An account balance refers to the amount of funds available in the financial accounts at the start of an accounting period.

Definition of Account Balance

The account balance is the sum of all deposits, credits, and other additions minus any withdrawals, debits, or other subtractions from the account during the accounting period. It can be a balance in a bank savings account, a brokerage account, or a loan account.

It reflects the financial transactions that have occurred in the account over time and the current state of an account at any given moment.

The account balance can be used to determine an individual’s financial standing. It also determines their ability to make purchases, investments, or the amount of money owed or due to them.

Types of Accounts

There are several types of financial accounts, including:

- Savings accounts: A savings account helps users to save money and earn interest. Savings accounts typically offer higher interest rates on your bank balance but may restrict the number of monthly transactions you can make.

- Checking accounts: A checking account allows you to deposit, withdraw, and transfer funds easily and quickly. People use checking accounts for everyday transactions, such as paying bills and purchasing. A checking account is a current account and shows its account balances after paying everyday expenses.

- Certificate of Deposit (CD) accounts: A CD account is a kind of savings account that pays a certain amount of fixed interest rate for a specified time. CDs are low-risk investments and typically offer higher interest rates than savings accounts.

- Money market account: It is similar to a savings account but usually offers higher interest rates. A money market account may restrict the number of transactions and require a higher minimum balance.

- Credit accounts: A credit type is typically associated with a line of credit, such as a credit card or a personal loan. Credit accounts allow you to borrow money up to a certain limit and are charged interest on the credit balance.

This is not an exhaustive list. Many other types of accounts can be used to determine the total wealth a concern holds at any time.

Types of Account Balances

Bank Account Balance

The bank account balance is an available balance in a checking or savings account at any moment. It reflects all transactions from the account, including deposits, withdrawals, debits, and credits.

The bank account balance is an addition to the total assets. One can track the checking/savings account balance to determine the money present for spending or withdrawal, making it a critical component of an individual’s financial standing.

Businesses must monitor their bank balances regularly to ensure their accounts are accurate. It also helps them in staying on top of their spending and budgeting.

So, if there are any discrepancies in your bank account balances, it’s important to address them with the financial repository to prevent potential financial problems.

Loan Account Balances

A loan account includes the total amount associated with a loan, such as a personal loan, car loan, or mortgage. A loan account gets established when an individual borrows money from a mortgage banker. It is used to track the balance of the loan and payments made towards it.

The balance is the total outstanding amount that is yet to be repaid through the loan tenure. It takes into consideration any payments made towards the principal and interest. As payments are made, the loan account balance decreases, and the loan account balance increases as interest accrues.

Loan accounts typically have a set repayment term for the total outstanding amount. It is important to track the loan/mortgage account balances and to make timely payments to maintain a good credit score and reduce the net debt.

Credit Card Account Balances

A credit card account balance is the amount of money owed on a credit card account. It represents all purchases and other transactions made with the credit card made in the previous months minus any payments or credits applied.

Monitoring the credit card account balance daily is important to avoid overspending and keep a check on the total liabilities. Untimely credit card payments or exceeding the credit limit can result in additional fees and negatively impact credit scores.

Examples of Account Balance

Example 1

A person opens a checking account with a starting balance of $1,00o.

Let’s assume he paid $200 to a third party that has been processed in the recipient’s account. After these transactions, his account balance will be $800 ($1000-$200 = $800).

Example 2

Let’s assume you have a credit card with a limit of $5,000.

You can make up to $5,000 worth of various purchases, cash advances, or pay recurring bills from your credit card account balance. If you pay $2,000 on purchases or utility bills, your available credit would be $3,000 ($5,000 – $2,000).

The available balance on your credit card will increase if you pay $1,000 towards the outstanding amount, and the overall account balance for available credit will increase to $4,000 ($5,000 – $1,000).

