What is an Itemized Bill?

The itemized bill contains a selling price and quantity-wise breakdown of all the goods and services charged to the customer.

The document provides a detailed description of each transaction, including the date, item description, and the cost of the service or item purchased by the customer or owed by the business to its vendors.

Industries like healthcare, legal, retail, construction, automotive, and hospitality, among others, use itemized bills to help customers understand the breakdown of their charges, making it easier for them to review and verify the accuracy of their bills.

For example, itemized hospital bills may include costs for specific medical procedures, medications, or diagnostic tests. In retail, an itemized bill may provide a breakdown of costs associated with the purchase of an individual item, such as taxes or applicable fees.

Itemized bills also help businesses track their expenses better, ensure they pay for the goods and services they receive and help identify areas where they can reduce their expenses or negotiate better supplier pricing.

Purpose of Itemized Bill

The purpose of making an “itemized bill” lies primarily in understanding “what is an itemized bill.” The notion of giving a detailed breakdown is to provide the legal and written records of the prices and items charged to the customer.

An itemized invoice gives a detailed breakdown of costs and expenses associated with a transaction for services or products. Customers get a clear and transparent record of all the charges associated with the purchased product or services. This allows the business to build long-term trust and credibility with them.

For businesses, itemized bills help them maintain accurate financial records and supporting documentation for tax deductions and credits related to business expenses. The itemized bill can also be used as evidence to resolve disputes. It can prevent errors, misunderstandings and inform all parties involved in a transaction about the terms and costs.

What is included in an Itemized Bill? – Elements & Format

The format of an itemized statement can vary depending on the industry, business type, payment, and billing practices. But business owners can use some general key elements for creating and sending their invoices.

Elements of Itemized Bill

- Invoice number: Is a unique number that the seller needs to assign to identify a particular invoice.

- Invoice date: It is the date on which the invoice is created. Mentioning this date will help customers calculate the days left to make the payment.

- Billing company details: Business owners need to provide the name of their business, give details of the appropriate contact person, the person’s name, business email, phone number, and the business’s Tax ID in the invoice.

- Customer details: Provide the customer’s contact details – the person who is supposed to receive the invoice and is liable to pay for it.

- Line items: These include the product name and its description, cost per product or rate per hour of the services rendered, number of hours worked or units produced, and the amount due for the product or service.

- Billable expenses, including taxes: If a business had to pay for some material to provide its service that the customer needs to cover, they would be included under billable expenses along with other expenses like shipping charges, sales tax, and other applicable charges.

- Total charges: It should summarize all the expenses related to the services listed below the line items.

- Footer: It summarizes the invoice and details detailing the payment terms and instructions, charges, and special notes for the client.

- Payment terms: These are the terms and conditions agreed upon between the seller and customer regarding the purchase. These generally include the payment amount, expected timeline for payment of the invoice document, applicable discounts, and late fee charges.

- Special note: A small “thank you note” or next purchase discount code can be included to make the customers feel special or induce them to revisit the business for their next purchase or service to avail of the benefits.

Format of Itemized Bill

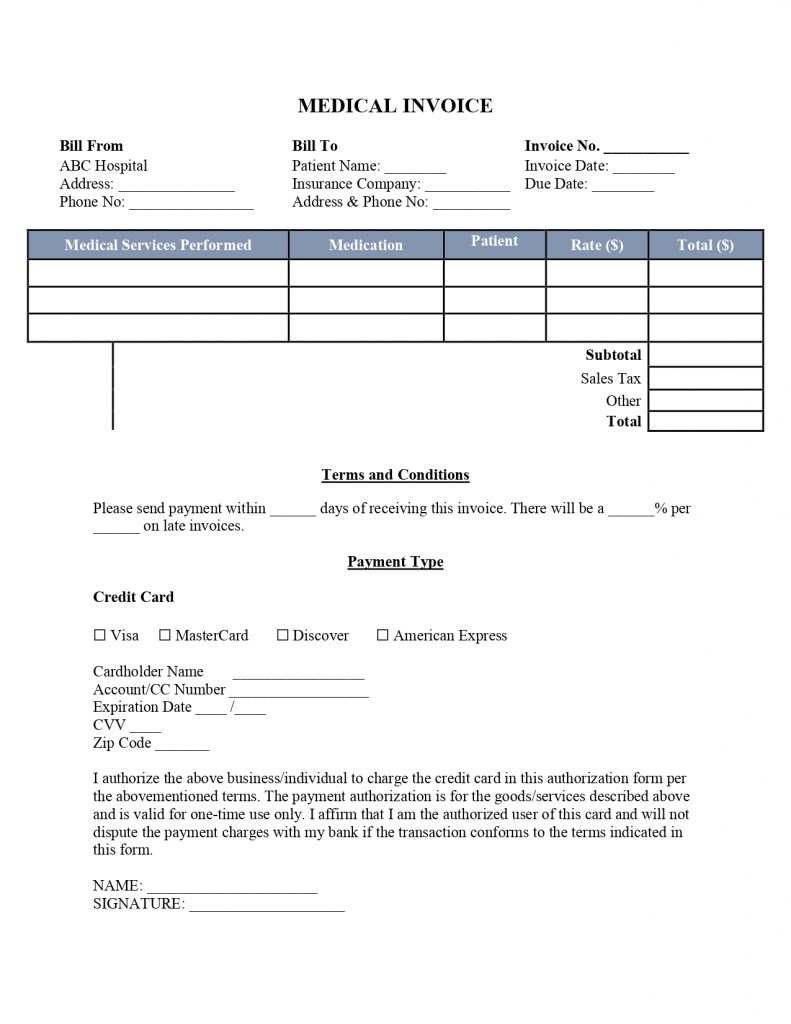

An itemized bill is used for goods and services payment, including by an insurance company for medical billing to a hospital. Below is the format of an itemized bill from ABC Hospital’s billing department.

