What is Financial Modeling?

Financial modeling is a forecasting model to evaluate business decisions, predict financial performance, calculate valuation or comparisons, etc.

Financial modeling is one of the dynamic tools of corporate finance, where it tries to forecast the performance of business units, strategies, or decisions in multiple scenarios.

Like any other model, there is an expectation for financial models to match the real-world conditions to the possible extent. However, such a proper financial model is difficult to achieve as it is limited by its assumptions and varying degrees of input.

Most importantly, all financial models are future-looking models.

To build financial models, a financial modeler uses spreadsheets or Microsoft Excel to reflect the company’s historical performance while integrating assumptions about future scenarios. A financial modeler must have expert-level Excel skills to build financial models.

The source of historical data for financial modeling is usually:

- Company’s Income Statement

- Company’s Balance Sheet

- Company’s Cash Flow Statement

The broad classification of financial models can be based on their usage. There are two basic usages, namely:

- Internal models that help internal managerial teams with decision-making, like capital budgeting, cash flow management, expansion, etc.

- External models impact business models and other businesses. This can be related to mergers and acquisitions, diversification, takeovers, etc.

The decision-making process involves a detailed understanding of the business model, including revenue streams, cost structures, and capital requirements. The model serves as a virtual simulation, allowing analysts to explore the financial impact of different business decisions and market conditions

Uses and Significance of Financial Modeling

Within the financial sector, the financial models are used by investment bankers, equity analysts and researchers, accounting firms, underwriters, and other strategic decision-making fields of corporate finance like treasury management, forex management, in evaluating mergers and acquisitions (M&A), initial public offerings (IPOs), raising capital, etc.

The basic goal of all financial models is to enable data-based informed decision-making by ensuring the simulation is as much closer to the real-world situation as possible.

Financial modeling is a fundamental skill in finance, serving as a bridge between historical data and future projections and trying to get a clearer picture by deducing a comprehensible financial narrative.

In investment banking, the financial models enable bankers to assess the viability of transactions, forecast the company’s performance post-transaction, and advise clients accordingly.

When it comes to private equity and venture capital, financial models are used for valuing potential investments, anticipating changes and impacts on stock valuations, capital structure, etc.

Leveraged buyout models, for instance, help in determining the feasibility of acquiring a company through significant debt financing. These financial models calculate expected returns, considering various operating scenarios and the company’s ability to generate free cash flows.

Corporate finance teams utilize financial modeling for strategic planning and financial analysis. It aids in budgeting, forecasting future sales growth, and managing business units organically. Financial models help in identifying key drivers of financial performance, enabling businesses to allocate resources efficiently and plan for future expansions or contractions.

Equity research analysts build financial models to forecast a company’s financial performance, aiding in stock valuation and investment recommendations. These models often include detailed analyses of cash flows, a company’s income statement, and a balance sheet, providing a comprehensive view of the company’s operations.

On a much broader level, the financial model can also gauge the impact of changes in the macroeconomic environment and its financial impact on the company, helping in planning, resource allocation, policy adjustment, etc.

Components of Financial Modeling

The primary components in financial modeling are:

- The Income Statement, which details revenue, expenses, and net income, offers insights into profitability.

- The Balance Sheet is another crucial element, presenting a snapshot of the company’s assets, liabilities, and equity, reflecting its financial stability.

- The Cash Flow Statement complements these by tracking the actual cash inflows and outflows, highlighting the company’s liquidity.

- Supporting Schedules such as depreciation, amortization, and debt schedules provide detailed breakdowns of specific financial statement items.

In more complex types of financial models, the following components are also added:

- Sensitivity Analysis and Scenario Planning are included to assess the impact of various assumptions on the model’s outcomes, enhancing decision-making and strategic planning.

Building Financial Models

Building financial models requires a deep understanding of both the company’s operations and the market dynamics.

A financial model integrates historical data, assumptions about future performance, and various financial metrics into a cohesive structure. The computation of these models typically follows two primary approaches: Top Down and Bottom Up.

Top Down

The top-down approach in financial modeling starts with a broad market perspective and then narrows down to the specifics of the company. It begins by analyzing the overall market size, trends, and the company’s position within the industry.

In a top-down model, financial analysts often begin by examining macroeconomic indicators and industry-wide trends to estimate the total available market. They then determine the company’s market share and project future sales growth based on these broader market forecasts. This method is particularly effective for companies operating in well-established industries where historical market data is abundant and reliable.

The top-down approach is particularly useful in investment banking and equity research, where understanding the broader market dynamics is crucial for forecasting a company’s performance.

