Understanding Inventory Valuation

Inventory valuation helps determine the monetary value of the goods available for sale and the cost incurred in storing unsold inventory stock.

Inventory accounting includes assessing raw materials, work-in-progress, and finished goods. In other words, knowing ‘how much inventory’ you have and its total worth is vital for accurate financial reporting and tax liability calculations.

Inventory valuation plays an instrumental role in managing inventory for every business owner.

What is Inventory?

Inventory represents the goods available for sale in a company’s regular course of business. It consists of raw materials, work-in-progress, and the finished goods sold to customers.

Inventory is considered a current asset on a company’s balance sheet. Excessed unsold inventory can lead to higher storage costs, while a shortage might result in lost sales and customers.

Rising prices can impact the cost of goods sold and the value of unsold inventory. Proper inventory management, including accurate inventory valuation, impacts current asset reporting on the balance sheet and computation of net sales.

Inventory valuation also impacts a company’s income statement, as the cost of goods sold is deducted from sales revenue to determine gross profit.

The chosen inventory valuation method can have significant tax implications and affect the company’s reported profit.

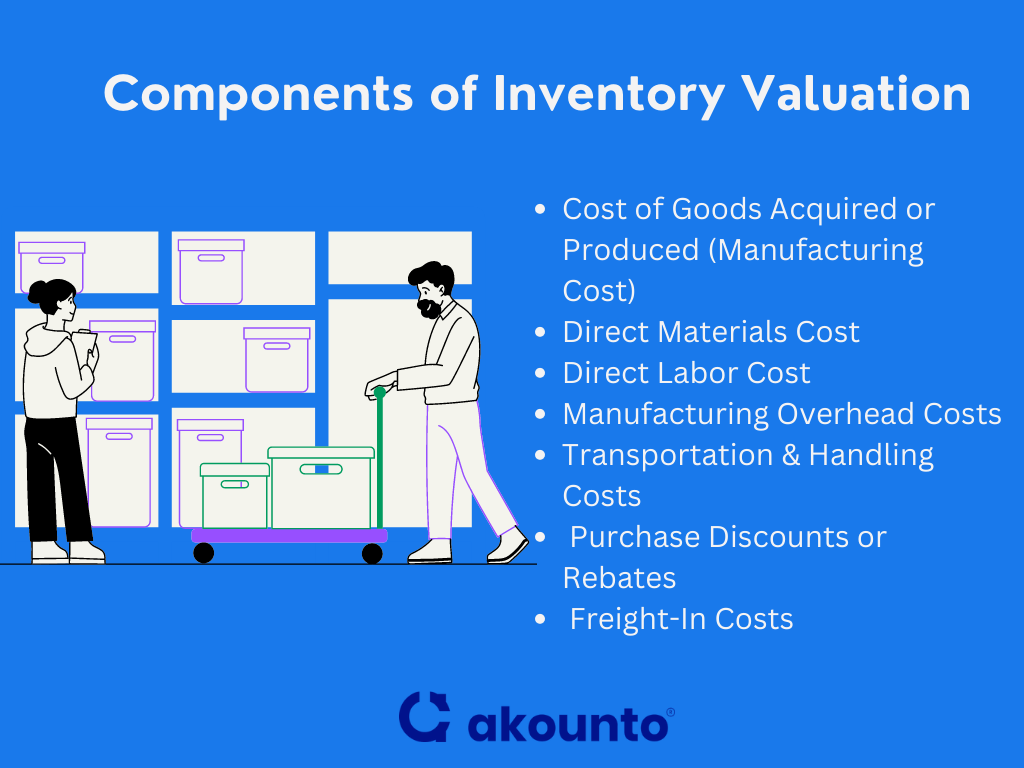

Components of Inventory Valuation

The process of inventory valuation comprises several components. Each component is input in various inventory costing methods and helps to compute the total cost of goods sold, determining the remaining inventory’s value and ultimately affecting a company’s balance sheet and net income.

