Introduction to Income Statement

The Income Statement (Profit and Loss Statement) meticulously details the company’s revenue and expense accounts to calculate net profit or loss within an accounting period.

The income statement is also sometimes called an earnings statement in financial accounting.

The Income Statement is one of the three major financial statements used in corporate finance and accounting, the other being the Balance Sheet and the Cash Flow Statement.

The income statement clearly shows a company’s financial performance, showing whether it made a profit or incurred a loss during a particular period.

Structure of Income Statement

The income statement comprises three main sections: revenue, expenses, and net income.

Revenue is the money a company earns from business activities like the sale of goods, provision of services, or other activities that are part of the company’s operations. Net sales are calculated here, which is goods sold minus goods returned.

These are the business expenses incurred by the company in generating revenue. The total expenses of a business include (but are not limited to):

- Operating Expenses (OPEX)

- Cost of Goods Sold (COGS)

- Non-Operating Expenses

- Depreciation and Amortization

- Research and Development (R&D) Expenses

- Capital Expenditures (CAPEX)

- Variable Expenses

- Fixed Expenses

- Selling, General, and Administrative (SG&A) Expenses

- Interest Expenses

- Other Expenses

Net income is the final figure on the income statement, computed by subtracting total expenses from total revenue, representing the company’s profit or loss for the period.

A company’s income statement is structured logically and coherently, making it easy to identify trends and make informed decisions by providing a structured view of its operations, revealing whether it is making a profit or loss for a given period.

Understanding the income statement is crucial for anyone involved in corporate finance or business.

Significance

As one of the company’s core final accounts, the income statement shows a comprehensive overview of the company’s profitability over a specific reporting period.

The income statement is a crucial tool for various stakeholders. For management, it offers a clear picture of the company’s performance, helping them make informed decisions about future strategies. For investors and creditors, it provides valuable insights into the company’s financial story, enabling them to assess the viability of their investment or loan.

The income statement is a key component in financial forecasts. By analyzing trends in revenue, expenses, net income, and other line items, businesses can predict future financial performance and make strategic decisions accordingly.

The income statement records the company’s profit and loss over the financial year. It’s a testament to the company’s ability to generate revenue, control expenses, and ultimately create shareholder value.

Income statements are prepared following generally accepted accounting principles (GAAP), ensuring consistency and comparability across different companies and industries.

Components

An income statement consists of several key components, each contributing to a holistic understanding of the company’s profitability.

Sales Revenue

Sales Revenue, often called the ‘top line,’ signifies the total revenue generated from the company’s core business activities. It’s the initial income statement figure derived by multiplying the number of goods sold by their selling prices.

Cost of Goods Sold

Cost of Goods Sold (COGS) represents the direct costs related to producing the goods a company sells. This includes the cost of raw materials and labor expenses directly tied to the production process. It’s subtracted from sales revenue to determine the gross profit.

Expense Accounts

Expense Accounts include all costs not directly tied to production, such as general and administrative expenses, advertising expenses, and other operating expenses. These indirect costs are subtracted from the gross profit to determine the operating profit or Earnings Before Interest and Taxes (EBIT).

Operating Profit (EBIT)

Operating profit is computed by subtracting operating expenses from gross profit, providing an understanding of a company’s profitability from its core business operations, excluding interest and taxes.

Earnings Before Taxes (EBT)

Earnings Before Taxes (EBT) or Pre-Tax Income is calculated by subtracting interest expense from the operating profit. It represents the income that a company has earned before taxes are deducted.

Earnings Before Interest Tax Depreciation and Amortization

EBITDA measures the company’s operating performance. It’s calculated by adding back depreciation and amortization expenses to EBIT. Depreciation refers to the decrease in the value of physical assets over time, while amortization refers to the gradual reduction of debt over a specific period.

Earnings Per Share

Earnings Per Share (EPS) measures profitability by calculating the earnings available to each shareholder. EPS is estimated by dividing net income by the total number of outstanding shares. Investors majorly use EPS to compare profitability across companies in the same industry.

