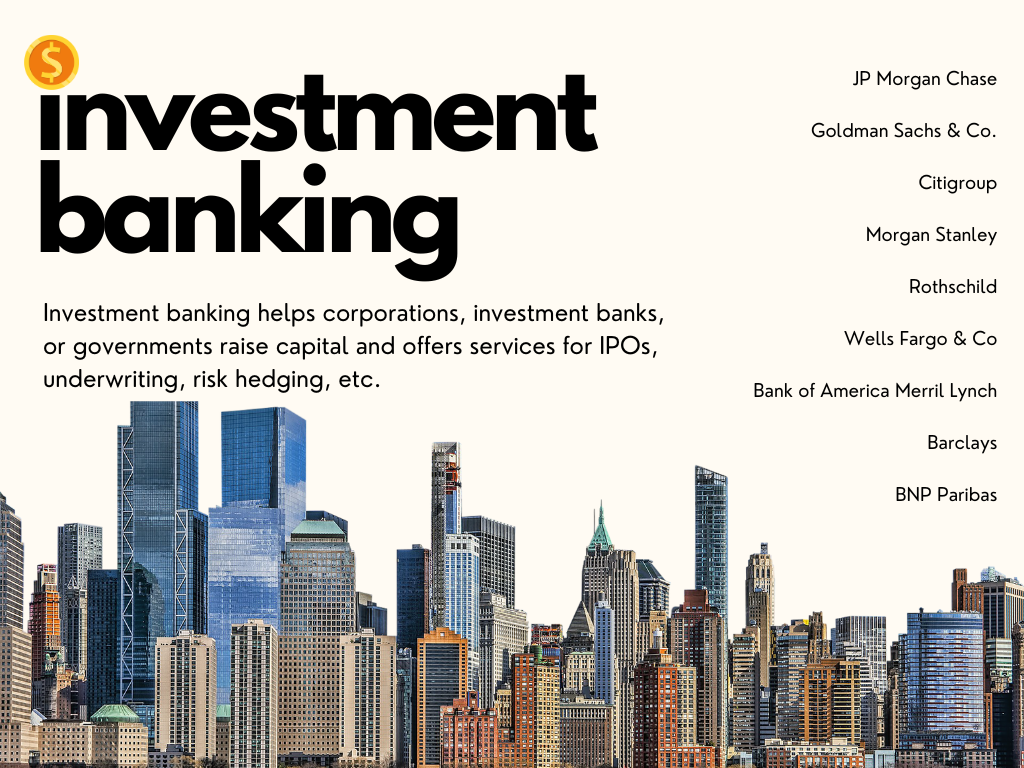

What is Investment Banking?

Investment banking helps corporations, investment banks, or governments raise capital and offers services for IPOs, underwriting, risk hedging, etc.

Investment banking is a specialty within the financial services industry. These entities serve as intermediaries, underwriters, and advisors for corporations, governments, and investment funds. Among the important services that investment banks offer are:

Underwriting of new debt and equity securities

Supporting functions in the sale of securities

Enabling mergers and acquisitions

Brokering trades for institutions and private investors

Offering investment advice

Assisting businesses and institutions with strategic development planning.

Some of the common examples of an investment bank are:

