What is Fair Value Accounting?

Fair value accounting refers to estimating the valuation of an asset or liability that can be sold or settled to a third party in an orderly transaction under current market conditions.

This approach ensures that the value of an asset or liability reflects the actual market conditions at the measurement date, irrespective of the holder’s intent to continue holding it.

The fair value accounting method assumes an orderly transaction, meaning there is no undue pressure to sell, as might be the case in a corporate liquidation sale, and both the buyer and seller exercise their due diligence eliminating information asymmetry.

The ideal determination of fair value is based on prices offered in an active market, with a high volume of transactions providing ongoing pricing information. The market from which a fair value is derived should be the principal market for the asset or liability, as it would presumably lead to the best prices for the seller.

Fair market value accounting is adaptable to different types of assets and liabilities, making it a versatile tool in financial accounting.

It provides a true measure of a company’s income based on the actual value of its assets and liabilities rather than relying solely on historical costs.

Examples

A company may own an investment property that was purchased for $1 million a decade ago. Today, the current market valuation of the property is $1.5 million. Under fair value accounting, the company would report the property at its current value of $1.5 million on its balance sheet.

If a business owns shares in a publicly traded company, the fair value of those shares would be the current market price. This method provides a more accurate and up-to-date reflection of the company’s financial position.

IFRS 13 and FASB ASC 820

The IFRS 13 (International Financial Reporting Standards) and the FASB (Financial Accounting Standards Board) ASC 820( Accounting Standards Codification) are two widely recognized valuation standards that guide the implementation of fair value accounting.

FASB ASC 820 defines fair value and establishes a structure for fair value measurement. It also requires disclosures about fair value measurements and uses a fair value hierarchy similar to IFRS 13. The standard applies to U.S. companies that follow Generally Accepted Accounting Principles (GAAP).

