What is Actual Cost?

Actual cost, also known as historical cost, is the total amount of money paid to produce, manufacture, or acquire a product or service. Actual costs can include both direct and indirect costs.

In cost accounting, actual costs incurred are compared with the budgeted costs (standard costs) to analyze cost variance, assess performance, and optimize the cost structure.

In a company’s balance sheet, actual costs are represented as the value of the fixed asset.

Actual costing is a decision-making input for managerial accounting as well as cost accounting. It must be noted that managerial accounting decisions are made at the management level where policy decisions are made; in this case, cost accounting becomes its sub-set and is more specialized in nature.

At the management level, the management can make decisions based on production volume or set long-term expectations for the break-even point and profit-volume analysis based on the actual cost approach.

At the costing level, the operations can be realigned and the manufacturing process optimized so that the difference between budgeted costs and actual costs is minimized.

Any commercial enterprise aims to earn profits, and for this, cost control is important to check for unnecessary leakages, which impact sales margins and make the production process efficient.

Costing approaches are not only meant to control costs. Additionally, they also help in price discovery, budgeting and forecasting, resource allocation, capital budgeting decisions, manpower planning, inventory management, etc.

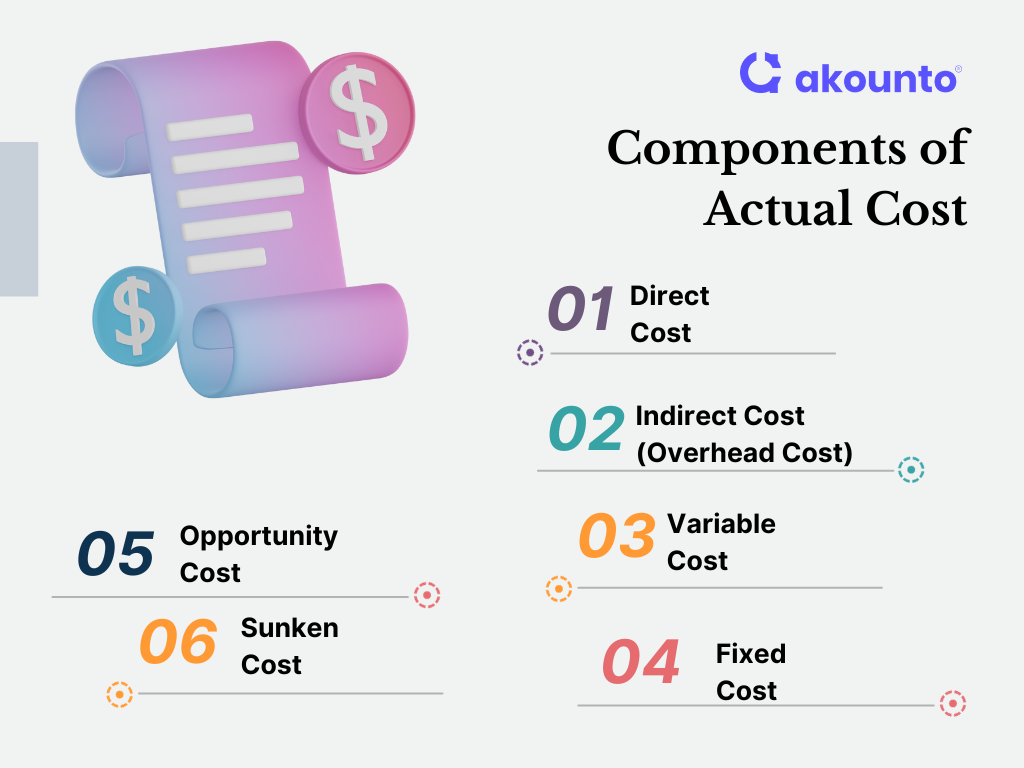

Components of Actual Cost

Direct Costs

Costs directly related to manufacturing a product or rendering a service. It includes actual labor cost, cost of raw materials, purchase price, machine and packaging costs, marketing and advertisement expenses, etc.

