Defining Interest Expense

Interest expense represents the cost of borrowing money. This expense is associated with the interest payments on any outstanding debt obligations, such as loans or bonds. It is a core expense that businesses choose to incur when they borrow funds to finance operations, invest in assets, or expand their scope.

Interest expense is recorded as a liability account on the balance sheet until paid off. It directly impacts a company’s net income and operating profit, as it is subtracted from the gross income to calculate net profit.

Interest expense is tax-deductible, providing a company with significant financial advantages.

Managing interest expense requires careful financial planning and understanding of the company’s finances, given its potential impact on the company’s bottom line and the time period of the debt obligation.

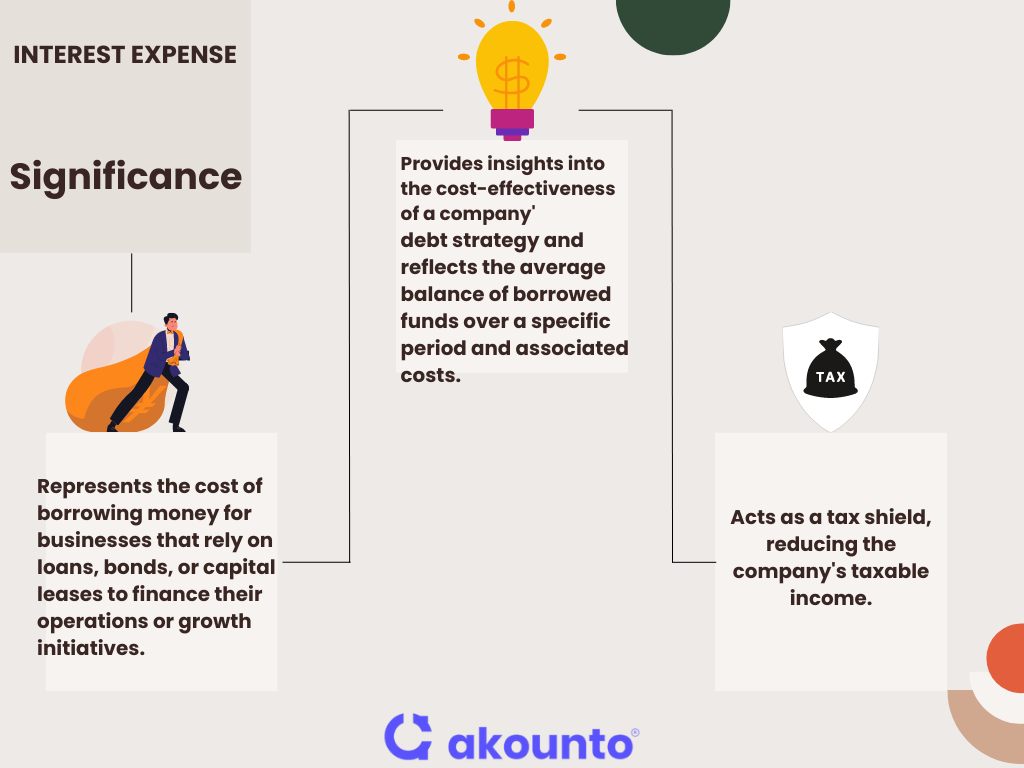

Significance

A company’s interest expense is the cost of borrowing money. The interest rate applied to these borrowed funds determines the annual interest expense, which can significantly impact a company’s bottom line.

Interest expense provides insights into the cost-effectiveness of a company’s debt strategy, reflecting the average balance of borrowed funds over a specific period and the associated cost reflecting company’s financial health.

Interest expense plays a key role in tax planning by acting as a tax shield, reducing the company’s taxable income.

The higher the interest expense, the lower the taxable income, given that interest payments are generally tax-deductible. The actual tax savings depend on the company’s tax rate.

Calculation

The calculation of interest expense involves determining the cost incurred due to the interest accrued on borrowed funds over a specific period. This calculation is essential for accurately reporting interest expenses on the company’s income statement.

Interest Expense Formula

The interest expense is calculated by multiplying the outstanding debt balance by the applicable interest rate. Here’s the formula:

Interest Expense = Outstanding Debt Balance x Interest Rate

The formula to calculate interest expense provides the interest expense for a specific period, usually a year.