Cost of Goods Acquired or Produced (Manufacturing Cost)

A significant component of inventory valuation is the cost of goods acquired or produced. It represents the expense directly incurred in manufacturing or purchasing goods for sale. This cost is an integral part of calculating the inventory value, and it influences the cost of goods sold, thereby impacting the gross profit.

Direct Materials Cost

Direct materials cost refers to the expenditure on converting raw materials into finished goods. These costs vary directly with the number of inventory items produced. Keeping track of direct material costs is crucial for precise inventory valuation.

Direct Labor Cost

The labor cost directly associated with producing the goods is another component of inventory valuation. This cost includes wages, salaries, and payroll taxes paid to employees directly involved in manufacturing.

Manufacturing Overhead Costs

Manufacturing overhead costs are the indirect costs of production that cannot be directly linked to a specific product. These costs include utilities, rent, depreciation on machinery, and factory upkeep. Though not directly attributable to any particular inventory item, they are essential to inventory costs.

Transportation and Handling Costs

The cost of transporting raw materials to the manufacturing site and handling costs associated with receiving and storing materials also add to the total cost of the inventory.

Purchase Discounts or Rebates

Any purchase discounts or rebates obtained from suppliers decrease the cost of acquiring inventory and, subsequently, the inventory valuation.

Freight-In Costs

Freight-in costs refer to the transportation costs incurred to bring the goods to a company’s location. These costs form part of the cost of acquiring inventory.

Any Additional Costs

Other inventory costs include any other expenses directly attributable to acquiring or producing the inventory, such as costs for quality testing or product adjustments. They are incorporated in the inventory value according to generally accepted accounting principles (GAAP).

Accurately calculating these components helps business owners maintain proper inventory management, ensure compliance with accounting standards, and make informed business decisions.

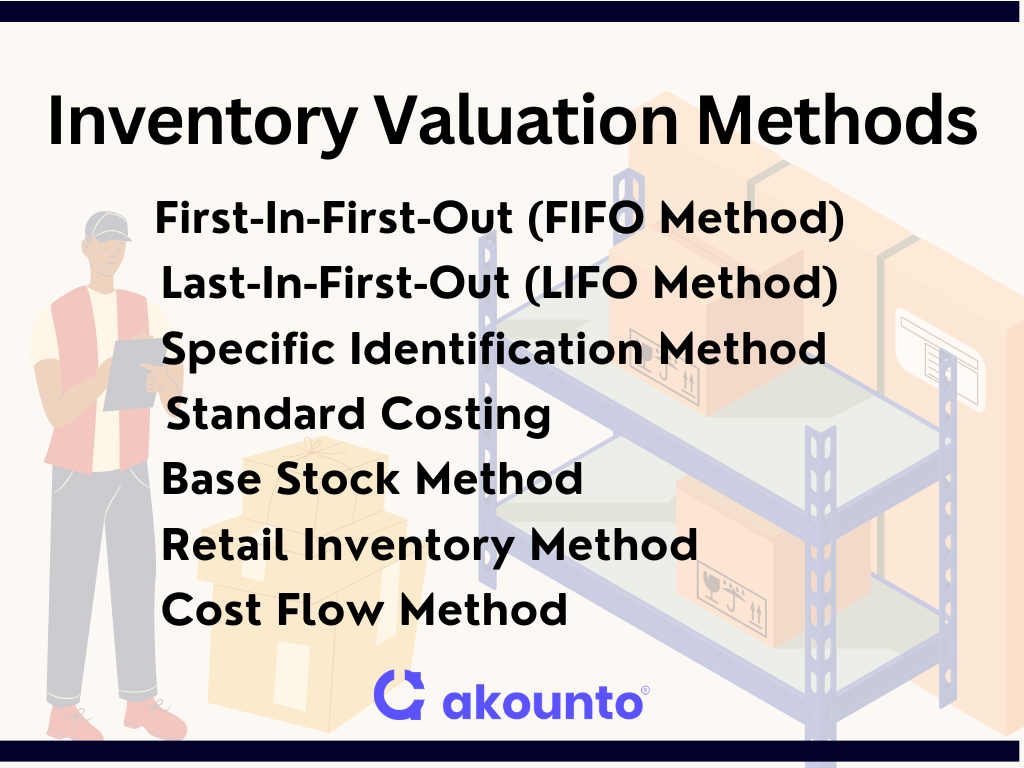

Inventory Valuation Methods

First-In-First-Out (FIFO Method)

The FIFO method states that the first inventory items acquired (or produced) are the first ones to be sold.

