Understanding Accumulated Depreciation

Accumulated depreciation is a contra-asset account as it contains a credit balance that offsets the balance in the normal asset account with which they’re paired.

The account records the total depreciation expense of a fixed asset over its useful life, representing a reduction in the asset’s net book value due to wear and tear via passage of time, obsolescence, or other factors. Net book value is the residual value of an asset on the company’s balance sheet after accounting for accumulated depreciation.

The intent of accumulated depreciation is to approximately match the revenue and other benefits an asset generates to its cost over its useful life. This helps companies ensure that their financial statements accurately represent the asset’s life, income produced from usage, and the taxable gain on the sale of an asset. It also helps companies avoid major losses in the year fixed assets are purchased by spreading their cost over several years.

Accumulated depreciation can be determined by the straight-line depreciation method, the declining balance depreciation method, and the double-declining balance depreciation method.

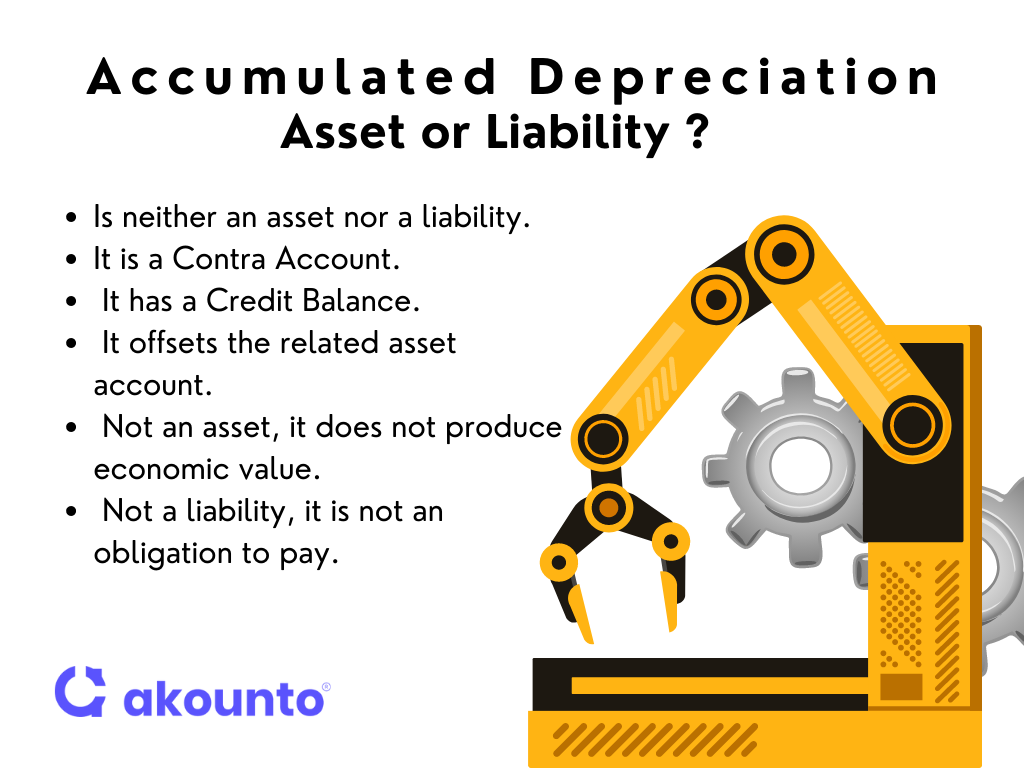

Accumulated depreciation is neither an asset nor a liability. It is not a fixed asset as the balances in the account do not denote something that will produce economic value to the company over multiple reporting periods, nor is it a liability since the balances stored do not represent an obligation to pay a third party.

Accumulated depreciation account appears under the heading Property, Plant & Equipment (PPE) or Fixed Assets section of the balance sheet.

Depreciation vs Accumulated Depreciation

| Basis | Depreciation | Accumulated Depreciation |

| Meaning | Depreciation expense is the portion of an asset’s cost allocated and reported at the end of an accounting period (e.g., quarterly or annual depreciation expense). It shows how much of the asset’s value has been used up in that year. | Accumulated depreciation is the total to date depreciation expense allocated for the asset since it was acquired and put to use. |

| Impact on Financial Statement | Depreciation expense is recognized on the company’s income statement as a non-cash expense that lowers the net income or profit of the business. | Accumulated depreciation, a contra-asset account on the balance sheet, reduces the gross amount of fixed assets reported. |

| Debit or Credit | Depreciation expense is debited. | Accumulated depreciation expense is credited. |

| Sale of Asset | Expense allocation ends when the asset is sold or put out of use. | When the asset is sold or put out of use, the accumulated depreciation associated with the asset is reversed, eliminating all records of the asset from the company’s balance sheet. |

Benefits & Impact

Accurate Financial Reporting

Accumulated depreciation accounts allow small businesses to accurately present a realistic picture of the assets and their net book value. This helps stakeholders, such as investors, lenders, and potential buyers make informed decisions based on reliable financial information.

Asset Valuation

Tracking the accumulating depreciation expenses can assist the companies in determining the remaining useful life of their assets. This information enables effective asset management and informed decision-making regarding timely maintenance and repairs, replacements, and upgrades. It is also useful for conducting asset-related transactions, such as sales or acquisitions.

Insurance Coverage

Small businesses can choose appropriate insurance coverage amounts based on the net book values of the assets after accumulated depreciation has been calculated. This can help protect the companies against potential future losses or damages.

Tax Benefits

By properly tracking and reporting accumulated depreciation in profit and loss (P&L) account as a non-cash expense, small businesses can take advantage of tax deductions, which can contribute to reducing the overall tax burden and increasing cash flows.

Accounting Treatment

Under the GAAP (Generally Accepted Accounting Principles), the matching principle requires that all depreciation expenses must be attributed to the same accounting period within which the associated revenue is generated.

By depreciation, a company will invest a portion of the capital asset’s value over its useful life each year. It ensures that a capitalized asset is put to use each year and produces income, and the costs associated with the usage of the asset get reported.

Accumulated depreciation is the total amount depreciated for an asset up to a single point. Each period is added to the opening accumulated depreciation balance, the depreciation expense recorded in that period.

An asset’s carrying value is the difference between its historical cost and accrued amortization on the balance sheet. At the end of the useful life of an asset, its balance sheet carrying value will match its salvage value.

To report accumulated depreciation, a company debits the depreciation account in the general ledger and credits accumulated depreciation. Depreciation expenses will flow through the income statement of a specific period when the entry is passed.

Accumulated depreciation is displayed below the related capitalized assets line on the balance sheet. The accumulated balance of depreciation increases over time, adding the amount of the depreciation expense recorded during the current period.

Conclusion

Regardless of size, all businesses rely on capital asset accounts like buildings, vehicles, equipment, etc., as part of their daily operations. They must comply with accounting rules to depreciate these assets over their useful lives to present an accurate outlook of their business and asset’s cost to stakeholders and investors. So, it is important to recognize accumulated depreciation.

Accumulated depreciation is the total depreciation expenses allocated to an asset since it was acquired and put to use. It is a contra-asset account (or a negative asset account) that offsets the balance of the asset account they’re normally paired with, allowing the company to show both the cost and total-to-date depreciation of the asset.

Employ Akounto‘s accounting software that provides users with a host of features that are helpful in recordkeeping your asset depreciation and make accounting hassle-free.