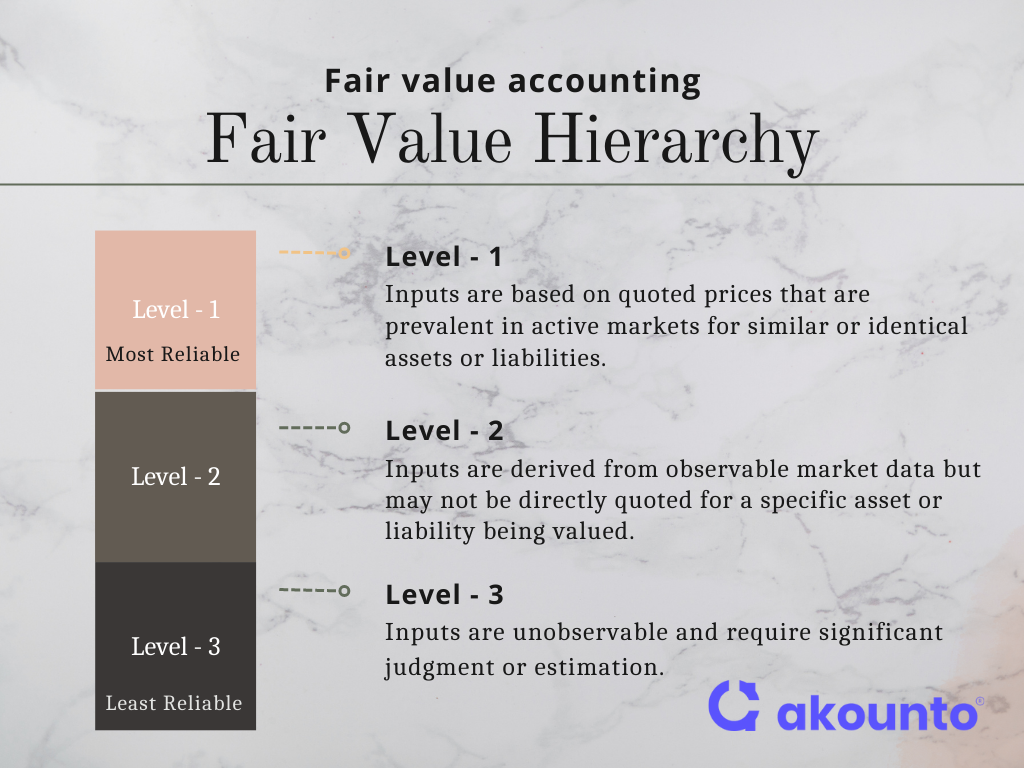

Fair Value Hierarchy

Accounting standard-setting bodies FASB (Financial Accounting Standards Board) and the IFRS (International Financial Reporting Standards) provide guidelines, known as the fair value hierarchy, to help accountants select the most appropriate inputs for these valuation techniques.

This hierarchy ranges from Level 1 (most reliable) to Level 3 (least reliable), with the general intent of guiding the accountant through a series of valuation alternatives.

- Level 1: At this level, the inputs are based on quoted prices that are prevalent in active markets for similar or identical assets or liabilities. These inputs are considered the most reliable and observable, as they reflect actual market transactions.

- Level 2: The inputs are derived from observable market data but may not be directly quoted for a specific asset or liability being valued. This category includes market prices for similar or identical assets or liabilities and pricing models that incorporate observable inputs.

- Level 3: inputs are unobservable and require significant judgment or estimation. They are used when market data is not available or not reliable. Level 3 inputs may involve complex models, assumptions, or management’s subjective assessments like an internally generated financial forecast.

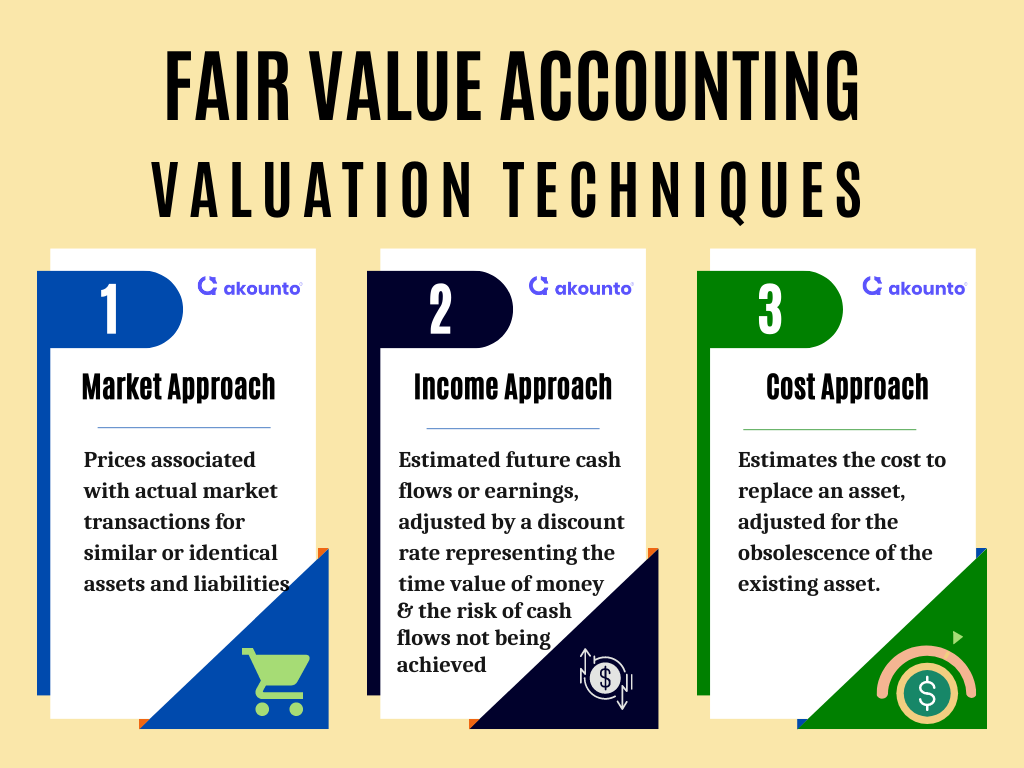

Valuation Techniques/ Methods

The following three techniques are designed to provide the most accurate and reliable estimation of the value of an asset or liability in an orderly transaction under current market conditions. Though different valuation techniques vary wildly they helps to determine a fair market value than can match the actual value of the asset.