Under the FIFO method, the cost of the beginning inventory and the earliest purchases are first recognized in the cost of goods sold, resulting in the remaining inventory being valued at the most recent costs.

This valuation method is generally more realistic as it mimics the actual flow of goods. Still, it can lead to higher gross profit in rising prices due to the lower cost of older inventory being matched against current sales.

Last-In-First-Out (LIFO Method)

The LIFO valuation method assumes that the most recently acquired or produced inventory items are the first to be sold.

The costs of the most recent purchases are matched against revenue and reported in the cost of goods sold. The older costs associated with the beginning inventory and earlier purchases are reported in the ending inventory on the company’s balance sheet.

While the LIFO method might not reflect the actual inventory flow, it can result in lower taxable income and tax liability during rising prices, as the higher cost of the recent inventory is recognized first.

Weighted Average Cost Method

Weighted Average Cost method involves calculating a weighted average cost per unit for all goods available for sale during an accounting period. In the weighted average cost, the inventory is determined by averaging the cost of all inventory items in stock, irrespective of when they were purchased or produced.

The weighted average cost is calculated by dividing the total cost of goods (beginning inventory plus all purchases) by the total number of units available for sale. The average cost is spread to the units sold and those remaining in the closing inventory.

The Weighted average cost formula:

Weighted Average Cost (per unit of inventory) = Total Cost of Goods Available for Sale / Total Units Available for Sale.

Where:

- The Total Cost of Goods Available for Sale is the sum of the beginning inventory cost and the cost of any additional inventory purchased or manufactured during the accounting period.

- The Total Units Available for Sale include all units in the beginning inventory plus any additional units purchased or manufactured during the accounting period.

Once the weighted average cost per unit is calculated, it is multiplied by the number of units sold and remaining in inventory to determine the COGS and the ending inventory value, respectively.

The weighted average cost method smoothes out cost fluctuations that can occur with LIFO or FIFO methods, making it particularly useful for businesses with large quantities of similar items where individual tracking isn’t practical.

Weighted average cost does not always accurately reflect the actual cost flow due to the averaging out of costs.

Specific Identification Method

The Specific identification method for inventory valuation precisely tracks the actual cost of each inventory item.

Specific identification method requires detailed record-keeping as each item in inventory must be separately accounted for, including its purchase price and associated costs.

Specific identification is most suitable for businesses that sell high-value, unique items with significant cost variations, such as real estate, artwork, or custom-designed products.

Specific identification provides the most accurate cost flow matching. Still, it can be subject to management manipulation as it allows the deliberate selection of costs to be recognized in income.

Standard Costing

The Standard Costing method is indeed a statistical technique employed for inventory valuation. It predetermines the standard costs of various production elements, including direct materials, direct labor, and overhead costs. These standard costs serve as benchmarks or norms for performance evaluation.

Inventory is initially valued at these standard costs in the standard costing system. When production costs are incurred, they are compared with the predetermined standard costs. The difference, known as variance, is analyzed to understand the reasons for the deviation. This analysis helps business owners to control costs, enhance efficiency, and make informed operational and financial decisions.

This valuation method simplifies bookkeeping, allowing for easier budgeting and performance evaluation. It highlights variances between standard and actual costs, helping businesses identify inefficiencies and take corrective actions.

Base Stock Method

The Base Stock valuation method is another inventory valuation method that assumes a certain level of inventory is always maintained in stock as safety or buffer stock. This “base stock” is valued at the historical cost, while any inventory over the base stock level is valued using another method such as FIFO, LIFO, or Weighted Average Cost.

