Defining Capital Budgeting

Capital budgeting (investment appraisal) is used to evaluate potential major investments or expenditures, which include long-term investments such as the acquisition of new machinery, land, and buildings or the initiation of new projects or businesses.

Capital budgeting focuses on ascertaining the future value of these investments and determining whether the projected cash inflows will exceed the total cash outflows over the investment’s life. This process involves a detailed analysis of each potential project’s profitability, market value, and associated risks.

Capital budgeting analysis considers several factors, like the initial investment cost, the potential return on investment, the project’s life span, and the cost of capital or interest rate. It also considers the potential impact on the company’s overall market value and accounting earnings.

The decision to commit to capital expenditure is significant, as it can have long-lasting effects on a company’s financial health. Therefore, capital budgeting decisions must be made with a high degree of diligence and accuracy. To aid in this process, companies employ several capital budgeting methods, each with strengths and weaknesses.

Capital Budgeting Decisions

Capital budgeting, often called capital investment analysis, is a comprehensive process that guides companies in making informed investment decisions. These decisions involve evaluating and selecting capital investments that generate cash flows and contribute to the company’s growth and profitability.

The capital budgeting process starts with the selection of potential capital expenditures. These could include the acquisition of a capital asset, such as machinery or real estate, initiating new projects, or even purchasing existing business operations. Each potential capital investment is then evaluated using various capital budgeting techniques.

These techniques help assess the potential return on each dollar invested, considering the initial cash outlay, the projected future cash flows, and the time value of money. The most commonly used techniques include the Net Present Value (NPV) method, IRR (Internal Rate of Return), and Payback Period.

The capital budgeting decision is not solely about identifying the most profitable projects. It also involves understanding the company’s financial commitments and ensuring that the chosen investments align with its strategic objectives and risk tolerance. For instance, a project with a high potential return might be rejected if it also carries a high level of risk that exceeds the company’s risk tolerance.

Time Value of Money

The Time Value of Money (TVM) is a fundamental financial concept recognizing that money’s worth varies over time. Today’s dollar is worth more than tomorrow’s as it can earn interest or increase liquidity.

Let’s illustrate this with an example.

Example 1: When given two options: receive $10,000 today or $10,000 two years from now. Despite the equal face value, $10,000 today has more value and utility than it will two years from now. This is because the money received today can be invested, earned interest, and grow to a sum greater than $10,000 by the end of the two years.

Example 2: Choosing between a $100,000 payout today or $10,000 per year for the next ten years, totaling $100,000. Money in hand could be invested and can generate considerable returns.

In capital budgeting, the time value of money is crucial as it allows businesses to compare the value of dollars today with the value of dollars in the future, thereby aiding in making informed investment decisions. It helps evaluate the profitability of investments, considering the returns that can be earned over time. This understanding of the time value of money is fundamental to capital budgeting.

Capital Budgeting Methods

Net Present Value Method

The Net Present Value (NPV) method is a capital budgeting technique that computes the present value of the future cash inflows and outflows related to the investment or project and then determines the difference between these two values.

If the NPV is positive, it indicates that the present value of the cash inflows is greater than the cost of the investment, making the project or investment financially viable.

A negative NPV suggests that the cost of the investment outweighs the PV of the future cash inflows, indicating that the project or investment may not be profitable.

The formula for calculating NPV is as follows:

NPV = ∑ (CFn / (1 + i)^n) – Initial Investment

Where:

- CFn represents the net cash inflow during the period n

- i represents the discount rate, or the rate of return forgone, that could be generated on an investment in the financial markets with the similar risk profile

- n represents the number of periods

In capital budgeting, net present value analysis helps make informed decisions about whether to proceed with a particular investment or project based on its projected profitability. It’s important to note that while the NPV method provides valuable insights, it should be used in conjunction with other capital budgeting techniques for a comprehensive analysis.

Payback Period Method

The Payback Period Method calculates the time it takes for an investment to generate cash flows sufficient to recover the initial investment. Businesses often use this method to evaluate the feasibility of a project or an investment quickly.

