What is the Matching Principle?

The matching principle is a fundamental accrual accounting principle where all expenses and related revenues are matched for the particular accounting period.

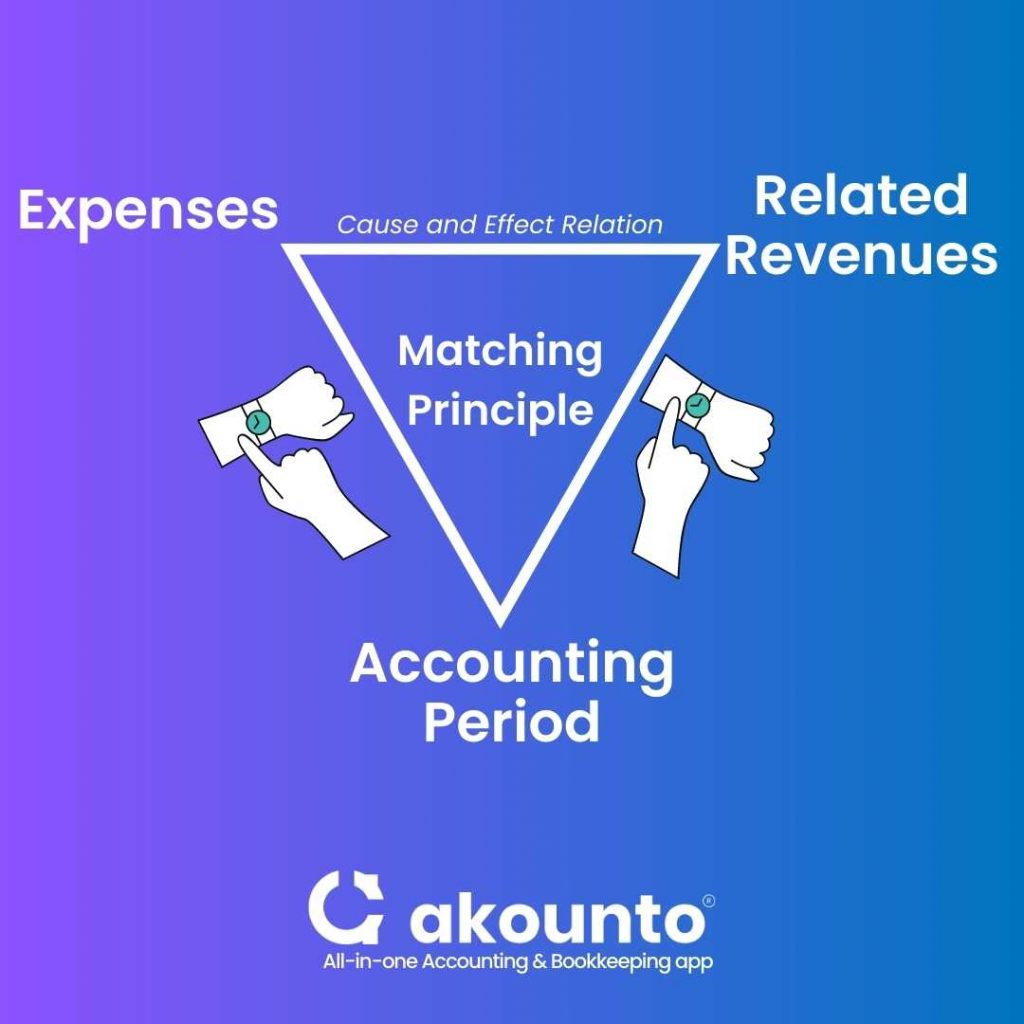

The matching principle is a core concept that guides the preparation of financial statements, such as the income statement, cash flow statement, and balance sheet. The matching principle concept relies on the cause-and-effect relationship that binds expenses and their associated revenues. The basic three factors of this principle are:

- Expenses,

- Related revenues (highlighting cause-and-effect relation), and

- Same accounting period.

The matching principle is similar to the accrual basis of accounting, which states that revenue and expenses are to be recognized as and when they are incurred, irrespective of whether cash is transferred.

The matching principle and accrual accounting are contrary to the cash basis of accounting, where business transactions are recorded based on receipt or payment of cash.