Example of Top Down Approach

In a top-down financial model for a retail company, the analysis might start with global retail market trends, followed by regional analysis, and finally focus on the company’s specific segment within that market. The model would incorporate factors like consumer spending habits, e-commerce growth, and competitive landscape, which influence the company’s sales growth and market share.

Bottom Up

The bottom-up approach in financial modeling begins at the granular level of the company’s operations and builds up to an overall financial picture. This method is more focused on the company’s internal factors, such as unit sales, pricing strategies, and operational efficiencies. It’s particularly useful for startups and companies entering new markets where historical market data may be scarce or irrelevant.

In this approach, the model is constructed based on the company’s specific revenue drivers and cost structures. Analysts examine the company’s sales channels, product lines, and customer segments to forecast revenue. They also analyze direct and indirect costs, considering factors like production capacity, supply chain logistics, and overhead expenses. The bottom-up approach provides a detailed view of the company’s financial health, making it an essential tool for strategic planning, budgeting, and financial planning.

Example of Bottom-Up Approach

A Bottom-Up financial model for a technology startup would focus on the number of users, subscription fees, and server costs. It would build up these individual components to forecast the company’s overall revenue and expenses, providing a detailed insight into the startup’s financial trajectory.

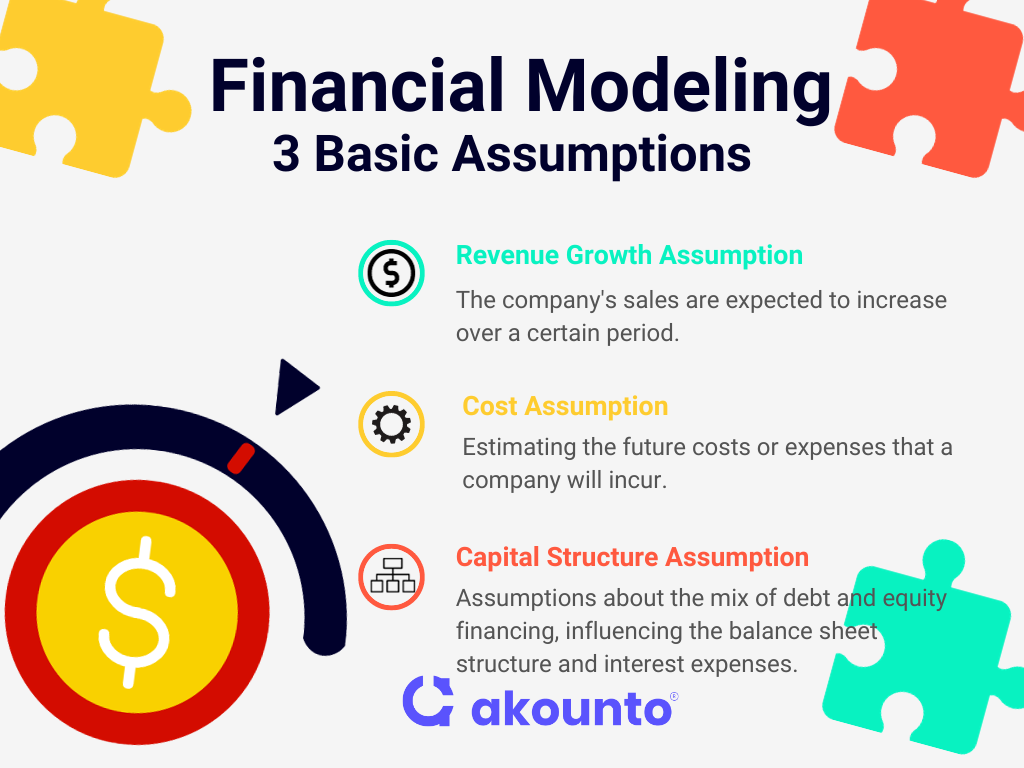

Basic Assumptions in Financial Modeling

Revenue Growth Assumption

The revenue growth assumption states that the company’s sales are expected to increase over a certain period. It’s a prediction of future sales based on various factors like historical sales data, market trends, industry analysis, and the company’s growth strategy.

In different types of financial models, from simple budget models to complex DCF analyses, revenue growth rates are tailored based on historical data, industry benchmarks, and future market expectations.

Cost Assumption

This involves estimating the future costs or expenses that a company will incur. It includes both fixed costs (like rent and salaries) and variable costs (like raw materials and production costs). Accurate cost assumptions are essential for predicting a company’s future profitability.

