Accounting period is a fixed timeframe usually an year to record accounting transactions and generate business reports including final accounts and calculate income and taxes accordingly.

A full 12-month accounting period is often referred to as a fiscal year, which is the standard period for completing a full cycle of accounting, reporting, and tax calculation. However, businesses frequently use shorter accounting periods within the fiscal year for ongoing analysis and decision-making. These shorter periods allow businesses to monitor and assess performance regularly, respond to trends, and adjust strategies if needed like monthly reports, qaurterly results (performance), bi-annual reports, etc.

Definition & Importance

Accounting period or accounting cycle is a fixed time period during which a company records, categorizes, and summarizes financial data and activities to generate financial reports (income statement, balance sheet, cash flows).

These financial statements provide a consistent overview of the company’s financial health, position, and cash flows during the established period.

Small businesses can use financial information to make informed decisions regarding investments, product pricing, and growth strategies for the next accounting period by evaluating the feasibility and profitability of various options.

The accounting cycle also encourages investing, allowing analysts and investors to identify trends and evaluate a company’s performance based on its revenue, expenses, and profitability against competitors during the same accounting period.

Some common accounting periods businesses follow include; monthly, quarterly, half-yearly, or annual accounting periods.

As per the US SEC (Securities and Exchange Commission), all publicly-held companies must report their financial statements quarterly, i.e., every three months.

The IFRS (International Financial Reporting Standards) allows a period of 52 weeks (or a fiscal year) as the accounting period, and the IRS (Internal Revenue Service) allows taxpayers to use either the calendar year (twelve months) or fiscal year for tax reporting.

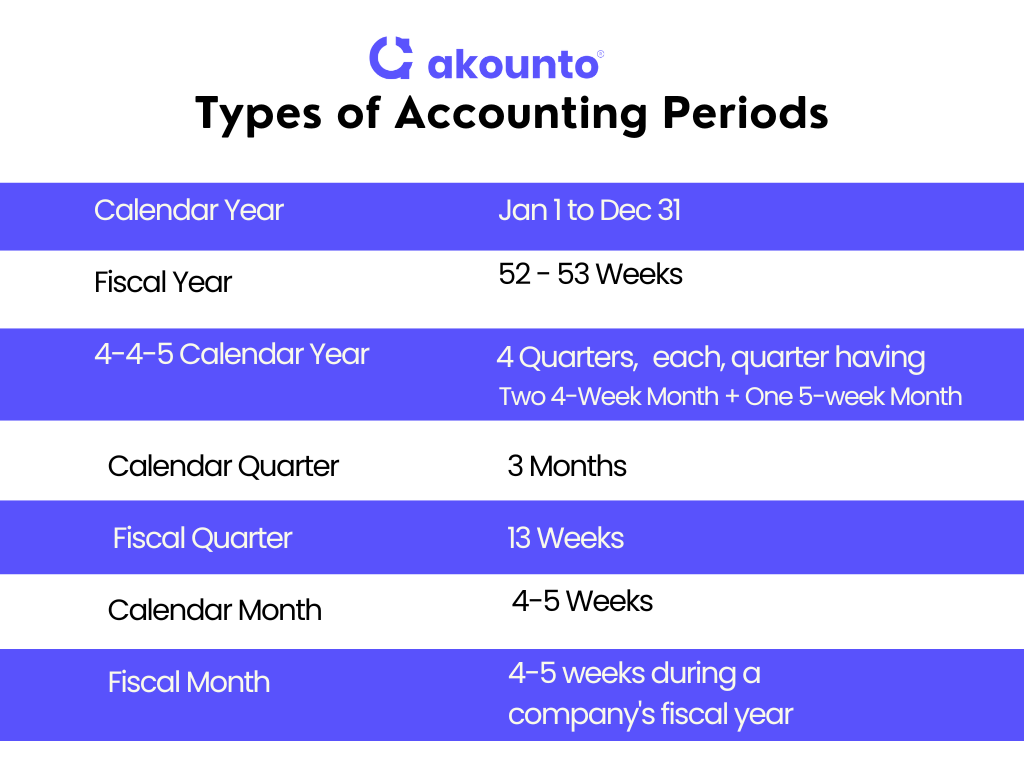

Types of Accounting Periods

Calendar year

The accounting period follows the standard Gregorian calendar year, consisting of a twelve-month accounting time frame, beginning on January 1 and end date on December 31.

The advantage of using this accounting period is that starting and end dates are always the same. So the management can easily analyze accounting records and identify trends and patterns for future growth plans.

Small Businesses of sole proprietors, partnerships, limited liability companies, and personal service corporations can use the calendar year accounting period to align with the annual tax filing requirements.

Fiscal year

The fiscal year refers to an annual accounting period that does not end on December 31. The IFRS allows companies 52 or 53 weeks as an accounting period. Companies can choose the reporting period they want to consider in their fiscal year. This gives them time to prepare their strategy for collecting financial data.