Morgan Stanley

Rothschild

Wells Fargo & Co

Bank of America Merril Lynch

Barclays

BNP Paribas

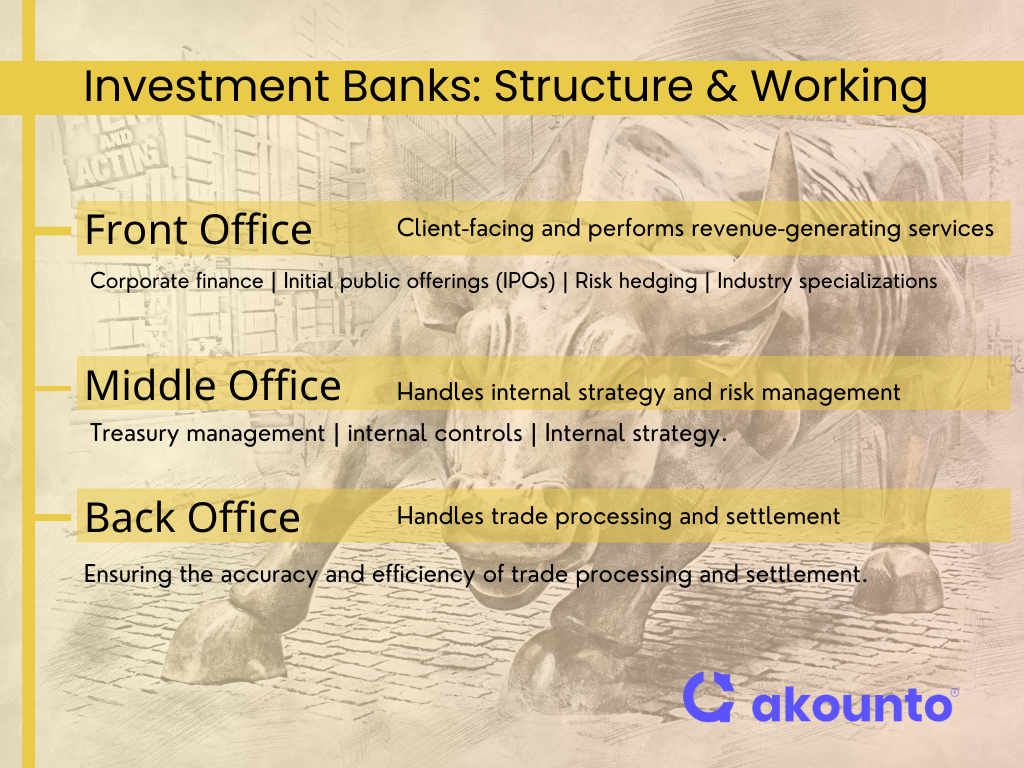

The three primary divisions of investment banks are:

Front Office: This is client-facing and performs revenue-generating services.

Middle Office: Handles internal strategy and risk management

Back Office: Handles trade processing and settlement

Dodd-Frank Wall Street Reform and the Glass-Steagall Act are some of the legislations that mark the compliance standards of operations, disclosures, and corporate citizenship in investment banking.

How does an Investment Bank Work?

Every department, including the front, middle, and back offices, is essential to the smooth operation of the business.

The front office is where revenue-generating activities take place. For instance, it involves:

Issuing securities to raise capital for clients

Engaging in market-making and securities trading for equities and fixed-income

Providing specialized services such as advising corporations on going public

The roles in investment banking can be broadly categorized into three areas:

Front office: This includes roles such as investment banking, sales and trading, and research. These roles are client-facing and involve generating revenue through fees and commissions for services provided to clients.

Middle office: The middle office supports the front office and ensures smooth operations and risk management. This includes roles such as treasury management, internal controls, and internal strategy.

Back office: The back office is responsible for ensuring the accuracy and efficiency of trade processing and settlement.

These wide-ranging roles offer diverse career opportunities, including an investment banking career for an investment banker in the investment banking industry.

Functions of Investment Banking

Investment banking functions cover a wide range of services that include:

Corporate finance

Initial public offerings (IPOs)

Risk hedging

Industry specializations

Investment banks, with their team of investment bankers, offer a plethora of services that cater to the unique needs of their clients.

Its valuable to explore each of these functions in detail to gain a comprehensive understanding of their contribution to investment banking as a whole.

Corporate Finance

Corporate finance in investment banking is about:

Raising funds for clients

Providing financial planning for clients

Offering financial guidance and support in securing funds through debt and equity offerings

Activities like Initial Public Offerings (IPOs), credit facilities, private placements, and bond issuances

Furthermore, a corporate finance department within an investment bank is also responsible for:

Capital Financing

Underwriting for capital raising

Overseeing mergers and acquisitions

Analyzing financial activities

Making capital investment decisions

Sale and Trading

The primary role of sales and trading consists of the following:

Buying and selling financial products

Formulating trading strategies for institutional and high-net-worth investors

Managing orders and forwarding them to trading desks

On the other hand, trading desks carry out trades or develop new products tailored to meet particular client requirements.

Sales and trading are differentiated in the following ways:

Sales is primarily centered on negotiating deals that are customized to meet the specific requirements of corporate clients.

Market-makers are involved in trading using standardized terms and play a crucial role in ensuring market liquidity.

