CAGR is helpful in comparing projects with consistent cash flows, while IRR is used when projects or investments have different cash flows.

CAGR and IRR are used to evaluate loans, projects, returns from investments, capital management, etc., for specific periods based on cash flows.

CAGR, also known as Compound Annual Growth Rate, evaluates investments’ growth, while IRR, also known as Internal Rate of Return, evaluates the profitability of investments, ventures, new projects, etc. CAGR flattens irregular growth rates and gives an average annual growth rate, and IRR gives the rate of return at which the present value of cash inflows and outflows are zero.

CAGR evaluates the annual growth rate generated by consistent cash flows, while IRR evaluates profitability by taking into consideration the timing and amount of cash flows. Both CAGR and IRR are used in investment analysis.

Defining and Understanding CAGR in Simple Terms:

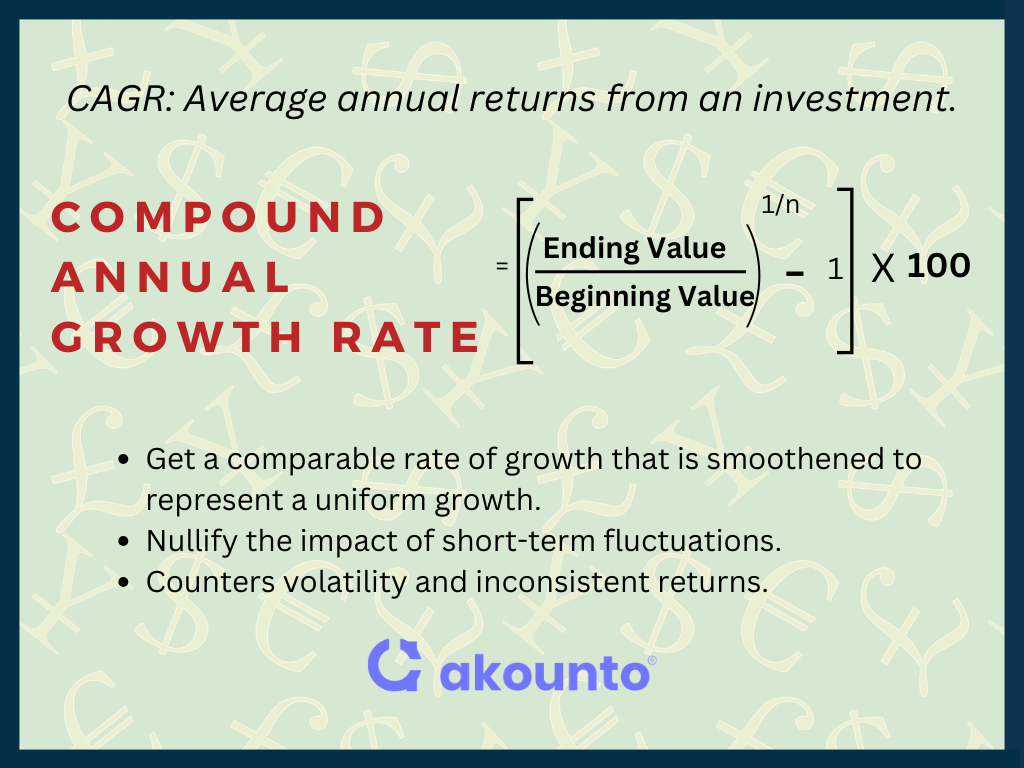

CAGR considers the impact of compounding and gives the average annual return of your investment or growth over a specific period. It measures growth on an average basis for a given period, so it helps in historical comparisons, too. CAGR is not used to measure the “degree of risk” because it smoothens the highs and lows of an investment.

CAGR is a kind of “pro forma” number, which means that it is representational and simplifies the metric “for the sake of simplicity and understanding” but does not reflect the real situation.

Example of CAGR

Let us understand CAGR with a simple example. Suppose your business or investment generates revenue every year, and the amount is different for every year, as given below in the table.

| Year | Revenue |

| 2020 | $100 |

| 2021 | $120 |

| 2022 | $150 |

| 2023 | $180 |

| 2024 | $200 |

If you interpret it in absolute terms, you may mistakenly think that your revenue doubled (100%) from 2020 to 2024. But in reality, the rate of growth per annum is different.

| Year | Revenue | Difference from the previous year | Rate of Growth Every Year |

| 2020 | $100 | 0 | 0 |

| 2021 | $120 | 20 | 20% |

| 2022 | $150 | 30 | 25% |

| 2023 | $180 | 30 | 20% |

| 2024 | $200 | 20 | 11.11% |

Now, to find the average growth rate:

Add up the growth rates for each year:

- 0 + 20% + 25% + 20% + 11.11% = 76.11%

Divide the sum by the total number of growth rates:

- 80% / 5 (since there are 5 growth rates) = 15.22 %

Now, we can say that the growth rate of investing $100 from 2020 to 2024 is 15.22 % per annum.