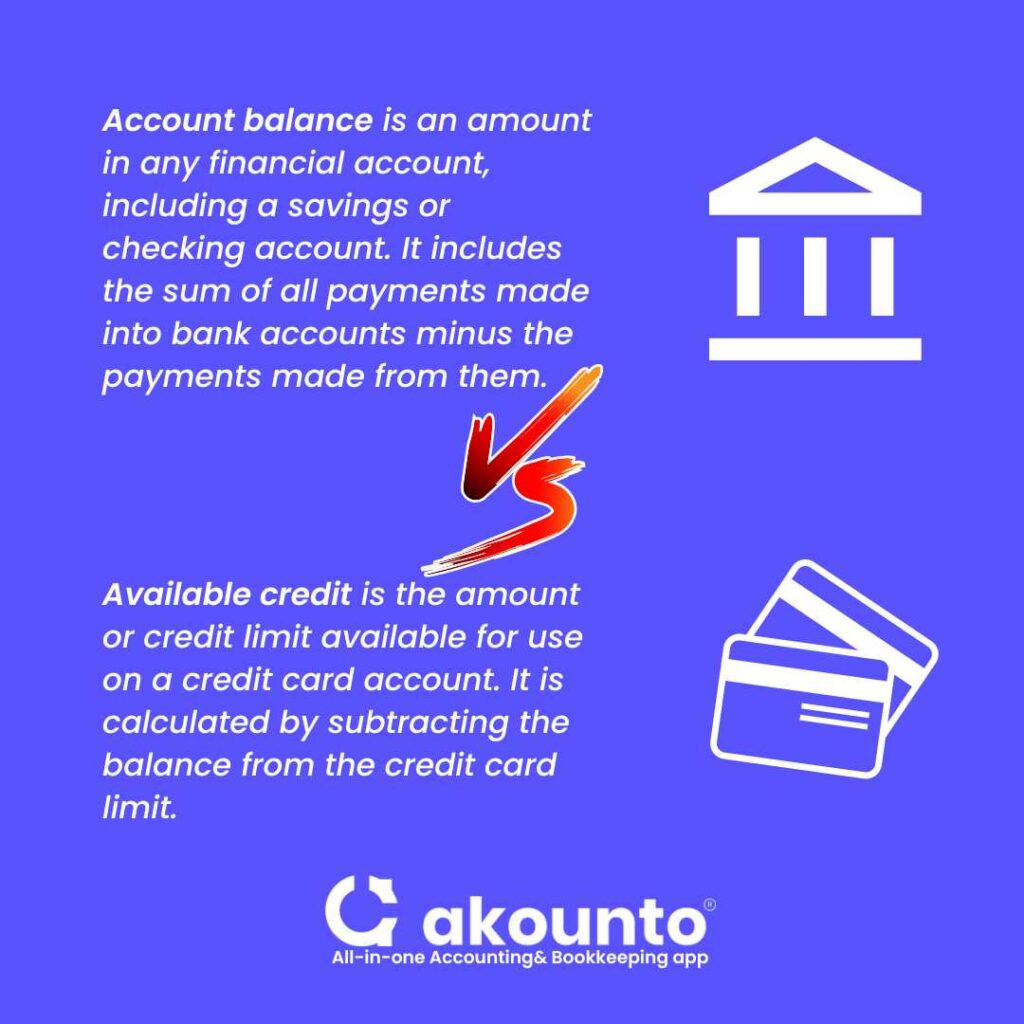

Account Balance Vs Available Credit

The account balance and available credit are two different concepts.

An account balance is an amount in any financial account, including a savings or checking account. It includes the sum of all payments made into bank accounts minus the payments made from them. It helps in calculating the net worth of an individual or business. It can help determine if they have a negative or a positive balance in their bank account.

The available credit is the amount or credit limit available for use on a credit card account. It is calculated by subtracting the balance from the credit card limit.

For example, if the credit card limit is $5,000 and the used account balance is $2,000, the available credit would be $3,000 ($5,000 – $2,000).

How To Interpret Account Balance?

The interpretation of an account balance depends on the type of account it is associated with. There are some common factors considered when interpreting an account balance.

Positive Balance

A positive balance in a checking/saving account means money is available for usage. For example, if the account balance shows $2,000, $2,000 is available for transactions or withdrawals.

Negative Balance

A negative balance in a checking/saving account means that the account is overdrawn. It means more money has been spent than is available.

For example, if the current account balance is -$100. It means that $100 has been spent over and above the available balance from the account. There may be additional overdraft fees associated with the account.

Zero Balance

A zero balance means no money is in the checking or saving account.

Final Words

Understanding the differences between these balances is important to manage your finances effectively. One must regularly monitor accounts to ensure they are accurate and determine available credit for spending and budgeting. Understanding the interpretation of an account balance can help with financial analysis, planning, and management.

Accounting software can help any business plan its expenditure. You can get the best accounting software services from Akounto. Feel free to explore more accounting information on our blogs.