Who is a Bookkeeper?

A bookkeeper keeps track of a business’s purchases, sales, and other financial transactions.

Bookkeepers record daily transactions in a general ledger and help monitor the day-to-day financial activities of a business. They might only record information into a spreadsheet, compare it to receipts, or take on other responsibilities like managing cash flow and tax filing.

The financial data bookkeepers manage includes purchases, sales, receipts, and payments. They ensure that all financial records are accurate, up-to-date, and organized.

Bookkeepers are usually overseen by the business owners or the senior financial managers they are associated with. A business can avail of various bookkeeping options depending upon the needs, ranging from in-house bookkeeping to outsourced and virtual bookkeeping services.

History of Bookkeeping

Bookkeeping is not a recently developed practice. It has and continues to evolve through the centuries.

As per historical findings, some of the oldest surviving bookkeeping artifacts date as far back as 8000 B.C. in Jericho, a historic West Bank city, Babylon, Egypt, and even Greece, where records were kept on clay tablets, papyrus, and other materials for tracking the accounts of properties owned by kings.

Later, as time progressed and trading systems evolved, merchant and other trading industries fueled the desire for more complex record keeping. The tablets recorded business and communal contracts such as borrowing, lending, wills, lawsuits, and marriage dowries in terms of the barter system, which was then used for trade.

As currencies became available, math-phobic tradesmen and merchants began to hire bookkeepers to maintain a record of their business accounts – what they owed and who owed debts to them.

Until the late 1400s, the bookkeeping information was arranged in a narrative style that showed all the numbers in a single column—the amount paid, owed, or otherwise. The format was known as “single-entry” bookkeeping. Luca Pacioli introduced the modern double-entry bookkeeping system in 1494.

Industrialization in the 19th and 20th centuries made bookkeeping a more formalized profession. The introduction of accounting standards and regulations led to the establishment of professional bodies, like the IMA (Institute of Management Accountants) and the AICPA (American Institute of Certified Public Accountants), which set ethical and professional standards for the profession.

In recent years, technology has revolutionized bookkeeping by introducing accounting software that automates many tasks traditionally performed by bookkeepers. The rise of cloud computing and online services has made it easier for businesses to outsource their bookkeeping needs to remote professionals.

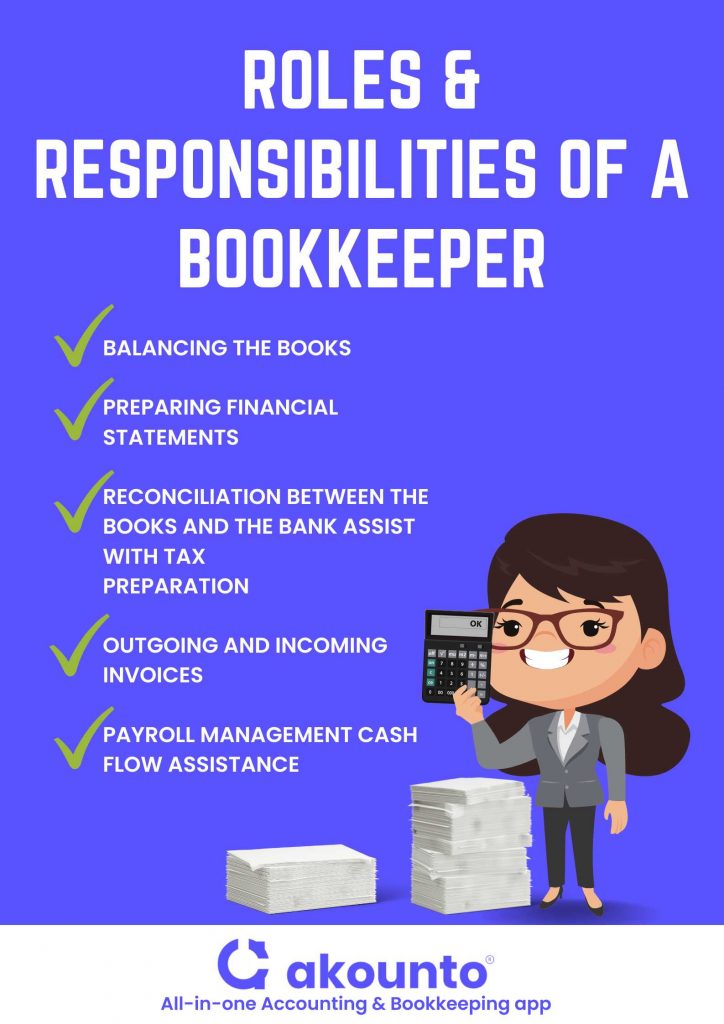

Roles & Responsibilities of a Bookkeeper

Bookkeepers generally record day-to-day monetary activities and collect and organize the business’s financial records and cash flow statements. These records include profit and loss statements, balance sheets, and tax returns.