Strategists provide guidance to both external and internal clients regarding strategies that can be implemented across different markets to optimize performance.

The adoption of electronic processing and algorithm-driven trades has significantly transformed the sales and trading division of investment banks.

IPOs and Underwriting

Initial public offerings (IPOs) and underwriting services are instrumental in helping companies issue new shares or bonds to the public. In the process of an initial public offering, investment banks perform vital functions such as:

overseeing underwriting

determining optimal timing and pricing for the market offering

creating SEC documentation

engaging in due diligence, document preparation, marketing, and share issuance.

Investment banks use the underwriting process to promise the public a certain amount of securities at a certain price when they go through the initial public offering (IPO) process. Investment banks run the risk of suffering a financial setback, though, should they overvalue the stock and end up selling it for less than what they were originally paid to acquire the company prior to the initial public offering.

Mergers and Acquisitions

Mergers and acquisitions, reorganizations, and broker trades for institutions are areas where investment banks have a significant impact. They provide expertise in determining the value of a company and identifying the most suitable structure for a deal, which is an essential part of the investment banking business. Investment banks generate revenue from mergers and acquisitions advisory services through a range of fee structures, such as advisory fees, success fees, and transaction fees.

A few notable mergers and acquisitions that were made possible by investment banks are the Exxon-Mobil merger, Google’s acquisition of Android, and Disney’s acquisition of Pixar and Marvel.

Asset Management

Optimizing client investment returns is the aim of asset management. Investment banks manage a broad range of assets on behalf of their clients, including cash, stocks, bonds, mutual funds, exchange-traded funds (ETFs), index funds, and annuities. Investment banks utilize a range of asset management techniques, such as value, growth, and income investing, in addition to active and passive management and the integration of thorough risk management procedures.

The advantages of asset management in investment banking include:

Cost savings

Professional generation of investment ideas

Portfolio construction and ongoing management

Increasing wealth over time

Simplifying the financial planning process by maintaining and maximizing the value and returns on investments.

Risk Hedging

Risk hedging is the practice of using financial instruments to protect clients from market risks. In the investment banking sector, risk hedging is the use of different financial tools and techniques to lessen or balance potential losses brought on by unfavorable price changes or market oscillations. In investment banking, financial instruments like swaps, options, futures, and forward contracts are frequently used for risk hedging.

Through reduced risks, improved risk-sharing arrangements, and protection against possible negative effects of market fluctuations, clients can profit from risk hedging.

Restructuring

Restructuring services provided by investment banks include:

Advising on restructuring strategies

Developing plans

Negotiating with stakeholders

Conducting financial analyses

Managing the restructuring process

Offering ongoing support

These services help clients reorganize their businesses to improve financial performance. The advantages of engaging investment banks for business restructuring include:

Proficiency in modifying the capital structure

Wider array of services compared to business brokers

Guidance on mitigating the risk of insolvency or bankruptcy

Compliance Assistance

Assistance with compliance guarantees that customers follow industry norms and financial regulations. Compliance assistance is important to investment banking because it helps to prevent policy, rules, regulations, and laws from being broken by making sure that external regulations and internal controls are followed. It includes a range of financial operations and is essential to maintaining the bank’s integrity and good name.

Compliance assistance benefits clients in the financial sector by:

Ensuring their adherence to regulatory requirements and industry standards

Protecting their interests

Safeguarding their data

Maintaining trust in the financial system.

Leveraged Finance

Financing high-risk, high-reward debt for clients is the focus of leveraged finance. Lending money to highly leveraged and speculative-grade companies is known as leveraged finance in the context of investment banking. Helping corporate clients issue more debt to finance operations or acquisitions is what this entails.

Potential risks of leveraged finance encompass:

Heightened financial risk stemming from the necessary cash flow for debt service

Added strain on cash flow

The possibility of non-compliance with covenants necessitates recompense to investors.

Equity Trading

Buying and selling stocks is known as equity trading, and the goal is to make money for the bank or clients. Purchasing and selling financial products is the main function of sales and trading. The responsibilities of the sales team include handling orders, sending them to trading desks, and making recommendations on trading ideas to institutional and high-net-worth investors.

