Understanding a Debit Memorandum

A debit memo (debit note) is a document a seller uses to notify a buyer that their account has been debited or charged for a specific transaction.

The document is issued when there is a discrepancy in the amount owed, additional charges incurred on the purchase, change in order quantity or taxes, etc. The debit memo helps a business update its original invoice without issuing a new invoice. Debit notes are generally issued when goods are purchased on credit.

For example, a company mistakenly sold a product for $1,000 instead of $1,200. The company can notify the additional amount the buyer owes by issuing a debit memo. Based on the debit memo, both parties must rectify incorrect values in the invoiced amount.

The customer would add $200 to their accounts payable, and the seller would add a debit memo for $200 to their accounts receivable balance. Thus, a debit memo records corrected financial transactions, ensuring both parties have accurate accounting records.

Alternatively, buyers can send debit memos to sellers if they return the goods or services. For example, a purchase return is where a buyer informs the seller that they are returning the purchased goods along with their reasons. Once the seller receives a debit memo, they must approve it and issue a credit note.

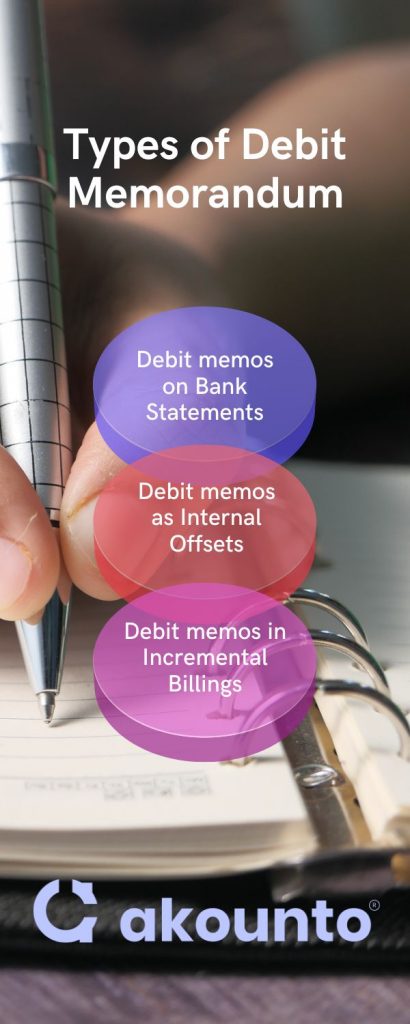

Types of Debit Memorandum

Debit memos used in accounting depend on the nature of the business and the kinds of transactions involved. Some common types of debit memos are as follows;

Debit Memos on Bank StatementsВ

A debit memo can notify that the bank account balance of a customer has decreased for reasons other than a cash withdrawal, usage of a debit card, or a cashed check. Debit memos may arise due to insufficient funds fees, bank service charges, check printing fees, bounced check fees, overdraft fees, etc., leading to money withdrawal from a customer account.

The debit memos and their monthly bank statements are sent to bank customers. The debit memorandum is denoted by a negative sign next to the charge.

Debit Memos as Internal Offsets

Debit memos can be created as internal offsets to reverse the credit balance of a customer’s account. This is done when a customer pays more than an invoiced amount. The business can issue a debit memo to offset the credit and eliminate the positive balance.

However, if the credit balance is significant, the business will refund the customer instead of creating a debit memo.

Debit Memos in Incremental Billings

An incremental billing debit memo is sent when a business completes a purchase order but accidentally undercharges the client for less than the agreed amount; they issue a debit memo to indicate the accounting error and detail the balance.

How Does it Work?

The debit memo’s objective is to ensure that buyers are aware of any changes to their account balance and maintain accurate accounting records.

The debit memo process works in the following way:

- Issuance: A seller issues a debit memo to a customer when there is a billing error in the amount owed or additional charges have been incurred.

- Notification: Upon reaching the customer, the debit memo notifies them of the debit charged to their account, along with details like the transaction date, the amount charged, and the reason for an increase or decrease in charge of the typical invoice item.

- Acceptance: The debit memo becomes valid only after the buyer has reviewed the document and agreed to the adjustments.

- Adjustments & Payment: The customer’s account is adjusted to reflect the debit amount. The seller would add the amount to their accounts receivable balance. At the same time, the customer would update his records to reflect the amount in the accounts payable balance and make payment of the outstanding balance to settle the account.

By notifying the customer of the debit and adjusting the account accordingly, small businesses can reduce their debt obligation, ensure that the customer pays the correct amount owed, and ensure the business’s records are maintained up-to-date.