When the net annual cash inflow is even, meaning the same cash flow is received every period, the payback period can be computed by dividing the initial outlay in the project by the annual cash inflow. The formula is as follows:

Payback Period = Initial Investment / Annual Cash Inflow

This method is useful for small businesses or projects with a tight budget, as it helps determine how quickly they can expect to recover their initial investment.

This method does not consider the time value of money, risk, financing costs, or cash flows beyond the payback period. Therefore, while it can be a useful tool in the initial stages of capital budgeting, it should not be the sole determinant in the decision-making process.

Discounted Payback Period

The Discounted Payback Period is another capital budgeting method that considers the time value of money. Unlike the simple Payback Period method, this approach discounts the future cash flows before subtracting them from the initial investment.

The formula for calculating the Discounted Payback Period is as follows:

Discounted Payback Period = year Before the Discounted Payback Period Occurs + (Cumulative Cash Flow in the Year Before Recovery / Discounted Cash Flow in the Year After Recovery)

In this formula, the ‘Year Before the Discounted Payback Period Occurs’ refers to the last year where the cumulative discounted cash flow was negative. ‘Cumulative Cash Flow for the Year Before Recovery’ is the absolute value of this negative cash flow, and ‘Discounted Cash Flow in the Year After Recovery’ is the discounted cash flow for the following year.

This method is particularly useful for long-term investments, where the impact of discounting is more significant. It provides a more realistic estimate of the payback period, considering the diminishing value of future cash flows due to factors such as inflation and opportunity cost. It does not consider cash flows beyond the payback period, which can lead to sub-optimal investment decisions if these cash flows are significant.

Discounted Cash Flows Method

The Discounted Cash Flows Method is a capital budgeting technique that considers the time value of money. It is a preferred method for long-term investment projects where future cash streams are expected to be significant.

The formula for the Discounted Cash Flows Method is as follows:

Net Present Value (NPV) = ∑ [Cash inflow in period t / (1+r)^t] – Initial Investment

Here, ‘t’ represents the period, ‘r’ is the discount rate, and the summation (∑) is the overall project life period. The cash inflows are the projected cash flows from the investment project, and the initial investment is the amount of investment funds committed to the project at the beginning.

The Discounted Cash Flows Method provides a net present value for the project, which is the sum of the present values of all cash inflows and outflows. A positive NPV signifies that the project is expected to generate a return above the discount rate, making it a potentially profitable investment. This method is a cornerstone of the capital budgeting process and is widely used in financial and investment analysis.

Internal Rate of Return

The Internal Rate of Return (IRR) is a crucial component of the capital budgeting process. It is one of the many capital budgeting methods used to evaluate the profitability of potential investments. The IRR is the discount rate that makes the NPV of all cash flows (inflow and outflow) from a project equal to zero.

The formula for IRR does not have a simple algebraic solution and is usually found through numerical methods. However, it can be conceptually represented as follows:

0 = NPV = ∑ [CFt / (1+IRR)^t] – Initial Investment

Where:

CFt = Cash flow in time period t

IRR = Internal Rate of Return

t = Time period

The IRR method is particularly useful for future proposals, as it provides a percentage return expected from an investment, making it easier to compare with other potential investments or the company’s required rate of return.

Profitability Index

The Profitability Index (PI), also known as the profit investment ratio, is another vital tool in capital budgeting. It is used to identify the relationship between the costs and benefits of a proposed capital investment. The PI is a useful indicator of an investment’s value relative to its cost.

The formula for the Profitability Index is as follows:

Profitability Index = Present Value of Future Cash Flows / Initial Outlay or Investment

The PI helps make investment and financial commitments by providing a clear ratio that can be compared across different projects.

A PI greater than 1 indicates that the project’s present value of future cash flows is greater than the initial investment, suggesting a profitable venture.

This method is particularly useful when purchasing existing business operations or investing in fixed assets, as it helps to determine how such investments will affect future projects. The higher the value investment ratio, the more attractive the investment becomes.