These assumptions vary across types of financial models, depending on the nature of the business and the specific model’s focus. For instance, in a Three-Statement Model, cost assumptions directly influence the net income and cash flow projections.

Capital Structure Assumption

Capital structure assumption involves assumptions about the mix of debt and equity financing, influencing the company’s balance sheet structure and interest expenses.

This assumption varies in different types of financial models, affecting the overall valuation and investment return projections.

The capital structure assumption is vital in financial modeling, particularly in models like the Leveraged Buyout Model.

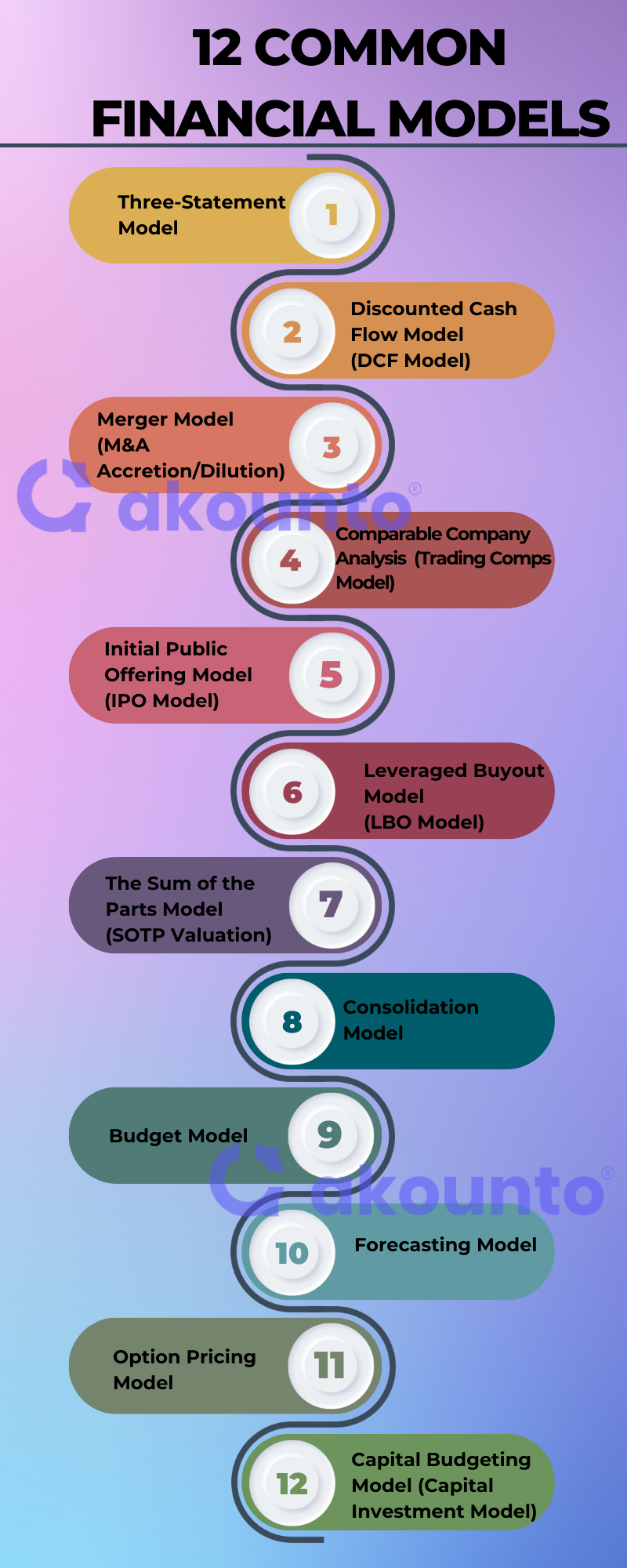

12 Common Financial Models

- Three-Statement Model (Income Statement, Cash Flow Statement, Balance Sheet)

- Discounted Cash Flow Model (DCF Model)

- Merger Model (M&A Accretion/Dilution)

- Comparable Company Analysis (Trading Comps Model)

- Initial Public Offering Model (IPO Model)

- Leveraged Buyout Model (LBO Model)

- The Sum of the Parts Model (SOTP Valuation)

- Consolidation Model

- Budget Model

- Forecasting Model

- Option Pricing Model

- Capital Budgeting Model (Capital Investment Model)

1- Three-Statement Model (Income Statement, Cash Flow Statement, Balance -Sheet)

The Three-Statement Model integrates the Income Statement, Cash Flow Statement, and Balance Sheet into a comprehensive financial model.

