LLC and S Corp Structures: Introduction

LLC and S Corporation offer liability protection for owners. S Corp offers tax benefits and LLC offers flexibility in management and operation.

Deciding on the right business structure is the first decision taken by an entrepreneur that impacts not just tax savings and company profits, but also how you’ll operate your business, manage its growth, legal compliances, and even a business owners’ personal assets.

In some manner, LLCs and S corps are not divergent. Rather choosing between LLCs and S Corps is more of a tactical decision by small business owners.

LLCs are a type of business structure, while S Corporations are a type of tax classification to file taxes with the Internal Revenue Service. In addition to tax consequences, compliance, and stringent regulations are also considered before choosing between LLCs and s corps.

Basic Concepts Before Understanding LLCs and S Corporations

Personal Liability Protection

It is also called limited liability protection. A business structure where the owner’s personal assets are protected or shielded from business transactions. In case a business faces any legal, financial, or creditor issues, then the owners are not personally liable to settle business obligations, debts, etc. from their personal assets.

Double Taxation

When corporate taxes and personal income taxes are applied to the same income, it results in double taxation.

The company profits are taxed and subjected to corporate income tax. Further, these after-tax profits are when distributed to the owners or shareholders, then they are again taxed as income in the owners’ personal tax returns, making it double taxation.

Double taxation is often seen in the case of a C Corporation.

Pass-Through Taxation

When income in the hands of the corporation is not taxed and passed to the owners where it is taxed is called pass-through taxation. Pass-through taxation is the solution to avoiding the problem of double taxation.

LLCs and S Corporations act as pass-through entities where the income tax applies to the owners or shareholders as a part of personal income tax return and not as a corporate tax.

Management and Operations

Management and operations are related to the difference between the owners and managers calling the shots in the business entity. S Corp is more for tax reporting purposes while LLC offers flexibility in operations.

There are right management structures for S Corporation while an LLC can be a single member LLC, multimember LLC, or can have as many members as they can add. LLCs can have member-managed business structures or they can be managed by a business manager who may not be the owner or member.

Once an entity gains S Corp status, the shareholders elect the board of directors controlling decision-making and selection of key managerial personnel.

What is an LLC (Limited Liability Company)?

LLC or Limited Liability Company is a type of business entity that can be formed by both U.S. and non-U.S. citizens and residents. An individual or an entity can also be a member of an LLC, the only exceptions are banks and insurance companies.

Forming an LLC requires filing Articles of Organization with the state regulatory bodies. LLC requires less compliance than S Corps.

LLC is a kind of hybrid business entity that offers the combined characteristics of a partnership or sole proprietorship and a corporation.

As the name suggests, “limited liability”, thus LLC owners are protected from any personal liability for any debts and obligations of the LLC.

In case of any fraud or any failure by an LLC to meet any legal obligation, then the creditors of the LLC can file against the LLC owners.

LLCs are regulated on a state level and every state has its own rules regarding LLCs.

LLC is a pass-through entity where the income is taxed in the hands of the owners and not at the level of the corporation. Any wages paid to the members of the LLC are treated under business expenses as operating expenses and are deducted from the company’s profits.

A single-member LLC is treated as a sole proprietorship for tax purposes, while a multimember LLC is treated as a partnership where each partner reports profits and losses on their tax returns. To form a multimember LLC, the LLC has to apply for an “Employer identification number” (EIN) for tax reporting purposes.

Generally, single-member LLCs are classified as disregarded entities and use the owner’s social security number (SSN) for tax filing.

What is an S Corporation or S-subchapter Corporation?

S Corporation as the name goes, relates to Subchapter S (Chapter 1) under the Internal Revenue Code, is majorly a pass-through entity where the business profits and losses are passed to the shareholders and income is taxed in the hands of owners and not at the corporation stage. This is done to overcome the double taxation problem.

S Corporation is a tax arrangement for federal tax purposes to establish only one taxation point. It is more of a tax status and does not interfere with the working of the corporation.

S corporation need not pay any federal income tax, as the tax burden is shifted to the owners/ shareholders. The dividends or profits of S corp are distributed tax-free to the shareholders, while taxes will be levied

S corporation is synonymous with “Small business corporation”, a business structure mostly preferred by small business owners.

Similar to a C Corp, an S Corp is also to file articles of incorporation, has to hold regular board of directors meetings or shareholders meetings, has to conduct voting on critical decisions, and has similar accounting guidelines to follow.

Due to stringent regulatory oversight by the IRS, the S Corp enjoys better credibility.

An S Corporation is a classification for tax purposes, in other words, an LLC, sole proprietorship, partnership, or C Corp can elect to be classified under Subchapter S and thus attain S Corp status.

