FIFO and LIFO are inventory valuation methods, where LIFO assumes the latest inventory to be sold first, while FIFO assumes the oldest inventory to be sold first.

Brief Overview of FIFO and LIFO

Inventory management is critical to any business dealing with goods and products. The two most commonly used inventory valuation methods are FIFO (First-In, First-Out) and LIFO (Last-In, First-Out).

These methods differ in calculating the cost of goods sold and ending inventory, ultimately affecting the company’s reported profit and tax burden.

FIFO (First-In, First-Out)

The FIFO method assumes that the goods purchased or produced by a company are the first to be sold. When prices rise, the method results in lower COGS, higher profits, and higher taxes.

FIFO is widely accepted under the International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP).

LIFO (Last-In, First-Out)

The LIFO method assumes that the recently acquired inventory or produced goods are sold first. This method results in a higher cost of goods sold, lower profits, and reduced tax burden during rising prices.

While LIFO is accepted under GAAP, it is not permitted under IFRS.

Both FIFO and LIFO have advantages and disadvantages, and the choice between them depends on various factors like the nature of the organization, the type of inventory, and the financial and tax objectives of the company.

Importance of Inventory Valuation in Accounting

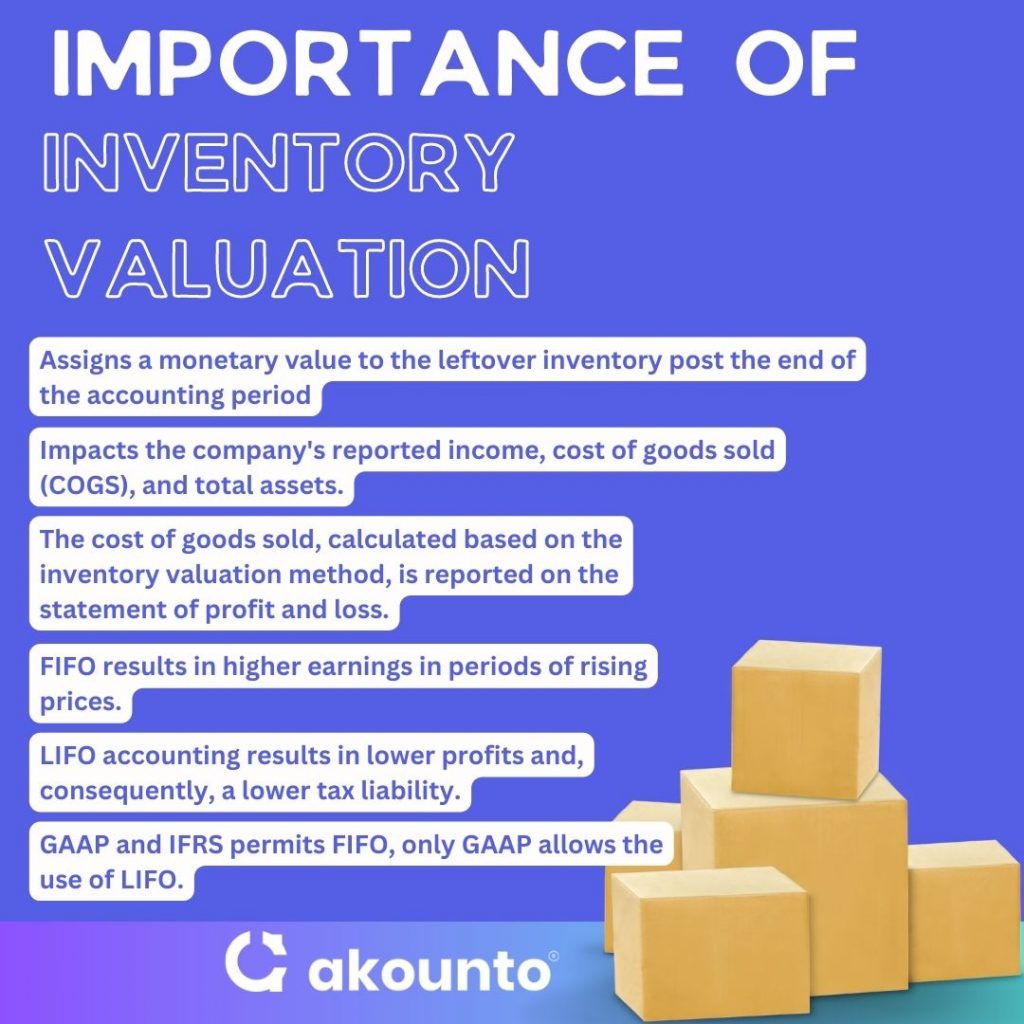

Inventory valuation is pivotal in accounting, particularly in determining a company’s profitability, financial stability, and tax liability. It assigns a monetary value to the leftover inventory post the end of the accounting period.

The method chosen for inventory valuation significantly impacts the company’s reported income, cost of goods sold (COGS), and total assets.