On the other hand, trading desks carry out trades or develop new products tailored to meet particular client requirements. Moreover, the adoption of electronic processing and algorithm-driven trades has significantly transformed the equity trading division of investment banks.

Tax Consulting

Strategies to reduce tax liabilities are given to clients through tax consulting. Investment banks help their clients lower their tax obligations by using techniques like tax-loss harvesting, which is the practice of selling investments at a loss in order to deduct taxable gains. Additionally, they may offer tax planning advice and recommend tax-minimization actions to optimize deductions and decrease overall tax liability.

Effective tax consulting strategies employed by investment banks encompass optimizing deal structuring, establishing relationships with private equity groups, and future-proofing tax and finance functions.

Structured Finance

Structured finance creates customized financial solutions for clients with unique needs. Within the domain of investment banking, structured finance encompasses the creation of tailored financial remedies through the aggregation of cash flow-generating asset-backed loans, and the subsequent valuation of various tranches according to their level of risk. Investment banks provide a range of structured finance products, such as:

Collateralized Debt Obligations (CDOs)

Collateralized Loan Obligations (CLOs)

Mortgage-backed Securities (MBS)

Asset-backed Securities (ABS)

Structured Notes

Credit Default Swaps (CDS)

Synthetic CDOs

Industry Specialisations

Industry specializations in investment banking include:

Real Estate

Healthcare

Technology, Media & Telecom (TMT)

Financial Sponsors Group (FSG)

Financial Institutions Group

Leveraged Finance (LevFin)

Mergers & Acquisitions (M&A)

Debt Capital Markets

Equity Capital Markets

Restructuring

Bankers provide guidance to healthcare companies on a range of financial issues, including:

mergers

acquisitions

debt

equity capital offerings

This sector is influenced by demographic shifts rather than traditional market forces.

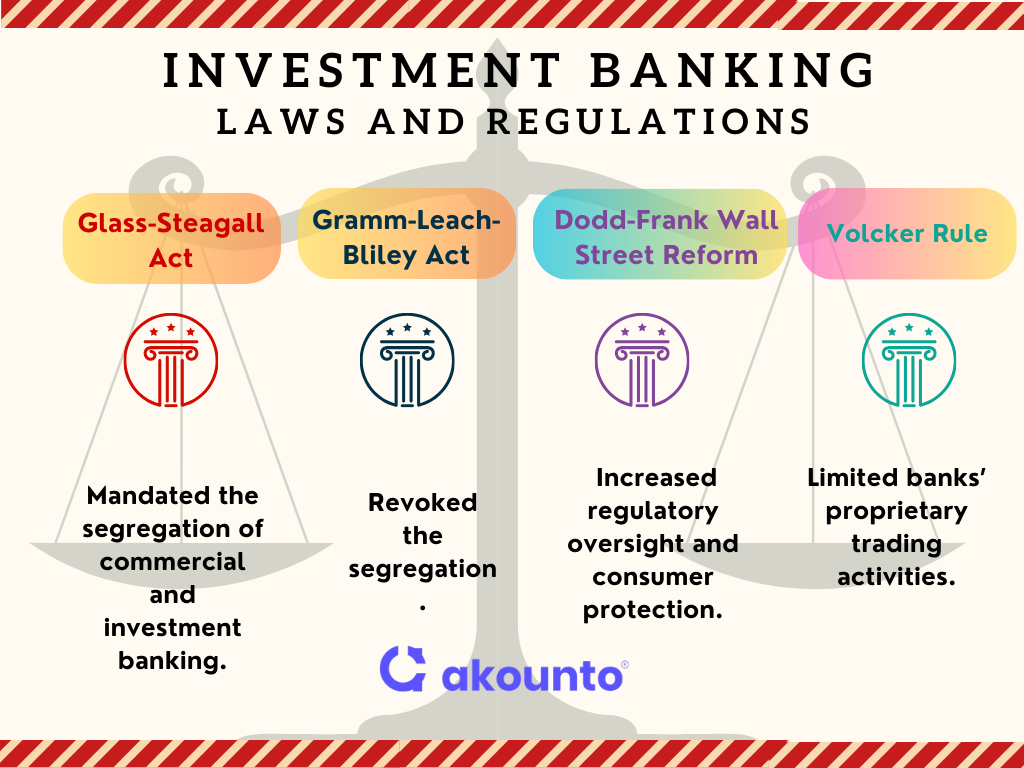

Laws and Regulations Related to Investment Banking

The regulatory landscape of investment banking comprises of the following laws and regulations:

The Glass-Steagall Act – mandated the segregation of commercial and investment banking.