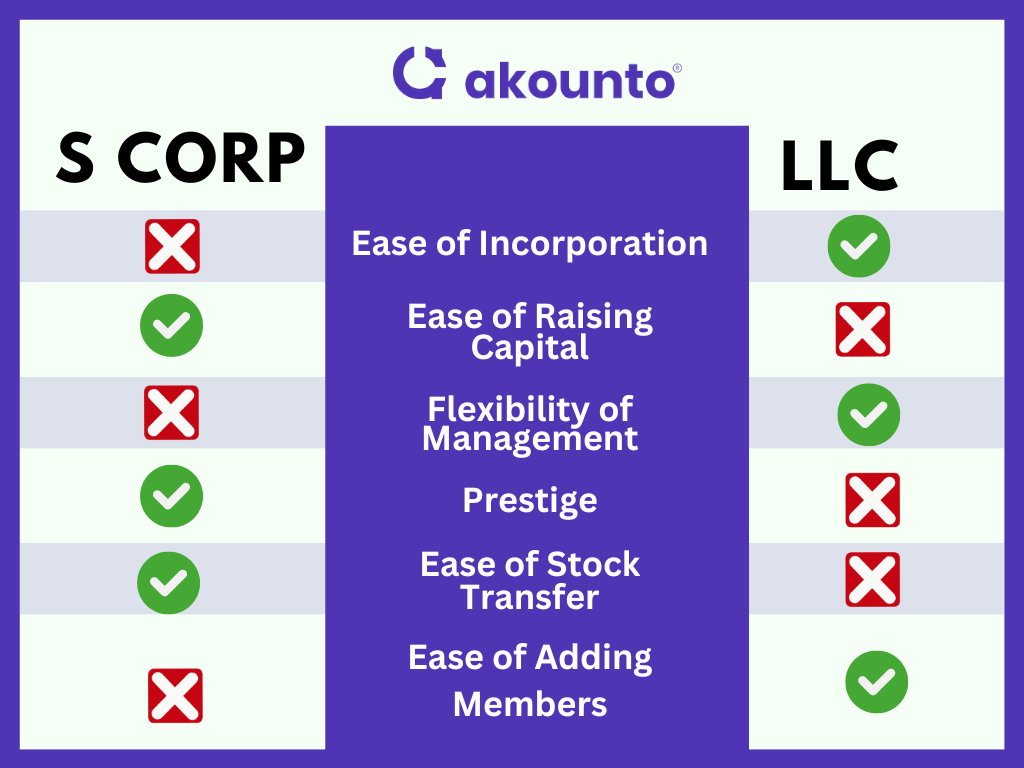

S Corp vs LLC: The difference between an S Corp and an LLC

Key factors to consider when comparing LLCs and S Corps

| Points of Difference | S Corp | LLC |

|---|---|---|

| Formation | A C Corporation or an LLC has to qualify for an S Corporation election by adhering to the requirements of the Internal Revenue Service (IRS). | LLC is easier to form with fewer regulatory requirements. |

| Suitability | Often opted by small and medium-sized business owners needing board oversight. S Corp is also chosen by businesses to float stocks, sell stocks, or seek funding from investors i.e. raising capital. | Mostly opted by Sole Proprietors and for Partnerships. Often chosen by professionals, family businesses, etc. |

| Number of members/ shareholders | S Corp is allowed to have up to 100 shareholders | LLC can have unlimited members. |

| Management and Operations | An S Corp must have a board of directors and corporate officers and key managerial personnel like CFOs and CEOs. | LLC can be led by a member or can be managed by a business manager. Thus offering flexibility of operations. |

| Existence | An S corp, generally has perpetual existence. | An LLC in some states, by law has a specific duration of 20 years. Though most states allow perpetual existence. In case the owners go bankrupt, the LLC will be dissolved and needs to be reregistered. |

| Applicability | Though all states recognize and have provisions for S Corp, a few jurisdictions do not recognize federal S Corp: District of ColumbiaNew HampshireTennessee | The provision for LLC is available in all the states. |

| Tax-Related Issues | S Corp offers pass-through taxation by default as a part of Subchapter S of the Internal Revenue Code. | LLC can be flexibly taxed as a sole proprietor, partnership, S Corporation, or C Corporation. |

| Self-Employment Taxes | The income of an S Corp is paid as dividends to the owners which are taxed at a lower rate. In an S Corp, the wages paid to an employee are subjected to employment tax. | All the members of the LLC are treated as self-employed for taxation purposes and are obligated to pay self-employment tax contributions for Medicare and Social Security. |

| Compliances | Stringent recordkeeping requirements and compulsion to have CFO and other positions, conducting regular board/ shareholder meetings, maintaining minutes of the meetings, etc. | Flexibility in managing and operating the LLC. No need for a board of directors, can opt for the accounting method as per the business requirements. |

| Transfer of Ownership | Ease of transferability of shares, raising capital etc. | Restricted by LLC agreement. |

| Stock Restrictions | Restricted to only one kind of stock. | Can have as many classes of members as may be required. |

| Accounting System | S Corp is mandated to have an accrual accounting system. | LLC can choose between an accrual or cash-based system as per the business needs. |

Benefits of LLC over S Corporations

LLCs can distribute the business income or profits flexibly in different proportions, while in the case of S Corp, there are fixed percentages or ratios.

LLCs have flexible management structures where business can be managed by managers or owners, but an S Corporation is mandated to have regular board meetings and voting for major decisions.

LLCs have no restriction for having members as in the case of S Corporations.

LLCs have fewer compliance requirements in comparison to S Corporations.

Conversion from an LLC to any other business structure is easier than conversion from an S corporation to any other business form.

In a few states, the self-employment taxes are more favorable for LLCs than in the case of S Corporations.

Benefits of S Corporations Over Limited Liability Companies

S Corporations have positive perceptions and have been around for longer as compared to LLCs. It is easier to raise capital, find investors, transfer ownership, etc.

Sharing profits is based on a percentage, which makes it easier and simpler and less likely vulnerable to any disputes.

S Corporations avoid double taxation easily due to the rule under the Internal Revenue Code.

Conclusion

LLC is a formal business structure while S Corp is a tax classification. S Corp offers tax savings and helps raise capital easily, while LLC is more flexible in operations and management. A business owner has to make an informed choice which results in significant tax advantages and also balances compliance pressure. Checking the state laws is important before making such a choice.

Make a wise decision for your business and visit Akounto’s Blog for more knowledge to run your business and implement bookkeeping and accounting solutions.