This method is more applicable to businesses dealing with non-perishable goods where there’s a need to maintain a certain inventory level at all times.

Retail Inventory Method

The Retail Inventory method is used primarily in the retail industry for valuing inventory. This method uses the ratio of the cost of merchandise purchased to the retail price. By applying this ratio to the retail price of ending inventory, an approximation of the cost of ending inventory can be obtained.

The advantage of the Retail Inventory method is its simplicity and convenience. It allows retailers to estimate inventory costs without a physical count, which can be time-consuming and disruptive to business operations. This method provides an estimate, not the exact cost of ending inventory, and may not always accurately reflect inventory costs.

Cost Flow Method

The Cost Flow valuation method refers to the assumptions about the flow of inventory costs in a business. It doesn’t necessarily follow the actual flow of goods but determines how costs are moved from inventory to the cost of goods sold. The cost flow assumptions include methods like First-In-First-Out (FIFO), Last-In-First-Out (LIFO), and Weighted Average Cost.

The selection of the cost flow assumption is crucial for valuing inventory and significantly impacts the financial statements. It affects the value of ending inventory, COGS, gross profit, and net income. The chosen cost flow assumption must accurately reflect a company’s business model and the nature of its inventory.

Accounting Guidelines on Inventory Valuation

Inventory valuation is a significant aspect of financial reporting and is regulated by several accounting standards. The main regulatory bodies for these standards are the Financial Accounting Standards Board (FASB), which formulated the GAAP (Generally Accepted Accounting Principles), and IASB (International Accounting Standards Board), which establishes the International Financial Reporting Standards (IFRS).

Under GAAP, the primary guideline for inventory valuation is Accounting Standards Codification (ASC) 330.

ASC 330, issued by the Financial Accounting Standards Board (FASB), prescribes the use of either the First-In, First-Out (FIFO); Last-In, First-Out (LIFO); or the Weighted Average Cost method for inventory valuation. This standard adheres to the “lower of cost or market rule, which mandates inventory to be reported at the lower of either the original cost or the current market value on the balance sheet.

FRS standard for inventory valuation is International Accounting Standard (IAS) 2. According to IAS 2, set by the International Accounting Standards Board (IASB), the LIFO method is not permissible for inventory valuation.

IFRS requires businesses to record their inventory at the lower of its cost and its net realizable value (estimated selling price minus estimated costs of completion and sale).

Businesses must understand the rules and guidelines laid out by these accounting standards. They must select the right inventory valuation method that best suits their operational structure, inventory type, and financial objectives.

A business owner must disclose the inventory valuation method used in the financial statements.

Stock Turnover Ratio

The Stock Turnover Ratio (Inventory Turnover Ratio) measures the times a company sells and replaces its inventory within a given period. It is an indicator of inventory efficiency and liquidity. The formula to calculate the Stock Turnover Ratio is:

Stock Turnover ratio = COGS / Average Inventory

Where:

- Cost of Goods Sold (COGS) represents the direct costs of producing the goods a company sells during a specific period.

- Average inventory is the mean value of the inventory during the period. It is typically calculated as the average of the beginning and ending inventory for the period.

A higher Stock Turnover Ratio signifies that a company is efficiently managing its inventory, selling its products quickly, and is less likely to experience stock obsolescence. A lower ratio might suggest overstocking or challenges in selling the inventory.