Indirect Costs (Overhead Costs)

Indirect costs or overhead costs are not directly attributable to a particular product or service. It could be factory rent where multiple products are manufactured, depreciation, insurance, indirect labor like managerial staff, security, taxes, etc.

Indirect expenses are related to operations but are still not directly related to the manufacturing process.

Variable Costs

Variable costs related to the units produced. They increase or decrease in relation to the units produced. If the company increases its manufacturing volume, more raw materials will need to be purchased, and vice versa.

Variable costs include both direct costs and indirect costs.

Fixed Costs

Costs that are not dependent on the production plan, sales volume, or changes in demand. Fixed costs can also be indirect as well as direct costs. Fixed costs can be capital expenditures to purchase a piece of equipment, such as license fees, insurance premiums, salaries of management, etc.

Know the difference between fixed cost and variable cost. Fixed is not dependent on volume of production while variable, as the name says, varies with the volume of production.

Opportunity Costs

Opportunity costs are the cost of foregoing the next best alternative. In accounting term, the opportunity cost is not included in calculations, but at the management level, it impacts the decision-making process.

Sunken Costs

Sunken costs are costs that cannot be recovered. Sunken costs are normally fixed costs and are irrecoverable; they can be incurred due to an error in the process. Sunk costs can include costs incurred on training employees who left or failed in training or costs incurred in marketing and sales, but the product failed to launch.

Do not confuse sunken cost with burden cost; earlier is the loss, and later is a type of indirect cost.

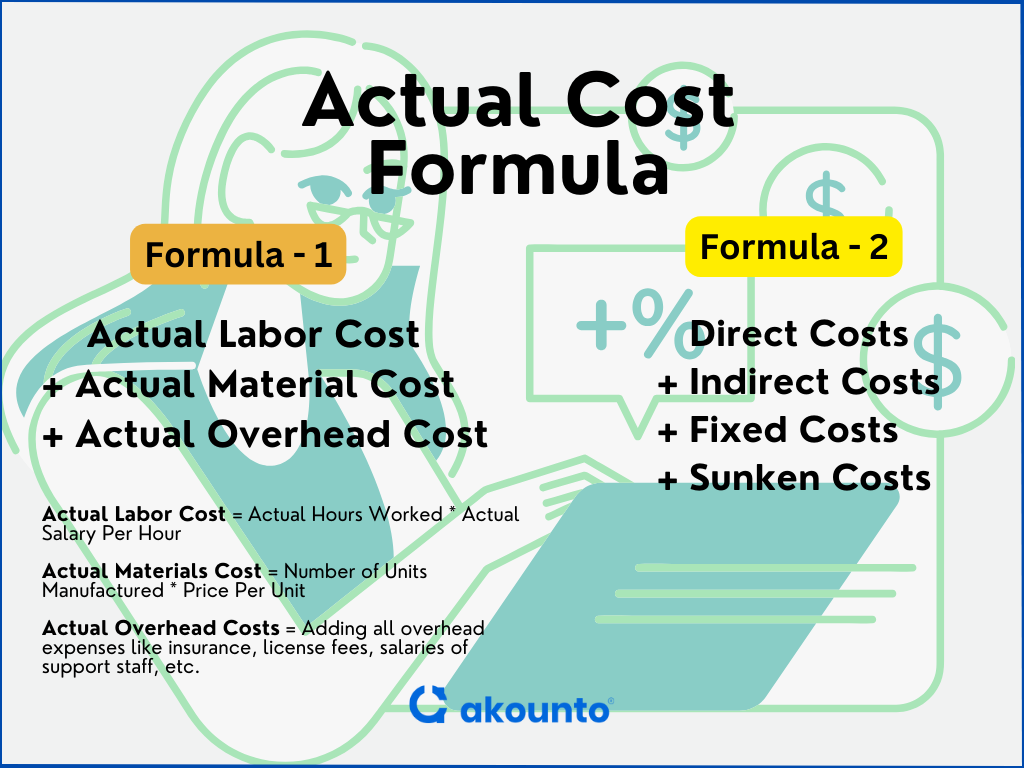

Actual Cost Formula

Actual Cost Formula = Actual Labor Cost + Actual Material Cost + Actual Overhead Cost

