Cash flow constitutes cash inflow and outflow from a business, capturing its operational, investment, and financing activities.

Defining Cash Flow

Positive cash flow creates value for the shareholders while negative cash flow endangers the short-term liquidity position of the company.

The thumb rule is to have sufficient cash to meet day-to-day business requirements, pay for inventory and vendors, have provision to purchase more inventories if there is a spike in demand, etc.

Cash inflow and outflow as a whole constitute a cash cycle. Holding cash is just a single dimension of cash strategy, it is the timing of cash inflows vis-a-vis the outflows. Keeping too much cash also blocks investment, while being cash-strapped will hamper you from taking advantage of opportunities arising in the business environment.

Cash inflows and outflows take place broadly due to 3 kinds of activities in a business:

- Operating Activities

- Investing Activities

- Financing Activities

A positive cash flow highlights the company’s ability to settle debts, reinvest in its operations, pay back to shareholders, pay expenses, and act as a safety net against upcoming financial difficulties. A negative cash flow signifies that a company’s liquid assets are decreasing.

Cash flow is a quintessential measure of a company’s financial health. It can be used to evaluate the quality of income generated by normal business operations, the capacity to pay dividends to shareholders, and the ability to maintain and grow operations.

Cash flow differs from net income, which includes transactions that have yet to turn into cash, like accounts receivable, and expenses incurred but not yet paid, like accounts payable.

It provides a dynamic overview of the company’s cash on hand, which can be used to evaluate and manage the business’s financial status. It is a key indicator that business owners, investors, and creditors look at when deciding to invest, lend money, or assess the company’s financial health.

Types and Examples

There are three different types of cash flow, each corresponding to a different aspect of a company’s operations. These are:

Operating Cash Flow

It refers to the cash generated from normal business operations. It includes cash received from customers, cash spent on inventory, payments to employees, and other day-to-day business expenses.

A positive operating cash flow means that the company’s core business operations generate more cash than is being spent, which is a good sign of financial health.

Example

If a retail store makes sales totaling $10,000, pays $4,000 for inventory, and incurs $1,000 in operating expenses, its operating cash flow would be $10,000 – $4,000 – $1,000 = $5,000.

Investing Cash Flow

It involves cash flows related to purchasing or selling long-term assets, such as plant, property, equipment, and business acquisitions. A negative investing cash flow is common for growing businesses, as they are often investing in their long-term growth.

Example

If a company purchases a piece of machinery for $20,000, its investing cash flow would be -$20,000.

Financing Cash Flow

It includes cash flows from activities related to a company’s capital structure. It includes cash from investors, such as banks and shareholders, and cash paid to these stakeholders in the form of debt repayments, dividends, or share repurchases.

Example

If a company raises $50,000 in equity and pays out $10,000 in dividends, its financing cash flow would be $50,000 – $10,000 = $40,000.

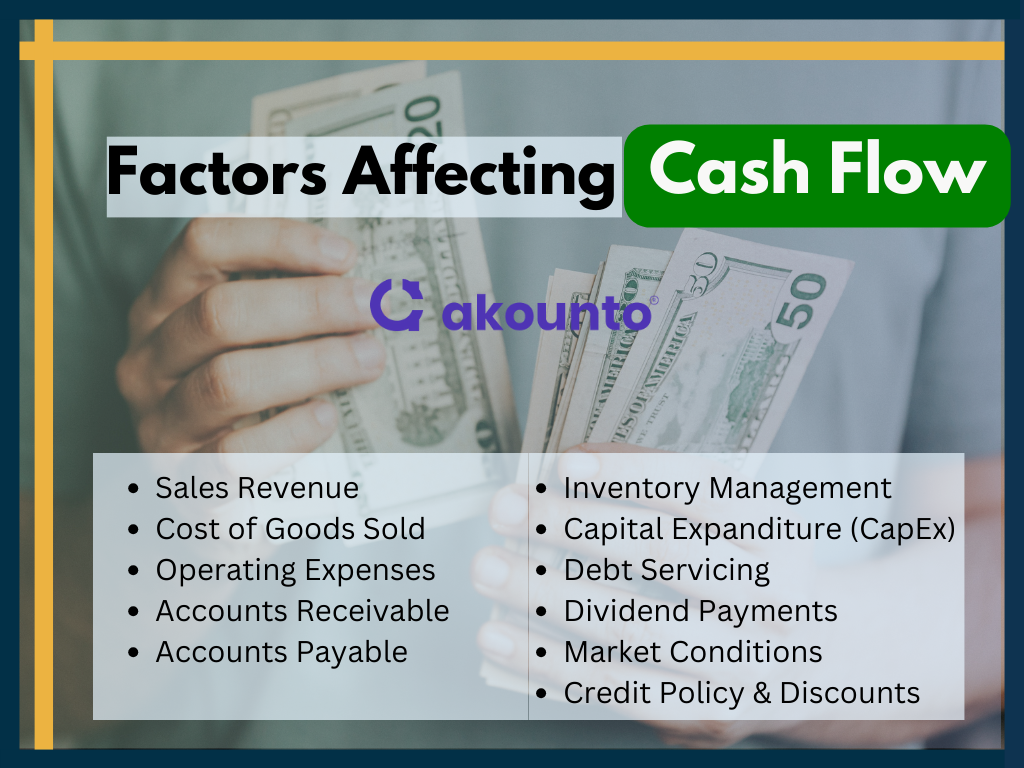

Factors Affecting Cash Flows

Cash flow, the lifeblood of any business, can be influenced by several factors. Understanding these can help business owners manage their cash more effectively. Here are ten key factors:

- Sales Revenue: The primary source of cash for any business is the revenue it generates from sales. A decrease in sales will directly affect the operating cash flow.