Businesses that use this period include seasonal businesses, accounting firms, and event businesses that earn revenue from events occurring during specific times of the year.

4-4-5 Accounting Period

The 4-4-5 calendar year divides the accounting period into four quarters. Each quarter has thirteen weeks grouped into one 5-week month and two 4-week months.

The benefit of using this time range over regular calendar months is that each accounting period corresponds to the same accounting period in the previous year and the next year, meaning it provides a review and forecast tool for management and helps in comparative analysis.

Businesses often using these monthly accounting periods include retail companies and manufacturing industries.

Calendar Quarter

A calendar quarter begins at the start of a fiscal quarter (such as January 1, April 1, July 1 & October. 1) and lasts three months. Small businesses can use these accounting periods to prepare accounting data more than once per year, allowing them to schedule when they want to analyze their financial performance.

Fiscal quarter

The accounting period lasts for 13 weeks, and a company’s fiscal year determines the timing of fiscal quarters. This means a business can choose 13 weeks during which it wants to evaluate and schedule its financial performance.

For example, if a company wants to assess its financial standings post-tax season, it can start its fiscal quarter on April 30 and continue its accounting processes for 13 weeks until July 30. The second quarter would start on July 31.

Calendar month

A calendar month lasts over four or five weeks and begins on the first day of the month a business considers. For example, a business could analyze financial records from July 1 to July 31.

These periods give businesses a real-time financial health overview, including cash, assets, inventory, revenue, and orders.

Businesses use these accounting periods to quickly produce financial statements and analyze small portions of data at a time.

Fiscal month

A fiscal month may last four or five weeks during a company’s fiscal year. The company can set a specific date to start accounting practices.

For example, Company SSS wants to collect financial data over a fiscal month that includes two calendar months in the fall. It may schedule the accounting period from October 10, 2023, to accomplish this. The accounting period will last five weeks and conclude on November 14, 2023.

Advantages

- Timely Financial Reporting: The accounting period provides small businesses a structured time frame for preparing and reporting financial statements.

- Performance Evaluation: By comparing financial statements from different periods, small business owners can identify areas for improvement, and set realistic goals, while investors can assess the company’s growth, profitability, and efficiency.

- Planning and Budgeting: Small businesses can analyze historical financial data from previous accounting periods to make informed decisions regarding risk management, resource allocation, pricing strategies, cost control, investments, and growth strategies.

- Internal Control: The accounting period cycle concept provides a systematic approach to financial management. Breaking down the accounting time period helps small businesses easily track and reconcile their accounting records.

- Compliance & Tax Planning: Small businesses can meet their financial and tax reporting obligations by aligning their accounting period with the relevant deadlines and regulations.

Disadvantages

- Potential for Manipulation: Division of financial activities into an accounting period can open up opportunities for manipulation and window dressing of the statements. Businesses could artificially inflate or defer revenue or expenses by timing revenue recognition or expense reporting to improve their results during a specific period, distorting the accuracy and reliability of financial statements.

- Administrative Burden: Preparing accounting statements for each period requires time, resources, and expertise. Small businesses may find it challenging to allocate their limited resources for recordkeeping, financial statement preparations, and compliance with reporting deadlines, resulting in increased administrative burden and diversion of focus from core business operations.

- Complexity in Comparisons: Evolving business conditions, changing accounting policies, or one-time events can make meaningful comparisons during an accounting period challenging. Small businesses may need to adjust or give additional disclosures to evaluate profitability and trends over time accurately.

- Compliance: Changes in accounting standards or tax laws may require adjustments to the accounting period or reporting processes.

- Time Lag in Reporting: Accounting periods can result in a time lag between when transactions occurred and their inclusion in financial statements making it challenging to make quick decisions in the ever-changing market conditions.

Accounting Period vs. Financial Year

| Basis | Accounting period | Financial year |

| Meaning | It is a specific time frame (monthly, quarterly, half-yearly, or annual period) for which financial statements are prepared and reported. | It is a twelve month period designated by the business for financial reporting and tax purposes. |

| Flexibility | Accounting Period can be chosen based on business needs, industry practices, and internal reporting requirements. | Financial year can be set according to operational cycle, legal requirements, and industry norms. |

| Comparability | Financial performance of business can be analyzed and compared over different accounting periods. | Enables comparison of financial results and trends across different financial years. |

| Tax Considerations | It may or may not align with the tax year depending on jurisdiction and company’s choice. | It is often aligned with the tax year to simplify reporting and compliance with tax laws. |

Conclusion

An accounting period provides a structured framework for financial reporting, and performance evaluation. Small businesses can prepare timely and accurate financial statements, measure performance, meet regulatory requirements and make informed decisions for long-term growth. Potential investors and shareholders can analyze a company’s performance through its financial statements, based on a fixed accounting period.