Net Income

Net income (net profit or net earnings) refers to revenue that remains as profit for a company after accounting for all costs, expenses, taxes, interest, and dividends. It’s essentially the income statement’s bottom line.

The relation between net earnings and income tax expense is direct. Taxes are a significant expense a company must pay based on its earnings before taxes (EBT). The higher the EBT, the higher the tax expense, and vice versa. The result is the net earnings after the tax expense is deducted from the EBT.

Income Statement Format

The format of an income statement can differ, but it typically aligns with one of four main structures: single-step, multi-step, horizontal, or vertical. Each format provides a unique way to analyze a company’s financial performance.

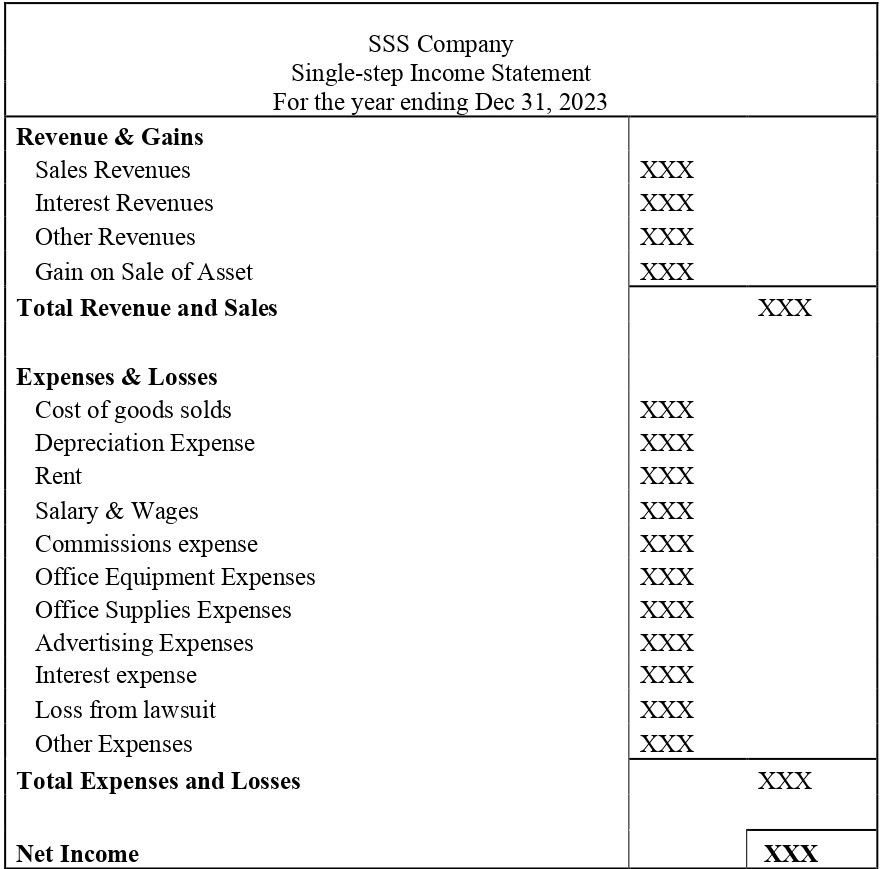

Single-step income statement

A single-step income statement is a simplified format that consolidates all revenues, gains, expenses, and losses. This format is easy to read and understand for small businesses and individuals. It provides a clear snapshot of net earnings but lacks a detailed breakdown of revenues and expenses in a multi-step income statement.

