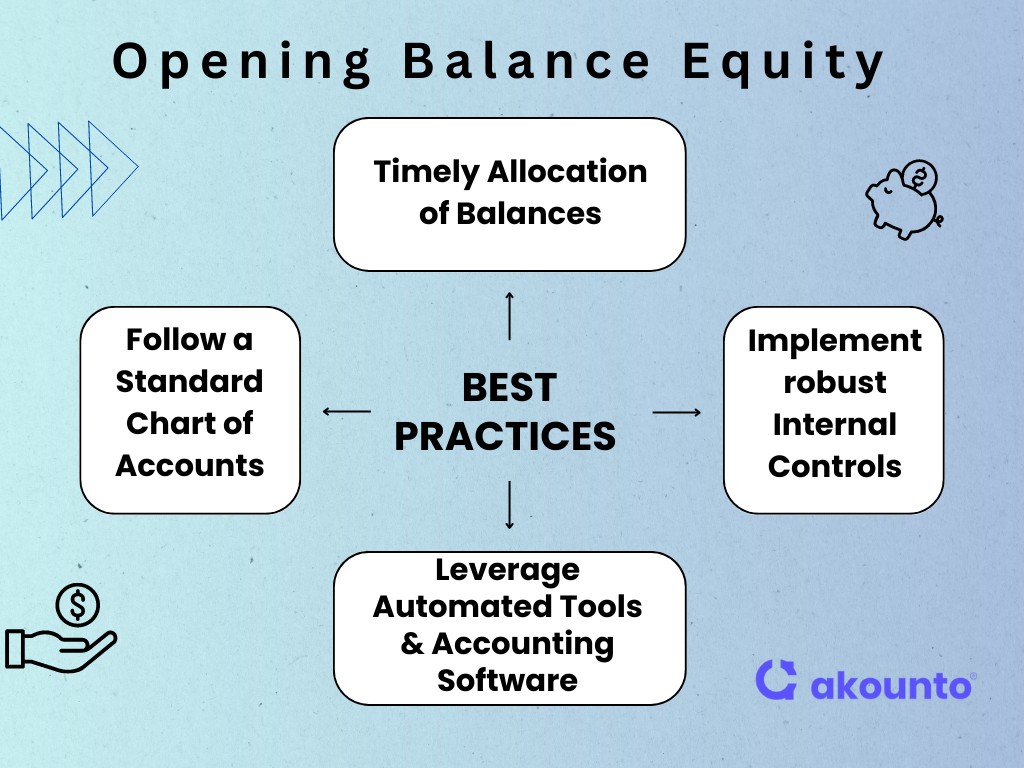

Best Practices to Avoid Opening Balance Equity Issues

Timely Allocation of Balances

Avoid leaving balances in the opening balance equity account for an extended period, as lingering balances may lead to incorrect bank reconciliation adjustments and financial reporting, leading to discrepancies between the company’s records and the bank account statements.

Small businesses can remedy this by reconciling the oepning balance equity account to zero by entering the ending balance, marking bank-cleared items, and ensuring that all items are properly reconciled.

Follow a Standard Chart of Accounts

Ensure that the chart of accounts is well-structured, comprehensive, and properly organized to avoid misclassifications and errors during the initial setup and later account entry process from opening balance equity accounts to relevant accounts.

Implement robust Internal Controls

Implement internal controls to segregate duties, regular financial reviews, reconciliations with the bank account, and authorization of procedures to minimize potential errors and improve accuracy in financial reporting of the balance sheet.

Small businesses should also provide comprehensive training to the accounting and financial record-keeping staff to ensure they understand the importance of allocating beginning balances to all the accounts and the potential impact of opening balance equity issues.

Attention to Detail

Double-check the accounting entries for accuracy, including their account numbers, customer entry, amounts, and classifications. Small businesses can leverage the automated tools and accounting software of Akounto to minimize manual data entry errors to prevent them from carrying forward and impacting future financial records. For example, outstanding balances may result in an accounts receivable opening balance.

Final Words

As a small business owner, if you find yourself with an opening balance equity account, do not panic. It is simply an automated function programmed into accounting software demonstrating an issue with the previous term’s balance sheet. There may be many simple reasons for opening balance equity accounts to show up, even though there have been no recent new bank or customer entry additions.

It could be due to missing uncleared bank checks or a journal accounting entry amount that does not match the bank statement balance transaction. So, it is important to understand the root cause of opening balance equity accounts and resolve the issue to ensure the accuracy of your balance sheets.

To learn more, visit Akounto’s blog and explore topics on business, finance and taxation.