What is Bookkeeping?

Bookkeeping is a process that records financial transactions, organizes financial information, and prepares financial statements.

Bookkeeping is a quintessential aspect of every business, and it is necessary to maintain accurate financial records of a business’s financial transactions. Bookkeeping involves several steps, including analyzing transactions, recording entries, updating the ledger, and preparing statements.

Bookkeeping ensures that businesses’ financial records are maintained accurately, enabling companies to keep track of their financial performance and make informed decisions.

It is the basis of the accounting process, which involves analyzing financial data and preparing financial statements and financial reports.

Why Bookkeeping Matters?

Accurate bookkeeping is essential to ensure the sustainability of a small business. By recording all transactions, companies can effectively manage their cash flow, meet financial obligations, and make informed investment decisions. With proper bookkeeping, small business owners can confidently assess their financial position, make strategic decisions, and plan for future growth.

Benefits of Bookkeeping

- Financial Control: Bookkeeping for income, expenses, and cash flow gives business owners financial control making it easier to spot areas where expenses can be minimized, and profits can be increased.

- Decision Making: Accurate bookkeeping process empowers business owners to make well-informed choices for their enterprise. Small business owners can make better pricing, promotion, and resource allocation choices by accessing accurate and updated business finances.

- Tax Compliance: By providing correct records, bookkeeping helps in tax preparation and meeting statutory compliances. Tax fines and penalties may be avoided in this way.

- Impact on Business Performance: Bookkeeping helps a business manage its financial health by highlighting which aspects of the company are operating well and which require improvement, leading to a profitable business.

Businesses must adhere to IRS bookkeeping regulations to avoid penalties and fines. Companies must abide by specific bookkeeping regulations set forth by the IRS.

Pre-requisites for Bookkeeping in a Business

Below are some of the principal prerequisites:

- Recordkeeping: Keeping precise and comprehensive records of the company’s financial transactions is necessary. Recordkeeping encompasses earnings, expenditures, acquisitions, appropriations, and sales. The minimum retention period for records is three years.

- Business Expenses: A business owner must maintain receipts, invoices, and other supporting documents, including any outflows for entertainment, travel, or additional business-related costs.

- Payroll Records: Companies are mandated to keep accurate records of every aspect of an employee’s pay, including wages, taxes deducted, and any additional perks or deductions.

- Tax Returns: Companies must submit proper tax returns, which necessitates maintaining thorough and accurate records.

- Electronic Records: The IRS permits firms to keep electronic records, but they must make sure that the documents are accurate, comprehensive, and simple to access if the IRS makes a request.

Types of Bookkeeping for Small Businesses

As per IRS Publication 583, the choice between single-entry and double-entry bookkeeping systems must be made by considering the needs of your business. While the single-entry system is relatively easy to maintain, it may only be appropriate for some. On the other hand, the double-entry system offers better accuracy and control as it has in-built checks and balances.

Single Entry System

Usually, a sole proprietor, new business owner, or small startup prefers a single entry system because they have simple and uncomplicated financial transactions with a low volume of transactions during the early phase of their business.

A single-entry system of bookkeeping records financial transactions where each transaction is recorded only once, either as an income or an expense.

A single-entry method is simple, easily understandable, practical, and has the least learning curve. Generally, a single-entry system works in tandem with the cash basis of accounting.

Based on the income statement, the single entry method, the following financial information is maintained:

- The cash sales journal holds a record of daily cash receipts.

- A cash disbursements journal records the expenses.

- The records of receipt and expenses should reconcile with the bank statements.

Double Entry Bookkeeping System

The double-entry bookkeeping system is a financial recording technique where transactions are recorded in two accounts, representing a debit and a credit. The primary advantage of the double-entry method is that it offers a more comprehensive and detailed representation of a business’s financial condition by monitoring the dual effect of every transaction, thereby improving accuracy and control.

The double-entry bookkeeping system involves using journals and ledgers to record financial transactions. The transactions are recorded in a journal and then posted to ledger accounts showing various financial aspects such as income, expenses, assets, liabilities, and net worth.

While the income and expense accounts are closed at the close of each tax year, the asset, liability, and net worth accounts remain open permanently.

The double-entry method enhances financial analysis and promotes internal financial control measures. Furthermore, this method enables businesses to identify discrepancies and errors efficiently, allowing for prompt remedial action and maintaining accurate records.