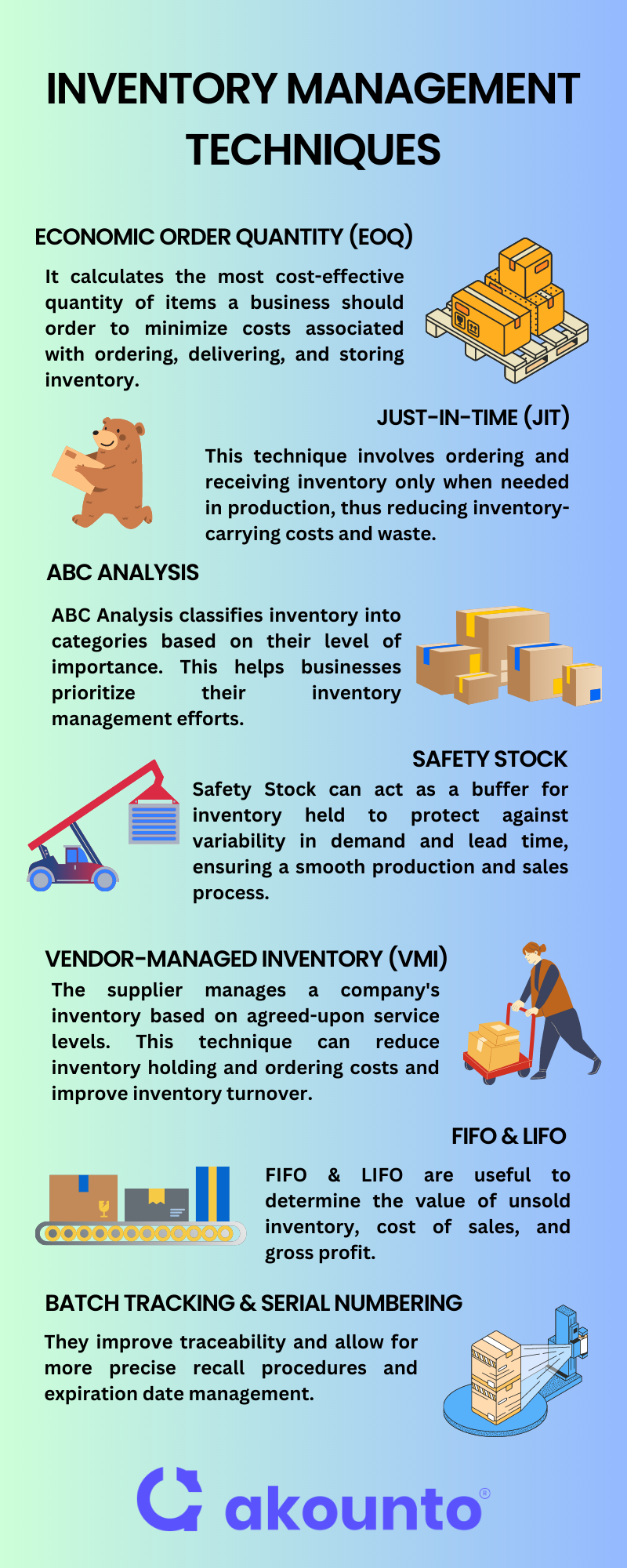

Inventory Management Techniques

Effective inventory management is vital for business profitability and operational efficiency. Several inventory management techniques can be applied to optimize inventory value and reduce holding and ordering costs.

Economic Order Quantity (EOQ)

EOQ is a formula that calculates the most cost-effective quantity of items a business should order to minimize costs associated with ordering, delivering, and storing inventory. EOQ is a fundamental part of calculating inventory, aiding in maintaining a balance between carrying too much or too little stock.

Just-In-Time (JIT)

The JIT technique involves ordering and receiving inventory only when needed in production, thus reducing inventory-carrying costs and waste. It requires accurate demand forecasting and reliable suppliers to avoid stockouts that can disrupt production.

ABC Analysis

This method classifies inventory into three categories (A, B, and C) based on importance. ‘A’ items are high-value items with a low frequency of sales, ‘B’ items are moderate-value items with a medium frequency of sales, and ‘C’ items are low-value items with a high frequency of sales. This analysis helps businesses prioritize their inventory management efforts.

Safety Stock

Safety stock is a buffer of inventory held to protect against variability in demand and lead time. It helps prevent stockouts and ensures a smooth production and sales process.

Vendor-Managed Inventory (VMI)

Under VMI, the supplier manages a company’s inventory based on agreed-upon service levels. This technique can reduce inventory holding and ordering costs and improve inventory turnover.

