Accounts payable are the funds a company owes to creditors, while accounts receivable are the money debtors owe to the company.

Daily business transactions sometimes lead to payment lag which creates accounts payables and accounts receivables. A credit sale creates accounts receivable, while a credit purchase creates accounts payable.

Accounts payable is a current liability, while accounts receivable is a current asset. The former has a credit balance, while the latter has a debit balance.

What Are Accounts Payable (AP)?

Accounts payable is the amount of funds a company owes to its vendors or suppliers for services and goods that have been received but are yet to be paid. It is considered a liability account to record short-term debts that a company owes to its creditors.

Accounts payable is considered a liability on a company’s balance sheet.

When To Use Accounts Payable?

Accounts payable is typically used when a company purchases goods or services on credit and receives an invoice from the supplier or vendor. The invoice is then recorded as an accounts payable, and the company is responsible for paying the invoice within a certain time frame.

Examples Of Accounts Payable

- Bills for office supplies, utility bills, rent, and employee wages.

- Raw materials that a manufacturer has received from a supplier but has yet to pay for.

- Rent for a commercial property that still needs to be paid.

- Invoices for goods or services that a company has received but has yet to pay.

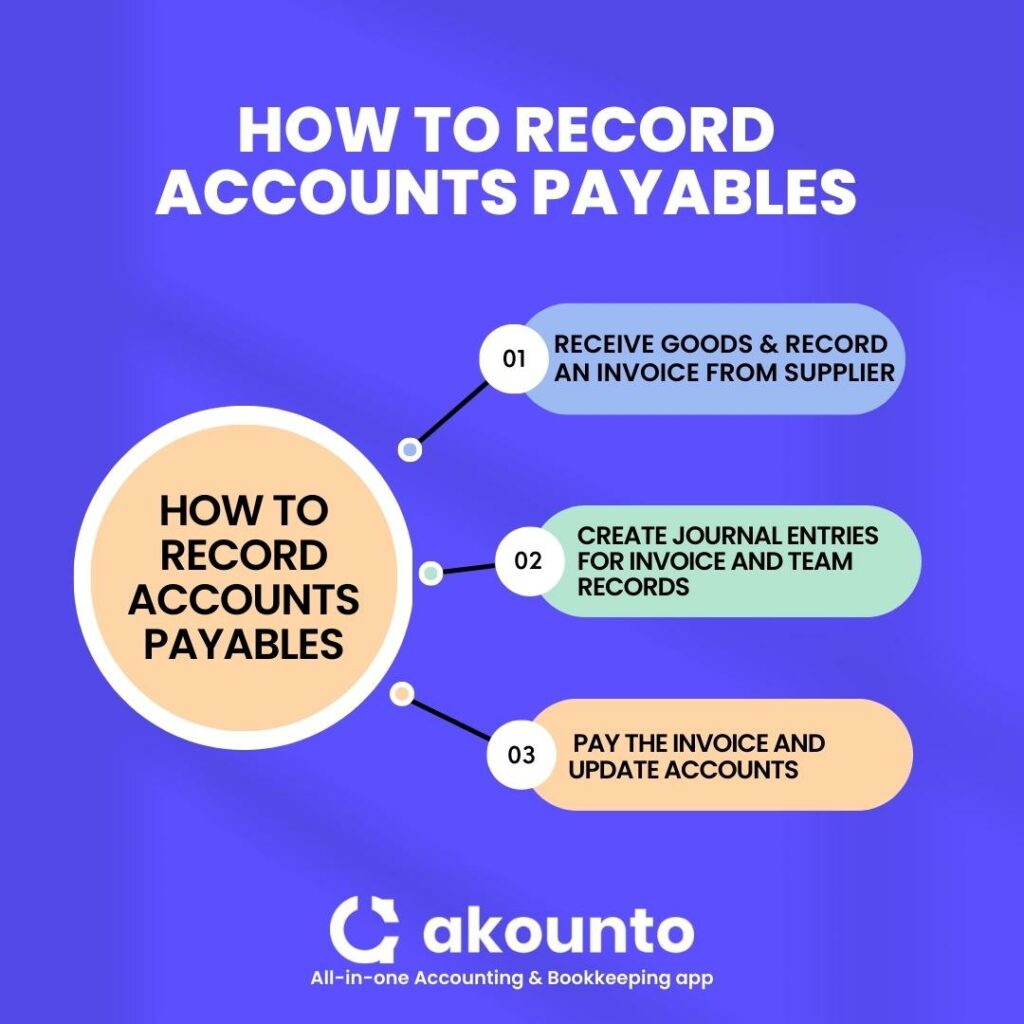

How To Record Accounts Payables?

Accounts payables are generated when the payment to the creditors is pending due to credit purchases.

Account payables have a credit balance. These creditors are shown in the company’s balance sheet as current liabilities. Journal entries and ledgers are made in the name of the creditors.

Recording accounts payables signify the amount due to be paid in the short term and impact the short-term creditworthiness of the company.

Vendors, sellers, and investors are interested in the short-term liquidity position of the company and its ability to pay for its credit purchases.

Accounts payable provide transparency for services rendered and makes it easier to forecast cash flows in working capital and line accounts payable.