A double entry system can use either cash or accrual basis of accounting for recording transactions.

Cash Basis vs Accrual Basis of Recording Transactions

In bookkeeping, applying either a cash or accrual basis is possible while utilizing single or double-entry methods. However, it is worth noting that the single-entry method is commonly used as the fundamental framework for cash-based bookkeeping. In contrast, the double-entry method is considered more suitable for the accrual basis.

Cash basis and accrual basis are two methods of accounting and financial record keeping used in a business.

Cash basis in bookkeeping records revenue and expenses when cash is actually received or paid. The revenue is recognized when a payment is received, and expenses are recognized when a payment is made. It is a straightforward method that is ideal for small businesses with a low volume of transactions.

Accrual basis accounting records revenue and expenses when earned or incurred, irrespective of when payment is received or made. The revenue is recognized when earned, and expenses are recognized when incurred, irrespective of when the payment is received or made.

Cash basis accounting provides a simpler approach to recordkeeping; it may not give an accurate picture of financial reporting. Accrual basis accounting is more complex but offers a better understanding of the business’s financial position.

As per IRS Publication 538:

The majority of individuals and small businesses prefer the cash method of accounting. However, in cases where there is production, purchase, or sale of merchandise, it becomes necessary to maintain an inventory and use the accrual method for recording the sales and purchases of the merchandise.

- Cash basis is not allowed for the following:

- A corporation (other than an S corporation)

- Partnership with a corporation as partner (other than an S corporation)

- Tax shelter u/s 448(d)(3)

- Exceptions

- Corporation or partnership that meets gross receipt test

- Qualified personal service corporation (PSC)

Before selecting the accounting method, please consider IRS requirements and guidelines by US GAAP.

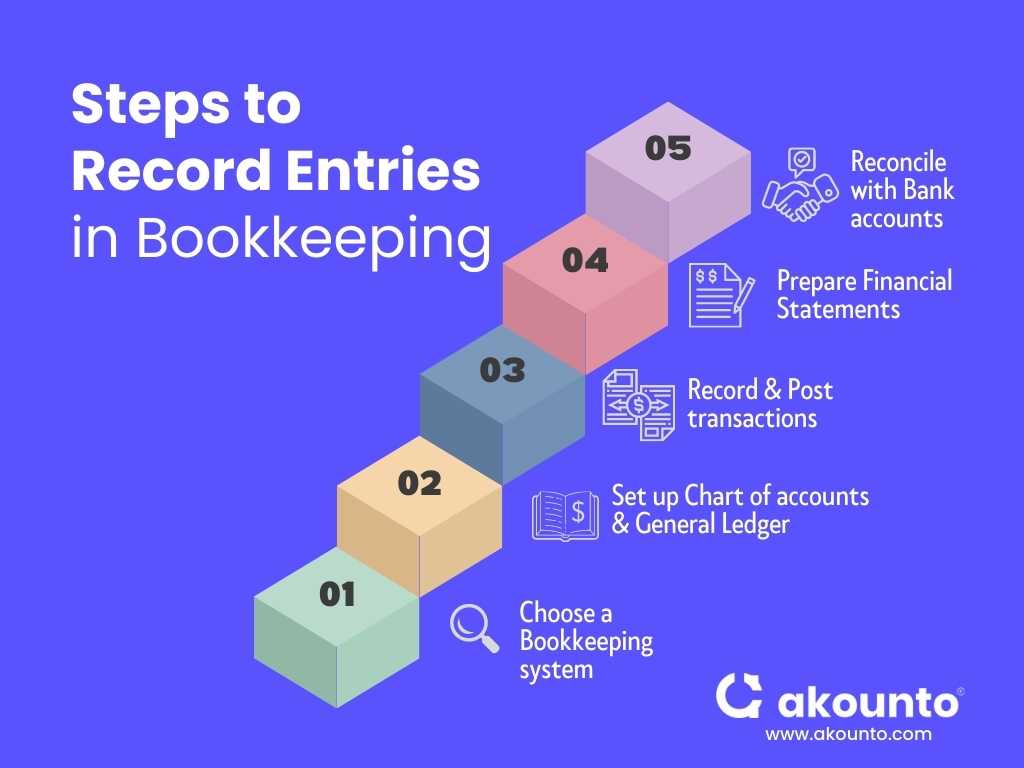

Steps to Record Entries in Bookkeeping

Bookkeeping is meticulously and systematically recording a company’s financial activities and transactions. Maintaining accurate and updated records is crucial for business owners and accountants to manage the company’s finances effectively. The steps to recording entries in bookkeeping are as follows:

- Choose a bookkeeping system: Choose from the single-entry or double-entry method. Bookkeeping software helps maintain accuracy and consistency for in-house bookkeeping tasks. Depending on the size and phase of a business, the company can choose to do its own bookkeeping or outsource bookkeeping services.