Below we have a breakdown of the major roles and responsibilities of a bookkeeper:

Balancing the Books

The most important role of a bookkeeper is to record daily financial transactions. He should record every transaction in the respective ledger mentioning its amount, the name of the receiving or the paying party, and the transaction date.

Preparing Financial Statements

Bookkeepers generate financial reports that display the business’s financial standing. He uses the records of day-to-day business transactions in the general ledger to prepare these reports. A bookkeeper may also use bookkeeping software for this purpose.

Reconciliation between the Books and the Bank

Bank reconciliation means that a bookkeeper ensures that the transactions on the bank statements of a company match the outgoing and incoming invoices. The cash account of a business should also match the balance sheet.

In effect, all financial reports of a business should match and explain every transaction. In case of a discrepancy, a bookkeeper is responsible for documenting it and reporting the missing invoice or transaction.

Assist with Tax Preparation

A professional bookkeeper can help a small business owner file taxes or assist other financial professionals with tax returns. However, bookkeeping tasks do not include tax filing unless the bookkeeper is also a tax preparer.

A bookkeeper hands over the files to the accountant come tax time if he is not a tax preparer.

Outgoing and Incoming Invoices

Day to day responsibilities of a bookkeeper include managing the company’s accounts receivable and accounts payable.

These duties include issuing invoices to customers or clients for goods or services rendered and tracking incoming invoices from vendors and suppliers.

Payroll Management

Large companies require separate departments for payroll management, and a business owner can use the bookkeeping services for payroll accounting. A bookkeeper will calculate employees’ salaries and the relevant taxation and ensure they are paid on time. He may also be taking care of the insurance and other allowances of the employees.

Cash Flow Assistance

An experienced bookkeeper with an associate degree or sufficient experience in double-entry bookkeeping can assist with maintaining cash flows. He can prepare a cash flow statement and provide a forecast, helping the business stay ahead of its finances.

What Credentials does a Bookkeeper Need?

There is no legal requirement for a bookkeeper to hold any license or a certification, but a certified bookkeeper surely has proof of skills that helps in professional growth. Certification helps small business owners to gauge their skill and expertise before employing a bookkeeper.

Certifications are provided by NACPB (National Association of Public Bookkeepers) and AIPB (American Institute of Professional Bookkeepers) after conducting related skill-based examinations. There are various other bookkeeping credentials also available.

The bookkeepers with NACPB licenses are called Certified Public Bookkeepers (CPB), while the bookkeepers with AIPB certification are called Certified Bookkeepers (CB).

Students who have completed their college coursework in at least one accounting subject can get a basic bookkeeping job. This experience qualifies them for more and better bookkeeping and assistant accountant jobs.

Generally, an associate degree in bookkeeping takes about two years, often sufficient to qualify for an accounting clerk or bookkeeping job responsibility. It mainly teaches math and accounting skills and can be extended into a bachelor’s degree.

Types of Bookkeeping

There are two main types of bookkeeping:

- Single-Entry Bookkeeping

The single-Entry method refers to a single-entry system where bookkeepers record transactions only once in one account.

Small businesses that do not need to record multiple daily transactions and do not intend to apply for a loan shortly may use a single-entry bookkeeping system. However, this bookkeeping system does not comply with the US GAAP.

- Double-Entry Bookkeeping

The double-entry bookkeeping method records each transaction in two accounts: a debit and a credit. The double entry system is the only method complying with the IFRS and the US GAAP.

Larger companies invariably use the double-entry method to prepare their financial reports.

Why should a Small Business Hire a Bookkeeper?

A professional bookkeeper may help small business owners in the following ways:

- Maintain accurate financial records for transparency and compliance with the IFRS and GAAP accounting standards. The accuracy of bookkeeping also saves a business the high costs of financial errors.

- Prepare monthly reports to keep track of the business’s financial data by the end of every accounting period.

- Prepare and regularly update financial statements to provide useful information to investors, lenders, and regulators.

- Manage accounts receivable and payable to streamline the finances of a business so that the business owner can tend to more urgent responsibilities.

- A bookkeeper can offer valuable insights into a company’s cash flow management and general financial health.

Difference between a Bookkeeper and an Accountant

Conclusion

Bookkeepers play a crucial role in managing the business’s finances by recording transactions, generating reports, and assisting with the accounting efforts of all organizations, such as nonprofits, small businesses, and corporations.

Depending on the stage of the company, business owners can hire a full-time professional bookkeeper or employ bookkeeping services like Akounto and outsource their bookkeeping to worries.