Liabilities in accounting encompass a business’s financial obligations to other entities, which are classified as either short-term or long-term liabilities.

Liabilities represent the claims of creditors against a company’s assets and can be found on the company’s balance sheet.

There are different types of liabilities in accounting, including both long-term and short-term liabilities (noncurrent liabilities).

Short-term liabilities, such as trade payable and wages payable, are obligations expected to be settled within one year or the business’s operating cycle, whichever is longer.

Non-current liabilities, like long-term loans or mortgage payments, are debts that are due beyond the next year.

Liabilities play a significant role in the accounting equation, which states that a company’s assets equal its liabilities plus shareholders’ equity.

Accounting equation provides a framework for understanding the relationship between a company’s financial statements—balance sheet, income statement, and statement of cash flows—and helps determine the company’s overall financial position.

It’s important to differentiate liabilities from expenses.

Expenses represent costs incurred in generating revenue; liabilities are the resulting financial obligations arising from past transactions or events.

Expenses are recorded on the income statement, while liabilities are reported on the balance sheet.

By accurately recording and tracking liabilities in accounting, businesses can assess their financial stability and determine if they have sufficient funds to meet their financial obligations.

Liabilities are essential for calculating various financial ratios and indicators that measure a company’s financial health, such as the debt-to-equity ratio.

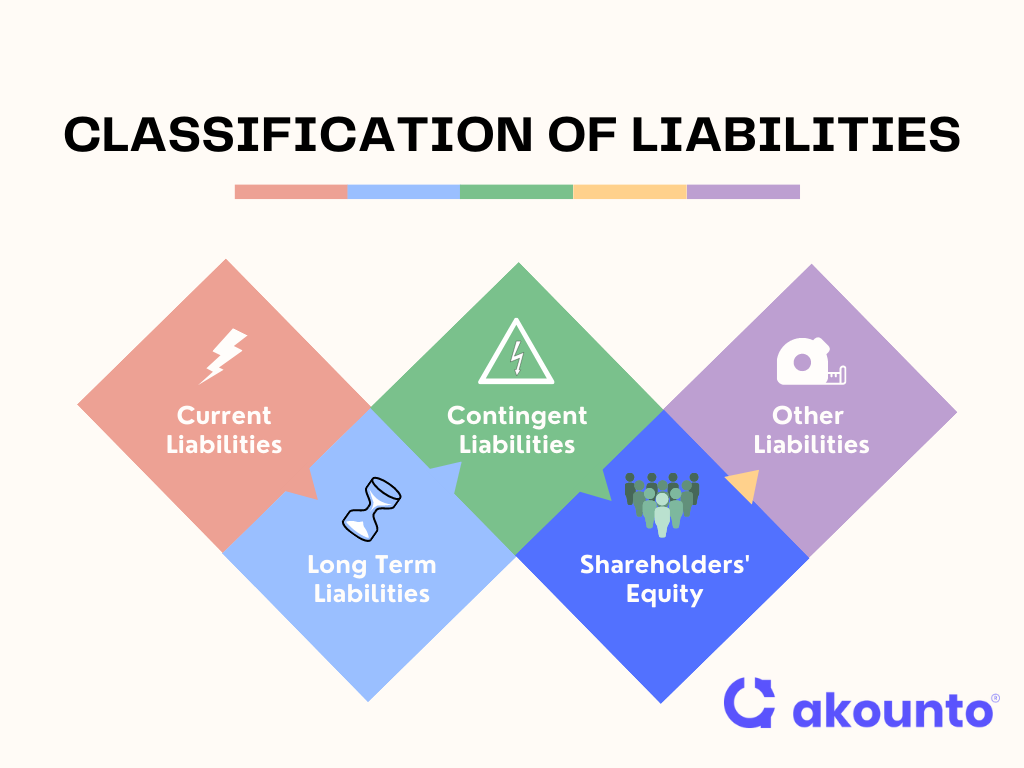

Classification of Liabilities and Examples:

Liabilities can be classified into different categories based on their nature, duration, and timing of payment. Here are the main classifications, along with brief descriptions and examples of liabilities:

Current Liabilities

Current liabilities are obligations that the businessowes and are expected to be settled within the next operating cycle or one year, whichever is longer.

Examples

- Accounts payables: Money owed to suppliers for goods or services received.

- Short-term loans: Debt that needs to be repaid within a short period, usually less than one year.

- Income taxes payable: Amounts due to tax authorities for income taxes based on current period earnings.

- Sales tax payable: Taxes collected from customers on behalf of tax authorities.

- Accrued expenses: Costs incurred but not yet paid, such as accrued salaries or accrued interest payments.

Long-Term Liabilities (non-current liabilities)

These are debts or obligations due beyond the next operating cycle or one year.

Examples

- Mortgage payable: Long-term loan is taken to finance the purchase of property or real estate.

- Bonds payable: Long-term debt securities issued by a company to raise capital from investors.

- Pension obligations: Financial obligations to provide retirement benefits to employees.

- Deferred tax liabilities: Future tax obligations resulting from temporary differences between accounting and tax rules.

Contingent Liabilities

Contingent liabilities are potential obligations that may arise from uncertain future events.

Examples

- Lawsuits and legal claims: Potential liabilities arising from pending legal actions against the company.

- Product warranties: Obligations to repair or replace defective products within a specified period.

- Guarantees and warranties: Promises assuming financial responsibility if certain conditions are unmet.

Shareholders’ Equity

Shareholders’ equity represents the residual interest in the company’s assets after deducting liabilities.

Examples

- Common stock: Equity capital raised by issuing shares to shareholders.