- Set up a chart of accounts and a general ledger: Build a chart of accounts and create categories to organize financial transactions into general ledger accounts, for example, cash, accounts receivable, accounts payable, inventory, and expenses.

- Record and post transactions: After defining ledgers, you can start recording financial transactions. Storing, curating, and preserving financial documentation as evidence and support for every financial transaction are important. Transactions include sales, purchases, payments, receipts, and other financial activities. Record the date, amount, and accounts related to each transaction. Start with a journal entry and then post them to the related ledgers.

- Prepare financial statements: After posting all the transactions, you can prepare financial statements comprising an income statement (statement of profit and loss), a balance sheet, and a cash flow statement. These statements summarise the business’s financial activities and can help you make informed decisions.

- Reconcile with bank accounts: To identify discrepancies, compare your bookkeeping records with bank statements and other records. Reconciling is essential to maintaining accurate and up-to-date records and helps ensure that the financial information used for decision-making is reliable.

Do Bookkeeping & Accounting Work Together?

Bookkeeping and accounting are distinct yet interconnected functions in managing a business’s finances.

Bookkeeping involves the systematic recording and organizing of a business’s financial records, which include tasks such as invoicing, billing, payroll, and reconciling transactions.

Accounting focuses on interpreting and presenting financial data, which includes tax returns, auditing, and analyzing performance. Together, bookkeeping and accounting ensure that a business maintains accurate financial records, complies with tax laws, and makes informed decisions to improve its financial performance.

Common Examples of Bookkeeping Activities:

- Recording financial transactions like sales, purchases, and expenses in a ledger or accounting software, completing payroll, etc.

- Reconciling bank statements is important to ensure that all the transactions are accounted for and accurate.

- Preparing and issuing invoices to customers and recording payments received.

Common Examples of Accounting Activities:

- Preparing financial statements like income statements, balance sheet, and cash flow statements.

- Conducting audits to ensure that financial records are accurate and comply with accounting standards.

- Advising on tax planning strategies and preparing tax returns for businesses and individuals.

Tips to Practice Good Bookkeeping

- Follow bookkeeping basics like setting up a chart of accounts, classifying ledgers, and regularly recording financial transactions as they occur.

- Having a separate business bank account and a personal bank account is needed to avoid any mixing of transactions.

- Being a basis of accounting and other financial documentation makes bookkeeping important. Use accounting and bookkeeping software to maintain accurate records.

- Choose a bookkeeping and accounting system per your business needs and legal compliances. For example, single or double entry, cash or accrual basis, etc.

- Record every financial transaction, including supporting documentation like receipts, invoices, issue notes, authorizations, etc.

- Keep track of accounts receivable and payable to know the money owed to and by the business and schedule payments accordingly.

- Seek professional advice from a bookkeeping business at regular intervals to know about compliances and regulations related to auditing and tax filing needs.

- Reconcile bank accounts at periodic intervals by matching transactions in the bank account with those in the accounting records to ensure that they are accurate and complete.

- Choose a depreciation method based on the guidelines provided under US GAAP and establish accounting standards and define accounting policies.

- Review financial statements regularly and maintain procedures for recording entries. Train in-house bookkeepers or outsource bookkeeping. Ensure that the required skill set is available and updated per tax laws and accounting standards changes.

Conclusion

Bookkeeping and accounting go hand in hand, providing insights that help businesses make informed decisions and achieve financial success. Bookkeeping is the process of managing a small business’s finances.

Whether using accrual or cash basis bookkeeping, it’s important to follow best practices such as recording transactions accurately, reconciling accounts regularly, and seeking professional advice when needed.

Click here to learn more about other bookkeeping concepts related to small businesses.