Definition

Intangible assets like patents, goodwill, customer lists, etc., do not have a physical form and are crucial for a company’s financial health.

Intangible assets hold significant value in a company’s rights, privileges, or competitive advantages, enhancing its market value and providing more value for a small business.

Examples of intangible assets include intellectual property like patents, copyrights, trademarks, brand recognition, and company acquires like customer lists and proprietary technology.

An identifiable intangible asset can be separated from the company and sold, transferred, licensed, rented, or exchanged.

During an acquisition, the purchasing company also acquires intangible assets as their price is included in the purchase price.

Unidentifiable intangible assets, such as a company’s reputation or brand equity, cannot be separated from the company.

Intangible assets are recorded as long-term assets in the company’s balance sheet because they can generate future economic benefits like financial assets.

Intangible assets are not depreciated like tangible assets but are usually subject to amortization, which is reported as an amortization expense on the profit and loss statement.

Types and Examples

The company’s intangible assets are divided into two broad categories: identifiable and unidentifiable.

Identifiable Intangible Assets

Identifiable intangible assets can be separated from the company and sold or transferred. They have a specific value and can be attributed directly to the company’s activities. Examples of identifiable intangible assets include:

- Intellectual Property: includes patents, copyrights, trademarks, and trade secrets. Intellectual property provides exclusive rights to the owner, enabling them to protect their innovations or brand.

- Customer Lists: are an important resource for marketing and sales departments. They contain valuable information such as customer preferences and contact details.

- Software and Technology: Internally developed intangible resources like proprietary software and technology can offer a competitive edge to a small business.

- Licenses and Permits: Government grants in the form of licenses and permits provide businesses with legal rights to perform specific activities or to operate in certain locations.

- Brand Recognition: Brand equity, often created through advertising and customer experience, is a significant intangible asset. It refers to the added value a brand brings to a product or service in the marketplace.

Unidentifiable Intangible Assets

Unidentifiable intangible assets cannot be separated from the business. They contribute significantly to the company’s value but cannot be sold or transferred separately.

- Goodwill: arises when a company buys another company at a premium paid over the fair market value of the net tangible assets. The excess value is attributable to factors like the company’s reputation, customer loyalty, and brand reputation.

- Brand Equity: relates to the value a well-known brand name brings to an organization. It’s developed over time and is dependent on customer perception.

Valuation

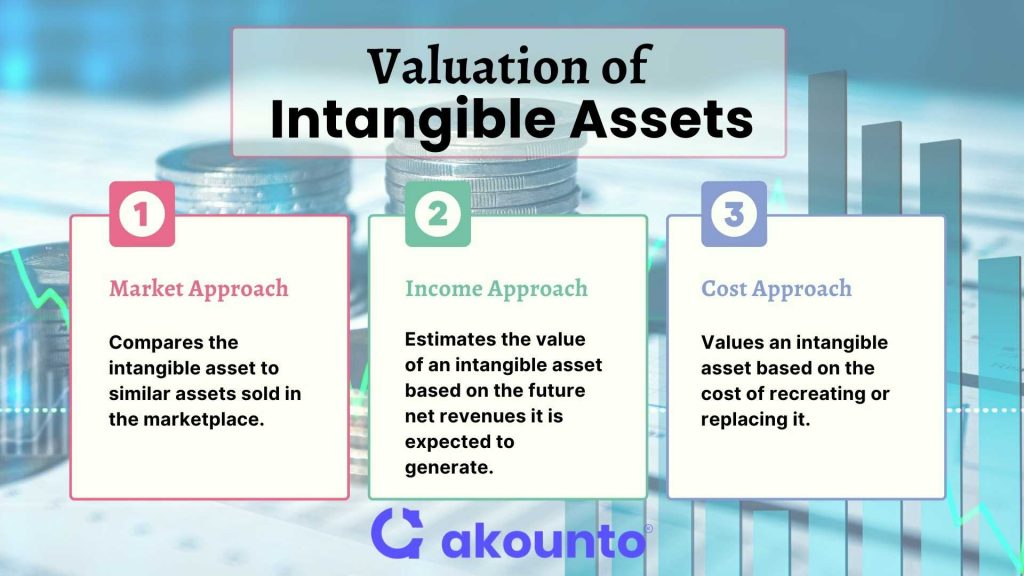

The valuation of intangible assets can be complex due to their non-physical nature and the fact that they are often unique to a specific business. The three most common valuation methodologies are:

- Market Approach: This method compares the intangible asset to similar assets sold in the marketplace. It provides a fair market value based on what buyers are willing to pay under current market conditions.

- Income Approach: estimates the value of an intangible asset based on the future net revenues it is expected to generate. These future revenues are then discounted to present value terms. The method is widely used for assets that directly contribute to a company’s revenue, such as patents or customer lists.