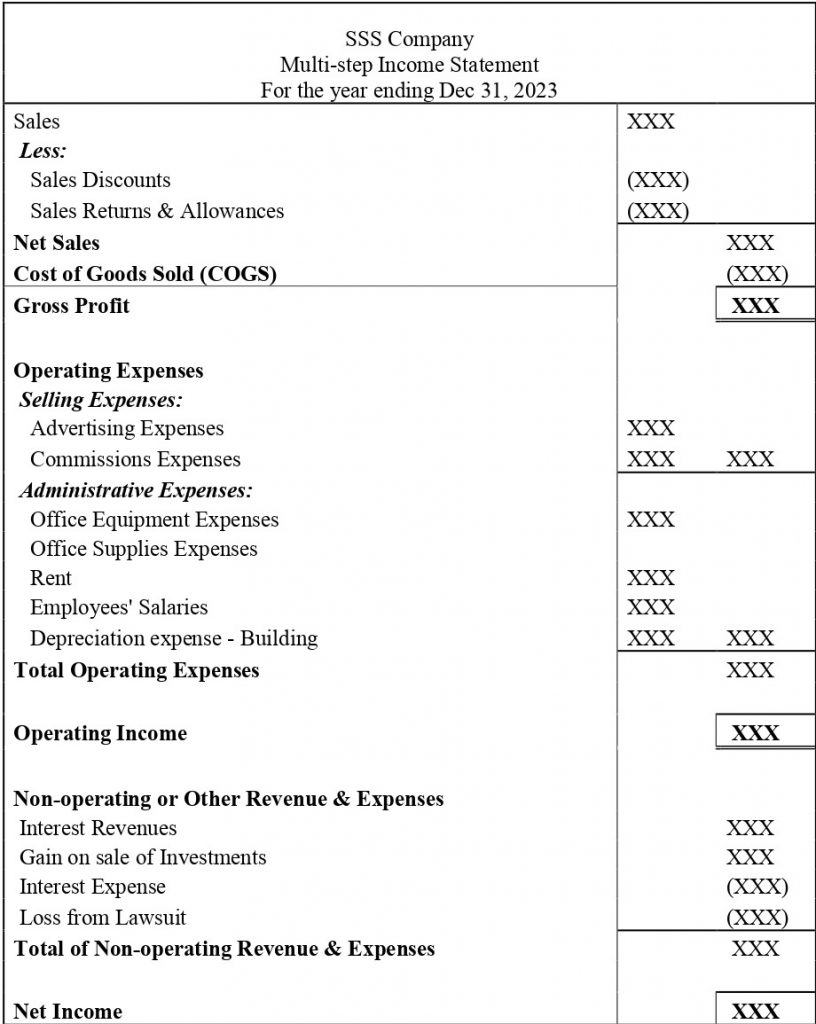

Multi-step income statement

The multi-step income statement offers a more detailed view of a company’s financial health. It separates operational revenues and expenses from non-operational ones, providing insights into the core business activities. This format is used by those requiring a more comprehensive financial performance analysis.

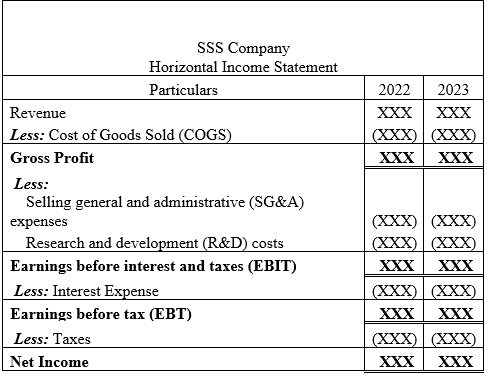

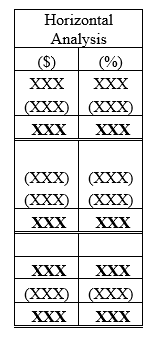

Horizontal Format

The horizontal format of an income statement provides a comparative view of financial data over multiple accounting periods. It helps identify trends and growth patterns, line by line. This format is useful for businesses that must analyze their performance over time and make strategic decisions based on historical data.