How to Calculate an itemized bill?

Steps for Calculation

- List all the services or products purchased bt a customer in the invoice, along with their prices and quantity.

- Multiply the quantity of each item by their price to calculate the subtotal.

- Add subtotals of all purchased items to get the subtotal cost for the bill.

- Add applicable taxes, fees, or any other charges to the subtotal. For example, if the applicable sales tax rate is 20%, it can be calculated by multiplying the subtotal by 0.20.

- In case of discounts or promotions applicable on the purchase order, deduct them from the total. For example, a 20% discount on the purchase or service can be calculated by multiplying the subtotal with 0.20.

- Lastly, add the final amount the customer owes, including all charges and discounts, before presenting the bill for payment.

Numeric Example

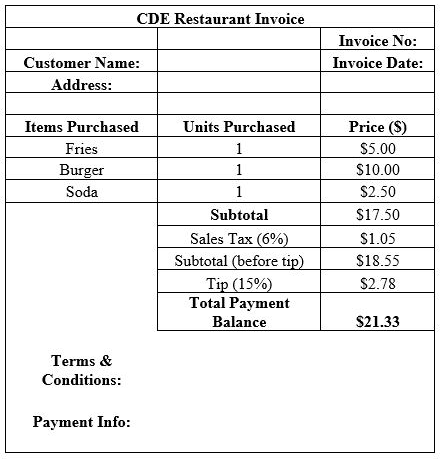

A customer in a restaurant ordered fries, a burger, and soda for $5, $10, and $2.50, respectively. The restaurant charges a 6% sales tax on all orders. The customer also paid a tip of 15% to the server. Calculate the total amount the customer must pay and prepare an itemized bill based on the information provided.

Solution: To calculate the total amount of the itemized bill for payment, we need to determine the amount of the purchased, sales tax and

First, calculate the subtotal of all the items ordered by the customer by multiplying the item quantity with their prices and summing up the total.

=> $5 x 1 + $10 x 1 + $2.50 x 1 = $17.50

Second, calculate the sales tax on the subtotal by multiplying it by the tax rate.

=> $17.50 x 0.06 = $1.05

Then, add the sales tax amount to the subtotal to get the total cost of the invoice before the tip.

=> $17.50 + $1.23 = $18.55

To calculate the tip, multiply the total cost by the tip percentage.

=> $18.55 x 0.15 = $2.78

Add the tip amount to the total cost of the order to get the final amount for the invoice payment.

=> $18.55 + $2.78 = $21.33

Based on the above calculations, here is the restaurant’s invoice.

Advantages of Itemized bill

- Transparency: An itemized statement provides a clear and detailed breakdown of the cost associated with a transaction, making it easier for the customers to get an idea of what they owe.

- Accountability: Itemized documents can help businesses demonstrate accountability and build customer trust by providing a clear and objective record of all charges and transactions.

- Dispute resolution: It can serve as vital evidence to help resolve any disputes. For example, patients can use the itemized bill to ask questions about specific charges to be paid or request clarification from a hospital.

- Insurance processing: Insurance companies require an itemized statement for processing medical claims and determining the amount they need to reimburse for medical treatments provided by the hospital. The itemized bill helps insurers to verify all the services, match them with the patient’s policy coverage, and check for discrepancies or potential frauds.

- Tax deductions: Small business owners or self-employed persons can use itemized statements to deduct certain business expenses (like office supplies, equipment, etc.) on their tax returns. So, keeping track of the expenses and maintaining invoices can provide documentation to support the tax deductions and potentially reduce taxable income.

- Budgeting and financial planning: An itemized bill allows businesses and individuals to assess and incorporate expenses into their budget and financial plans. Understanding them can help businesses make informed decisions about their resources and individuals about their healthcare and adjust their health coverage or spending choices.

Disadvantages of an Itemized bill

- Time-consuming process: Preparing itemized statements can be time-consuming and may require extra effort from businesses for customization, detailed and error-free record-keeping, and communication.Businesses may need to communicate with the customers to clarify bill details or address concerns. It can be time-consuming and may require some additional follow-ups.

- Complex: An itemized bill can be complex and difficult to understand, especially in medical billing, if there are many line items or if the charges are not clearly defined.Some customers may find itemized bills confusing or overwhelming if they are not familiar with the billing practices of the industry or the business.

- Privacy Concerns: Some customers may be uncomfortable with the level of details provided in an itemized bill if the charges relate to sensitive or personal information.

- Additional Costs: Preparing and processing an itemized document may result in additional costs like software fees, labor costs, etc., for small businesses.

Wrapping up

An itemized bill is a crucial document that provides small businesses and customers details of the expenses associated with purchasing a product or service, including their quantity, price, and total cost of the bill post discounts and sales tax.

Itemized bill helps customers understand what they are paying for, while small businesses can use it to maintain organized transactions, track inventory, resolve disputes, and manage cash flows, tax calculations, and negotiations with customers. Use Akounto’s accounting software to maintain the bills’ accuracy, get invoice templates, and much more.