This Three-Statement Model is fundamental for financial analysts and investment bankers, providing a holistic view of a company’s financial health.

The Income Statement details the company’s revenues and expenses, thus computing the net income.

The company’s Balance Sheet or Position Statement provides a snapshot of the company’s assets, liabilities, and equity at a specific point in time, presenting its financial stability and liquidity.

The Cash Flow Statement reconciles the net income with the actual cash inflows and outflows, highlighting the company’s ability to generate cash.

The integration of these three statements allows for a thorough analysis of financial performance, supporting tasks such as valuation, financial planning, and strategic decision-making.

For compiling information about different companies, there are certain public databases maintained by governments, which can be accessed to build financial models:

- For the US, you can access EDGAR Database, maintained by SEC

- For Canada, you can access SEDAR

- For the United Kingdom, you can access the public database known as Companies House.

2- Discounted Cash Flow Model (DCF Model)

The Discounted Cash Flow (DCF) Model is used extensively in corporate finance, private equity, and investment banking. The discounted cash flow model calculates the present value of a company or asset based on its projected future free cash flows.

The core principle of the DCF analysis is the time value of money, which states that a dollar today i.e. present date, is worth more than a dollar in the future.

The DCF model states that the value of a business is equal to the sum of its projected free cash flows, discounted back to their present value using a discount rate, typically the weighted average cost of capital (WACC).

The sum of the discounted cash flows and the terminal value, which represents the value of cash flows beyond the forecast period, gives the net present value (NPV) of the company.

This NPV is used in DCF analysis to evaluate the investment. The NPV reflects the intrinsic value of the company or project/ investment based on its cash-generating ability.

The net present value (NPV) calculation helps determine whether the expected rate of return meets the investment threshold. The DCF model is particularly valuable in sensitivity analysis, allowing financial analysts to assess how changes in assumptions impact the company’s valuation.

3- Merger Model (M&A Accretion/Dilution)

The Merger Model, also known as M&A Accretion/Dilution Analysis, is a financial model used in investment banking to evaluate the financial feasibility of a merger or acquisition.

The merger model focuses on whether the combined entity will create value post-merger, specifically looking at the accretion (increase) or dilution (decrease) in earnings per share (EPS) of the acquirer in a post-M&A (merger and acquisition) scenario.

Key elements of this merger model include:

- the purchase price,

- form of payment (cash, stock, or debt), and

- the expected synergies.

The merger model forecasts the financial performance of both the acquiring and target companies, combining their income statements to assess the impact on EPS. It also considers various financing scenarios and their effects on the company’s capital structure.

In the Merger Model, if the EPS of post-merger entity is larger than the pre-merger entity, then it is “accretive”, otherwise it is “dilutive”. Thus, the merger model helps corporate finance teams to understand the impact of M&As on shareholder value and the company’s financial health.

4- Comparable Company Analysis (Trading Comps Model)

Comparable Company Analysis or Trading Comps Model, is a relative valuation methodology used to value a company by comparing it to similar companies (peer-to-peer comparison) in the same industry.

The Trading Comps financial model is based on the concept that similar companies will have comparable valuation metrics.

To evaluate a company’s market value, financial analysts and equity research professionals identify a set of comparable companies and then analyze their business metrics, such as Price/Earnings, Enterprise Value/EBITDA, Price/Sales, etc.

The Trading Comps Model is essential for understanding market trends, evaluating investment opportunities, and making informed business decisions.

5- Initial Public Offering Model (IPO Model)

The Initial Public Offering Model, or IPO Model, is a specialized financial model used in investment banking to evaluate a company’s valuation while preparing for its public market debut.

The IPO model is used it determining the appropriate price range for a company’s shares during an IPO.

The IPO Model analyses the company’s financial statements, market trends, and comparable company valuations to evaluate the company’s market valuation and the potential impact of the IPO on the company’s capital structure and future financial planning.

The IPO Model focuses on key elements like sales growth, net present value, and financial performance to forecast the expected market reception of the IPO.

IPO financial models are applied in the case of companies that are looking to raise capital in the public market.

6- Leveraged Buyout Model (LBO Model)

A leveraged buyout is the acquisition of a company, where the major part of the acquisition is funded by debt, thereby generating debt leverage.

The Leveraged Buyout Model, or LBO Model, is often used by private equity firms to evaluate the acquisition of a company using a significant amount of borrowed funds by assessing the viability of achieving high returns on equity through the strategic use of debt leverage.

The LBO financial model include the structuring of financing (debt and equity mix), the company’s ability to generate free cash flows for debt repayment, and the potential exit strategies.