Or, it can be said that:

$100 was invested in 2020 when growth @15.22 % per annum will double itself.

Or

To double your investment over a 5-year horizon, it must grow by 15.22 % per annum.

If we calculate CAGR by formula (mentioned below), then we get 14.87 %

(the difference in calculation methodology will give a slight variation)

Defining and Understanding IRR in Simple Terms

Understanding NPV and Discount Rate

To evaluate the investments, you need to compare them first. But to compare, they must be on an equal footing. A 100$ in the present is not equal to 100$ ten years from now. Money, over time, loses its value. The loss in value is a combination of 3 things:

- Inflation: Decline in the purchasing power of money.

- Time Value of Money: 100$ today is more valuable than 100$ received 10 years from now.

- Opportunity Cost: You could have chosen to invest 100$ received today and earned more rather than than receiving a mere 100$ a few years later.

- Risk: This includes market fluctuations, interest rates, risk-free rate of return, etc.

Taking effect of the above 3 factors, you can calculate the NPV (net present value) of 100$ received 10 years from now. So now you can bring both present cash outflow and future cash inflow on the same time slab. The above 4 factors combine into a “discount rate.”

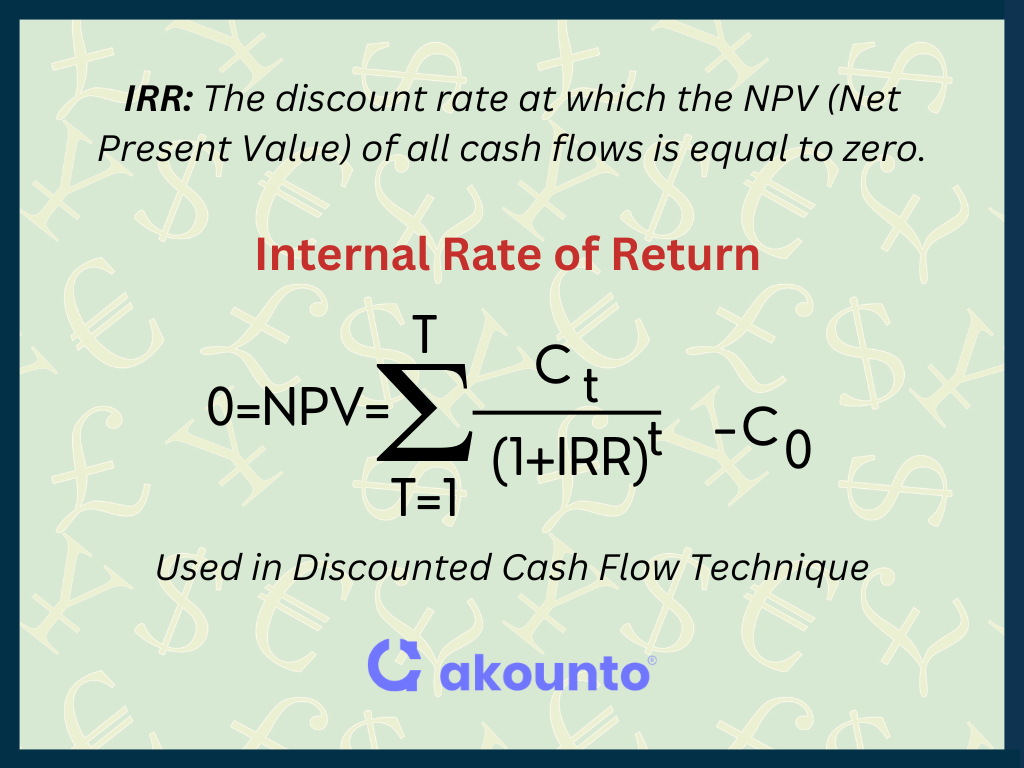

The discount rate helps to bring the value of future cash flows to the current time, known as Net Present Value. IRR is a special kind of discount rate, where the future value of all the cash flows is zero in the present value. Remember that IRR is calculated; thus, you arrive at the discount rate.

IRR reflects market volatility across irregular cash flows and takes into account the time value of money concept and discount rates.

Example of IRR

A telecaller called Laura and told her that if she invests in Schema A, then she’ll double her investment of $ 10,000 in 9 years. She only has to pay $10,000 upfront in the first year and then after 9 years, she’ll be getting $20,000. Can you advise her if the deal is good or not?

