What are Internal Controls in Accounting?

Internal controls are accounting and audit mechanisms for risk mitigation, preventing and detecting errors, frauds, and irregularities.

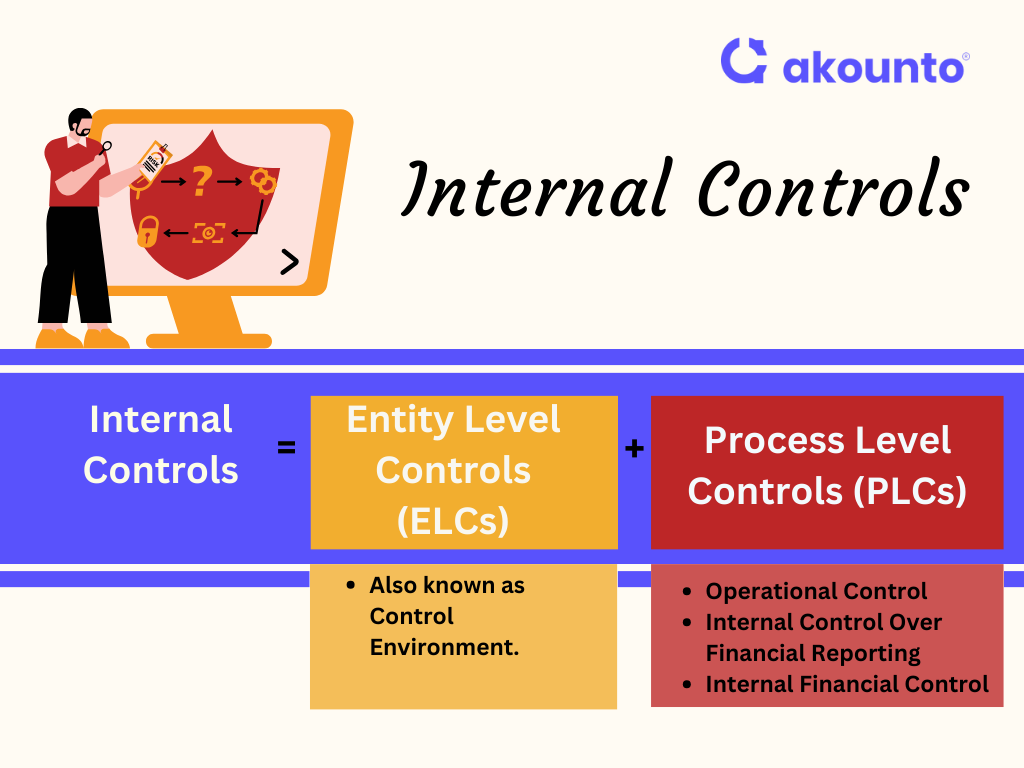

Internal controls can be broad-based and related to a specific process. Broad-based internal controls are applicable to the whole organization, hence the names “Entity Level Control (ELCs) “and “Process Level Controls (PLCs).”

An example of ELCs includes a code of conduct, organizational culture, awareness, etc. An example of PLCs includes a focus on payrolls, invoice processing, etc,

Internal controls are essential for risk assessment and provide reasonable assurance that a company’s financial statements are free from accounting errors or fraudulent activities.

Entity level controls (ELCs) are also called “Control Environment.”

Process level controls (PLCs) include these 3 components:

- Operational Control

- Internal Control over financial reporting

- Internal Financial Control

Thus we have,

Internal Controls = Control Environment + Process Level Controls

In any financial audit, the external auditors examine and test internal accounting processes, internal auditor’s reports, and the effectiveness of internal controls to give a “professional auditor’s opinion” about the effectiveness of financial processes and as a part of larger inputs for preparing the financial statements.

Internal controls aim to pre-empt, prevent, and detect any financial misconduct, be it deliberate or by mistake. This is to ensure the accuracy and reliability of financial information in terms of accounting reports, financial statements, and any statutory disclosures.

In the US, the Sarbanes-Oxley Act (2002) imposes criminal penalties on managers for failing to establish and implement internal controls. This is done to protect the investors from any financial or accounting fraud. There must be an audit trail, justification, and documentation of all the transactions and financial processes to substantiate the financial records.