- Retained earnings: Accumulated profits of the company that have not been distributed as dividends.

- Dividends payable: Amounts owed to shareholders as a result of declared dividends.

Other Liabilities

This category includes liabilities that do not fit into the above classifications.

Examples

- Bank account overdrafts: Negative balances in bank accounts exceeding available funds.

- Notes payable: Formal written promises to pay a specified amount by a certain date.

- Unearned revenue: Payment received in advance for goods or services yet to be delivered.

- Deferred tax liabilities: Future tax obligations resulting from temporary differences between accounting and tax rules.

- Interest payments: Payments due on borrowed funds or outstanding debt.

Businesses need to understand and classify their liabilities accurately to assess their financial obligations, meet payment deadlines, and make informed decisions about financing and investments. By appropriately managing their liabilities, businesses can ensure sufficient funds to operate and maintain a healthy financial position.

How to Calculate Liabilities In Accounting?

Calculating liabilities in accounting involves analyzing financial information and utilizing specific formulas to determine the amount of outstanding obligations. Here’s a step-by-step guide on how to calculate liabilities:

- Collect all relevant financial statements, including the balance sheet, income statement, and cash flow statement. Identify the specific accounts related to liabilities, such as interest payable, salaries payable, and sales tax payable.

- Identify and separate current and non-current liabilities and separate liabilities into current and long-term categories.

- Add up all the current liabilities, such as interest payable, salaries payable, and sales tax payable. Include any current portion of long-term liabilities due within the next year.

- Identify the non-current liability accounts on the balance sheet, such as long-term loans or bonds payable.

- Evaluate the likelihood and potential impact of any contingent liability arising from an uncertain future event.

- Sum the current liabilities and non-current liabilities to obtain the total liabilities of the company.

- Compare the total liabilities to total assets to calculate the debt-to-asset ratio and assess whether the company has sufficient funds and equity to cover its liabilities.

By carefully calculating liabilities, businesses gain a comprehensive understanding of their financial obligations and can make informed decisions regarding finance operations.

It’s crucial to comply with accounting principles and accurately record liabilities on financial statements to ensure transparency and integrity in financial reporting. Regularly reviewing liabilities concerning other financial metrics helps companies evaluate their financial health and plan for future growth.

Question: From the financial information of Company A, calculate liabilities.

- Current liabilities:

- Accounts payable: $50,000

- Tax liability: $15,000

- Bank loans: $30,000

- Long-term liabilities:

- Deferred taxes: $100,000

- Contingent liability:

- Potential legal settlement: Estimated at $50,000

- Total equity: $500,000

Calculation of liabilities

- Calculate Current Liabilities:

- Current liabilities include accounts payable, tax liability, and bank loans.

- Current liabilities = $50,000 + $15,000 + $30,000 = $95,000

- Determine Long-Term Liabilities:

- These consist of deferred taxes.

- Long-term liabilities = $100,000

- Consider Contingent Liability:

- Assess the potential legal settlement, estimated at $50,000.

- Calculate Total Liabilities:

- Total liabilities = Current liabilities + Long-term liabilities + Contingent liability

- Total liabilities = $95,000 + $100,000 + $50,000 = $245,000

Liabilities vs. expenses

| Liabilities | Expenses |

| Liabilities are financial obligations or debts owed by a company to external parties or individuals. | Expenses are costs incurred by a company in its day-to-day operations. |

| Common liabilities: Accounts payable, loans payable, accrued expenses. | Common expenses: Rent, utilities, salaries, marketing costs. |

| Liabilities arise from past events or past transactions that have created a present obligation for the company. | Arise from current activities or transactions that require immediate or future payment. |

| The company expects to settle liabilities by providing economic benefits (e.g., payment of debts). | The company expects to incur expenses as part of its ongoing operations to generate revenue. |

| Recorded on balance sheets as they represent the company’s financial obligations. | Recorded income statements as they affect the company’s profitability. |

| Impact on financial stability and creditworthiness of the company. | Impact on profitability and operational efficiency of the company. |

| Examples: Accounts payable, non-current liabilities, and business loans. | Examples: Rent expense, salary expense, income tax expense. |

| Relationship to current assets and income tax liabilities. | Relationship to non-current assets and income tax liabilities. |

Liabilities vs. Assets

| Assets | Liabilities | |

| Definition | Resources or economic benefits owned or controlled by a company. | Financial obligations or debts owed by a company to external parties or individuals. |

| Examples | Cash, inventory, property, equipment, and accounts receivable. | Taxes payable, long-term liabilities, accounts payable. |

| Represent | The company’s value and potential for generating future economic benefits. | The company’s financial obligations and claims against its assets. |

| Recorded on | Balance sheets as they reflect the company’s total assets. | Balance sheets as they represent the company’s total liabilities. |

| Classification | Tangible or intangible assets with a monetary value. | Current liabilities or long-term liabilities with varying repayment periods. |

| Increase | Acquisitions, investments, or earnings from business operations. | Borrowings, accrual of expenses, or creation of financial obligations. |

| Decrease | Depreciation, disposal, or loss of value. | Repayment of debts, settlement of obligations, or write-offs. |

Conclusion

Understanding and managing liabilities is crucial for the financial health of businesses. Small business owners can benefit from utilizing accounting software to track and manage their liabilities efficiently.

By leveraging technology, they can accurately calculate, monitor, and address their financial obligations, ensuring smooth operations and informed decision-making. Accounting software provides a valuable tool for small businesses to navigate the complexities of liabilities and maintain financial stability.

All-in-one accounting software, Akounto, assists small businesses in tracking their assets and liabilities efficiently and helps generate insightful reports for informed decision-making. To know more, visit our website.