Accounts Payable Process

The accounts payable process involves the following steps;

- Step 1: Receive and record an invoice from a supplier or vendor. The invoice should include the name of the supplier, the date the invoice was received, the amount of the invoice, and any relevant details about the goods or services received.

- Step 2: Create a journal entry for invoice and team records. Once the invoice has been recorded, the next step is to post the invoice to the accounts payable account. It will increase the balance of the accounts payable account, which is a liability account.

- Step 3: Pay the invoice for goods sold and update accounts payable and cash accounts. Once the company has paid the invoice, the payment should be recorded in the accounting system. It will decrease the balance of the accounts payable account, which is a liability account.

What Is Accounts Receivable (AR)?

Accounts receivables are the amount which the customers owes to the company, because the customer has bought the goods or service on credit and are obliged to pay later.

It is considered an asset account and is used to record short-term debts that a company’s customers owe to it.

When To Use Accounts Receivable?

Accounts receivable refers to a company selling goods or services on credit and issuing an invoice to the customer. The invoice is then recorded as an account receivable, and the company’s finance team is responsible for collecting payment from the customer within a certain time frame.

Examples Of Accounts Receivable

Accounts receivables are short-term debts that are normally realized within a year of their occurrence. Some examples of accounts receivable include;

- Unpaid invoices for sales of goods or services,

- Outstanding payments from customers,

- Invoices for goods or services that a company has sold but is yet to be paid for,

- Customer deposits that have been received but not yet applied to a sale,

- And unpaid rent from tenants.

How To Record Accounts Receivable?

- Accounts receivables are generated when the services or goods are delivered to the customer and payment is due.

- Accounts receivables are short-term in nature and are termed current assets. They reflect a debit balance in the statements. The company records this on the asset side of the balance sheet.

- Companies keep tabs on the aging of these due customer payments to ensure they are received on time. Fundamental analysts look at the accounts receivables by verifying the accounts receivable to their turnover ratio. It helps understand the capacity of the company to collect the receivables in an accounting year.

- If customers don’t pay their dues on time, they are written off from the company accounts and accounted as bad debts in the financial statements.

Accounts Receivable Process

- Step 1: Record the sale of goods the customer pays. Finance teams should record the sale in their accounting system when a company makes a sale. The sale should include the name of the customer, the date of the sale, the amount of the sale, and any relevant details about the goods or services that were sold, including the sales tax.

- Step 2: Post the sale or credit purchases to accounts receivables. Once the sale has been recorded, the next step is to post the sale to the accounts receivable account. It will increase the balance of the accounts receivable account, which is an asset account.

- Step 3: Record the payment or cash flow in the general ledger. Once the customer has paid the invoice, payment should be recorded in the accounting system. It will decrease the balance of the accounts receivable account, which is an asset account.

- Step 4: Monitor and follow up on overdue accounts to ensure healthy cash flow. Accounts receivable management becomes much easier when businesses track invoices and their age. It’s crucial to be up to date and keep a tab on reports for overdue invoices of money customers owe, trial balance sheets, and reconciliation of assets.

- Step 5: Apply payments to current asset customer accounts. Once the business finally receives the money owed by customers, the accounts receivable department should post the payment entries to the respective accounts and work out any pending receivable balance.

- Step 6: Reconcile the bottom-line accounts in the department. The respective department needs to update the balance sheet, make a journal entry and adjust any bad debts to maintain a clear report of each account.

Accounts Payable Vs Accounts Receivable: Key Differences

| Accounts Payable | Accounts Receivable |

|---|---|

| Liability account | Asset account |

| The company owes suppliers or vendors | Customers owe company |

| Short-term debts | Short-term assets |

What are some common aspects of Accounts Payable and Accounts Receivable?

Accounts payable and accounts receivable are created because business accounting follows the accrual basis of accounting.

Due to accrual accounting, the payments can be recorded in the accounting system even if the obligation to pay and receive has been created due to a business transaction.

In case the company would have followed a cash basis, then accounts payable and accounts receivable are not created because accounting entries are created only when the cash is given or received.

The accrual method follows the double-entry accounting method. Every entry in the accounts has its corresponding contra-entry. Any updations in receivables and payables are made, and the same is also reflected in the company’s balance sheet under the ledgers termed accounts payable and receivable.

Some more common aspects of accounts payable and accounts receivable are:

- Both are accounted for in the general ledger.

- Both are necessary for understanding the financial health of the company.

- Both are a part of the working capital of the company.

- Both are short-term in nature.

- Both are necessary for cash flow management.

Why Accounts Payable and Receivable Matter For Your Business?

Accounts payable and receivable impact the working capital cycle of the company. The running of day-to-day operations requires the company to track its accounts payable and receivable because it impacts the cash flows.

Tracking accounts payable and receivable is crucial to maintaining a healthy cash flow statement and ensuring that a company can pay its bills on time and collecting payments from customers promptly. It helps maintain a positive relationship with suppliers and vendors and ensures financial stability.

How Can Akounto Accounting Software Help?

Accounts receivables and payables impact the working capital cycle of the company. For running day-to-day business operations, cash collection and payment optimization are needed.

Small businesses must accurately track their account receivable and accounts payable. Akounto offers an intuitive dashboard where you can track all your business finances at a glance. See where the funds are coming from and where they are going. For more information, visit our website.