The Gramm-Leach-Bliley Act – Revoked the segregation.

The Dodd-Frank Wall Street Reform – Increased regulatory oversight and consumer protection.

The Volcker Rule – Limited banks proprietary trading activities.

Glass Steagall Act in 1933

The Glass-Steagall Act was enacted in 1933 in the aftermath of the 1929 stock market crash to address the subsequent significant bank failures.

The Glass-Steagall Act mandated the segregation of investment and retail banking and banned the investment of depositors funds for high-risk investments.

Earlier, the banks were investing the funds from retail depositors into speculative ventures, including investments in equity markets, which are riskier than other investment options like corporate bonds, debentures, government back securities, etc.

Gramm Leach Bliley Act, 1999

Gramm-Leach-Bliley Act in 1999 repealed the Glass-Steagall Act. and removed the distinction between investment and commercial banks.

The Gramm-Leach-Bliley Act was passed in 1999 with the intention of safeguarding the banking system’s stability, attempting to achieve financial integration by consolidating banks like financial services companies offering comprehensive financial products.

Dodd-Frank Wall Street Reform, 2010

Dodd-Frank Wall Street Reform Act was enacted in the backdrop of the 2007-2008 financial meltdown, which was caused by sub-prime lending crises and lack of liquidity in financial markets.

The 2007-2008 subprime lending and housing bubble burst was due to excessive risk-taking by the commercial banking industry and mortgage companies offering home loans to people with low credit scores, resulting in very high debt defaults throughout the economy, resulting in the collapse of many big banks.

In this crisis, a significant portion of the bailout was from the taxpayers’ pocket. So the Dodd-Frank Wall Street Reform stressed consumer​ protection, where markets should be transparent and comprehensive regulation plugging in the loopholes that can be exploited. A strong systemic risk​ regulation limits the brunt of financial risk where the market participants should address the risks and not the taxpayers.

The Volcker Rule

Volcker rule forbids speculative trading activities that can adversely impact banks’ customers and “real economy” sectors. Volcker rule separates the lending activities of a bank from its proprietary trading, investment banking, and private equity divisions in a commercial bank (like Bank of America, HSBC, etc.).

Volcker Rule named after Paul Volcker, a former Federal Reserve chairman who headed the Economic Recovery Advisory Body in 2009. This rule is in effect from January 1, 2020.

The Federal Deposit Insurance Corp. (FDIC) amended some of the restrictions where it allowed banks to invest 3% of their Tier 1 capital into private equity and hedge funds.

In Volcker rule there is also a provision, Super 23A that gave rules for low-risk transactions where related funds are involved, and along with Regulation W banned low quality collaterals including equity securities, intangible assets, letters of credit, guarantees etc.

The aim is to limit excessive risk-taking by banks to earn profit, but at the same time, not jeopardize the investment environment.

Types of Investment Banks with Examples

Investment banks are not a monolithic entity. They vary in size, focus, and services, including:

Bulge bracket banks

Middle market banks

Boutique investment banks

Regional banks

Digital investment banks

Each type of bank caters to specific market segments and offers unique advantages.

Bulge Bracket Banks

Bulge bracket banks are recognized as global investment banks that serve governments, large corporations, and institutions.

In fact, most investment banks aspire to reach the level of success and prestige that these top-bulge bracket banks have achieved. The top bulge bracket banks are:

Goldman Sachs

JPMorgan Chase

Morgan Stanley

Bank of America Merrill Lynch

Citigroup

The typical career advancement at a bulge-bracket investment bank usually involves progressing through various levels of hierarchy, with the potential for employees to receive substantial compensation, such as an MD earning a minimum of $1 million USD per year.

Middle Market Banks

Middle market banks are financial institutions that offer services to companies generating revenues between $50 million to $1 billion. Their typical clientele consists of businesses that fall between large corporations and small enterprises, necessitating customized banking services and financial solutions to suit their requirements. Middle market banks generally manage smaller deals, typically under $500 million, as opposed to bulge bracket banks, which handle larger transactions.