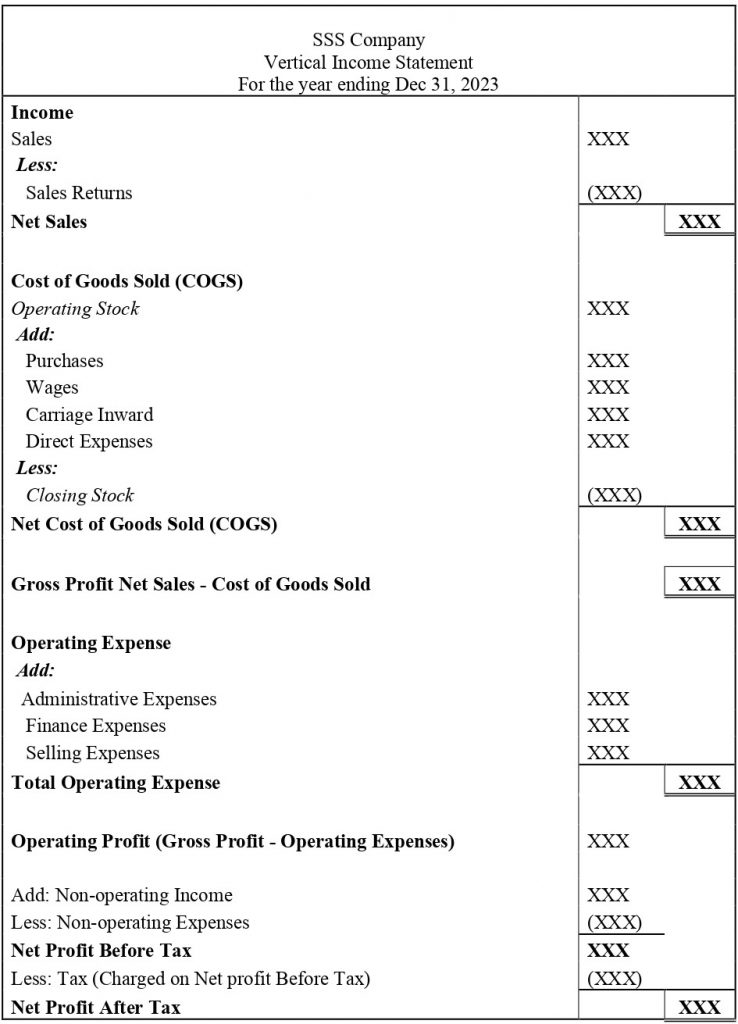

Vertical Format

Also known as a common size analysis, the vertical format expresses each line item as a percentage of total revenue for a given period allowing easy comparison of annual statements across different periods or between companies, regardless of their size. It’s particularly useful for identifying cost trends and evaluating a company’s expense management efficiency.

Steps to Make an Income Statement

Step 1: Gather Relevant Information like sales revenue, cost of goods sold (COGS), operating expenses (OPEX), and other income or expenses.

Step 2: Calculate Gross Profit. Subtract the COGS from the sales revenue. This calculation will give you the gross profit, the gross amount earned from selling goods and services.

Step 3: Include Operating Expenses: Add up all the operating expenses on the trial balance. Enter the total operating expenses into the income statement naming it as selling and administrative expenses line item, directly below the gross profit line.

Step 4: Calculate Operating Income: Subtract the total selling and administrative (S&A) expenses from the gross profit to get pre-tax operating income. Enter this amount at the bottom of the income statement.

Step 5: Include Income Taxes: To calculate income tax, multiply the applicable tax rate with the pre-tax income figure. Add this to the income statement below the pre-tax income figure.

Step 6: Calculate Net Income. To determine your business’s net earnings, subtract the income tax from the pre-tax income figure. Enter this figure as ‘Net Income’ into the final line item of your income statement.

Step 7: Finalize the Income Statement: To finalize your statement, add a header mentioning the title as income statement, then add the accounting period for which the profit and loss are calculated.

Refer to an income statement template mandated or advised by the accounting body or IRS.

Reading an Income Statement

Reading income statements is quintessential for business owners, investors, and financial analysts.

The income statement starts with the company’s revenue or sales, representing the total earnings from selling goods or services. The next line item is the cost of goods sold (COGS), which includes the direct costs related to manufacturing the goods the company sells. Subtracting COGS from revenue gives us gross profit, which indicates how efficiently a company uses its resources.