The Market Approach

Market approach relies on the prices associated with actual market transactions for similar or identical assets and liabilities. This approach is most effective when an active market with a high volume of transactions provides current market value.

Calculating fair market value should be objective where none of the market participants are influenced by a corporate insider, a price cartel or such distortion techniques.

For instance, the prices of securities can be obtained from financial markets managed by the securities exchange commission (SEC), where these securities are routinely bought and sold at quoted prices.

The Income Approach

It uses estimated future cash flows or earnings, adjusted by a discount rate that represents the time value of money and the risk of cash flows not being achieved of the company’s assets. This approach derives a discounted present value, incorporating risk by developing a probability-weighted-average set of possible future cash flows.

The Cost Approach

Cost approach estimates the cost to replace an asset, adjusted for the obsolescence of the existing asset. This approach is helpful when dealing with assets that suffer from physical deterioration or functional or economic obsolescence.

Fair Value vs. Market Value

| Criteria | Fair Value | Market Value |

| Definition | Fair value is the amount received if you sell an asset or pay transfer a liability in an orderly transaction between market players at the particular date. | Market value is the price for which an asset trades in a competitive auction setting. |

| Determination of Price | The price determination is based on specific advantages and disadvantages to both parties, not active in a market. | Price determination is dependent on demand and supply forces active in a market. |

| Valuation Date | A particular date is not necessary. | A particular date of valuation is necessary. |

| Transaction Parties | The transaction is between specific parties. | The transaction is between a willing buyer and seller but not specific. |

| Stability | Fair value is more stable as it is less influenced by external market forces. | Market value is unstable and can be altered by changing supply and demand patterns. |

| Special Value | Fair value does not disregard special value. It forms part of the fair value assessment. | Market value disregards special value. |

| Use in Accounting | Fair value is recognized globally and accounting standards also accept it. | Market value is not globally accepted since market value depends on external market forces. |

Fair Value Accounting vs. Historical Cost Accounting

| Fair Value Accounting | Historical Cost Accounting |

| Fair value accounting (mark-to-market accounting) reflects the amount a company would receive if it were to sell assets or settle liabilities in the market today. | Historical cost accounting records assets based on the original cost at which they were acquired. This method is conservative, easy to calculate, and reliable. |

| Fair value accounting provides a more accurate and updated reflection of a company’s financial position by considering current market conditions. | While reliable, historical cost accounting may not reflect an asset’s current market value, especially if a significant amount of time has passed since the asset was acquired. |

| The fair value of an asset can fluctuate based on market conditions, demand, supply, and other factors. | The historical cost of an asset remains constant over time, providing stability in financial reporting. |

| Fair value accounting requires specialized knowledge and calculation skills, as it often involves complex valuation techniques. | Historical cost accounting is straightforward to calculate, as it simply involves recording the original cost of an asset. |

| Fair value accounting allows for better comparability between companies as it reflects current market conditions. | Comparability using historical cost accounting can be challenging due to different methods of depreciation and inventory valuation. |

Conclusion

Fair value accounting provides a realistic and timely snapshot of a company’s financial position by reflecting current market conditions. While it involves complex valuation techniques and can lead to volatility in financial statements, it offers better comparability between companies. Understanding the nuances of fair value accounting is crucial for accurate financial reporting and informed decision-making.

Akounto, a cloud-based accounting system helps start-ups and small businesses maintain their accounts, file taxes and make sound business decisions based on its expansive reporting feature.