Internal controls are formulated and established by the management of the company, represented by the Board of Directors, key managerial personnel, and any such person as mandated by law. The internal controls aim to provide “reasonable assurance” for accuracy and reliability in typically 3 areas:

- Operations: Using the entity’s resources effectively and efficiently.

- Reporting: Ensuring timely preparation of accurate and reliable financial statements.

- Compliance: Compliance with rules, laws, and regulations in force.

Internal controls are a combination of policies, guidelines, and processes that can be manual as well as automated.

Internal Control-Integrated Framework

The Committee of Sponsoring Organizations of the Treadway Commission (COSO) gave an Internal Control-Integrated Framework, which is used all over the globe and has been widely adopted in the United States.

COSCO was formed in 1985 as a sponsor of the National Commission on Fraudulent Financial Reporting and also gave recommendations for the Securities Exchange Commission (SEC), independent auditors, and various educational institutions.

COSO was organized in 1985 to sponsor the National Commission on Fraudulent Financial Reporting, an independent, private-sector initiative that studied the causal factors that can lead to fraudulent financial reporting. It also developed recommendations for public companies and their independent auditors, for the SEC and other regulators, and for educational institutions. COSO has representatives from various industry bodies, the New York Stock Exchange, investment firms as well as public accounting bodies.

​Internal Control—Integrated Framework (ICIF) was released in 1992 and updated in 2013 (ICIF-2013 or Framework). It is a guidance to ensure “reasonable assurance” and confidence in data and information disclosures.

COSO issued supplemental guidance for achieving effective internal control for sustainability reporting in 2023.

“Internal control is a process, effected by an entity’s board of directors, management, and other personnel, designed to provide reasonable assurance regarding the achievement of objectives relating to operations, reporting, and compliance.”

ICIF-2013

Further, ICIF gives 5 Components of Internal Controls

- Control Environment

- Risk Assessment

- Control Activities

- Information and Communication

- Monitoring Activities

Each component has its own set of principles, having 17 principles in total for all the components of the Internal Controls Framework, which together form ICIF Cube.

These principles can be applicable on a very wide spectrum ranging from entity level to even a particular division, branch, operating unit, or a specific function.

5 Components of Internal Controls

I. Control Environment

The control environment aims to involve senior leadership of the organization to set the tone right from the top management level. The standards of conduct established at this level are in alignment with the organizational value statement and vision and are applicable on the organizational scale.

The top management is in a position to enforce policy compliance and can develop an oversight mechanism. They can take corrective measures and address deviations when detected.

Principles covered under Control Environment:

- Commitment to integrity and ethical values

- Independent board of directors oversight

- Structures, reporting lines, authorities, responsibilities

- Attract, develop, and retain competent people

- People held accountable for internal control

II. Risk Assessment

Risk assessment is a continuous process involving setting benchmarks and “materiality”, setting levels of precision, detecting and identifying risks, deciding risk tolerance levels, and mechanisms to mitigate the risk.

Principles covered under Risk Assessment:

- Clear objectives specified

- Risks identified to achievement of objectives

- Potential for fraud considered

- Significant changes identified and assessed

III. Control Activities

Control activities can be preventive or detective and can be manual or automated. The nature of control activities includes:

- Approvals and authorizations

- Segregation of duties

- Reconciliations

- Technology controls

- Verifications

- Mapping responsibilities to the individuals

Principles covered under Control Activities:

- Control activities selected and developed

- General IT controls selected and developed

- Controls deployed through policies and procedures

IV. Information and Communication

Internal and external communication are important to ensure reliable transmission and understanding of data, reports, processes, internal controls, etc. Relevant, qualified and material information should be exchanged between authorized parties and there should be transparency in disclosures. The communication with third parties, regarding internal controls and their functioning should be complete within the legal and operational boundaries.