- Cost of Goods Sold (COGS): is the cost of producing goods sold by a company. It includes the cost of materials and direct labor costs. A high COGS can lead to a decrease in cash revenue.

- Operating Expenses: These are the costs incurred in running the business, such as rent, utilities, and salaries. High operating expenses can lead to a decrease in cash flow.

- Accounts Receivable: This represents the money owed to a business by its customers. If customers delay payments, it can lead to cash and liquidity issues.

- Accounts Payable: This is the money a business owes to its suppliers. Delaying payment can help maintain cash flow, but it’s a delicate balance, as late payments can harm supplier relationships.

- Inventory Management: Poor inventory management can tie up cash in unsold goods, affecting cash flow. Efficient inventory management ensures that money is not unnecessarily tied up in stock.

- Capital Expenditures: funds a company uses to acquire or upgrade revenue-generating assets such as property, industrial buildings, or equipment. High capital expenditures can lead to a decrease in the cash stream.

- Debt Servicing: includes interest payments and principal repayments on a company’s debts. High debt servicing costs can lead to a decrease in the cash stream.

- Dividend Payments: If a company pays dividends to its shareholders, it can affect the cash in hand. High dividend payments can lead to a decrease in the cash stream.

- Changes in Regulations or Market Conditions: Changes in government regulations or market conditions can also affect a company’s cash position. For example, new tax laws or a downturn in the market can decrease the cash stream.

- Credit Policy and Discounts:В A business’s terms and conditions for its customers can significantly impact its cash stream. If a company’s credit policy is too lenient, it might have high accounts receivable and low cash collection. On the other hand, a strict credit policy might deter potential customers. Discounts can boost sales in the short term and reduce the cash inflow from each sale.

Cash Flow Statement

The cash flow statement thoroughly analyzes how a company’s cash inflows and outflows affect its overall cash position over a given period. This statement is divided into three sections: operating activities, investing activities, and financing activities, each representing a different type of cash stream.

As a Part of Financial Statements

The cash flow statement is one of the three main financial statements used to evaluate a company’s financial performance and position, the other two being the profit and loss account and the balance sheet.

While the profit and loss account provides information about profitability and the balance sheet gives a position of a company’s assets, liabilities, and equity at a specific date, the cash statement focuses on the inflow and outflow of funds, providing insights into the company’s liquidity and its ability to generate and use cash.

Reporting Requirements

The Financial Accounting Standards Board (FASB) has specified the requirements for creating and presenting the cash flow statement, under US GAAP.

Companies must include a statement of cash flows in their annual financial statements per Statement of Financial Accounting Standards No. 95 (FASB ASC 230).

This requirement also aligns with the International Financial Reporting Standards (IFRS), ensuring consistency in global financial reporting.

Uses

- Investors and Creditors: They use it to assess a company’s ability to generate positive cash flow and repay its debts.

- Management: They use it to make internal business decisions and plan future cash needs.

- Regulatory Bodies: They use it to ensure companies follow the required financial reporting standards.

Cash Flow Statement Format

The cash flow statement is typically divided into three sections:

- Cash from Operating Activities: This section reports the cash generated from a company’s core business operations. It includes cash inflows from sales of goods and services and cash outflows for operating expenses, interest payments, and taxes.

- Cash from Investing Activities: This section reports the cash used for investing in long-term assets and the cash received from selling these assets. It includes cash outflows for purchases of property, plant, and equipment (capital expenditures) and cash inflows from the sale of these assets.

- Cash from Financing Activities: This heading in the statement reports the cash transactions with owners and creditors. It includes cash inflows from borrowing money or issuing stock and cash outflows for repaying debt, repurchasing stock, or paying dividends.

Cash Flow and Liquidity

Cash and liquidity, while interconnected, serve distinct roles in financial management. Both are vital for maintaining the financial health of a business, but they offer different perspectives on a company’s financial situation.

Cash Flow: The net movement of cash and cash equivalents into and out of business is known as cash flow. It’s a dynamic measure that provides insights into a company’s ability to generate cash to sustain its operations, settle its obligations, and provide returns to its investors.

Liquidity: measures a company’s ability to meet its short-term liabilities with its short-term assets. It’s a snapshot at a specific point in time that shows how readily a company can convert its assets into cash to meet immediate obligations.