Examples

Example 1

A company is considering an investment that will cost $1 million upfront and is expected to generate $25,000 a month in revenue for seven years. The company’s discount rate is 8%, the return it could earn on an alternative investment of comparable risk.

Solution

The NPV of this investment can be calculated as follows:

| Year | Cash Flow | Discount Factor (1 / (1 + 0.08)^t) | Discounted Cash Flow |

| 0 | -1,000,000 | 1 | -1,000,000 |

| 1 | 300,000 | 0.9259 | 277,770 |

| 2 | 300,000 | 0.8573 | 257,190 |

| 3 | 300,000 | 0.7938 | 238,140 |

| 4 | 300,000 | 0.7350 | 220,500 |

| 5 | 300,000 | 0.6806 | 204,180 |

| 6 | 300,000 | 0.6302 | 189,060 |

| 7 | 300,000 | 0.5835 | 175,050 |

| NPV | 561,890 |

The NPV of the project is $561,890. Since the NPV is positive, the project is considered profitable and worth undertaking.

Example 2:

A company is considering an investment project that requires an initial investment of $100,000. The project is expected to generate the following cash inflows over the next five years:

- Year 1: $20,000

- Year 2: $30,000

- Year 3: $40,000

- Year 4: $10,000

- Year 5: $10,000

Calculate the payback period for this investment.

Solution:

The payback period is calculated by adding up the cash inflows until the total equals the initial investment. Let’s calculate it year by year:

- After Year 1: $20,000

- After Year 2: $20,000 + $30,000 = $50,000

- After Year 3: $50,000 + $40,000 = $90,000

- After Year 4: $90,000 + $10,000 = $100,000

So, the payback period is 4 years. This means that it will take 4 years for the company to recover its initial investment of $100,000 from the cash inflows generated by the project.

Example 3:

Suppose a company is considering an investment in a new project. The initial cash outflow required for the project, including equipment purchase, installation, and initial marketing expenses, is $500,000.

The project is expected to generate cash inflows of $150,000 in the first year, $200,000 in the second year, $250,000 in the third year, and $300,000 in the fourth year.

The company’s cost of capital, the rate of return required to persuade the investor to make a given investment, is 10%.

The Profitability Index (PI) is calculated as the present value of future cash inflows divided by the initial investment. The present value of future cash inflows can be calculated using the formula for the present value of an ordinary annuity:

PV = CF1/(1+r)^1 + CF2/(1+r)^2 + CF3/(1+r)^3 + CF4/(1+r)^4

Where:

- PV is the present value

- CFn is the cash inflow in year n

- r is the discount rate (cost of capital)

So, the present value of future cash inflows is:

PV = $150,000/(1+0.10)^1 + $200,000/(1+0.10)^2 + $250,000/(1+0.10)^3 + $300,000/(1+0.10)^4 = $136,364 + $165,289 + $187,907 + $205,793 = $695,353

Now, we can calculate the Profitability Index:

PI = PV of future cash inflows / Initial investment = $695,353 / $500,000 = 1.39

A PI greater than 1 indicates that the project is expected to generate more cash inflows than it costs, suggesting that it could be a good investment. In this case, the PI of 1.39 suggests that the project is expected to return $1.39 for every dollar invested.