The main services provided by middle market banks include M&A intermediary services, research, trading, and underwriting.

Boutique Investment Banks

Boutique investment banks typically specialize in specific areas or industries such as M&A advisory, restructuring, and industry-specific investment banking services. The organizational structure of a Boutique Investment Bank differs from that of a Bulge Bracket Bank in terms of hierarchy, flexibility, and operations. Boutique banks have a more flat organizational structure and are typically top-heavy with senior bankers and rainmakers.

Examples of Boutique Investment Banks include Evercore, Moelis & Company, and Lazard.

Investment Banking Divisions of Commercial Banks

Investment banking divisions within larger, diversified commercial banks provide a range of services. The investment banking division includes:

Equity research

Sales and trading

Commercial banking

Asset management

Advisory

Trading

Equity capital markets

Debt capital markets

Mergers and acquisitions

Corporate restructuring

Retail banking services

The organizational structure of investment banking divisions within commercial banks are structured into:

Front office roles such as equity research, asset management, commercial banking, sales, and trading

Middle office roles performing risk management and compliance

Back office roles handling operations and support functions.

Regional Banks

Regional banks in investment banking operate within a specific geographic area and offer specialized financial services. They utilize their local market expertise and connections to cater to the requirements of their clients. Regional investment banks primarily serve specific regions or local markets, and their services provide a range of specialized financial services such as:

Investment advisory

Capital raising

Mergers and acquisitions

Debt and equity financing

Other tailored financial transactions to meet the specific needs of clients within a particular geographic area.

Digital Investment Banks

Digital investment banks provide investment banking services through digital channels. They function by employing digital platforms that combine automated financial activities with human oversight as necessary. These banks offer services such as:

Online trading

Investment advisory

Portfolio management

Access to a variety of investment products

Digital investment banks encounter drawbacks such as:

Security concerns

Reliance on internet connectivity

Potential absence of personalized human interactions

Restricted physical presence

Difficulties associated with the volatility of digital assets

Despite these drawbacks, digital investment banks still offer many benefits.

| Top Investment Banks in 2025 (by region) | ||||||||

| USA | UK | France | China | India | Australia | Brazil | UAE | |

| 1 | Goldman Sachs | Barclays Investment Bank | BNP Paribas | China International Capital Corporation (CICC) | Kotak Investment Banking | Macquarie Group | BTG Pactual | First Abu Dhabi Bank (FAB) Investment Banking |

| 2 | JPMorgan Chase | HSBC Global Banking & Markets | Société Générale Corporate & Investment Banking | CITIC Securities | ICICI Securities | Commonwealth Bank of Australia (CBA) Institutional Banking | Itaú BBA | Emirates NBD Investment Banking |

| 3 | Morgan Stanley | Standard Chartered | Natixis | Haitong Securities | Axis Capital | Westpac Institutional Bank | Bradesco BBI | Abu Dhabi Commercial Bank (ADCB) Investment Banking |

| 4 | Bank of America Merrill Lynch | NatWest Markets | Crédit Agricole CIB | Huatai Securities | JM Financial | National Australia Bank (NAB) Corporate & Institutional Banking | Banco Santander Brasil | Mashreq Bank Investment Banking |

| 5 | Citigroup | Lloyds Bank Corporate Markets | Rothschild & Co (French operations) | Guotai Junan Securities | SBI Capital Markets | ANZ Institutional Banking | XP Investimentos | Dubai Islamic Bank Investment Banking |

| 6 | Wells Fargo Securities | Rothschild & Co | 6. Lazard (French operations) | China Securities Co. | HDFC Bank Investment Banking | UBS Australia | Credit Suisse Brasil | HSBC Middle East |

| 7 | Lazard | Close Brothers | BPI France | Industrial and Commercial Bank of China (ICBC) | Avendus Capital | Morgans Financial Limited | Citi Brazil | Citigroup UAE |

| 8 | Evercore | Investec | Oddo BHF | Bank of China International | Edelweiss Financial Services | Bell Potter Securities | Banco Safra | Standard Chartered UAE |

| 9 | Jefferies | Cazenove Capital | Kepler Cheuvreux | Ping An Securities | Motilal Oswal Investment Banking | Moelis Australia | UBS BB Investment Bank | Gulf Capital |

| 10 | Guggenheim Partners | Peel Hunt | CIC Market Solutions | Everbright Securities | IIFL Securities | Jarden Australia | Genial Investimentos | Shuaa Capital |

Investment Bank vs Commercial Bank

While both investment banks and commercial banks operate within the broader financial services industry, they offer different services and cater to different market segments. The focus of investment banks lies in high finance, managing complex transactions, and offering advisory services to larger entities. Commercial banks, on the other hand, primarily cater to smaller savers and less capital-intensive clients through services like loans, mortgages, and retail banking.

