What is Straight Line Depreciation Method?

Straight-line depreciation method calculates the depreciation expense of a fixed asset by spreading it evenly throughout its entire useful life.

A fixed depreciation amount gets deducted from the asset’s value yearly, resulting in constant depreciation each year till the asset reaches its salvage value.

Using straight-line depreciation, a company can allocate the same percentage of an asset’s value to the physical assets. Straight-line amortization, a similar concept, is applied to intangible assets with definite useful lives, like trademarks, patents, copyrights, etc. The amortization does not assume salvage value and is calculated on the entire intangible asset value.

Straight-line depreciation is determined by dividing the difference between the purchase price of an asset and its expected salvage value by the years it is expected to be used.

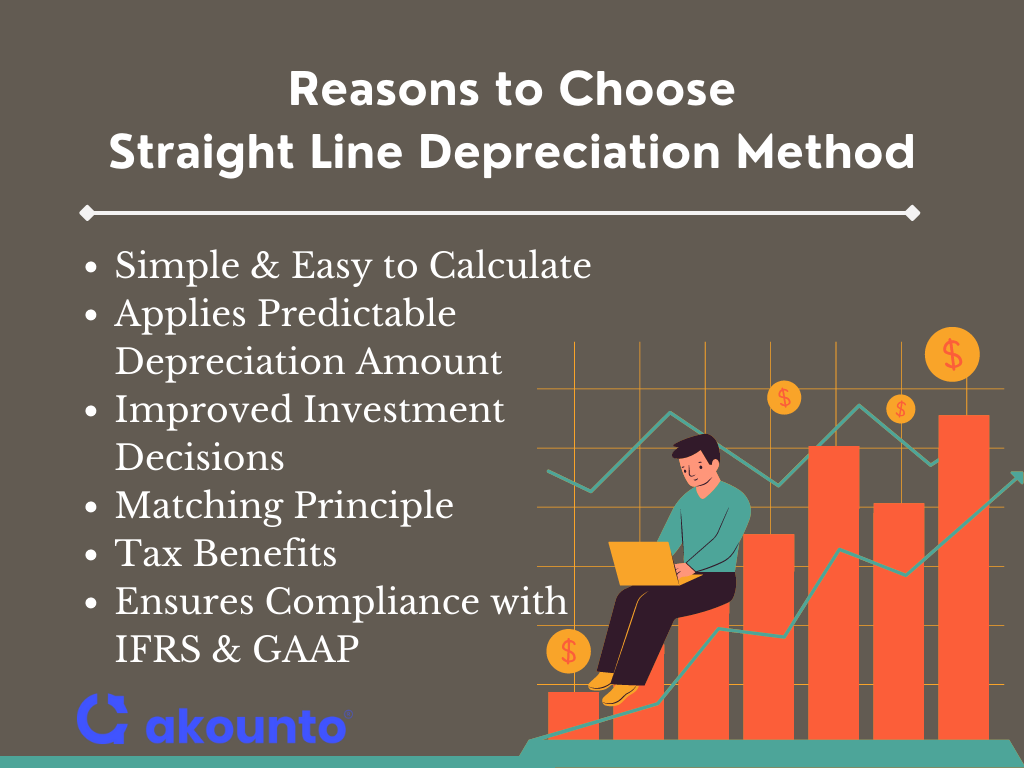

Reasons to Choose Straight Line Depreciation Method

The straight-line method is generally used when there is no set pattern for an asset’s use over time. It is one of the easiest depreciation methods to use and provides highly accurate depreciation calculations. Here are a few reasons for small businesses to opt for straight-line depreciation.

- Simple: Straight-line depreciation is simple to apply for most businesses. The method involves dividing the difference between the purchase price of an asset and its expected salvage value by the number of years of useful life, resulting in a constant annual straight-line depreciation expense.

- Predictable: The straight-line method provides a predictable and consistent depreciation expense over the asset’s useful life, making it easier for businesses to plan and budget for future asset replacement or maintenance needs.

- Improves investment decisions: Knowing the annual depreciation expense amount can help businesses accurately calculate the net income generated by the asset and determine if the asset is generating enough income to justify the investment or if it would be better to invest in a different asset.

- Consistent with Matching Principle: By spreading the asset cost evenly over the asset’s useful life, the straight-line depreciation ensures that the depreciation expense is recognized in a way that matches the revenue generated by the asset.

