Current assets (liquid assets) are cash or cash equivalents that helps in meeting short-term obligations and routine business expenses within one year.

What Are Current Assets?

Assets that can be quickly converted to cash are known as current assets. They are important because they indicate a company’s ability to meet short-term financial obligations. These obligations include paying off short-term debts, accounts payables, payment against credit notes, and covering everyday expenses.

The generally accepted accounting principles (GAAP) mandated for listed companies highlight them as the first account in the balance sheet. It is important for investors because it highlights the company’s short-term liquidity, which is vital to understanding its financial health.

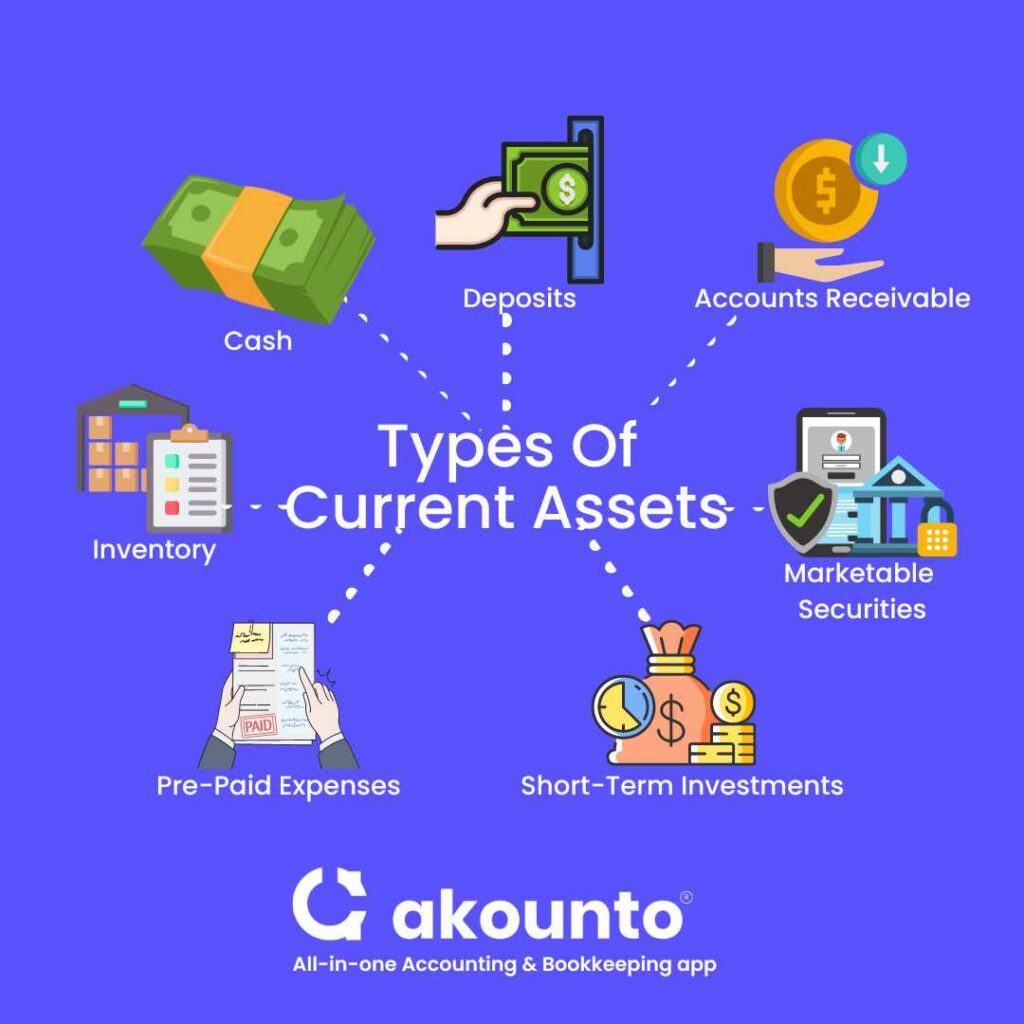

Types Of Current Assets

Cash and Cash Equivalents

These are assets that can be easily converted into cash. Cash and cash equivalents are current assets that represent cash or other assets. These can be easily converted into cash with a short maturity period, typically within three months or less.

Cash refers to physical currency, coins, and funds in checking and savings accounts. On the other hand, cash equivalents are short-term investments that are highly liquid and have a low risk of value fluctuations.

Examples of cash equivalents include money market funds, Treasury bills, and commercial paper.