Principles covered under Information and Communication:

- Quality information obtained, generated, and used

- Internal control information internally communicated

- Internal control information externally communicated

V. Monitoring Activities

Ongoing routine evaluations, real-time feedback mechanisms, employing technology and automation to track and detect irregularities, third party audits and risk evaluations, etc. are employed to ensure the effective working of the 5 components.

Principles covered under Monitoring Activities:

- Ongoing and/or separate evaluations conducted

- Internal control deficiencies evaluated and communicated

Need for a Company’s Internal Controls

Internal controls are indispensable for risk assessment, regulatory compliance, operational efficiency, and financial integrity. They are the safeguards every company needs to operate effectively and maintain trust among stakeholders.

Risk Mitigation

Companies face various risks, including financial, operational, and compliance risks. Internal controls help identify these risks and implement measures to mitigate them. For instance, preventative and detective controls can help avoid accounting errors and detect fraudulent activities.

Regulatory Compliance

Internal controls ensure that a company meets all legal requirements, including financial reporting and audits. This is particularly crucial for public companies subject to regulations like the Sarbanes-Oxley Act.

Operational Efficiency

Internal controls also contribute to operational efficiency. Standardizing accounting procedures and financial transactions helps eliminate redundancies and streamline operations. This not only saves time but also resources, thereby contributing to the company’s overall productivity.

Financial Integrity

Maintaining the integrity of financial information is another critical need for internal controls, ensuring that all financial transactions are correctly authorized, recorded, and reported, thereby preventing any discrepancies in financial statements.

Audit Preparedness

Being audit-ready is essential for any business. Internal controls facilitate internal and physical audits by ensuring that all accounting records are thorough and accurate. This makes the audit process smoother and more efficient.

Types of Internal Controls in a Company

Preventive Controls

Preventive controls are proactive measures designed to prevent fraud and errors before they occur. These include access controls that limit physical access to sensitive financial and accounting information. Approval authority is often required to approve financial transactions, ensuring that only authorized personnel can make financial commitments on behalf of the company.

Detective Controls

Detective controls are designed to identify and flag errors and inconsistencies in financial reporting and accounting systems. These controls include periodic reconciliations of account balances and internal audits. Their primary function is to detect fraudulent accounting activities and accounting fraud that might have slipped through preventive measures.

Corrective Controls

Corrective controls come into play after a discrepancy or error has been identified. These controls focus on rectifying the issue and may involve adjusting account balances or taking disciplinary action against managers responsible for the oversight.

Control Activities

Control activities encompass a range of actions within the accounting controls framework. These can include everything from limiting physical access to financial records to ensuring that financial transactions are properly authorized and recorded.

Importance of a Robust Control Structure

A robust control structure is not just a compliance requirement but a business imperative. Internal controls are important for safeguarding assets, ensuring accurate financial reporting, and preventing fraud. They provide the foundation for a secure and efficient accounting system, thereby reinforcing the company’s financial stability.

Examples

Vendor Payment Authorization

In many companies, the accounting department employs a two-step verification process for vendor payments. An employee prepares the payment but requires managerial approval before processing. This separation of duties is a preventative control against fraudulent activities and errors.

Daily Cash Count and Reconciliation

Retail businesses often require employees to count cash at the end of each day. This amount is then reconciled with sales records to ensure accuracy. Any discrepancies trigger an internal audit, providing a layer of detective control that can uncover issues ranging from simple accounting errors to potential theft.

Automated Inventory Tracking

Modern businesses often use automated systems to track inventory receipts and shipments. These systems are programmed to flag discrepancies, such as missing items or unexpected surpluses, thereby serving as a quality control measure that ensures accurate financial disclosures.

There are many modern-day methods to track inventories, like the Perpetual Inventory System and the Specific Identification Method. The Periodic Inventory System is for physically tracking the inventory and is useful for businesses yet to transition to automation.

Employee Expense Reports

Companies often have stringent policies and procedures for filing employee expenses. Receipts must be submitted, and expenditures must fall within company guidelines. The accounting department reviews these reports, and any anomalies are escalated for further investigation, serving as a preventative control.

Digital Access Logs

To protect sensitive financial information, companies often maintain digital access logs that record who has accessed particular files or systems. This is a preventative and detective control, as unauthorized access can be immediately identified and addressed.