The interest rate should match the period for which the interest is calculated.

Note: Convert the annual interest rate to the monthly interest rate while calculating monthly interest expense.

Example

Example 1: A company has an outstanding debt balance of $10,000 at an annual interest rate of 5%. Calculate interest expense on an annual basis.

Solution: The annual interest expense would be calculated as follows:

Using Interest Expense Formula = $10,000 x 0.05 = $500.

The company would report an interest expense of $500 on its income statement for that year.

Example 2: A company has a $5,000 loan at 4% interest and a $7,000 loan at 6% interest. Calculate total annual interest expense.

Solution: The total annual interest expense would be calculated as follows:

| Loan Amount | Interest Rate | Interest Expense |

| $5,000 | 4% | $200 |

| $7,000 | 6% | $420 |

| Total | $620 |

Therefore, the company would report a total interest expense of $620 on its income statement for that year.

Example 3: A company has a $20,000 loan at an annual interest rate of 7%. However, the company pays off $5,000 of the loan halfway through the year. Compute annual interest expense.

Solution: For the first half of the year, the interest expense is calculated on the full loan amount: $20,000 x 0.07/2 = $700. For the second half of the year, the interest is calculated on the remaining loan amount: ($20,000 – $5,000) x 0.07/2 = $525. So, the total interest expense for the year is $700 + $525 = $1,225.

Interest Expense – Recording in Books of Accounts

Journal Entries

Journal entries for interest expense are made when the interest is accrued, regardless of whether the payment has been made.

The interest expense account, an expense account on the income statement, is debited, and the interest payable account, a liability account on the balance sheet, is credited. Here’s the format:

| Date | Account Title | Debit | Credit |

| Interest Expense | Amount | ||

| Interest Payable | Amount |

When the interest payment is made, another entry is made to debit the interest payable account and credit the cash account.

| Date | Account Title | Debit | Credit |

| Interest Payable | Amount | ||

| Cash | Amount |

Cash Flow Statement

The interest paid, on the cash flow statement, is listed as a separate line item under the section operating activities. This reflects the cash outflow due to interest payments. If the interest is capitalized as part of an asset’s cost, it may be reported under investing activities.

Balance Sheet

On the balance sheet, the outstanding principal of the borrowed money is reported as a liability. Any interest accrued but unpaid is reported as interest payable under current liabilities. If the company has prepaid any interest, it is reported as a prepaid item under current assets.

Understanding the Interest Coverage Ratio

The Interest Coverage Ratio (ICR) is a key financial metric that helps assess a company’s ability to meet its interest expenses on borrowed money. It provides insight into the finances of a business by measuring how comfortably a company can pay interest on its outstanding debt.

Formula for computing the Interest Coverage Ratio:

Interest Coverage Ratio Formula = Earnings Before Interest and Taxes (EBIT) / Interest Expenses

A higher ratio indicates that the company generates sufficient earnings to cover its interest expenses, suggesting strong financial health.

A lower ratio may signal financial distress, indicating that the company might struggle to meet its interest obligations.

The Interest Coverage Ratio is typically reported along with the income statement and is a critical tool for investors, lenders, and analysts to evaluate a company’s financial stability and risk level. It’s integral to understanding a company’s finances and capacity to manage debt effectively.

Debt Leverage

Debt leverage or financial leverage involves using borrowed money to finance company operations, investments, and growth initiatives. The Debt quantifies it to Equity Ratio, which is calculated as follows:

Debt to Equity Ratio = Total Debt / Total Equity

A higher ratio means greater debt leverage, suggesting that the company relies heavily on borrowed funds.

While debt can provide a company with the resources it needs to expand and thrive, excessive debt leverage can increase financial risk and potentially lead to financial distress.

Conclusion

Interest expense impacts a company’s income statement, balance sheet, and cash flow statement and plays a key role in financial metrics like the Interest Coverage Ratio and Debt to Equity Ratio. Companies can optimize their financial performance and ensure sustainable growth by effectively managing interest expenses.

Visit Akounto and explore the potential benefits of accounting software for accurate interest expense calculations.