- Tax benefits: Straight-line depreciation can provide tax benefits by reducing taxable income. It treats depreciation expense as a deductible expense that reduces the taxable income and the business’s tax burden.Small businesses can use the straight-line method to reduce the risk of unexpected tax bills, free up cash flows for investment, plan for future tax liabilities, and improve overall financial planning.

- Compliance: The straight-line method of depreciation is one of the most common method to calculate depreciation and is accepted under both GAAP (Generally Accepted Accounting Principles) and the IFRS (International Financial Reporting Standards). By using this method, businesses can ensure compliance with these standards.

Calculation of Straight Line Depreciation

Formulas to calculate Straight-line depreciation

There are two formulas for calculating straight-line depreciation.

Straight-line depreciation = (Purchase price of Asset – Salvage Value) / Useful Life

Or

Straight-line depreciation = (Purchase price of Asset – Salvage Value) x Depreciation Rate

where:

- Purchase price of asset: It is the initial cost of purchasing the fixed asset or capital expenditure, along with any labor and material costs incurred to bring it into service, such as customization, shipping costs, and installation fees.

- Estimated Salvage Value: is the residual value of a tangible asset at the end of its useful life when the asset is sold, scrapped, or removed from service. Companies may set this estimate based on past experiences or resale industry guides.

- Useful Life: The estimated number of years in which the fixed asset is anticipated to be used in the business or offer economic benefits

Both formulas will give the users the same result while calculating depreciation. The Depreciation Rate in the second formula can be arranged as Depreciation Rate = (1 / Useful Life) x 100 to get it in % terms to match the First formula.

Straight-line calculation steps

- Determine the purchase price of all fixed assets, including an asset’s cost and any costs put into their acquisition, like customization, transportation, and installation costs.

- Calculate the useful life of the assets, and how long they are expected to be in service before the asset’s life is fully depreciated. The IRS updates IRS Publication 946 with a complete list of all assets and their useful lives. Alternatively, businesses can estimate the useful life of an asset. However, this may open up the risk of overestimating the asset’s usage value.

- Estimate the salvage value of the assets to determine the net book value of an asset at the end of its useful life after it has fully depreciated.

- Apply the straight-line depreciation formula. Subtract the asset’s purchase price from the estimated salvage value to obtain the depreciable asset amount. Then divide the depreciation amount by the useful life of the asset to get the annual depreciation expense for the asset.

- Optional step: Divide the annual depreciation expense amount by 12 to calculate the monthly depreciation expense.

- Optional step: Divide 1 by the useful life for an annual depreciation rate. For example, five years equals 1/5, or 20%, yearly depreciation expense. Then multiply the annual depreciation rate by the depreciable base.

- Record the depreciation expense: The depreciation amount is debited to a depreciation expense account on the company’s income statement and credited to an accumulated depreciation account on the balance sheet.The accumulated depreciation is a contra-asset account, which is paired with and reduces the fixed asset account. Accumulated depreciation is eliminated from the accounting records when a fixed asset is disposed of.

Example of Straight Line Depreciation

Company ABC has brought office furniture for $ 20,000. The estimated useful life of the office furniture is to be four years, with a salvage value of $ 2,000. Calculate the straight-line depreciation cost of the asset and its annual depreciation rate.

Solution: Based on the data provided, we have;

- Purchase price of the asset = $ 20,000

- Estimated salvage value = $ 2000

- And useful life of the asset = 4 years

So, applying the straight-line depreciation formula = (Purchase price of asset – Salvage Value)/Useful Life

=> (20,000 – 2000)/4 = $4,500

Given the annual depreciation amount (4,500) and the total asset (4 years), we can calculate the straight-line depreciation rate, which is the Annual Depreciation Amount/Useful Life x100

The depreciation rate is (1/8) x 100= 12.5%

After calculating depreciation expense, the depreciation account of the balance sheet will look like this over the four years of the office furniture’s life:

| Year | Book Value (Beginning year) | Depreciation | Book Value (End of the year) |

| 1 | $20,000 | $4,500 | $15,500 |

| 2 | $15,500 | $4,500 | $11,000 |

| 3 | $11,000 | $4,500 | $6,500 |

| 4 | $6,500 | $4,500 | $2,000 |

Merits of Straight Line Depreciation

- Helps measure Profits: Straight-line depreciation provides a consistent depreciation rate which can be useful for comparing assets across different competitors or industries.

- Promotes timely asset replacement: By providing a predictable depreciation expense over the asset’s life, businesses can timely plan to replace depreciable assets at the end of their useful life.

- Suitable for Small Businesses: The method is suitable for small and medium-sized businesses as it is easy and quick to compute and also does not require specific knowledge to practice.