Lets calculate the IRR of the investment or the rate of return at which $20,000 received after 10 years will be equal to $10,000 now.

| Laura’s Cash Flow as per the Scheme A | ||

| 2024 | -10000 | |

| Year 1 | 2025 | 0 |

| Year 2 | 2026 | 0 |

| Year 3 | 2027 | 0 |

| Year 4 | 2028 | 0 |

| Year 5 | 2029 | 0 |

| Year 6 | 2030 | 0 |

| Year 7 | 2031 | 0 |

| Year 8 | 2032 | 0 |

| Year 9 | 2033 | 20000 |

Calculating IRR using IRR Function in the spreadsheet

The IRR of 8% means that if her invested money (initial investment) grows annually at 8% per annum and the interest or dividend is also reinvested at 8%, then she’ll be doubling her money. This is quite a conservative investment, and she can consider any other investment options that suit her risk appetite and can give +10% returns.

When to Use CAGR?

CAGR (Compound Annual Growth Rate) is useful in evaluating investments and projects when there are regular cash flows at fixed intervals. When the cash flows, be it inflows and outflows, are volatile, and their pattern is not uniform or predictable, then CAGR should not be used.

Conditions to use CAGAR:

- Consistent cash flows

- Knowledge of Initial Outlay (Investment) and Ending Value.

- When the user is trying to establish a long-term trend.

CAGR is useful when the investments/ projects to be compared have similar tenure, and there is a fixed pattern or consistency of cash flows.

When to Use IRR?

IRR plays a significant role in asset valuation, project evaluation, capital allocation, and loan decision-making. Thus, it is widely used in underwriting, financial modeling, investment decisions, and capital budgeting. In corporate finance, IRR and XIRR are the base of discounted cash flow methods for comparing investment options and building a portfolio. If the IRR exceeds the RRR (Required Rate of Return) or the hurdle rate, then that investment is favorable.

IRR gives the discount rate at which the present value of all the cash flows is equal to the initial outlay in the present period.

If the two investments have different tenures, interest rates, and cash flows, then simply comparing their CAGR will be misleading. The two cannot be compared due to differences in the cash flow patterns. In such a scenario, IRR is used.

IRR also helps in comparing different investment options and even portfolios consisting of different assets and asset classes. By applying IRR, you get the comparable percentage (discount rate) on a present-value basis.

IRR can be effectively used for decision-making in capital budgeting projects by comparing their returns, as IRR takes into account the timing and the size of the cash flows.

Advantages of CAGR over IRR

- CAGR is simple to calculate and useful in evaluating linear growth.

- CAGR focuses on initial outlay and ending amount; thus, it can be applied even when the data for cash inflows is unavailable or is irregular.

- One of the major advantages of CAGR is that it can generate long-term trend analysis and is not influenced by any short-term fluctuations. Thus, you can generate average annualized returns over extended periods.

- CAGR is useful in comparing investments with the same investment horizon and assessing relative performance irrespective of initial costs.

- CAGR is not needed to make any assumptions and thus has higher accuracy.

Advantages of IRR over CAGR

- IRR is useful in evaluating investments/ projects having irregular cash flows or payouts.

- IRR is more versatile as it easily accommodates non-linear growth or non-linear cash flows, thereby taking into account significant fluctuations in returns.

- As IRR gives the discount rate at which there is no profit or loss situation in an investment, it is helpful in calculating the required rate of return from an investment and assessing the opportunity cost of an investment by comparing the rate of return from an alternative investment with the discounted rate of the project/ investment under consideration.

- IRR can handle complex investments where the interest or returns are reinvested even at different rates.

- In decision-making, you need to compare the IRR with the cost of capital or the RRR.

Calculating CAGR and IRR

The formula for CAGR is:

CAGR = (Ending Value / Beginning Value)^(1 / Number of Years) – 1

The formula for calculating IRR is:

​Ct = Net Cash Inflow for the chosen time period

C0 = Total Investments made into the project

IRR = Internal Rate of Return

T = Time Period

Calculating CAGR in Google Sheets

Use RRI Function to calculate CAGR in Google Sheets = (ENDING_VALUE/STARTING_VALUE)^(1/PERIODS)-1

You can also use the RATE function in any spreadsheet (Google Sheets) or Excel for calculating CAGR:

All the spreadsheets, like Google Sheets and Excel, have IRR Functions for easy calculation.

