What is a Depreciable Cost?

Depreciable cost is an accounting concept that refers to the part of the asset cost that can be depreciated over its useful life.

The depreciated cost reflects the value of an asset deducting all the accumulated depreciation that has been recorded against it. To determine the value, one must deduct the asset’s salvage value from its original cost.

Accumulated depreciation signifies the total depreciation expense recorded by an asset over its useful life. It reduces the asset’s carrying value on the balance sheet. By recording accumulated depreciation expense, a business can match the asset’s cost to the revenue it generates over time and reduce its taxable income.

For instance, a business has a taxable income of $100,000 and records a depreciation expense of $10,000 for a year. Its taxable income would be reduced to $90,000. As a result, the business would owe less in taxes for that year. However, depreciation is not a permanent tax saving as the depreciation expense will eventually be recaptured when the asset is disposed of or sold.

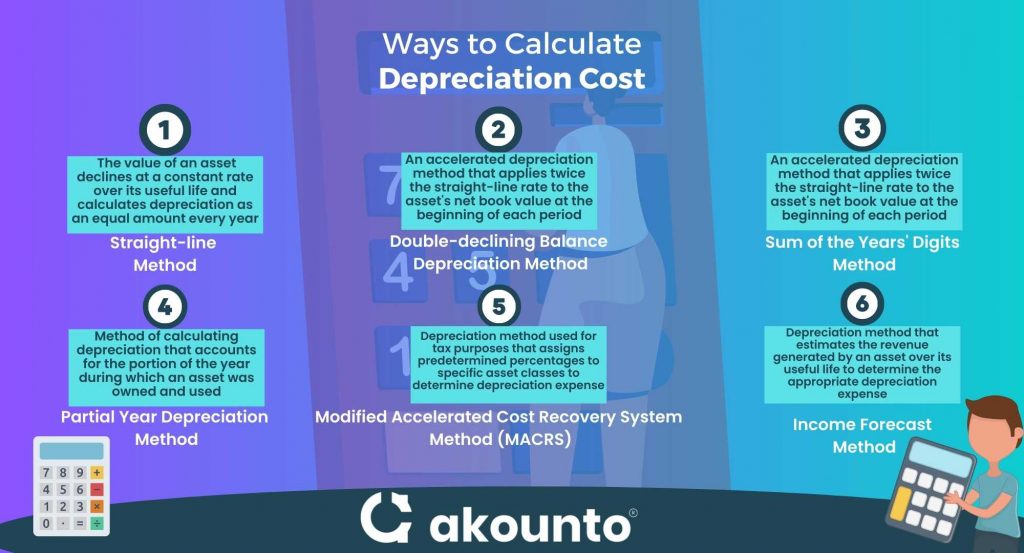

Methods and Formula for Calculating Depreciation Cost

Straight-line Method

In the straight-line depreciation method, the value of an asset declines at a constant rate over its useful life and calculates depreciation as an equal amount every year.

Formula: (Original Cost – Salvage Value)/Useful Life

Double-declining Balance Depreciation Method

The double-declining method depreciates the asset at two times the rate projected by the straight-line method. This method helps businesses defer their taxes to later years.

Formula: 2*(Original Cost-Salvage Value)/Useful Life

Sum of the Years’ Digits Method

The sum of the years’ digits is another accelerated depreciation method that takes the expected useful life and adds the numbers for each year. For instance, if an asset’s expected useful life is four years, the sum of the digits will be 4+3+2+1 = 10.

Next, the rate or percentage of depreciation will be determined by dividing each digit by the total sum.

Formula: Depreciation Expense using the sum of the years’ digits = (Remaining Useful Life/Sum of the Years Digits)*Depreciable cost

Partial Year Depreciation

Financial professionals use this method to calculate the depreciation costs of assets owned or operated for a part of the year. To calculate the partial year depreciation, we calculate the monthly depreciation amount and then multiply it by the months the item had been used.

Formula: (Annual Depreciation/12)*Number of months used or owned

Modified Accelerated Cost Recovery System Method (MACRS)

In Modified Accelerated Cost Recovery System (MACRS) method, the tax depreciation method applies to properties acquired after 1986. It allows companies to recover the cost of tangible assets over a specific period by taking tax deductions under strict IRS guidelines.

Income Forecast Method

The income forecast method is used for tax purposes of intangible assets like film, videotape, copyrights, patents, etc. However, the process may not be used to depreciate certain non-physical assets like goodwill, rent-to-own agreements, etc.

Example for Calculating Depreciation Cost

Company ABC Inc purchases equipment with a useful life of 10 years and a salvage value of $10,000. Its purchase price is $50,000.

Annual depreciation using the Straight-line Method

(50000-10000)/10 = $4000

Annual depreciation using the Double-declining Balance Method

Depreciation for the first year = 2*(50000-10000)/10 = $8000

Now, the net book value at the end of the first year will be $42000 ($50000-$8000)

Therefore, the depreciation for the second year will be-

2*(42000-10000)/10 = $6400

Annual depreciation using the Sum of the Years’ Digit Method

The sum of useful life will be 55 (10+9+…..+2+1)

Now, the depreciation factors will be-

1st Year: 10/55

2nd Year: 9/55

3rd Year: 8/55 and so on.

Using the sum of the years’ digits, the depreciation for the first year will be-

(10/55)*$40000 = $7272.72

Annual depreciation using the Partial Year Method

Let’s say the company used the machine only for six months. So, using the partial year method, the depreciation will be-

(4000/12)*6 = $2000

Basis for Depreciation

The basis for depreciation is a concept used for calculating the amount of an asset’s depreciated cost that could be subtracted for tax purposes. It calculates the annual depreciation deduction, which can be deducted from yearly taxable income.

Cost as Basis for Depreciation

Cost as a basis for depreciation is the actual cost of buying an asset, including the taxes or installation charges. To determine the depreciation expense, a business should divide the cost basis by the asset’s useful life.

Adjusted basis for Depreciation

It is the process where the cost basis of an asset is adjusted for any improvements, deductions, or depreciation. It helps determine the allowable tax deduction for depreciation over the asset’s useful life.

Other Basis for Depreciation

There are generally three types of basis for depreciation: cost basis, fair market value basis, and adjusted cost basis.

A fair market value basis is used for the assets gifted, donated, or acquired through inheritance. It referred to the asset’s fair market value when it was acquired.

Benefits

- Tax Relief: Depreciation cost helps in reducing the taxable income for companies.

- Financial Reporting: The accounting method aids businesses in properly reporting the value of their assets on their balance sheet. The proper valuation on the income statement provides a clear picture of the company’s current financial condition to the stakeholders.

- Informed Decision: Depreciation provides a clear insight into the value and useful life of assets, which helps organizations make informed decisions about replacing the asset and other related investments.

- Reduced Cost: By properly tracking an asset’s value or useful life, depreciation lowers the risk of unexpected expenses or losses due to any asset failure.

Conclusion

The depreciable cost is a crucial accounting concept that helps businesses in many ways, especially for tax deductions. However, businesses should tread cautiously while choosing the method for calculating depreciation, depending on IRS guidelines, asset type, and other factors.

Sign up with Akounto to better manage your accounting tasks. You can visit and read our blogs for more information on depreciation and other related concepts.