Introduction to Percentage of Completion Method

The percentage of completion method allows proportional recognition of revenue and expenses over the project’s life based on its estimated completion percentage.

The percentage of completion method is particularly relevant for long-term contracts in industries like construction, where projects span multiple accounting periods. The completion method entails reporting revenues and expenses on a period-by-period basis, determined by the percentage of contract fulfillment.

Under the percentage of completion method, income and expenses are compared to the total estimated costs, allowing for a more accurate determination of the tax liability for each year.

This approach is most effective when the estimation of project completion stages can be reasonably made or when the remaining costs to complete the project can be estimated.

The company must be reasonably assured of collections and capable of reasonably estimating costs and the project completion rate.

The percentage of completion method is a valuable accounting method for the construction industry and other sectors dealing with long-term contracts. It enables businesses to recognize revenue and expenses more accurately and consistently over the project’s duration, enhancing financial reporting transparency and compliance with generally accepted accounting principles.

The percentage of completion method should be avoided in cases of significant uncertainties about completion percentage or remaining costs.

Key Elements of the Method

The percentage of completion method relies on several key elements to calculate the revenue for a specific accounting period in long-term contracts. These elements are:

- Total estimated contract costs for the complete project form the basis of measuring the annual costs incurred yearly. The total estimated contract cost is the total allowable construction cost for public sector infrastructure projects.

- Total estimated contract revenues are the expected revenue from the client over the contract’s lifetime. It is also referred to as total contract value. It includes penalties, fees, incentives, and adjustments toward the final payment.

- The percentage of completion method considers the cumulative cost of the project incurred up to the current period and the cumulative revenue recognized from the project until the present time. It helps in annual reporting and impacts financial statements.

These figures provide the baseline for measuring progress and recognizing revenue over time and are basic inputs for the percentage of completion method.

Ongoing Basis Recognition vs. Period by Period Basis Recognition

| Aspect | Ongoing Basis Recognition | Period by Period Basis Recognition |

|---|---|---|

| Revenue and Expense Recognition | Recognizes revenue and expenses continuously as the project progresses. | Recognizes revenue and expenses at specific intervals, typically at the end of each accounting period. |

| Suitable for Projects with | A continuous and steady rate of progress, with accurate estimation of percentage of completion. | Irregular or uncertain progress, where accurate estimation of completion percentage is challenging. |

| Financial Performance Tracking | Offers real-time reflection of the project’s financial performance. | Provides stable representation of financial performance over time, avoiding significant fluctuations. |

| Reporting Precision | Provides detailed and up-to-date financial information. | Offers a more stable representation of financial performance over time. |

| Decision Factors | Reliability of progress estimation and desired level of financial reporting accuracy. | Project characteristics and level of precision required in financial reporting. |

| Advantages | Identifies potential issues early on. And allows tracking of revenue and expenses in detailed manner. | Avoids significant financial statement fluctuations, making it suitable for unpredictable progress scenarios. |

If the project progresses steadily and estimation is reliable, ongoing basis recognition may be the preferred choice for providing detailed and up-to-date financial information.

If progress is irregular or uncertain, period-by-period basis recognition may offer a more stable representation of financial performance over time.

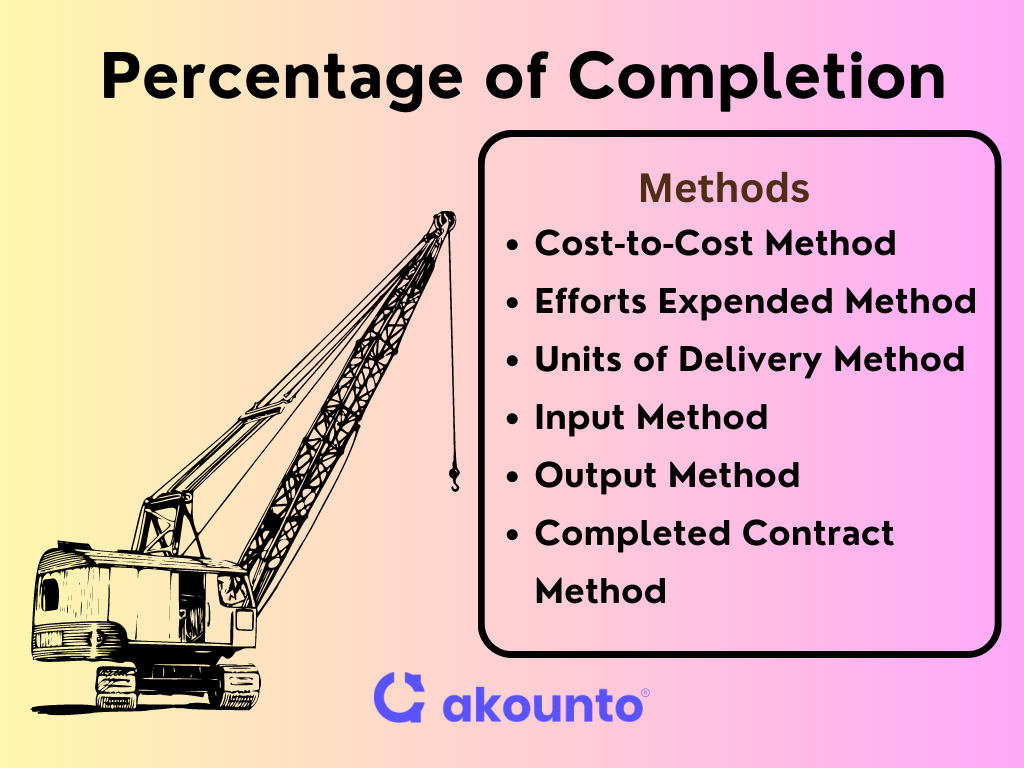

Methods

Each method of the percentage of completion method has its specific application depending on the project’s characteristics and contract terms. Accounting professionals must choose the most appropriate percentage of completion method to recognize revenue and comply with applicable accounting standards.

