What is a Job Costing?

Job costing is the method of tracking costs and determining the revenue for each project.

Job costing looks at each project in detail, breaking down the costs of direct labor hours, direct materials, and manufacturing overheads.

Job costing (project-based accounting) is an essential tool to understand the profitability of individual jobs and make informed decisions regarding resource allocation and pricing strategies.

The job costing system determines the cost against a specific job undertaken for completing a customer’s order. Job costing is not applied to stock but to a production batch against a certain order, so it is also called “job lot costing.”

Components of Job Costing

Direct Labor Costs

Direct labor costs refer to the cost of labor directly involved in the production process of a product or project. The direct labor hour cost is calculated to estimate unit-level costs for a specific project or an order. Wages incurred per hour of production processes in manufacturing a single unit or order is an example of direct labor cost.

Direct Materials Costs

Direct material cost refers to the cost of raw materials or components specifically used to manufacture a particular product or complete a specific project. It includes the cost of all the materials required to manufacture the product, such as raw materials, components, and subassemblies.

Let’s say a bakery receives an order to make a custom wedding cake. The direct material cost for this job would include the cost of flour, sugar, butter, eggs, and other ingredients required to make the cake.

Manufacturing Overhead

Manufacturing overhead refers to all the manufacturing or factory costs, excluding the direct labor and material costs incurred during the production process. It includes expenses such as electricity bills, machine depreciation, land depreciation, and property taxes.

Other Costs

Apart from direct labor, direct materials, and manufacturing overhead costs considered in job costing, other costs may also be involved, like shipping and handling costs, quality control costs, traveling expenses, and research and development costs.

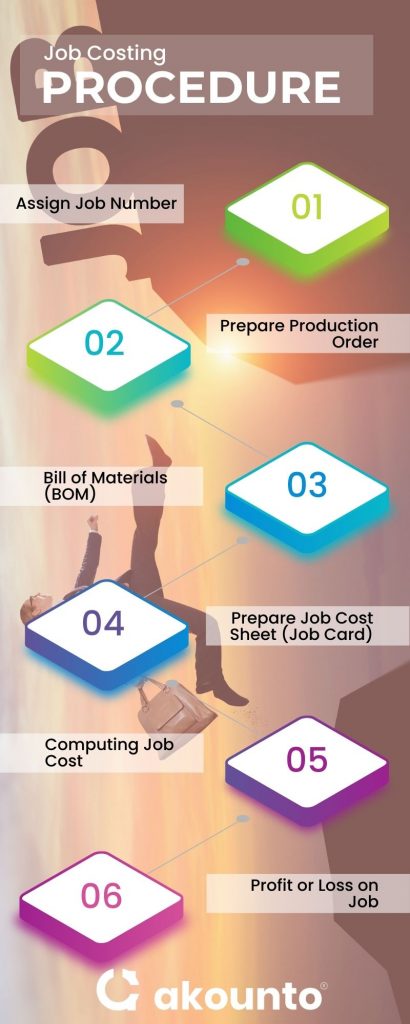

Job Costing Procedures

Assign Job Number

When a customer places a job order, a unique number is assigned to both the job and the order. It is referred to as the job number and serves as a means of identification.

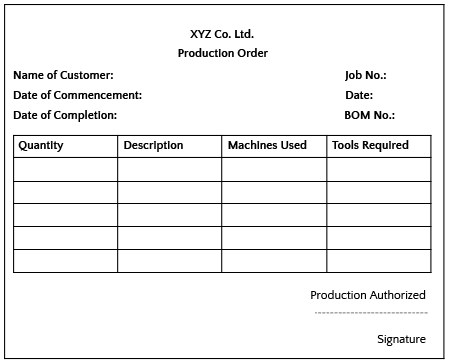

Prepare Production Order

Once the order is accepted, the production planning department prepares a production order. It contains the order number, date, customer name, quantity, job description, and the materials and operations required to complete the job.

The production order functions as a formal authorization to begin the job.

Bill of Materials (BOM)

A bill of materials is a detailed list of all materials required for the job. It acts as authorization to request the listed materials from the store and fill up the materials requisition form afterward.

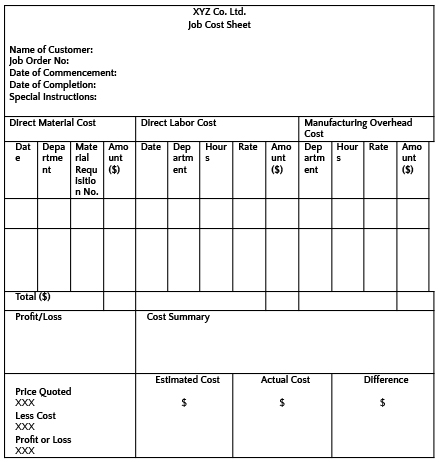

Prepare Job Cost Sheet

To record all costs, a job cost card or job cost sheet should be prepared.