The matching principle applies to small businesses and all the accounts mentioned in a chart of company accounts. This principle ensures that timeliness and true financial reporting are done, forming the bedrock of sound decision-making.

The Importance of the Matching Principle

The matching principle is quintessential for accounting and reporting as it ensures the coherence and accuracy of financial reports where the revenues and expenses have a cause-effect relationship for a given accounting period.

The matching principle states that the business expenses should be related to the revenues generated, thereby minimizing the scope of under-reporting, over-reporting, manipulation of financial statements, and any possible misrepresentation.

Amongst various accounting principles, matching concept and accrual accounting ensures that the timeliness of transactions is maintained and the impact of a transaction should not impact any other accounting period than when it is incurred.

A company’s cash flow statement is based on the matching principle; as the outflow and inflow are matched for a given accounting period, consistency and accuracy are maintained to represent a true and fair picture of financial health for decision-making.

There can be inherent misrepresentation and misreporting if the expenses are recognized for the wrong accounting periods. It will result in inaccurate reporting and can also be deliberately used to manipulate books of accounts, making the whole accounting process unreliable.

With the matching principle, the expense is recorded as and when it is incurred, even if the payment is made, and the related revenue is also recorded even if the money is not received.

Examples

- Where a company has sales representatives who earn commissions, the company should recognize the commission expense in the same period as the sales revenue that the sales representatives generated, even if the commission payment is not made until the following year.

- When a company generates sales revenue during a particular period, the cost of goods sold associated with those sales should be recognized in the same period, even if the company pays for the goods at a later time.

- When a company provides services in November but receives no payment until February, the revenue should still be recognized in November. It ensures that a business’s revenues are reported in the same period as the associated expenses. So, the income statement accurately reflects the cause-and-effect relationship between costs and revenues.

- When a company has a loan and the interest expense is incurred in a particular year, then the interest expense is recorded in the same year. Even in case of a moratorium or payment is made in the next financial year, the interest expense will be recognized in the same year as per the matching principle.