Demerits of Straight Line Depreciation

- Inaccurate Assumption: The method assumes that assets depreciate at a fixed rate each year and ignores that some assets (like vehicles and machinery) may depreciate more rapidly in the early years of use than others (like land and buildings). It also does not account for maintenance and repair costs and can lead to inaccurate financial reporting.

- Loss of Revenue: The deducted depreciation is not invested or used outside the company. So, there is no gain of any revenue or interest for the business.

- Unsuitable for large businesses: The straight-line method is unsuitable for large companies with different operations and various assets with different useful lives. So, may need to use other depreciation methods to reflect their value over time accurately.

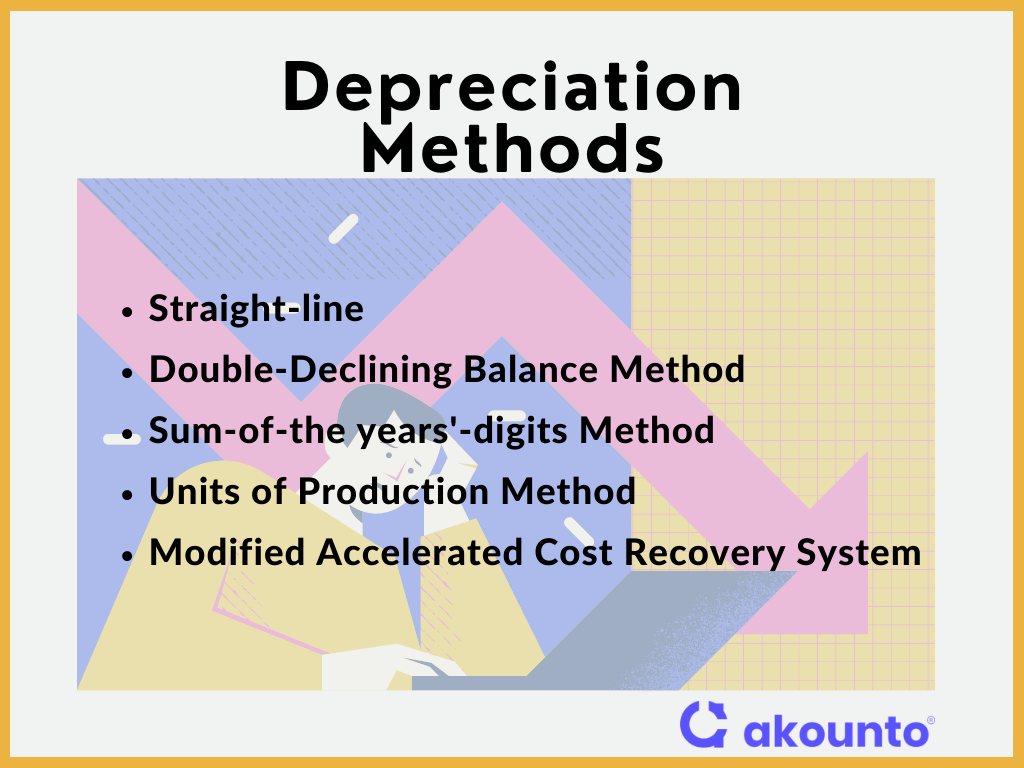

Other Depreciation Methods

Different methods offer varying advantages over others for particular situations, tax gains, and cash flow advantages. The other methods that a company can utilize to estimate the value of its long-term assets are:

Double-Declining Balance Method

The double-declining balance method is used to accelerate depreciation of the asset. The asset experiences higher depreciation expenses at the start of its useful life and lower toward the end of it. Companies use the double-declining balance method to record depreciation on assets that will lose their value early in life.

Sum-of-the years’-digits method

The depreciation method uses a fraction to determine the depreciation charges. The numerator is the number of years in an asset’s useful life, and the denominator is the total sum of digits from 1 to the number of years in the asset’s useful life.

Units of Production method

The units of production depreciation method calculate depreciation expense based on an asset’s usage, the number of units produced, or the hours it operates. A business may charge more depreciation when there is more asset usage and less depreciation when there is less usage.

Modified accelerated cost recovery system

The method is used for tax purposes in the US and fully depreciates assets to a zero value rather than the salvage value of an asset.

Conclusion

Straight-line depreciation is a straightforward method for calculating fixed asset depreciation expense. The method relies on just three variables and the passage of time for its calculation. And since it is the simplest GAAP-compliant formula, it is most commonly used in practice.

To learn more about accounting and bookkeeping for your business, visit Akounto Blog.