The job cost sheet shows the costs assigned to direct material costs, production costs, direct wages, and overhead applications. Material costs are recorded based on the BOM or materials abstract, while labor cost is based on the circulating job card.

Computing Job Cost

The costing department receives a job completion report after completing the job. The total cost of the job is calculated by posting all related job costs on the cost sheets if the job consists of multiple production units, where the total cost is divided by the number of units to determine the cost per unit.

Profit or Loss on Job

The profit or loss on the job is calculated by comparing the total cost to the selling price.

Calculation Steps

Calculating job costing is crucial for project-based businesses, especially in the construction industry. The goal is to determine the total cost of the project and its profitability.

Here are the steps involved in the job costing system:

Step 1: Calculate Direct Labor Costs

The first step is to calculate direct labor costs, including wages, salaries, and benefits paid to employees working directly on the project.

Determine each worker’s direct labor hour rate and multiply it by the estimated time required to complete the job. You should also factor in any costs related to subcontractors hired for specific tasks.

Step 2: Calculate Direct Material Costs

Calculate the cost of direct materials used in the job.

For instance, for construction companies, direct materials may include concrete, steel, and lumber. Including all costs associated with the materials, such as taxes, duties, and transportation fees, is essential.

Step 3: Estimate Manufacturing Overhead Application

To estimate the manufacturing overhead cost, use a predetermined overhead rate or calculate them based on the actual costs incurred.

Predetermined overhead cost is an estimated overhead cost calculated before production based on a predetermined rate. The formula to calculate the predetermined overhead rate is as follows:

Predetermined overhead rate = Estimated total manufacturing overhead cost / Estimated allocation rate

The formula is entirely based on estimates, so the actual costs may vary from the estimated amount.

Step 4: Calculate the Job Cost

Add up the direct labor costs, direct materials costs, and applied overhead costs.

The formula for calculating job costing is as follows:

Job cost = Direct Costs + Direct Materials Costs + Manufacturing Overhead Costs

It provides an accurate estimate of the total cost of the job, including all direct and indirect costs associated with the project.

Then, by comparing the job cost to the estimated revenue generated by the project, you can determine the job’s profitability.

Step 5: Calculate the Cost per Unit

The total cost, when divided by the number of units produced, gives a cost per unit. It’s an essential calculation that helps businesses determine how much it costs to produce each unit of the product.

Step 6: Determine Profitability and Optimize Pricing

Comparing the cost per unit with the selling price gives you a clear understanding of the job’s profitability. If the cost per unit is higher than the selling price, the job may not be profitable, and adjustments must be made to pricing and resource allocation.

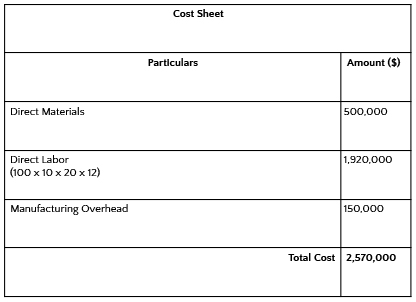

Example of Job Costing

Question: A construction company is tasked with building a new office building. The project is estimated to take 12 months to complete, and the company will use a team of 10 workers, each with an hourly rate of $100, working 8-hour shifts on weekdays (20 days a month).

The direct material costs, which include cement, steel, lumber, plumbing fixtures, and others, are estimated to be $500,000.

The manufacturing overhead costs, which include rent, utilities, and equipment depreciation, are estimated to be $150,000.

Calculate job cost.

Assuming the project will produce one building to calculate the cost per unit, it comes to $257,000. The company can then compare this cost per unit to the selling price to determine the project’s profitability.

Advantages

- Identifying profitable jobs: By analyzing the actual costs and revenues associated with each job, small businesses can identify the most profitable jobs and adjust their pricing and resource allocation accordingly.

- Efficient Resource Allocation: Job costing helps small businesses allocate resources efficiently by identifying the jobs that require more or fewer resources.

- Accurate Budgeting: By clearly understanding the costs associated with each job, small businesses can create more accurate budgets for similar projects.

- Better Job Control: Job costing helps companies identify where they are spending too much and where they can reduce expenses. It allows them to take corrective action to address deviations and prevent future cost overruns.

Disadvantages

- Time-Consuming: Job costing can be time-consuming, as it requires tracking costs and analyzing them for each job individually.

- Inaccurate Estimation: Job costing can be complex for small businesses, especially those with limited resources and accounting expertise. It may struggle to track and allocate costs accurately, leading to errors and inaccuracies in job costing calculations. Additionally, small businesses may lack the tools or technology to manage their job costing processes, making it time-consuming.

- Unforeseen Costs: Job costing may not account for unforeseen or excess costs during a project, such as unexpected raw materials or labor costs. To prevent this, regularly updating and monitoring job costing estimates is crucial to keep them accurate and reliable.

Wrapping Up

Job costing requires a significant investment of time and resources; the benefits can lead to increased efficiency, improved profitability, and a better understanding of a business’s financial performance.

To read more about accounting and financial management, check out the Akounto blog for informative and insightful articles.