What is a Chart of Accounts?

A chart of accounts is a comprehensive and structured list of all the accounts used in a business’s ledger.

A commercial entity has many types of transactions like expenses, income, drawings, purchases, sales, tax, depreciation, etc. Classifying the account types is the first basic step to organizing transactions and preparing financial statements based on accounting principles.

The rules of debit and credits need to categorize transactions into major account types before making a journal entry and ledger posting. This is quintessential for double-entry bookkeeping.

A chart of accounts is a valuable organizational tool that breaks down a company’s financial transactions into logical subcategories for a specific accounting period.

The list of accounts provides a comprehensive overview of a company’s financial statements, listed in a specific order. Usually, balance sheet accounts, such as liabilities, shareholders’ equity, and assets, are listed first, followed by income statement accounts, such as revenues and expenses.

Structure of a Chart of Accounts (COA)

A chart of accounts is a hierarchically arranged list of accounts for ease of navigation and understanding. The accounts are classified into different categories, each with nomenclature, numbering system, and subcategories.

The 5 Chart of Account Categories

The primary classification of the chart of accounts is divided into five main categories, which are:

- Asset Accounts: Assets include the resources the business owns and the obligation to receive payments by the business. Examples: land, accounts receivable, prepaid expenses, cash account, and other assets accounts. Learn about current assets and fixed assets.

- Liability Accounts: The company’s liabilities include the payments and obligations the business owes to others (creditors, loans, invoices payable, all the debts, taxes payable, etc.) from the company.

- Equity Accounts: Share and interest of shareholders and owners, which is the balance of assets minus the liabilities. Examples: common stock, retained earnings, preferred stock, etc.

- Revenue Accounts: Revenue from the company’s core business activities (operating activities), also known as operating revenues. Example: Sales revenue accounts, net income, net sales, etc.

- Expense Accounts: Expense accounts include the expenses incurred to generate the above revenues. The cause-and-effect relationship between revenue and expenses is established by applying the matching principle and accrual accounting. Examples: bank fees, wages expenses, operating expenses, etc.

Account Numbering System

A systematic numbering system is used to efficiently organize all the financial accounts. The numbering system is like a code that is given to every account type. This code then hierarchically flows to its sub-accounts to categorize transactions that can be easily referenced.

The account numbering system is particularly helpful in a double-entry accounting system where counter entries are passed in all the journal entries and the company’s general ledger.

In accounting or bookkeeping software, the number system allows a unique account number or a code for each account, facilitating easy tracking, identification, grouping, and representation of business accounts.

Sample Chart of Accounts

- Asset Accounts: 10001-10999 (“10” is the primary code, i.e., the first two digits for all asset accounts and the last three are asset numbers)

- Fixed Assets: 10001

- Buildings: 10002

- Machinery: 10003

- Liquid Assets: 10500 (First two digits, “10,” represents “asset account,” next digit, “5,” represents “Liquid Asset” sub-account, and the last two digits represent the account number)

- Cash Account: 105001

- Bank Account: 105002

- Current Assets: 106000

- Accounts receivable: 106001

- Liability Accounts: 20001-20999

- Current Liabilities: 20101

- Accounts Payable: 20102

- Deferred Revenue accounts :20103

- Taxes Payable: 20104

- Accrued Liabilities: 20125

- Fixed Liabilities: 20201

- Bank Loan: 20202

- Mortgage: 20203

- Equity Accounts: 30001-30999

- Common Stock: 30101

- Retained Earnings: 30200

- Preferred Stock: 30300

- Revenue Accounts: 40001-40999

- Sales Revenue: 40100

- Revenue from Product Line A: 40101

- Expense Accounts: 50001-50999

- Income Tax Expense:50100

- Advertisement Expense: 50200

- Salaries Expense: 50300

The numbering system may be tailored to accommodate the requirements and inclinations of each organization. Ensuring uniformity in the numbering system throughout all accounts and categories is crucial.

The quantity and intricacy of sub-accounts will differ based on the size and characteristics of a business. Achieving a balance between offering adequate detail and preserving simplicity is essential to prevent an excessively complex chart of accounts.