The LBO financial model provides a detailed projection of the company’s financial performance, including cash flow waterfalls and sensitivity analysis, to determine the investment’s risk and return profile and ensuring that the leveraged acquisition can yield substantial returns while managing the risks associated with high leverage.

7- The Sum of the Parts Model (SOTP Valuation)

The Sum of the Parts Model or SOTP Valuation is used for the valuation of conglomerates or diversified companies having multiple segments, divisions, business units, etc.

SOTP valuation is a complex financial modeling method where each of the business units or such individual units is analyzed separately and independently because here, each business unit will have distinct characteristics, valuation methodologies, business structure, etc.

Evaluating multiple business units requires using appropriate valuation methods, such as discounted cash flow analysis or comparable company analysis on a case-to-case basis.

The individual valuation for every business unit is then aggregated to derive the total enterprise value of the company. It is achieved by combining multiple discounted cash flow analysis into a single model projection.

This financial model needs a nuanced understanding of the company’s overall worth, highlighting the value contribution of each segment. SOTP Valuation is crucial for strategic planning, corporate finance decisions, and in scenarios like spin-offs, divestitures, or mergers and acquisitions, where understanding the discrete value of each business unit is essential for making optimal business decisions.

8- Consolidation Model

Consolidation model is used to create a unified financial statement that accurately reflects the financial performance and position of an entire corporate group which consists of a parent company and its subsidiaries.

The consolidation model in financial modelling is essential for companies with diverse business units or those that have undergone mergers and acquisitions, enabling them to assess overall performance, allocate resources efficiently, and make informed business decisions.

In corporate finance and accounting the consolidation financial model involves adjusting for intercompany transactions, minority interests, and other consolidating entries to ensure that the consolidated financial statements present a true and fair view of the company’s operations.

The Consolidation Model is particularly valuable in strategic planning and decision-making, as it provides a comprehensive overview of the financial health of the business as a whole, rather than just its individual units.

9- Budget Model

The Budget Model is used by businesses to plan and control their financial resources.

The budget model involves projecting a company’s expenses and revenues over a specific period, typically on an annual basis, to create a budget. It includes all streams of revenues and expenses including non operating expenses and revenues like operating, non-operating, sales, accrued, etc.

The process includes analyzing historical data, considering future business goals, and incorporating key financial elements like sales growth, cost management, and capital expenditure.

The Budget Model is helps in strategic planning that enables companies to allocate resources efficiently, set financial targets, and manage cash flow effectively.

10- Forecasting Model

In financial modelling, the forecasting method is used to predict a company’s future financial performance based on historical data, market trends, and business-specific variables.

The forecasting financial model helps financial analysts and corporate finance professionals to make projections about sales, revenue, expenses, and cash flows.

The accuracy of a forecasting model depends on the quality of the assumptions and the understanding of the business model and market dynamics.

It is used for various purposes, including financial planning, investment analysis, and risk management.

11- Option Pricing Model

The Option Pricing Model is used to determine the fair value of options, which are derivatives with their value based on underlying assets like stocks.

The Black-Scholes Model, is most often used for option pricing, it calculates the theoretical price of European-style options using factors such as the underlying asset’s price, the option’s strike price, time to expiration, volatility, and the risk-free interest rate.

Option Pricing Models are essential for traders and financial analysts to assess the value of options, hedge risks, and make informed trading decisions.

12- Capital Budgeting Model (Capital Investment Model)

The Capital Budgeting Model or Capital Investment Model, involves calculating the Net Present Value (NPV) and Internal Rate of Return (IRR) of the investment, providing a clear picture of the expected returns and associated risks.

The capital budgeting financial model is used for evaluating major investment decisions like the feasibility and value of potential investments, such as new projects, acquisitions, or infrastructure upgrades.

Capital budgeting calculates the initial capital outlay, projected cash flows, and the time value of money.

The Capital Budgeting Model is essential for companies to make informed decisions about allocating their capital resources effectively, ensuring that investments align with their long-term strategic goals and yield substantial returns.

Conclusion

Financial modeling is important for decision-making, course correction, and analyzing the impact of changing variables in the business environment. It helps businesses to evaluate the scenarios before implementing the decisions, thus saving any potential harm. Financial modeling is a simulation or anticipated model based on assumptions. The accuracy of the model depends upon the assumptions and quality of data input.

Small businesses and startups need to use financial modeling so that they can test their decisions before implementing and save capital, time, and strategic advantage.

Visit Akounto’s blog and learn more topics of finance that help grow your business.