FIFO and LIFO

FIFO and LIFO are inventory valuation methods used in cost accounting to determine the value of unsold inventory, cost of sales, and gross profit.

Batch Tracking and Serial Numbering

Batch tracking and serial numbering are techniques for tracking individual batches or units of inventory from production to sale. They improve traceability and allow for more precise recall procedures and expiration date management.

Examples

Example 1

Suppose a small clothing boutique buys five shirts at $10 each and later purchases another five shirts at $15 each.

If the boutique sells seven shirts, using the FIFO method,

the cost of goods sold will be $70 ($10/shirt x 5 shirts + $15/shirt x 2 shirts).

The remaining inventory will be $45 ($15/shirt x 3 shirts).

Example 2

Using the same scenario, if the boutique uses the LIFO method,

the cost of goods sold will be $85 ($15/shirt x 5 shirts + $10/shirt x 2 shirts).

The remaining inventory will be $30 ($10/shirt x 3 shirts).

Example 3

For the weighted average cost method,

the average cost per shirt is calculated as $12.50 [($10/shirt x 5 shirts + $15/shirt x 5 shirts) / 10 shirts].

So, if the boutique sells seven shirts, the cost of goods sold will be $87.50 ($12.50/shirt x 7 shirts).

The remaining inventory will be $37.50 ($12.50/shirt x 3 shirts).

Example 4

Assume a business had a beginning inventory of $100,000, an ending inventory of $120,000, and a cost of goods sold of $500,000 for the year. The average inventory is calculated as $110,000 [($100,000 + $120,000) / 2]. Therefore, the inventory turnover ratio would be 4.55 ($500,000 / $110,000). This means the company turns over its inventory 4.55 times during the year.

Example 5

The furniture company’s standard cost for a chair includes $50 for materials, $30 for labor, and $20 for manufacturing overhead, resulting in a total standard cost of $100 per chair.

If the company produces 500 chairs monthly, the standard cost for this production run is $50,000 ($100/chair x 500 chairs).

At the end of the month, the company found that the actual cost was $52,000 due to increased material prices and additional labor hours.

The difference of $2,000 is called a ‘variance,’ in this case, it’s an unfavorable variance. This variance helps the company identify areas of inefficiency and cost overruns, allowing them to make necessary adjustments to control costs better.

Inventory Valuation and Financial Statements

Inventory valuation is pivotal in preparing and interpreting a company’s financial statements. The choice of inventory valuation methods directly affects the balance sheet (position statement), statement of profit and loss, and cash flow statement, thus influencing a company’s financial performance and position.

Balance sheet

On the balance sheet, inventory is reported as a current asset. Different inventory valuation methods will result in different valuations, affecting the total assets and shareholders’ equity. For instance, in a period of rising prices, the LIFO method would result in lower inventory values than the FIFO, and vice versa.

Income statement

The choice of inventory valuation methods influences the cost of goods sold (COGS) and gross profit, operating profit, and net income. Using the FIFO during inflation will result in lower COGS and higher profits than LIFO, and the opposite is true during deflation. The chosen inventory valuation method also impacts taxable income, resulting in varying tax obligations.

Incorrect inventory valuation

It can distort financial statements, leading to misinformed business decisions, regulatory scrutiny, and potential financial losses. Hence, businesses must adopt accurate inventory tracking systems and robust internal controls for producing inventory reports and valuations.

Choosing among the different inventory valuation methods depends on various factors, such as the nature of the business, tax considerations, and the impact on reported profits. The choice of an inventory valuation method should accurately reflect the company’s inventory costs and financial position, providing reliable information to stakeholders.

Conclusion

Understanding and implementing the appropriate inventory valuation method is crucial for accurate financial reporting, tax calculations, and informed decision-making in a business. The selected method must reflect the company’s operational structure, inventory type, and financial goals. With proper inventory management techniques, businesses can optimize inventory value, reduce costs, and boost profitability.

Visit the Akounto blog section to stay updated on the latest accounting and financial trends.