What is the Month-End Close Process?

The month-end closing process is a set of activities that companies perform at the end of each month to finalize their financial statements.

The month-end close process involves keeping track of the company’s transactions, inter-company trades, income, expenses, and bank statements and reconciling them. The company prepares its financial reports based on the monthly data collected.

The accounting team then reviews and approves the financial statements of the company. Once the financial statements are finalized and approved, the company “closes the books” for the month, implying no further changes can be made to the financial data for that period.

An efficient month-end close process is essential as it:

- Shows the company’s spending and overall financial health

- Prevents future accounting mistakes

- Creates a standard accounting procedure to streamline accounting systems

- Eases account reconciliations for the future month-end process.

- Sets grounds for an easier and simpler tax filing process

How is a Month-End Close Performed?

Month-end close process has the following basic steps:

- Review and Reconcile Account Balances: The accounting team reviews the account balances as first step, such as bank accounts, accounts receivable, accounts payable, and inventory, to ensure they are accurate and complete. Each journal entry should match the invoice generated or the bill received.

- Post Necessary Adjusting Entries: Make any necessary adjusting entries to correct errors, recognize recurring expenses or revenue, and record accruals. Adjustments are essential to update the discrepancies and accounts for the transactions that have yet to be processed.

- Review Financial Statements: The accounting team ensures the accuracy and completeness of the financial statements and makes any necessary adjustments. There should be no discrepancies in the financial statements, nor should any transaction or economic activity go unaccounted for.

- Obtain Management Approval: The management approves the financial statements, which confirms that they are accurate and reliable.

- Close the Books: No further changes can be made to the financial data for that period once the accounting department closes the books.

For a smooth month-end close process, all working units of the company should follow consistent patterns of financial recordings, such as the generally accepted accounting principles (GAAP).

Performing journal entries for recurring monthly transactions is critical to the month-end close process. These include accrued expenses, amortization, depreciation, loan interest, and prepaid expenses such as insurance premiums.

What Information Does Accounting Need for Month-End Close?

The finance team will require the following financial accounting information to perform the monthly closing process:

- All journal entries made in the general ledger during the month

- Bank statements that could be reconciled with the company’s financial records

- Accounts receivable ledgers to ensure the accuracy of customer balances

- Accounts payable ledgers to ensure the accuracy of the vendor balances

- The inventory count for matching the physical inventory with the financial data

- Accruals and prepaid expenses

- Fixed asset ledgers to reconcile the fixed assets with the balance sheet accounts

- Depreciation and amortization calculations to ensure that they are up-to-date and accurate

- Company’s financial data of expense reports and invoice payments

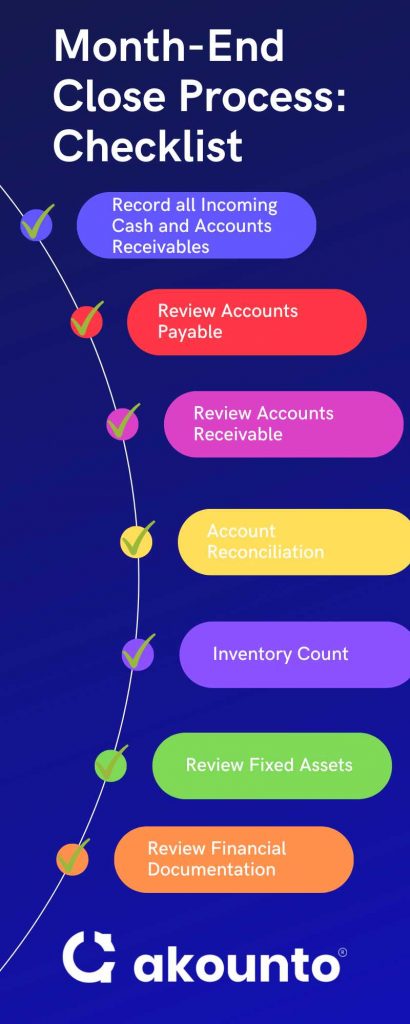

Month-End Closing Checklist For Small Businesses

Here are the areas of a month-end close that small businesses should focus on:

Record all Incoming Cash and Accounts Receivables

Incoming cash from all sources, whether revenue from sales, accounts receivable, bank loans, or invoice payments, should be recorded and matched. Check all the invoices generated during the period. Make sure the company has received the payments.

Cash on the trial balance must correspond with the ending cash balance on the bank statements.

Assume that a small retail store called “Green Goods” wants to keep track of all its incoming cash to monitor its financial performance.

They received a bank loan of $50,000. Green Goods records this transaction in its cash book as “Bank Loan Received,” The corresponding amount of $50,000 is added to its cash balance.

Green Goods sells eco-friendly products to its customers. The store generated invoices worth $40,000 in the last month. Its accounting team matches the invoices generated with the “Invoice Payment Received,” and the corresponding amount is added to their cash balance.

Green Goods also received rent from a tenant who rents a space in their building. When the tenant pays their rent, Green Goods records the transaction in their cash book as “Rent Received,” and the corresponding amount is added to their cash balance.

Review Accounts Payable

The payable balance must conform with the purchases made by the company.

Suppose Green Goods received an invoice of $3,000 for office accessories. However, the payment is due on the 5th of the coming month. So the $3,000 is placed in Accounts Payable, with another entry of the same amount in the expense account.