Benefits

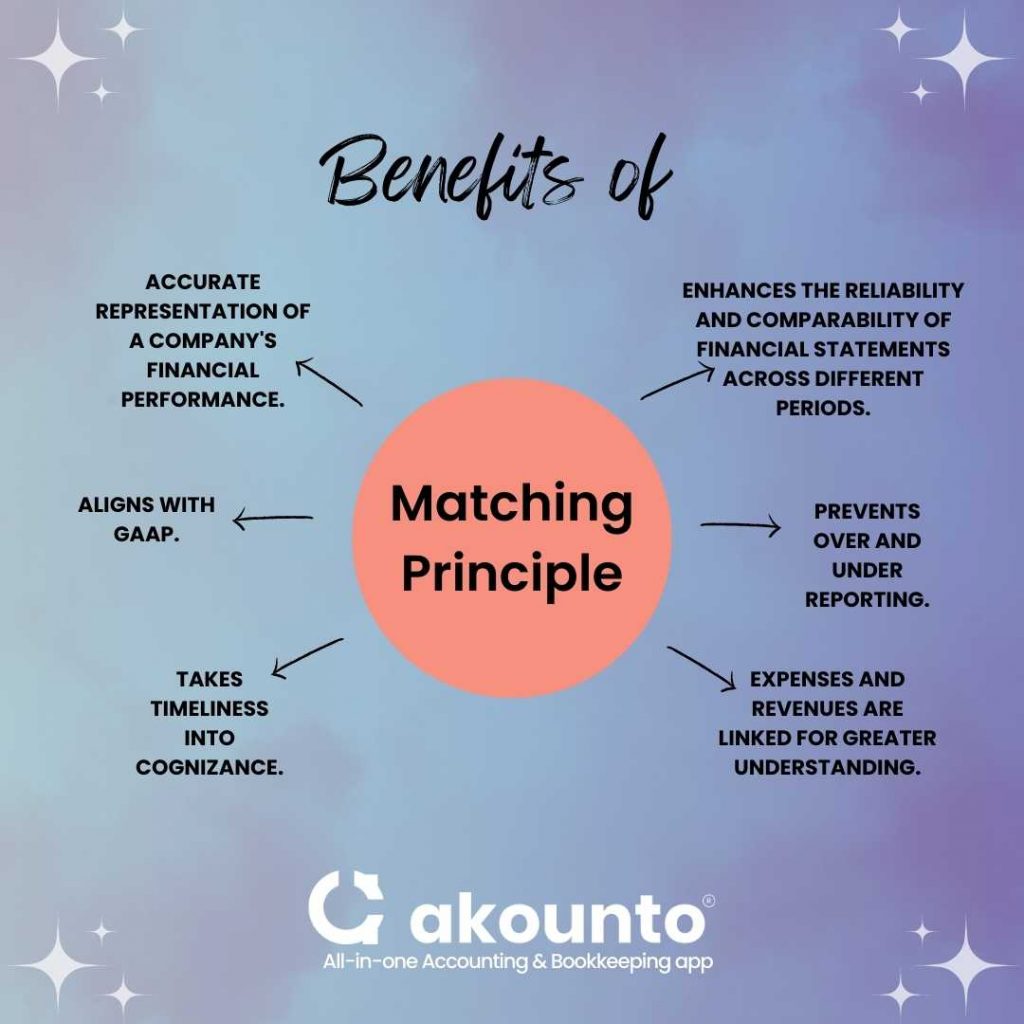

- Provides a more accurate representation of a company’s financial performance over a period of time.

- Allows properly matching expenses with the related revenue generated during the same period.

- Enhances the reliability and comparability of financial statements across different periods.

- It helps businesses to identify and control their costs effectively.

- It helps management to make informed decisions about pricing, cost control, and resource allocation.

- It enables investors and other stakeholders to evaluate a company’s financial health and potential for future growth.

- Aligns with generally accepted accounting principles and reporting standards.

- Facilitates the preparation of tax returns and compliance with tax regulations.

- It helps businesses to comply with regulatory requirements and maintain good standing with financial institutions and creditors.

- Enables companies to demonstrate transparency and accountability to stakeholders, promoting trust and credibility.

Challenges

- Estimating expenses can be difficult, particularly for long-term projects or those with variable costs.

- It can be challenging to identify the specific expenses related to a particular revenue source, particularly in cases where multiple products or services are sold.

- Accrued expenses and prepaid expenses can be difficult to allocate to specific periods, particularly when there are changes in accounting or reporting periods.

- The timing of expenses and revenue can be affected by external factors, such as economic conditions or unexpected events.

- There can be instances where one cannot determine the cause-and-effect relationship between revenue and expenses, particularly in cases where revenue is generated over a long period or by multiple sources.

- The matching principle can result in lower net income in certain periods, which may be challenging for companies under pressure to report strong financial results.

- Adjusting entries may be necessary to match expenses and revenue properly, which can be time-consuming and require specialized accounting knowledge.

- The matching principle may not accurately reflect the financial performance of a business, particularly in cases where expenses are incurred in one period. Still, revenue is recognized in a subsequent period.

Matching Principle Vs. Revenue Recognition Principle?

Revenue recognition recognizes revenue in the income statement when earned, regardless of when payment is received. This accounting principle is important in preparing true and fair financial statements. It ensures that revenue is recognized in the correct period and reflects the revenue the business generates.

The matching principle is concerned with the timing of expense recognition concerning revenue recognition, while the revenue recognition principle is concerned with the timing of revenue recognition. Both principles ensure accurate financial reporting and making informed financial decisions. The difference between the two is as follows:

|

Basis of Difference |

Matching Principle |

Revenue Recognition Principle |

|

Focus |

Expenses are recognized in the same period as the related revenue. |

Revenue is recognized when it is earned, regardless of payment. |

|

Purpose |

Matches expenses with revenue to reflect a cause-and-effect relationship. |

Ensures accurate revenue recognition for financial statements.

|

|

Scope |

This applies to all expenses, including wages, commission, and depreciation. |

Applies only to revenue earned, not expenses incurred. |

|

Application |

Used to prepare income statements and balance sheets. |

Used to prepare an income statement, balance sheet, and cash flow statement. |

|

Benefit |

Helps maintain consistency in reporting revenues and expenses. |

Helps ensure revenue is recognized in the correct period. |

Conclusion

The matching principle is a fundamental accounting concept emphasizing the cause-and-effect relationship between expenses and related revenues in the same accounting period. This principle ensures accurate and reliable financial reporting and is crucial in decision-making, investor evaluation, and regulatory compliance.