Advantages of Internal Controls

The implementation of robust internal controls in addition to internal and external audits, offers a multitude of advantages that extend beyond mere compliance with accounting policies and regulations like the Sarbanes-Oxley Act. Below are some key benefits:

- Risk Mitigation: Internal controls help identify relevant risks and implement corrective action, reducing the likelihood of accounting errors or fraudulent activities.

- Financial Accuracy: Regular checks, such as trial balances, ensure the accuracy of accounting information. This is crucial for stakeholders who rely on financial reports for decision-making.

- Regulatory Compliance: Standardized policies and procedures simplify adherence to laws and regulations. This is particularly important for public companies subject to stringent reporting requirements.

- Fraud Prevention: Effective internal controls make it difficult for employees or external actors to commit fraud. Measures like hand-counting cash and authorization practices add layers of security.

- Operational Efficiency: Streamlined accounting processes result in time and cost savings. For example, automated approval workflows for credit customers can speed up the sales cycle.

- Audit Preparedness: Internal controls facilitate easier and more efficient audits, ensuring that all financial transactions are well-documented and authorized.

- Enhanced Accountability: The clear delineation of roles and responsibilities within the accounting department helps hold individuals accountable for their actions.

- Public Trust: In the wake of corporate fraud scandals, strong internal controls can help rebuild and maintain public trust in businesses.

- Strategic Decision-Making: Accurate and reliable financial data enable better strategic planning and decision-making for the company.

- Customer and Investor Relations: Transparency and accuracy in financial reporting can significantly improve relations with customers and investors.

Limitations of Internal Controls

- Human Error: No matter how robust an internal control system is, the possibility of human error remains. Mistakes in data entry or misinterpretation of information can compromise the effectiveness of internal controls.

- Cost Factor: Implementing and maintaining internal control systems can be expensive. The cost may outweigh the benefits for smaller companies, making it less feasible to establish a comprehensive control environment.

- Complexity: As a business grows, its internal control systems may become increasingly complex, making it challenging to manage and monitor all control mechanisms effectively.

- Management Override: Even the best internal control systems can be overridden by senior management, leading to fraudulent activities or accounting irregularities.

- Technological Limitations: While technology can enhance internal controls, it also comes with challenges, such as cybersecurity risks, that can compromise the control environment.

- False Sense of Security: A well-designed internal control system can sometimes lead to complacency, making employees less vigilant in monitoring for irregularities within the control environment.

- Adaptability Issues: Internal controls may not be flexible enough to quickly adapt to a changing business landscape, regulatory updates, or market conditions.

- Internal Sabotage: Employees with sufficient knowledge of the internal control systems can manipulate them for personal gain, weakening the control environment.

- Effectiveness Over Time: The effectiveness of internal controls may diminish over time if they are not regularly updated and tested, making the control environment less reliable.

Using Finance Automation for Internal Controls

Automation tools can be integrated into existing internal control systems to enhance their effectiveness and reduce human error. Here’s how:

- Efficiency: Automation speeds up repetitive tasks like data entry, allowing employees to prioritize complex control activities.

- Accuracy: Financial data is more reliable because automated systems/software are less prone to errors than manual processes.

- Compliance: Finance automation can be programmed to adhere to regulatory requirements, making maintaining compliance and improving the control environment easier.

- Audit-Readiness: Automated systems maintain thorough documentation, simplifying the audit process and providing reasonable assurance of the integrity of financial statements.

- Risk Mitigation: Automation tools can flag inconsistencies or irregularities in real-time, allowing immediate corrective action and enhancing the company’s risk assessment capabilities.

Conclusion

Internal controls are the backbone of any organization’s financial integrity, offering a structured approach to risk assessment, regulatory compliance, and operational efficiency. These controls, which range from preventative measures to corrective ones, guarantee the accuracy and dependability of financial transactions and reporting. The incorporation of finance automation increases the efficiency of internal controls and offers a contemporary response to age-old problems.

Visit Akounto Blogs, to get knowledge and information about accounting and finance to manage your business better.