- Impact on Financial Statements: Inventory is reported as a current asset on an entity’s balance sheet and is vital in determining the total value of a company’s assets. The cost of goods sold, calculated based on the inventory valuation method, is reported on the statement of profit and loss and directly affects the company’s gross and net profit.

- Tax Implications: As FIFO results in higher earnings in periods of rising prices, it leads to higher tax liability. LIFO accounting results in lower profits and, consequently, a lower tax liability.

- Compliance with Accounting Standards: Inventory valuation methods comply with the accounting standards set by the Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS). While both standards accept FIFO, only GAAP allows the use of LIFO.

GAAP and IFRS Guidelines

The GAAP and IFRS provide guidelines for inventory valuation. These standards ensure consistency and transparency in financial reporting across businesses and industries.

GAAP Guidelines

Under GAAP, businesses can use the three cost formulas for inventory valuation: FIFO, LIFO, or weighted average.

The Financial Accounting Standards Board’s Accounting Standards Codification (ASC) Topic 330 provides detailed guidance on inventory accounting.

While most companies under GAAP choose FIFO or weighted average, some opt for LIFO, primarily for tax reasons.

IFRS Guidelines

IFRS permits only FIFO and weighted average methods for inventory valuation.

The International Accounting Standard (IAS) 2 provides the guidelines for inventory accounting under IFRS and emphasizes using a consistent cost formula for all inventories of similar nature and uses to the entity.

The use of LIFO is not permitted under IFRS, which is a significant difference from GAAP.

Comparison

The choice between FIFO and LIFO can substantially impact a company’s financial statements.

Under the FIFO method, the oldest inventory costs are assigned to the COGS, resulting in lower COGS and higher earnings when prices are rising.

The LIFO method assigns the most recent inventory costs to COGS, resulting in higher COGS and lower earnings in a rising price environment.

Use Case Examples

Understanding the practical application of FIFO and LIFO methods can help businesses make informed decisions about their inventory valuation. Here are some industry-specific examples of where these inventory accounting methods are commonly used.

- Retail Industry: FIFO

The retail industry often uses the FIFO method due to the nature of their products. Retailers typically sell perishable goods or items that go out of style or become obsolete over time, such as food, clothing, and electronics, i.e., older inventory, first.

The FIFO method ensures that the oldest inventory (first-in) is sold first, reducing the risk of inventory spoilage or obsolescence.

For example, a grocery store would use FIFO to ensure that the oldest produce is sold first, guaranteeing customers freshness and reducing spoilage waste.

- Manufacturing Industry: LIFO

The manufacturing industry often prefers the LIFO method, especially in times of rising prices. LIFO leads to higher COGS and lower net earnings, which can lead to lower income taxes.

For instance, a car manufacturer might use the LIFO method during periods of rising steel prices. By first selling the cars made with the most recently purchased (and more expensive) steel, the manufacturer can report higher costs and lower profits, reducing their tax liability.

- Oil and Gas Industry: LIFO

The oil and gas industry often experiences significant fluctuations in oil prices.

Using the LIFO valuation method, oil companies can match their sales revenue with the cost of the most recent inventory, providing a more accurate representation of their current operating performance.

Inventory Valuation Methods: FIFO and LIFO

Inventory valuation is a critical accounting practice that directly impacts a company’s inventory valuation. The two most common valuation methods are FIFO (First-In, First-Out) and LIFO (Last-In, First-Out).

Inventory Valuation

Inventory valuation is the process of calculating the cost associated with the inventory at the end of an accounting period. This cost is reported on the balance sheet and is useful in computing the cost of goods sold (COGS) on the Statement of Profit and Loss.

The method chosen for inventory valuation can significantly affect a company’s reported profit, tax liability, and financial performance analysis.

In the FIFO method, it’s assumed that the oldest inventory items are sold first. Therefore, the inventory cost on the balance sheet e is based on the cost of the most recent purchases.

The LIFO method assumes that the newest inventory purchased is sold first, leaving the older (and often cheaper) items on the balance sheet.

Impact on COGS and Net Income

The choice of inventory valuation method significantly impacts the COGS and, consequently, the net earnings.

During a price rise, the FIFO method will result in lower COGS than LIFO. It is because FIFO sells off the older, cheaper inventory first. Consequently, FIFO will report higher net earnings and higher taxes.

On the other hand, the LIFO method will result in higher COGS in a period of rising prices, as it sells off the newer, more expensive inventory first. It leads to a lower net profit and lower taxes compared to FIFO.

Examples of Inventory Valuation

Consider a business that purchases 100 units of a product for $10 each in January and another 100 units of the same product for $15 each in February. If the business sells 100 units in March, the COGS will differ based on the inventory valuation method.

Under FIFO, the COGS will be $1,000 (100 units $10/unit), as it assumes that the units bought in January are sold first. However, under LIFO, the COGS will be $1,500 (100 units $15/unit), as it assumes that the units bought in February are sold first.