Having a positive cash stream doesn’t necessarily mean a company has high liquidity. For instance, a company might have strong cash inflows from sales. Still, if the cash is tied up in accounts receivable or inventory, it might not be readily available to cover immediate expenses, leading to low liquidity.

Conversely, a company might have high liquidity with cash readily available, but if its long-term cash inflows are uncertain, it could face liquidity problems in the future.

Understanding the relationship between cash and liquidity is crucial for business owners. It helps them ensure they have enough cash on hand to meet immediate obligations (liquidity) and that can generate sufficient cash over the long term to sustain their operations and grow their business (cash flow).

Ratios and Interpretation

Understanding cash flow is crucial, but knowing how to interpret it is equally important. Various ratios can be used to analyze data, providing insights into a company’s financial health and operational efficiency. Here are some key ratios and their interpretation:

Operating Cash Flow Ratio:

This ratio measures how well a company can cover its short-term liabilities with the cash generated from its core business operations. It’s calculated as operating cash flow divided by current liabilities.

A ratio of 1 or higher signifies that the business can cover its current liabilities with the cash it generates from its normal business operations.

Free Cash Flow to Operating Cash Flow Ratio

This ratio measures the proportion of operating cash flow that becomes free cash flow, which is the cash a company has left over after accounting for capital expenditures. A higher ratio indicates that the company is more efficient at converting its operating cash into free cash flow.

Cash Flow Coverage Ratio

This ratio measures a company’s ability to pay off its debt using its cash revenue. It’s calculated as operating cash flow divided by total debt. A higher ratio indicates the company is better positioned to meet its debt obligations.

Cash Flow Margin

This ratio measures the ability of a company to convert sales into cash. It’s calculated as operating cash flow divided by net sales. A higher ratio indicates that the company is more efficient at turning sales into cash.

Cash Flow Management

Cash flow management involves tracking the cash coming in and out of your business and planning for future cash needs. Effective management ensures that a business always has enough cash to cover its expenses and invest in growth opportunities.

Here are some strategies for effective management:

- Monitor Your Cash Flow Regularly: Reviewing your cash flow statements can help you identify trends, anticipate future cash needs, and spot potential problems before they become serious. Understanding how much cash is coming in and going out of your business at any given time is important.

- Improve Receivables: Speeding up the collection of accounts receivable can increase your cash inflows. It could involve offering discounts for early payments, tightening credit requirements, or following up on invoices more aggressively.

- Manage Payables: Try negotiating longer payment terms with suppliers to keep your cash in your business longer. However, avoid damaging supplier relationships by delaying payments too long.

- Maintain a Cash Reserve: A cash reserve can buffer against unexpected liquidity issues. This reserve could be a certain amount of cash or a line of credit that a business owner can draw on when needed.

- Plan for the Future: Use cash flow projections to anticipate future cash needs. It can help you plan for large expenses, seasonal fluctuations in cash streams, or other events that could impact your cash revenue.

- Optimize Inventory: Too much inventory can tie up cash, while too little can lead to lost sales. Effective inventory management can help optimize your cash flow.

- Consider Financing Options: If you need more cash to fund growth opportunities, consider financing options such as loans or equity financing. However, remember that these options come with costs and should be used wisely.

Cash flow management is not just about preventing problems; it’s also about identifying opportunities to use your cash more effectively to drive growth and profitability.

Cash Flow vs. Income vs. Revenue

Understanding the difference between cash flow, income, and revenue is crucial for business owners. While they all relate to a company’s finances, they each provide different insights into the company’s financial health. Here’s a comparison:

| Cash Flow | Income | Revenue | |

| Definition | It is the net amount of cash and cash equivalents moving in and out of business. | Income, also known as net income or profit, is the amount of money a company earns after deducting all expenses, including the cost of goods sold (COGS), operating expenses, interest, and taxes. | Revenue, also known as sales, is the total amount of money a company generates from its business activities before any expenses are subtracted. |

| Importance | It provides insights into a company’s liquidity and its ability to cover short-term liabilities. It’s a key indicator of financial health. | Income provides insights into a company’s profitability. It’s a key indicator of financial performance. | Revenue provides insights into a company’s sales performance. It’s a key indicator of market demand for a company’s products or services. |

| Calculation | It is computed by adding or subtracting cash from operating, investing, and financing activities. | Income is computed as revenue minus expenses | Revenue is computed by multiplying the price of goods or services by the quantity sold. |

| Recognition | It is affected by the timing of cash inflows and outflows. | Income is recorded when earned, not necessarily when cash is received, or expenses are paid. | Revenue is recorded when goods are delivered, or services are provided, not necessarily when cash is received. |

By understanding these differences, business owners can make more informed decisions about their company’s operations and financial management.

Conclusion

Understanding and managing cash flows is crucial for business success. It provides insights into a company’s liquidity, operational efficiency, and financial health. By monitoring cash flow, optimizing receivables and payables, and making informed financial decisions, business owners can ensure their company’s financial stability and drive long-term growth.