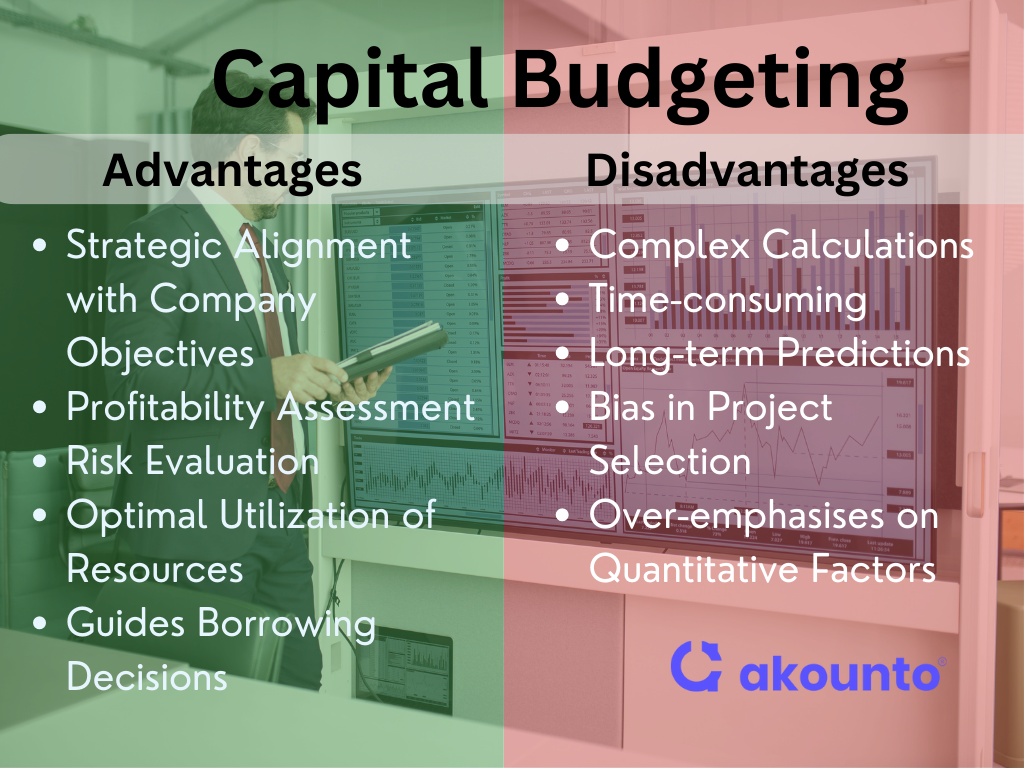

Advantages

Strategic Alignment

Capital budgeting aligns the selection of capital projects with the company’s strategic objectives. It ensures that resources are allocated to projects that support the company’s long-term goals.

Profitability Assessment

Through techniques like Net Present Value (NPV) analysis, capital budgeting allows for evaluating the projected cash flows against the initial cash outflow. This helps in determining the profitability of a project.

Risk Evaluation

Capital budgeting provides a framework for assessing the risk associated with capital projects. It helps identify projects with a high risk-reward ratio and those that align with the company’s risk tolerance.

Optimal Utilization of Resources

Capital budgeting ensures that the company’s capital is used most efficiently. It helps in avoiding over or under-investment in capital projects.

Borrowing Decisions

Capital budgeting analysis can guide decisions about borrowing money. If a project’s NPV is positive, it may be worth borrowing money to finance the project, as the return is expected to exceed the cost of borrowing.

Disadvantages

Complexity

Capital budgeting involves complex calculations and assumptions. For instance, the accuracy of NPV analysis depends on the correct estimation of future cash inflows and outflows and the discount rate.

Long-term Predictions

Capital budgeting requires making long-term predictions about cash inflows and outflows. These predictions can be uncertain and subject to various economic and market conditions.

Time-consuming

The process of capital budgeting can be time-consuming. It involves identifying, evaluating, and selecting capital projects, which can take considerable time and resources.

Bias in Project Selection

There can be a bias in selecting capital projects. Projects proposed by senior management or those that are more visible might get preference over others, despite their NPV or strategic alignment.

Over-emphasis on Quantitative Factors

Capital budgeting primarily focuses on quantitative factors like projected cash flows and NPV. It may overlook qualitative factors like the impact on employee morale or the company’s reputation, which can also significantly affect a project’s success.

Conclusion

Capital budgeting, as a part of corporate finance, helps in the evaluation of capital projects by examining factors like cash flows, risks involved, and the time value of money, etc. It helps companies to optimize resource allocation and make informed financial decisions. The capital budgeting process forecasts the cash flows, equates them with the initial outlay, and compares them in a single time frame.

Visit Akounto’s blog to learn about similar topics which are essential for small business owners.