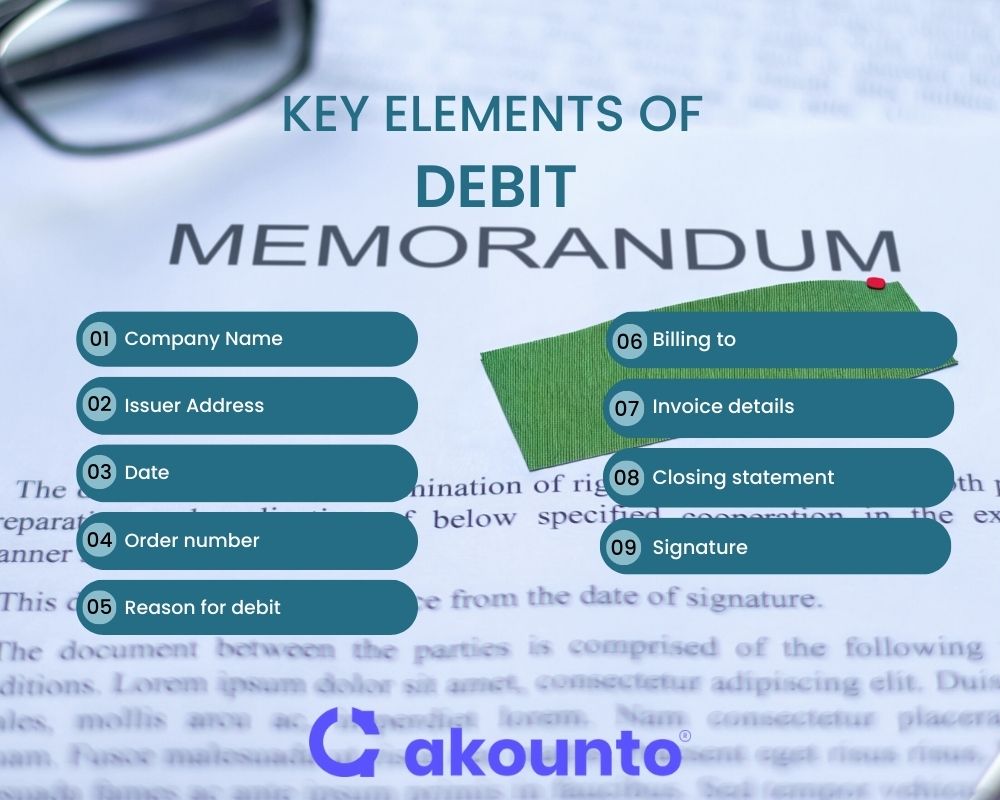

Key Elements to Include in a Debit Memorandum

A financial institution, commercial seller, or buyer can issue a debit memo to notify a debit placed on the recipient’s account balance in the sender’s books.

The format of a debit memo can vary depending on the industry, business-to-business transactions, and specifications. Although some common key elements that small businesses should include in their debit note are;

- Company Name: refers to the issuer or the company which sold the goods or rendered services and sent the debit memo.

- Issuer Address: includes the issuer company’s office address, zip code, phone number, and web address.

- Date: this is when the debit memo is issued to notify a specific bank account of the debit charge.

- Order number: for which account holder or customer it is issued.

- Reason for debit: gives a brief and clear subject line that identifies the reason for issuing the debit memo.

- Billing to: provides name and address of the customer or vendor who will receive the Debit Memorandum.

- Invoice details: gives information about the purchase order – item names, their description, quantity ordered, price per unit, the total amount, seller and buyer’s tax details, reasons for debit, and details of the corrected transaction, including the initial invoice amount and the corrected amount owed.

- Closing statement: thanks to the customer for their time and attention given to the matter.

- Signature: consists of the authorized person’s signature who issued the debit memo to the customer.

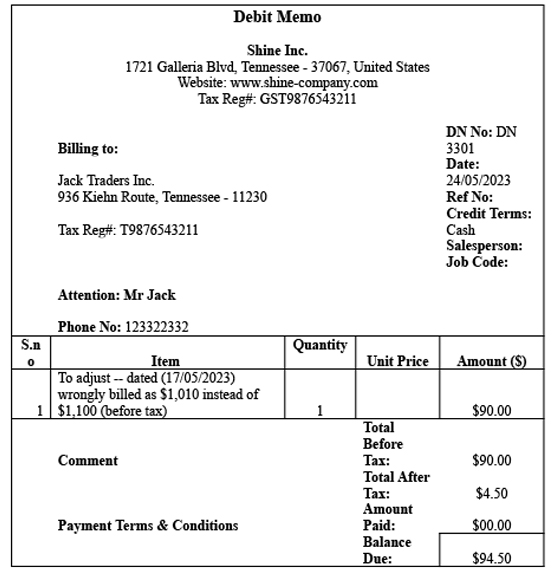

Below is the basic debit memo format that small businesses can use.

Debit Memorandum vs. Credit Memorandum

A vendor or business issues a debit memorandum to a customer to correct an error in an original invoice or to adjust the amount owed for a transaction. In contrast, a credit memorandum or credit memo is issued by the business issuing a refund credit for a transaction.

Following are some fundamental differences between the two;

| Basis of Comparison | Debit Memorandum | Credit Memorandum |

| Purpose | It notifies of adjustments that reduce the buyer’s account balance. | A credit memo issues a refund or credit for a specific transaction. It increases the credit of an account. |

| Payment Amount | It increases the amount owed by the buyer. | It decreases the amount owed by the buyer. |

| Usage | Buyer has to remit payment under a debit memo. | Buyer can use credit memo amount to offset future purchases. |

| Transaction | Under the debit memo, the seller debits the transaction as accounts receivable, and the buyer records it as a reduction in accounts payable. | Under a credit memo, a seller records a reduction of their accounts receivable, and the buyer records the amount as a reduction in accounts payable. |

When to Create a Debit Memorandum?

Some of the most common reasons to create debit memorandums may include:

- To enter the tax amount or a price adjustment for a line item from the initial invoice.

- Add necessary charges not present in the invoice, such as freight.

- A debit memo reversal can record the net amount of a successful debit or credit transaction.

- Debit memorandums can also be used to record late fees. A business can create a single debit memo for fines and late payment fees.

Conclusion

Overall, small businesses can use a debit memo to maintain accurate accounting records and resolve any disputes regarding the amount the buyer owes in situations of underpayment (via incremental billing), bank service fees, discounts, overcharges (via internal offsets), or any other discrepancies.

Visit the Akounto Blog section to learn best practices to deal with insufficient funds, reduce debt, and maintain and increase your account balance.