Marketable Securities

Marketable securities are short-term investments easily bought or sold in public financial markets. They are highly liquid, meaning they can quickly convert to cash without losing value.

Companies and other entities typically hold them to earn a return on their excess cash reserves. Also, they provide a source of liquidity that can be used to meet short-term financial needs. Examples of marketable securities include stocks, bonds, and other securities actively traded in public markets.

Accounts Receivables

When a business owner sells their goods on credit, it is known as accounts receivable. It is important to note that if the credit is given for more than one operating cycle, it shall not be a part of the current assets.

When a company sells products or services to customers on credit, it creates an accounts receivable balance. The balance represents the amount of money the customer owes to the company. The balance is typically due within a few weeks or months, depending on the terms of the sale.

Inventory

Inventory refers to a company’s stock of goods for resale or use. It includes raw materials, work-in-progress, and finished goods.

Raw materials are the materials that a company uses to produce its products. Work-in-progress refers to products that are still being manufactured or assembled. Goods that are ready for sale are referred to as finished goods.

Prepaid Expenses

Prepaid expenses are advance payments made by a company for goods or services it will receive. These expenses are considered assets because the company has already paid for the goods or services. The company will benefit from them in the future.

Other Types

Some other current assets apart from those mentioned above are:

- Short term investments

- Supplies

- Advances

- Deposits

How does a Current Asset Work?

The different types of current assets work in different ways.

Here are some examples:

- Cash and cash equivalents: These assets are readily available and can be used to pay bills or invest in other assets. These can include cash balance, foreign currency, etc.

- Marketable securities: These liquid assets can be sold quickly and easily for cash at their fair market value. They provide a source of short-term financing as a company can sell them and get cash when needed.

- Accounts receivable: These assets represent money owed to the company by its customers for goods or services provided on credit. They can be used to evaluate the company’s liquidity. They also speak for its creditworthiness and provide a source of short-term financing.

- Prepaid expenses: These represent advance payments made for goods or services that the company will receive in the future. They can be used to reduce future operating or short-term expenses.

- Inventory: Inventory as an asset represents a company’s stock of goods for resale or use. It is important for meeting customer demand and generating revenue. But carrying too much inventory can tie up a company’s cash and storage space. A company might not be able to provide cash for urgent concerns.

Ratios Concerning Current Assets

Investors use the current assets to understand the ability of the company to recover the financial obligations in the near future. Investors often analyze the financials of the business operations by calculating the financial ratios or observing the balance sheet.

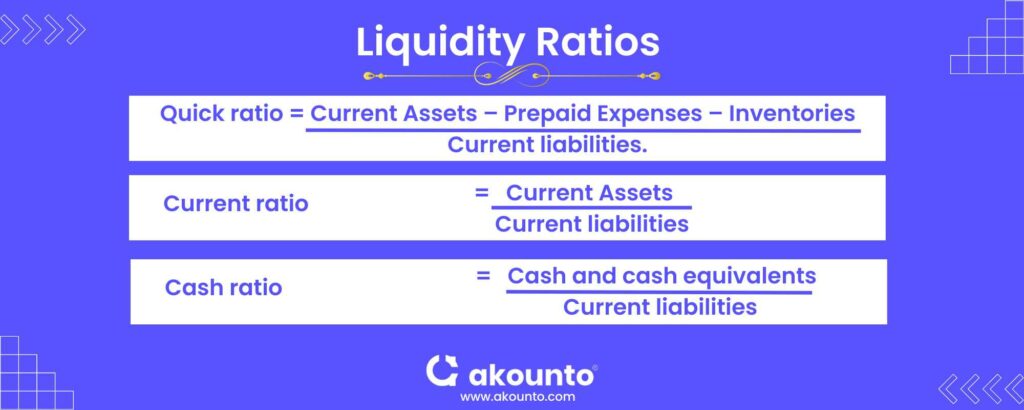

Some of these financial ratios, known as liquidity ratios, are calculated using current assets. These include;

Quick Ratio

A higher quick ratio indicates a company’s ability to meet short-term obligations. A lower quick ratio suggests that a company may struggle to meet its immediate financial needs.

To compute this ratio, divide total quick assets by current liabilities. Quick assets include all the current assets, less cash. It is also known as the acid test ratio.

The formula for quick ratio is:

Quick ratio = (Current Assets – Prepaid Expenses – Inventories) / Current liabilities.