FIFO vs. LIFO

| Criteria | FIFO | LIFO |

| Definition | Assumes that the first goods purchased or produced are the first ones to be sold. | Assumes that the most recently purchased or produced goods are sold first. |

| Cost of Goods Sold (COGS) | Lower in a period of rising prices, as older, lower-cost items are sold first. | Higher in a period of rising prices, as newer, higher-cost items are sold first. |

| Net Income | Higher in a period of rising prices, as COGS is lower. | Lower in a period of rising prices, as COGS is higher. |

| Tax Liability | Higher, as net income is higher. | Lower, as net income is lower. |

| Inventory Value on Balance Sheet | Higher in a period of rising prices, as it’s based on the cost of the most recent purchases. | Lower in a period of rising prices, as it’s based on the cost of the oldest inventory. |

| Impact of Inflation | Less favorable during inflation, as it results in higher taxes. | More favorable during inflation, as it results in lower taxes. |

| Compliance with Accounting Standards | Accepted under both GAAP and IFRS. | Accepted under GAAP but not permitted under IFRS. |

Impact on Financial Reporting

Financial Statements

Financial statements are key for stakeholders to understand a company’s financial health. The choice of inventory valuation method directly affects the reported figures on these statements. For instance, the beginning inventory plus inventory purchases minus the ending inventory gives us the cost of goods sold (COGS).

Balance Sheet and Income Statement

On the balance sheet, inventory is reported as a current asset. Under FIFO, the inventory value is based on the most recent costs, which can be higher during periods of inflation. This results in a higher total asset value and, consequently, a higher equity value.

On the income statement, the COGS is subtracted from revenues to calculate gross earnings. A higher COGS (as seen with LIFO during inflation) results in lower earnings leading to lower taxable income and reducing the company’s tax liability.

Calculating Cost and Gross Profit

The inventory valuation method directly influences the calculation of cost and gross profit. With FIFO, the oldest inventory costs are used first, resulting in lower COGS and higher gross profit during inflation.

LIFO uses the most recent, higher costs first, resulting in higher COGS and lower gross profit during inflation.

The choice of inventory valuation method has significant implications for financial reporting. It affects the reported inventory value; COGS; gross and net profit; and taxable income.

Small businesses must carefully consider their choice of inventory valuation method, their specific circumstances, and the potential impact on their financial reports.

Advantages

First-In, First-Out

- Preserves chronological order: FIFO ensures that the oldest items are used or sold first.

- Accurate representation of COGS: FIFO assigns the most recent costs to the remaining inventory.

- Reduced risk of obsolescence: Since FIFO uses older inventory first, there is a reduced risk of inventory becoming obsolete.

- Matches actual flow of goods: FIFO closely aligns with the physical flow of goods, making tracking and managing inventory easier.

- Smooth’s pricing fluctuations: During inflation or rising costs, FIFO helps mitigate the impact by valuing inventory at lower costs, resulting in more stable pricing.

Last-In, First-Out

- Tax advantages: LIFO can result in lower taxable income by assigning the most recent costs to the COGS.

- Reflects replacement costs: LIFO assigns the most recent costs to the COGS, which reflects the higher replacement costs.

- Higher inventory turnover: Older items are only stored for a short period. This can free up working capital and reduce carrying costs.

- Matches certain industries: LIFO is particularly suitable for enterprises with significant inventory depreciation or products with short shelf life, such as perishable goods or fashion industries.

- Matching of costs and revenue: LIFO can align costs more closely with revenue, especially in times of inflation when inventory costs tend to rise.

Choosing Between FIFO and LIFO

The choice between FIFO and LIFO depends on various factors, including the nature of the inventory, price trends, international operations, and inventory management practices.

Factors to Consider

- Nature of Inventory: FIFO is often preferred for physical inventory that is perishable in nature or items that become obsolete quickly, as it assumes the oldest inventory is sold first. LIFO may be suitable for non-perishable goods or items that do not become obsolete.

- Price Trends: LIFO will result in lower taxable income and tax liability if prices rise. If prices are falling, FIFO may be more beneficial.

- International Operations: LIFO is not permitted under IFRS. FIFO may be a more suitable choice if a company has international operations.

- Inventory Management Practices: Companies that maintain a physical flow of inventory that aligns with FIFO (i.e., sell older inventory first) may also find it easier to use FIFO for accounting purposes.

Role of Accounting Software

Modern accounting software can handle both FIFO and LIFO calculations, making it easier for businesses to switch between methods or use different methods for different types of inventory. The software can also help track inventory flow, manage unsold inventory, and generate accurate financial reports based on the chosen inventory valuation method.

Impact on Selling Price and Total Cost

The choice of inventory valuation method can indirectly impact the selling price of goods and the total inventory cost. For instance, using LIFO during inflation can result in higher COGS, which may prompt a business to increase selling prices to maintain profit margins.

Conclusion

FIFO vs. LIFO is a critical aspect of inventory management. Choosing between the two methods can help influence financial reporting, tax implications, and net profit. Businesses must consider their specific circumstances, including the nature of their inventory and pricing decisions.

For more information on accounting and bookkeeping topics, visit Akounto Blog.