What are Closing Entries?

Closing entries are journal entries to reset balances of temporary accounts on the income statement to zero at the end of an accounting period.

The temporary accounts are closed by transferring the balances to permanent accounts.

By the nature of the accounts, it must be noted that temporary accounts are income statement accounts, and permanent accounts are balance sheet accounts. So, the closing entries transfer the balances to permanent accounts of the balance sheet. This is done at the end of every single accounting period, and this process is known as closing the books.

At the beginning of every new accounting cycle, the temporary accounts start with a zero balance or a clean/fresh account, which is in accordance with the matching principle.

The revenue, expense, and dividend accounts must be closed in an accounting period as they are related only to that period and should start fresh for the next accounting period.

Closing entries are needed to bifurcate revenue and expenses from one financial period to another. The revenue and expense should not overlap and their reporting must adhere to the matching principle laid by GAAP. Therefore, resetting the revenue, expenses, and dividend-paid in the current financial year is important for maintaining the reporting integrity and credibility.

Temporary and Permanent Accounts

In accounting, there are temporary and permanent accounts.

Temporary accounts record transactions for a single accounting cycle, and then they are closed. The temporary accounts are used to create income statements.

Examples of temporary accounts:

- Revenue accounts

- Expense accounts

- Dividends account

The temporary account balances are not carried forward to the next accounting period, so they must be closed by passing closing entries at the end of an accounting period.

Permanent accounts, as the name suggests, do not need to be closed by the end of an accounting period. The closing figure of a permanent account becomes the opening amount for the new accounting cycle.

Permanent accounts are mainly balance sheet accounts. Examples of permanent accounts are:

- All fixed assets under the heading PPE (Property, Plant and Equipment)

- Debtors

- Equity accounts

Temporary accounts track business transactions during a single accounting period, while permanent accounts record transactions covering multiple accounting periods until the assets or liabilities are disposed/ paid.

Closing the Books: Understanding the Closing Process

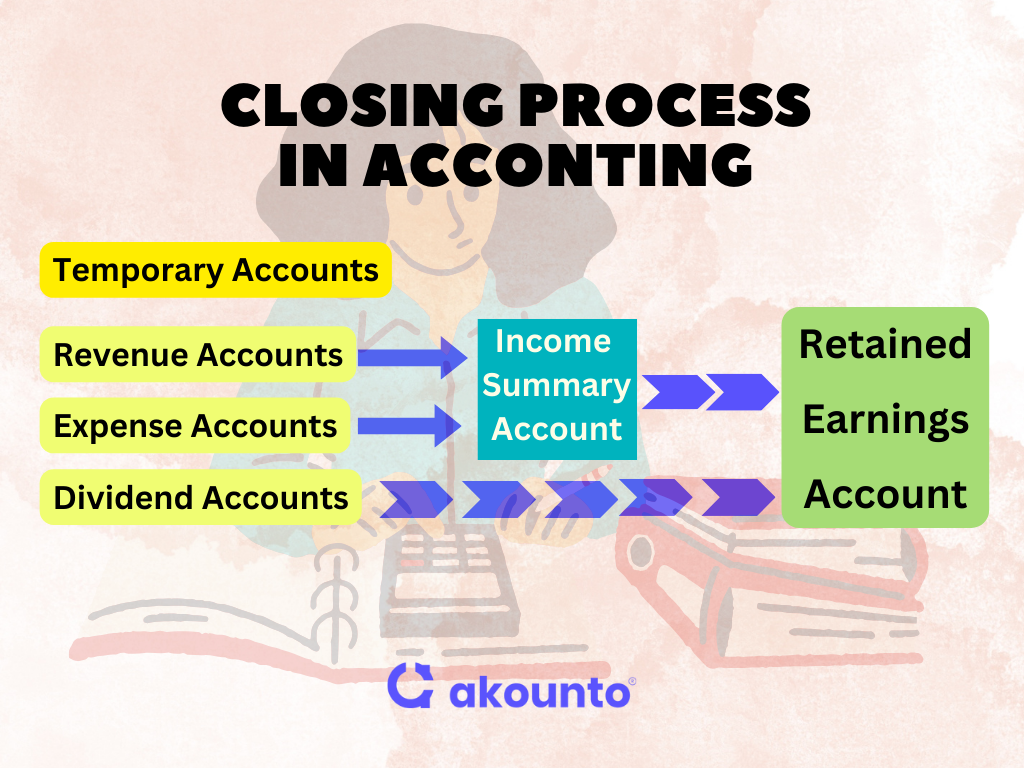

Basically, three accounts are closed at the end of the accounting cycle, these are:

- Revenue accounts

- Expense accounts

- Dividend accounts

In the closing process, the balances are not directly transferred to the income statement; rather, an intermediate income summary account is created. All the temporary account balances, except the dividends account, are transferred to the intermediate account account.

Dividend account balances are directly transferred to the retained earnings account.

An income summary account is like a clearing account where balances from the temporary accounts are transferred.

- To close revenue accounts, transfer the balance to the income summary account.

- To close expense accounts, transfer the balance to the income summary account.

- To close the dividends account, transfer the balance to the retained earnings account.

- To close income summary account, transfer the balance to the retained earnings account.