Cost-to-Cost Method

The cost-to-cost method is widely used for recognizing revenue and expenses in long-term contracts. This percentage of completion method compares the total costs incurred in the project to date with the total estimated costs for the entire contract. It calculates the percentage of completion and recognizes revenue and expenses accordingly.

The cost-to-cost method assumes that revenue will be proportional to the incurred costs.

The formula to determine the percentage of work completed is:

Percentage of completion = (Total Expenses incurred on the project till the end of the accounting period) Г· (Total Estimated Cost of the Contract)

To calculate the percentage of work completed in the current accounting year, subtract the percentage of work completed up to the last accounting period from the cumulative percentage.

Efforts Expended Method

The efforts expended method uses efforts involved in completing the project instead of costs. Efforts can be measured in direct man-hours, machine hours, or material consumption. This method is suitable when labor, machinery, or material significantly impact project costs.

Units of Delivery Method

The units of delivery method applies to contracts divided into multiple units delivered to the customer. Revenue is recognized in proportion to the units delivered to date compared to the estimated total units. This method suits projects with specified units, prices, and delivery schedules in the contract.

Input Method

The input method compares the costs incurred to date with the total expected costs to calculate the revenue for the current period. Costs directly related to the project, such as raw material and equipment purchase costs, are used in this method.

Output Method

The output method measures the results achieved against the total expected contract results. This method uses direct measurements of goods or services transferred to the customer, including units produced/delivered, milestones achieved, and value appraisal.

Completed Contract Method

The completed contract method is an alternative to the percentage of completion for long-term contracts. The revenue and expenses are recognized only upon project completion. The completed contract method is suitable for projects with significant uncertainties, making it challenging to estimate the percentage of completion or total costs until the project’s end.

Examples

Example 1

A construction project has a total expected contract cost of $500,000.

Contract period = 2 years.

At the end of the first year, the company incurred $200,000 in actual costs.

Calculate the percentage of completion and contract revenue recognized for the current accounting year.

Solution

Using Cost-to-Cost Method

Percentage of completion = ($200,000) Г· ($500,000)

Percentage completion = 0.4 or 40%

In the first year, the company would recognize 40% of the total estimated contract revenue and expenses for the project, which is $200,000.

Example 2

An IT project has a total estimated effort of 5,000 man-hours. At the end of the third month, the company has expended 1,500 man-hours on the project.

Solution:

Percentage of Completion Method: Efforts Expended Method

To calculate the percentage of work completed and revenue recognition for the current accounting period:

Percentage of completion = (1,500 man-hours) Г· (5,000 man-hours) = 0.3 or 30%

In the third month, the company would recognize 30% of the total estimated revenue and expenses based on the effort expended out of the total effort.

Example 3

A manufacturing contract specifies 1,000 units. At the end of the sixth month, the company delivered 200 units to the customer. Determine the percentage of completion and revenue recognition for the current accounting period.

Solution

Percentage of completion method: Units of Delivery Method

Percentage of completion = (200 units delivered) Г· (1,000 units in total) = 0.2 or 20%

The company would recognize 20% of the total estimated revenue and expenses for the contract based on the units delivered.

GAAP and IFRS on Revenue Recognition

GAAP and IFRS have established comprehensive guidelines for revenue recognition, ensuring consistency and transparency in financial reporting. The ASC 606 standard unifies revenue recognition practices across various industries, while IFRS 15 sets specific criteria for contracts to exist, emphasizing performance, collectability, and measurability criteria.

Accounting Standards Codification (ASC) Topic 606

The implementation of ASC 606 involves five essential steps:

- Contract Identification: Identify the contract with the customer, outlining the terms, payment, delivery of goods and services, and consequences for unmet obligations, either through written or verbal agreements.

- Performance Obligation Identification: Define the specific goods or services specified in the contract that create contractual performance obligations.

- Transaction Price Determination: Determine the transaction price, encompassing the price of goods and services, discounts, return policies, and additional fees.

- Allocation of Transaction Price: Allocate the determined transaction price to each contractual obligation based on its selling price.

- Revenue Recognition: Recognize revenue when the performing party satisfies the performance obligation. Revenue recognition should occur upon the transaction’s completion and the obligation’s fulfillment.

IFRS 15

Under IFRS 15, businesses must meet specific criteria for contracts to exist, categorized into three key conditions:

Performance Criteria

- Transferring the risk and reward from the seller to the buyer.

- Loss of control over the goods sold by the seller.

Collectability Criteria

- A reasonable assurance about the collection of payment.

Measurability Criteria

- Easy measurement of the amount of revenue.

- Easy measurement of the cost of revenue.

IFRS 15 provides guidance on treating stored materials in income recognition. Stored materials, not representing completed work, require separate treatment in revenue recognition.

Conclusion

The percentage of completion method is a valuable accounting approach for long-term contracts, especially in industries like construction. The percentage of completion allows for proportional recognition of revenue and expenses based on the project’s estimated completion percentage. Choosing a proper percentage of completion method is essential to align with the accounting standards.

To learn more about important topics on accounts and bookkeeping, visit Akounto’s blogs.