Conclusion

Investment banking plays a crucial role, from raising capital for businesses to managing complex financial transactions and providing advisory services; investment banks operate at the heart of the financial markets.

Investment bankers offer a wide range of services and expertise, helping businesses, governments, and investors navigate the complexities of financial transactions and markets.

Visit Akounto’s blog and get more knowledge in finance and accounting.

FAQs

Q1. What are the top 5 investment banks in the world?

The world’s leading investment banks, ranked by deal volume, revenue, and market influence, include:

1. Goldman Sachs – Dominates M&A advisory, securities trading, and wealth management.

2. JPMorgan Chase (J.P. Morgan) – A global leader in corporate finance, capital markets, and asset management.

3. Morgan Stanley – Specializes in investment advisory, trading, and institutional securities.

4. Bank of America Merrill Lynch – Offers end-to-end investment banking and risk management solutions.

5. Citi (Citigroup) – Provides underwriting, treasury services, and financial consulting worldwide.

Q2. What are the major functions of investment banks?

Investment banks facilitate complex financial transactions, including:

1. Mergers & Acquisitions (M&A) – Advising companies on takeovers, joint ventures, and buyouts.

2. Capital Raising & Underwriting – Issuing stocks, bonds, and IPOs to help businesses secure funding.

3. Securities Trading & Market Making – Buying and selling equities, fixed-income assets, and derivatives.

4. Asset & Wealth Management – Managing investment portfolios for corporations and institutional investors.

5. Financial Research & Advisory – Delivering insights on market trends, risks, and investment opportunities.

Q3. What certifications are needed to work in investment banking?

A degree in finance, economics, or business is a foundation, but key certifications include:

– CFA (Chartered Financial Analyst) – Recognized for expertise in valuation, portfolio management, and investment analysis.

– FINRA Licenses (Series 7, 63, 79, etc.) – Mandatory for securities trading and investment banking roles in the U.S.

– MBA in Finance – Often preferred by top-tier investment banks for leadership roles.

– CPA (Certified Public Accountant) – Beneficial for financial analysts handling financial statements and accounting-heavy deals.

Q4. Is investment banking the same as private banking?

No, they serve different client needs:

– Investment Banking – Focuses on large-scale corporate transactions like IPOs, M&A, and capital raising.

– Private Banking – Offers personalized financial management services to ultra-high-net-worth individuals (UHNWIs), covering wealth preservation, estate planning, and tax strategies.

Q5. Who are the typical clients of investment banks?

Investment banks serve a broad spectrum of clients, including:

– Corporations – Seeking funding for growth, restructuring, or M&A deals.

– Governments – Issuing sovereign bonds and managing public finances.

– Institutional Investors – Hedge funds, pension funds, and mutual funds looking for large-scale investment opportunities.

– High-Net-Worth Individuals (HNWIs) – Requiring tailored investment solutions and wealth advisory.

– Startups & Private Companies – Needing venture capital or preparing for an IPO.

Q6. Which course should I enroll in to get into investment banking?

Several top-tier courses help aspiring investment bankers build expertise:

– Bachelor’s in Finance, Economics, or Business Administration – The foundational academic path.

– MBA in Finance (Harvard, Wharton, INSEAD, LBS, etc.) – Preferred for mid-career transitions into investment banking.

– CFA (Chartered Financial Analyst) – Highly valued for roles in financial analysis and investment banking.

– Financial Modeling & Valuation Courses – Offered by platforms like Wall Street Prep, CFI, and Coursera to build essential skills.

– MSc in Investment Banking & Finance – Specialized programs from universities like London School of Economics (LSE) and HEC Paris.