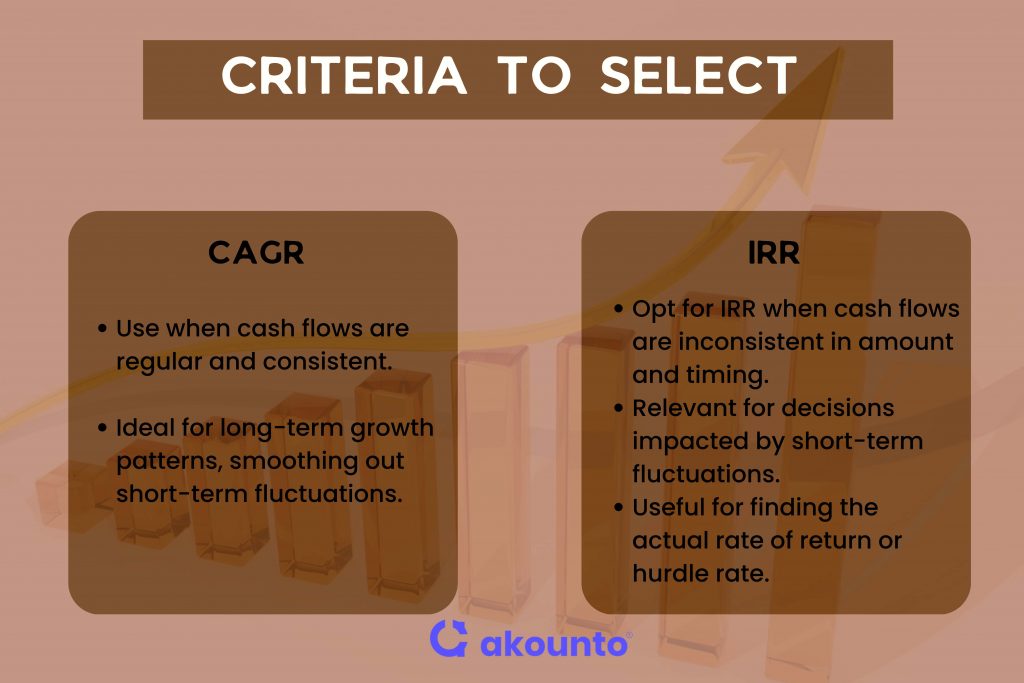

Criteria to Select CAGR or IRR

The choice of methodology is dependent on the following factors:

- If the cash flows are regular and consistent, then choose CAGR.

- If you wish to generate a long-term growth pattern by nullifying the impact of short-term fluctuations, then choose CAGR.

- If your cash flows are not consistent and vary even in amount and timing, then choose IRR.

- If the short-term fluctuations matter to your decision-making and your investment horizon is short, then choose IRR.

- If you are working to discover the actual rate of return or hurdle rate, then calculating IRR is of great advantage.

Use Cases

- Evaluating Projects: CAGR and IRR help evaluate the ROI of different projects. CAGR is more useful for linear investments, while IRR is used for dynamic projects.

- Evaluating Investments: Evaluating the investment options based on the duration (short-term or long-term) and cash flows helps the investor to choose the investment option as per their risk profile. CAGR and IRR are helpful in portfolio analysis, selecting a single stock, representing trends, or taking into account market volatility.

- Financial Modeling: CAGR and IRR help establish trends and discount rates that enable estimating projected revenue, cash flows, and expenses, thereby enabling risk assessment.

- Company Valuations: Using the discounted cash flow (DCF) technique, the present value of future cash flows helps determine the value of the company.

- Investment Banking: When it comes to mergers and acquisitions, concepts of corporate finance like CAGR, IRR, MIRR, and XIRR are handy for calculating the feasibility of a project and comparing options.

- Loans and Underwriting: The CAGR and IRR help evaluate the loan portfolio’s risk-return profile and assess the borrower’s creditworthiness. Moreover, when it comes to debt securitization, the rating of the security depends upon the past performance of paybacks and opportunity costs.

- Capital Management: CAGR and IRR are helpful in evaluating the efficiency and profitability of capital allocation decisions, thus helping in capital management.

Conclusion

Before making any investment decision, including buying a stock, share, mutual fund, machinery, business, etc., it is necessary to calculate the returns from the investment and compare them with the initial investment. Talking in terms of absolute returns and final amounts can be misleading or may not present a true picture. Calculating IRR or CAGR, as the case may be, enables you to make a smart decision based on data and not on the optics of investment (you invest x and get 2x after some years).

Sound investment decisions are backed by data and not the dream of being wealthy or some quickly getting rich scheme.

Visit Akounto’s blog for more practical knowledge about managing your finances smartly.