Current Ratio (Working Capital Ratio)

The current ratio indicates that a company has enough assets to cover short-term expenses. The formula for determining the current ratio is to divide current assets by current liabilities. It is done to measure the business’s ability to cover short-term liabilities.

A current ratio of 1:1 or higher is generally considered good. However, the ideal current ratio can vary depending on the industry and the company’s circumstances.

The formula for the current ratio is:

Current ratio = Current assets / Current liabilities.

Cash Ratio

The cash ratio is calculated to understand the capacity of the company to pay off its current liability through its cash and cash equivalents.

A cash ratio of 0.5:1 or higher is considered good. It indicates that a company has enough cash and cash equivalents to cover at least half its current liabilities. However, the generally accepted cash ratio can vary.

The formula for the cash ratio is:

Cash ratio = (Cash and cash equivalents) / Current liabilities.

How To Calculate Current Assets?

The following steps help in calculating current assets.

- Identify the liquid assets.

- Add up the total value of these assets.

- Once you have added up all of the assets, you will have the company’s total amount of current assets as in the balance sheet.

Formula For Current Assets

Current Assets = Cash + Cash Equivalents + Accounts Receivable + Marketable Securities + Inventory + Supplies + Prepaid Expenses + Other Liquid Assets

Example For Current Assets

Let us consider a hypothetical company called XYZ Corp. Here; we can consider the following values of the liquid assets in its balance sheet to calculate their total value.

- Cash and cash equivalents: $50,000

- Marketable securities: $25,000

- Accounts receivable: $75,000

- Inventory: $100,000

- Prepaid expenses: $10,000

Solution: To calculate the current assets for XYZ Corp, we would use the formula:

Current assets = Cash and cash equivalents + Prepaid expenses + Accounts receivable + Marketable securities + inventory

Plugging in the values for each type of asset, we get:

Current assets = $50,000 + $25,000 + $75,000 + $100,000 + $10,000

Current assets = $260,000

In this current asset example, the company’s balance sheet will show a value of $260,000.

What Are Current and Non-Current Assets?

Current assets and non-current assets are two broad categories of assets that appear on a company’s balance sheet. Together they help determine the company’s total assets.

They can be converted to cash within one operating cycle. Accounts receivable, inventories, cash on hand, and prepaid expenses reflected in current accounts are all examples of current assets. It can be seen on the asset side of the balance sheet.

Non-current assets, also known as long-term assets, are unlikely to be converted into cash within a year or the normal business operating cycle.

Some examples of non-current assets are property, manufacturing equipment, non-trade receivables, and intangible assets such as patents and trademarks. The non-current asset or fixed asset also appears on the balance sheet’s asset side.

Current Assets Vs Non-Current Assets

| Basis | Current Assets | Non-Current Assets |

| Liquidity | More Liquid | Less Liquid |

| Time Frame | Converts into cash within a year | It takes more than a year to convert into cash |

| Role in financial analysis | Assess a company’s ability to pay its short-term debts and obligations, | Evaluate the company’s long-term value and earning potential. |

| Risk level | Low-risk | High-risk |

| Examples of current assets and non-current assets | Cash and cash equivalents, marketable securities, accounts receivables, short-term investments, etc. | Plant and machinery, land, etc. |

How do Investors use Current Assets?

Investors use current assets as a key metric to evaluate a company’s short-term financial health and liquidity. They use the current assets to understand the ability of the company to recover the financial obligations shortly.

Here are some ways investors may use current assets:

- Determine liquidity: A company’s current assets provide a good indication of its short-term liquidity. If a company has a high concentration of current assets, it suggests that it can quickly cover its short-term debts and obligations.

- Assess working capital: Current assets are also used to calculate working capital is computed by subtracting current liabilities from a company’s current assets. A positive working capital indicates that a company has enough short-term assets to cover its short-term liabilities.

- Analyze trends: Investors may compare a company’s current assets over time through its income statement or a balance sheet. It helps them to see if there is a trend of increasing or decreasing liquidity. It can provide insights into how effectively the company manages its short-term assets.

- Compare to peers: Investors may compare a company’s current assets to its industry peers. It helps them evaluate its relative liquidity, financial health, and doubtful accounts.

Conclusion

Current assets represent a company’s ability to meet its short-term obligations. A company’s balance sheet, with a good amount of current assets highlights, is liquidity position that is important for running routine business operations.

Business accounting software can help simplify your task of managing your current assets. You can seek the necessary help from Akounto. Also, you can keep visiting the website for the more informational blog or sign up for updates!