Closing Journal Entries

Temporary accounts contain balances for a single accounting period, and the ending balances must be transferred to the retained earnings account.

The retained earnings account is updated from the statement of change in equity accounts. The revenue and expense accounts and the dividend account impact the retained earnings account directly.

All the temporary accounts are closed by passing journal entries to transfer their balances to the retained earnings account. These closing entries are then posted to the general ledger, which resets all the temporary accounts.

The closing entries are passed only at the end of the accounting cycle and not at any other time.

Closing Entry for Revenue Accounts

Revenue accounts have credit balances, i.e., if the revenue increases, the account is credited and vice versa. To transfer the balance of the revenue account to the income summary account, the revenue account balance is debited, while the income summary account is credited.

Revenue Account: Debited

Income Summary Account: Credited

Closing Entry for Expense Account

An expense account has a debit balance. When the expense account is closed, the balance of expenses account to the income summary account is transferred by passing a credit entry in the expense account and debiting the income summary account correspondingly.

Expense Account: Credited

Income Summary Account: Debited

Closing Entry for Dividends Account

The dividends account represents any dividend paid to the shareholders in the accounting cycle. The balance is directly transferred to the retained earnings.

(Note: By dividend paid account, we are also including the drawings account)

Dividend Account: Credited

Retained Earnings Account: Debited

Closing Entry for Income Summary Account

When revenues exceed the expenses, the income summary account will be positive and will have a credit balance. The balance of the income summary account should tally with the net income as derived from the income statement.

Income Summary Account: Debit

Retained Earnings: Credit

Note: If the company’s financial performance is negative, i.e., a loss is reported, then the income summary will be credited, and retained earnings will be debited.

Examples of Closing Entries

Question:

A company’s financial performance at the end of the accounting cycle (Dec 31) showed the following details:

- Interest Expense: $ 1500

- Rent Expense: $ 3000

- Depreciation Expense: $ 800

- Dividend Paid: $ 550

- Raw Materials Expense: $ 1000

- Revenue from the sale of Goods: $ 5700

- Service Revenue: $ 8,000

Pass the closing entries.

Solution:

Expenses:

| Expenses | |

| Interest Expense | 1500 |

| Rent Expense | 3000 |

| Depreciation Expense | 800 |

| Raw Materials Expense | 1000 |

| Expenses Total (Debit Balance) | 6300 |

Closing Entry

| Date | Particulars | Debit | Credit |

| Dec 31 | Income Summary Account Dr. | 6300 | |

| To Expenses | 6300 | ||

| (Being expenses account closed and the balance transferred to income summary account) |

Revenue

| Revenue | |

| Revenue from Sale of Goods | 5700 |

| Service Revenue | 8000 |

| Revenues Total (Credit Balance) | 13700 |

Closing Entry

| Date | Particulars | Debit | Credit |

| Dec 31 | Revenue Account Dr. | 13700 | |

| To Income Summary Account | 13700 | ||

| (Being revenue account closed and the balance transferred to income summary account) |

Income Summary Account

| Debit | Credit | ||

| To Expenses | 6300 | By Revenue | 13700 |

| To Retained Earnings Account (Balancing Figure) | 7400 | ||

| Total | 13700 | Total | 13700 |

Closing Entry

| Date | Particulars | Debit | Credit |

| Dec 31 | Income Summary Account Dr. | 13700 | |

| To Retained Earnings Account | 13700 | ||

| (Being income summary account closed and the balance transferred to retained earnings) |

Dividends Account

Dividend Paid: 550

| Date | Particulars | Debit | Credit |

| Dec 31 | Retained Earnings Account Dr. | 550 | |

| To Dividends Account | 550 | ||

| (Being dividends account closed and the balance transferred to retained earnings) |

Post-Closing Trial Balance

Post-closing trial balance ensures that the closing entries of temporary accounts are tallying and the ledger is also balanced i.e., the debits and credits equal each other, thus maintaining the accuracy of financial records.

Only balance sheet accounts are included in the post-closing trial balance and are prepared at the end of the accounting cycle.

People often confuse it with adjusted trial balance, which includes accounts from the balance sheet and income statement, along with the adjusted balances. Adjusted trial balance ensures that revenues and expenses are recognized as per the matching principle and are classified accordingly.

The post-closing trial balance helps in the following ways:

- Maintaining the accuracy of financial statements.

- Providing a quick glance of the long-standing financial position which is helpful in decision-making.

- Enables better internal control by providing an audit trail and detecting accounting errors.

- Directly useful in budgeting and forecasting exercises, especially in the case of zero-base budgeting.

- It’s accuracy ensures that financial statements are a credible source of information for investors.

Conclusion

Closing entries ensure that the revenues and expense account starts with zero balances in the new accounting cycle. If the company is using accounting software, then it automatically passes closing entries at the end of the accounting cycle and resets the temporary account balances to zero.

Closing the books is important, as the revenue, expenses, and dividends paid in the current accounting period should be wrapped up to get the complete financial picture and calculate net income. The income summary account made at the end of the financial period ensures the accuracy of the closing process.

Small business owners must keep themselves updated with the knowledge of accounting and finance to manage their finances better and prepare their businesses for a leap ahead. To learn more about finance and accounts, visit Akounto’s blog.