In subsequent line items, the income statement lists various operating expenses, such as salaries, rent, utilities, and depreciation. Subtracting these expenses from the gross profit gives us the operating profit or EBIT.

Next in line items are non-operating items like interest income, interest expense, and other income or expenses. After accounting for these, we arrive at the pre-tax income. Finally, after deducting income taxes, we get the net income, which is the company’s profit after all expenses and taxes.

Reading an income statement involves understanding these components and analyzing trends over multiple reporting periods. It’s also important to compare a company’s financials with industry peers to understand its relative performance.

Always read the income statement with the balance sheet and cash flow statement for a 360-degree view of a company’s financial health.

Income Statement vs. Balance Sheet

| Basis | Income Statement | Balance Sheet |

| Definition | The income statement, often the profit and loss statement, summarizes a company’s revenues, costs, and expenses over a reporting period. It ends with the net income, the company’s profit, or loss during that period. | The balance sheet gives a snapshot of liabilities, assets, and shareholders’ equity at a specific date. It shows what a company owns and owes, as well as the investment by shareholders. |

| Purpose | Income statements are used to assess a company’s operational efficiency and profitability over a period. It helps stakeholders understand how the company’s revenues are transformed into net income. | It evaluate a company’s financial strength and liquidity. It provides a snapshot of what the company owns (assets), what it owes (liabilities), and the net worth (shareholders’ equity). |

| Key Components | Major components of income statements include revenue, COGS, operating expenses (OPEX), and net income. | Key components of the balance sheet include assets (current and non-current), liabilities (current and long-term), and shareholders’ equity. |

| Time Frame | Income statements cover a specific period, such as a quarter or a year. | Balance sheets represent a single moment in time, typically the end of a quarter or fiscal year. |

| Analysis | Income statements are used for trend analysis, margin analysis, and to calculate financial ratios related to profitability. | Balance sheets are used for liquidity analysis, solvency analysis, and to calculate financial ratios related to financial structure. |

While both income statements and balance sheets are essential for understanding a company’s financial position, they should be used in conjunction with each other and the cash flow statement for a comprehensive analysis.

Accounting Standards and Principles

Several accounting standards and principles govern the creation of income statements. These guidelines ensure the accuracy and consistency of financial reporting across different businesses.

IRS Guidelines

The Internal Revenue Service (IRS) doesn’t provide specific instructions for income statement preparation. However, it mandates businesses to report their income and expenses for tax purposes accurately. The IRS uses this information to calculate the tax liability of a business. It also requires businesses to use cash or accrual accounting consistently.

GAAP Guidelines

GAAP (Generally Accepted Accounting Principles), as applicable in the United States, provide a framework for preparing financial statements, including income statements. Key principles include:

- Revenue Recognition Principle: Revenue is to be recognized when it is earned, not when payment is received.

- Expense Recognition Principle (Matching Principle): Expenses are recognized when the revenues they helped generate are recognized.

- Consistency Principle: Using the same accounting methods and procedures across periods.

- Materiality Principle: Strict accounting is required only for items significant to the business’s financial situation.

IFRS Guidelines

The IAS 1 standard guides the presentation of financial statements, including income statements. Key points include:

- Fair Presentation and Compliance with IFRS: Financial statements must present a fair representation of an entity’s financial position, performance, and cash flows.

- Going Concern: Prepare financial statements on a going concern basis unless management wants to liquidate the business.

- Accrual Basis of Accounting: Items are recognized as assets, liabilities, equity, income, and expenses according to the definition and recognition criteria in the IFRS Framework.

- Materiality and Aggregation: Similar items should be presented separately in the financial statements. Items of a dissimilar nature or function should be presented separately unless they are immaterial.

Conclusion

The income statement is important for financial reporting, tax calculations, and strategic decisions for future growth. Adhering to the guidelines set by IRS, GAAP, and IFRS ensures the accuracy and consistency of these financial reports. This not only aids in internal decision-making but also builds trust with external stakeholders, including investors and creditors.

Sign-up with Akounto to maintain your books of accounts and get an income statement template related to cash or accrual methods to suit your business needs.