Accounts can also be classified according to the financial statement they belong to. (balance sheet accounts, cash flow statement, income statement accounts)

Setting Up a Chart of Accounts for a Small Business

Bookkeeping and accounting for a business are primarily aimed at streamlining, recording transactions, keeping accounts organized, preparing financial statements, and facilitating financial statement analysis by providing various customized reports.

A chart of accounts provides a systematic approach; businesses can create a tailored and well-structured chart of accounts that meets their unique needs and supports effective financial management.

A small business can use the following suggestions to set up its chart of accounts:

- Assess your specific and unique business needs by taking into account your transaction volume, transaction frequency, the complexity of transactions, industry norms, requirements of the accounting system, and legal requirements.

- Blend standardized layout with customizable needs. Standardized layouts are given by various accounts automation software and regulatory bodies. Use standardization of typical needs and customization for industry-specific needs.

- Organize accounts into categories or sections for logical structure. Categorization could be based on account type like revenue account, expense account, liability account, etc. Categorization could also be based on statements like balance sheet accounts, income statement accounts, etc.

- Define numbering and naming convention which is uniform throughout the accounting system and avoid redundancy. The numbering system must be scalable to expand when the business grows, and old accounts can be easily integrated with new accounts.

- Define and use sub-accounts for detailed tracking of financial transactions. Subaccounts also help prepare detailed reports to track the company’s financial health by breaking down transactions according to the department, process, type, etc.

- Subscribe to cloud-based accounting software like Akounto, which provides an in-built chart of accounts along with options for customization or outsourcing bookkeeping to the experts.