- Cost Approach: The cost approach values an intangible asset based on the cost of recreating or replacing it. It includes direct, indirect, and opportunity costs of the time required to recreate the asset. This approach is typically used when neither the market nor income approach is feasible.

Usually, a combination of these methods may be used to compute a more accurate valuation.

The carrying value of an intangible asset on the balance sheet may not show its current market value. Over time, changes in the market or the asset’s ability to generate revenue can increase or decrease its value.

In-House Creation

Many intangible assets are created in-house due to a company’s innovation, strategic activities, or ongoing business operations. These internally-developed intangible assets can include proprietary technologies, software, customer lists, and the value tied to a company’s brand or reputation.

When an intangible asset is developed internally, it often starts as an expense. For instance, creating accounting software involves costs such as developer salaries, purchase of necessary equipment, and software testing. The expenses are initially reported on the profit and loss statement.

Brand recognition is cultivated through marketing campaigns, customer service experiences, and positive public relations efforts. Branding activities are expensed as they occur; the resulting brand equity is a valuable intangible asset that strengthens customer loyalty and supports premium pricing.

Internal creation of intangible assets allows businesses to tailor them to their specific needs and strategies.

Use in Financial Accounts

- Balance Sheet: Intangible assets appear as separate line item on a company’s balance sheet. They are listed alongside tangible assets under “Non-current Assets” or “Long-term Assets.” The net book value of an intangible asset is determined by deducting any associated amortization expense from its initial purchase price or fair value.

- Income Statement: The amortization of intangible assets, akin to depreciation for physical assets, is recorded as an expense on the income statement. This systematic reduction of the asset’s value over its useful life reflects its consumption or obsolescence.

- Cash Flow Statement:В A company acquires an intangible asset typically results in an outflow of cash, recorded under “Investing Activities.” Similarly, a company selling an intangible asset results in a cash inflow.

- Notes to Financial Statements: Companies often provide additional details about their intangible assets in the notes to the financial statements. These details might include the methods for valuing the assets, their useful lives, amortization methods, and any impairment losses.

Amortization Expenses and Intangible Assets

Amortization is the process of gradually reducing the value of an intangible asset over its useful life, reflecting the asset’s usage, expiration, or obsolescence.

Similar to depreciation for tangible assets, amortization is recognized as an expense on the profit and loss statement. The most common method used for amortizing intangible assets is the straight-line method.

The duration of the amortization period depends on the asset’s expected useful life. For example, a patent might be amortized over the time of its legal life.

Conversely, assets such as brand equity or goodwill with an indefinite useful life are not typically amortized. Instead, they are subject to annual impairment tests to ensure they are not overvalued on the balance sheet.

The amount of accumulated amortization is recorded as a contra-asset account on the balance sheet, reducing the book value of the intangible asset. Over time, this reduction in value reflects the asset’s declining potential to generate future economic benefits.

It’s important to note that the recorded book value of an intangible asset (its cost minus accumulated amortization) may not necessarily represent its current market value. Various factors, such as the asset’s condition, market demand, and the success of the underlying business, can significantly influence its market value.

IRS and Tax Treatment

- Purchased Intangible Assets: When a company acquires intangible assets, such as intellectual property or a customer list, it capitalizes the purchase price on the balance sheet. According to IRS regulations, this capitalized cost can be amortized over 15 years, irrespective of the asset’s actual useful life.

- Internally Created Intangible Assets: The IRS often treats the costs associated with developing such assets as ordinary business expenses, deductible in the year they are incurred. However, some expenses, like costs related to developing software or obtaining a patent, can be capitalized and amortized over their useful lives.

- Goodwill: arises when a company buys another for a premium over the fair market value of its net tangible assets. The IRS allows this goodwill to be amortized over 15 years, even though it’s considered to have an indefinite life for accounting purposes.

- Section 197 Assets: The IRS provides special treatment for Section 197 intangibles. These are certain types of intangible assets acquired in connection with the purchase of a business. They can be amortized over 15 years and include assets such as customer lists, copyrights, and brand names.

- Research and Development Costs: R&D costs aren’t intangible assets; they often lead to the creation of intangible assets. For tax purposes, companies can either expense R&D costs as they occur or amortize them over a minimum of 60 months, starting from when the research benefits are realized.

- Tax Credits: Some intangible assets can attract tax credits. For instance, expenses incurred in increasing research activities can be claimed as a tax credit, reducing a company’s tax liability.

Way Forward

Intangible assets hold tremendous potential, significantly contributing to a company’s overall value. By thoroughly understanding these assets’ nature, valuation, and tax implications, small businesses and entrepreneurs can gain valuable insights, ultimately leading to strategic advantages in today’s competitive business landscape.

To learn more about accounting topics, visit Akounto’s website today.