Actual Labor Cost Formula = Actual Hours Worked * Actual Salary Per Hour

Actual Materials Cost Formula = Number of Units Manufactured * Price Per Unit

Actual Overhead Costs Formula = Adding all overhead expenses like insurance, license fees, salaries of support staff, etc.

The following formula is another way to calculate the actual cost:

Actual Cost = Direct Costs + Indirect Costs + Fixed Costs + Sunken Costs

Example of Actual Costing

Question: The TechSmith Workers Inc. factory manager shared the following information with the cost accountant to calculate the actual cost.

- Actual Hours Worked: 100 hours

- Actual Salary Per Hour: $15

- Number of Units Manufactured: 500 units

- Price Per Unit: $6

- Overhead expenses (insurance, license fees, salaries of support staff, etc.): $1,200

Answer

Calculating actual cost will first include calculating its components and then summing them.

Actual Cost Formula = Actual Labor Cost + Actual Material Cost + Actual Overhead Cost

Actual Labor Cost = 100 hours × $15 per hour = $1,500

Actual Materials Cost= 500 units × $ 6 per unit= $ 3,000

Actual Overhead Cost = 1,200

Actual Cost = $ 1500 + $ 3000 + $ 1200 = $ 5700

Understanding Cost Variance

The difference between the actual cost incurred and the budgeted costs (planned costs or standard costs) gives cost variance.

Cost variance is a tool for cost control. The variance is calculated for all the components of actual cost, like materials, labor, and overheads.

A company plans the cost of a certain activity; if the actual cost is less than the planned costs and remains in the budgeted cost, then it is a favorable variance.

If the actual cost is more than the planned or standard costs, then it is an unfavorable variance.

Favorable Variance= Budgeted or Standard Cost > Actual Cost

Unfavorable Variance = Actual Cost > Budgeted or Standard Cost

Forecasted costs are estimates of a project’s running expenses. The estimates can be updated as more information becomes available or circumstances change.

Planned costs, also known as budgeted costs, are a kind of benchmark cost against which the progress of the project is measured. They provide the basis for resource allocation.

Standard costs are similar to planned costs and are determined at the start of an accounting period based on historical data, trends, industry standards, etc. It is important in an actual costing approach as cost control and variance calculations are normally done using standard costing.

Related Costing Concepts

Normal Costing

Normal costing aims to accurately determine the cost of the product by taking into account actual direct cost and estimated overhead cost. The difference between actual costing and normal costing is that the actual costing approach is based on costs incurred, while normal costing is based on estimation.

Standard Costing

Standard costing is the estimated price of a production plan, while actual costing is the costs incurred in real-time. The difference between standard cost and actual cost gives variance that is helpful in cost control. The standard costs are based on trends, industry standards, etc.

Standard costing helps prepare accurate budgets aligned with industry practices. All estimates are calculated prior to the production process, but the actual cost is ascertained after its completion.

Benefits of Actual Costing

- It is a simple method based on real-time costs incurred to produce a product or service.

- Since actual cost is not dependent on estimation, the data for variable costs are accurate, and the variances show actual deviations from the pre-determined benchmarks.

- It is a widely used method and can be easily implemented for cost variance control

Conclusion

Production and manufacturing costs are one of the major factors that impact the sales margins and profitability in the end. A business owner or manager aims to control unnecessary costs and optimize the production process to minimize losses. To do cost control, a comparison of actual cost with the allocated budgets or standard cost helps to detect gaps. Based on variances, any abnormal instances of cost are immediately highlighted that demand a course correction.

Visit Akounto’s blog to learn more about finance and accounting topics that help you manage your finances like a pro.