Role of COA in Financial Reporting

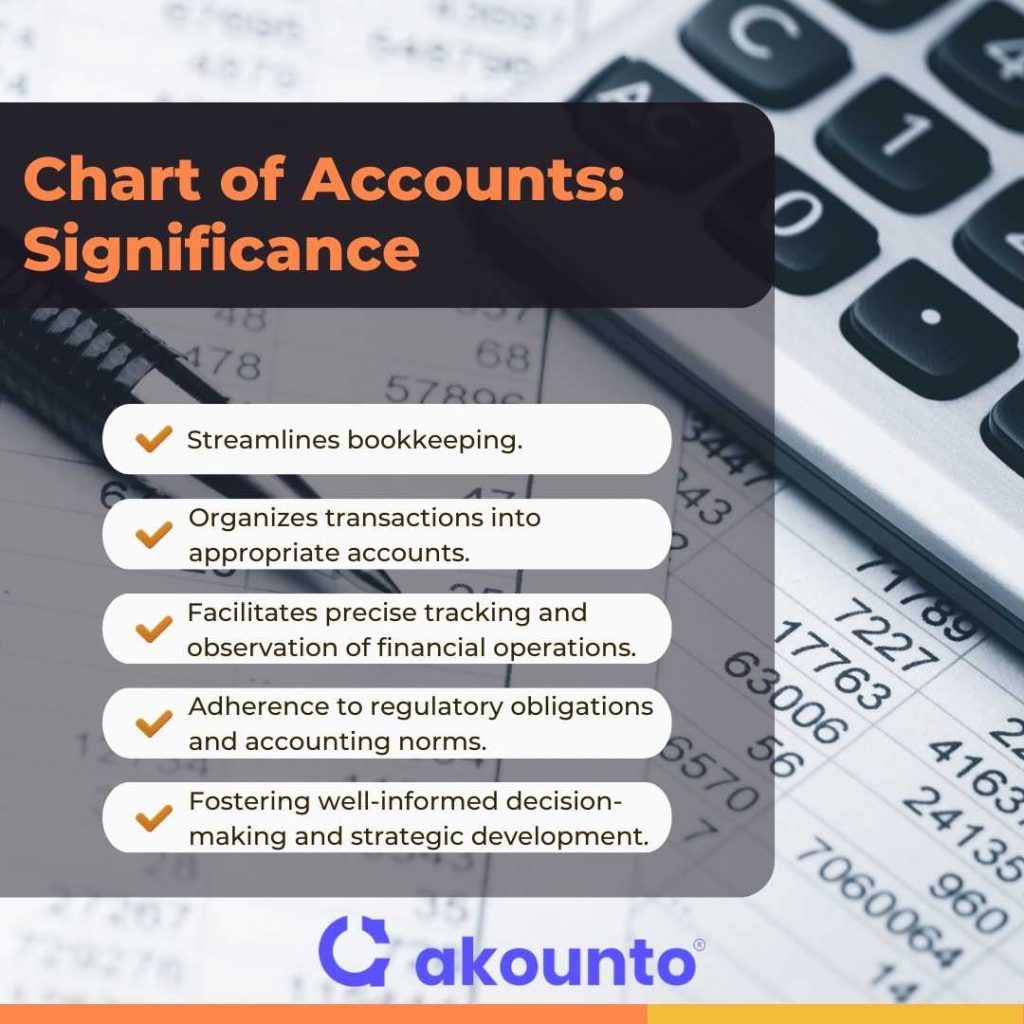

- Chart of accounts organizes transactions into appropriate accounts like balance sheet accounts, income statement accounts, expense accounts, liability accounts, etc., to help logically record financial data so that preparing financial statements become easy.

- By facilitating precise tracking and observation of financial operations, the chart of accounts contributes to the detection of potential concerns, including budget excesses, unapproved transactions, or possible fraud, thereby permitting prompt intervention and rectification measures.

- A properly managed chart of accounts promotes adherence to regulatory obligations and accounting norms, including Generally Accepted Accounting Principles, International Financial Reporting Standards, industry guidelines, etc. It guarantees that financial activities are documented and disclosed uniformly and transparently, aiding in creating precise tax returns and simplifying external auditing procedures.

- The chart of accounts is pivotal in fostering well-informed decision-making and strategic development. A lucid and uniform structure for financial reporting and examination empowers organizations to obtain insights into a company’s financial health.

COA and Accounting Software

- Pre-Built Templates: Accounting software offers a pre-built chart of accounts templates based on standard structures or industry-specific guidelines, simplifying initial setup.

- Customization and Flexibility: Users can modify the chart of accounts to align with unique business needs by adding, editing, or deleting accounts and categories.

- Automated Data Entry: Integrating a chart of accounts with accounting or bookkeeping software streamlines data entry and record-keeping processes, reducing errors and improving efficiency.

- Enhanced Reporting: Robust reporting features in accounting or bookkeeping software provide valuable insights into financial performance, cash flow, profitability, and other key metrics.

- Simplified Tax Preparation: A well-structured chart of accounts integrated with bookkeeping software ensures consistency with tax regulations, facilitating accurate tax reports and compliance.

- Seamless Integration: Bookkeeping software often integrates with other business systems, such as payroll and inventory, for a complete view of the business’s financial health.

- Access and Collaboration: Cloud-based accounting software allows multiple users to access financial records from any location, promoting collaboration and informed decision-making.

Best Practices

- Regular Review and Updates: Periodically assess and modify the chart of accounts to keep it accurate and relevant, adjusting for changes in the organization’s financial activities.

- Consistency in Accounting Practices: Maintain reliability in financial reporting by using standardized account numbering systems, descriptions, and transaction recording procedures.

- Access Controls and Segregation of Duties: Safeguard the chart of accounts’ integrity by implementing appropriate access controls, user roles, permissions, and approval processes.

- Integration with Accounting Software: Streamline financial transaction recording and reporting by integrating the chart of accounts with accounting software, minimizing errors and enhancing efficiency.

- Training and Support: Ensure accuracy and consistency by providing training and support to employees on accounting principles, transaction recording procedures, and software usage.

- Ongoing Monitoring and Auditing: Regularly monitor and audit user activity to prevent unauthorized changes or manipulation of the chart of accounts.

- Adaptability: Keep the chart of accounts flexible enough to accommodate organizational growth, changing financial reporting requirements, and evolving industry standards.

Conclusion

A meticulously structured chart of accounts is vital in proficient financial management for enterprises across various sizes and sectors. By establishing a transparent, well-ordered, and tailored framework, organizations can guarantee precise and consistent financial documentation and reporting, crucial for assessing financial performance and the business’s financial health.

Incorporating a chart of accounts with accounting software expedites the procedure, automating data input, augmenting reporting capabilities, and facilitating tax preparation and adherence to regulations. Visit Akounto’s Blog and learn more about accounting.