When the company releases the payment on the due date, an entry will be added to reduce cash by $3,000. At the same time, the Accounts Payable balance will drop by the same amount.

Review Accounts Receivable

The amount owed by the customers, the accounts receivable, must reconcile with the asset or inventory sold by the company.

For example, Green Goods earned $100,000 in revenue the previous month. The system has generated invoices, but payment is due on the 20th of the coming month.

So an accrual entry of $100,000 is made for the revenue, and the same amount is added to the Accounts Receivable account. When the cash is received next month, the Accounts Receivable drops by $10000.

Account Reconciliation

Reconcile intercompany accounts. The accounting data must be consistent in the books of each entity.

According to the IRS, reconciling accounts payable and accounts receivable aligns with the accrual accounting methods.

The company’s internal records should match the external statements, such as credit card and loan statements.

The accounting team will find and fix the error if the quotes do not match.

Assume the retail store ‘Green Goods’ had been issued the $50,000 loan. For the month-end close process, the accounting team verifies the bank loan statement with the company’s internal records, such as the cash balance statement.

Inventory Count

The financial reporting data should match the physical inventory value. A monthly inventory count is integral to the month-end close process as it will reveal discrepancies due to error, damage, or theft.

By counting inventory at the end of each month, businesses can ensure that they have an accurate picture of their inventory levels and values. This information is helpful for better purchasing, production, and sales decisions and provides more accurate financial statements to stakeholders.

Read here about Periodic Inventory System, where inventories are tracked at periodic intervals, the Perpetual Inventory System to monitor the inventories continuously, and the Specific Identification method to track inventories at a micro level, and learn about inventory tracking and valuation.

Suppose Green Goods purchased $60,000 worth of inventory from a supplier at the beginning of the month—the inventory list of 100 units of different electronic products.

The physical count showed that there were 90 units of inventory left, meaning that ten units were sold during the period. The sales records, however, only had the accounting data for five items.

The accounting team investigates the discrepancy and updates the record for the remaining five units sold.

Review Fixed Assets

Businesses distribute fixed asset costs over long periods through depreciation and amortization for accrual accounting and tax filing purposes.

As part of the month-end process, the details of fixed assets, such as initial cost, useful life, current book value, depreciation, and impairment costs, must be accurately recorded.

Assume Green Goods bought a machine for $100,000 at the start of the year. Every month, $20,000 is depreciated from the cost of the device.

The month in question is February, so the accountant will ensure that $40,000 has been depreciated and the current book value of the machine has been correctly placed at $60,000.

Review Financial Documentation

The month-end closing process involves organized and accurate financial records, including the general ledger, total revenue bank statement, income statement, and balance sheet accounts.

Accurate financial records will ensure a streamlined month-end closing process and a more reliable information basis for the company’s financial planning.

Common Challenges in a Month-End Close Process

The month-end close can face the following challenges to its efficiency and the smooth cycle of working:

Manual Nature of the Monthly Closing Process

The biggest challenge a small business owner faces while closing his books is the accuracy of the accounts, whether the general ledger or the revenue and expense accounts. This inaccuracy happens because of the manual nature of most of the company’s activities.

The tasks are tedious and time-consuming and are done by individuals with a high risk of error. The monthly closing process, as a result, takes more time and resources because the books won’t reconcile.

Disconnected Data Management Processes

Let us assume a company keeps the depreciation and amortization calculations for fixed assets in a different system while the cash, checking, and savings accounts data are in a separate accounting system.

The accounting team will face a massive challenge in bringing all the transactions and financial information on the same platform to reconcile.

They will spend extra time and workforce integrating all the cash accounts, account statements, and balance sheets. Even after that, they will have to cross-check for any errors, format the information and find and fill in the missing data.

Compliance and Regulatory Challenges

Companies must comply with various accounting standards and regulations, such as GAAP or IFRS, which can create additional challenges during the month-end close process. Ensuring compliance and staying up-to-date with new rules can be complex and time-consuming.

Petty Cash Fund Reconciliation

Offices have petty cash funds to cover small office costs without going through the formal requisition process. These transactions must be tracked manually by matching the receipts with the withdrawals from the petty cash fund. That is why these transactions carry a high risk of error.

During the month-end closing process, the petty cash fund must be reconciled to ensure that the balance of the fund is accurate. What makes it challenging is that the receipts must be included, and there can be discrepancies between the amounts recorded in the petty cash log and the actual cash on hand.

Lack of a Streamlined Month-End Closing Process

When the members of a company’s finance team may not have defined roles and responsibilities, unnecessary delays and errors may happen when the team needs to know what role they play or what support they need.

For example, multiple team members may work on the same task, or essential lessons may need to be noticed or remembered. It can quickly create delays and errors, leading to financial inaccuracies in the company’s financial statements.

Tips to Improve the Month-end Closing Process

Here are some best practices that a company and its accounting team can adopt for a more efficient and streamlined month-end closing process:

- Accurate Financial Records: Accurate record-keeping is essential for an efficient and smooth month-end close. Ensure all transactions and entries have been correctly recorded in the accounts. Accounting software can go a long way for this purpose.

- Set Deadlines: There should be clear deadlines for each task for the month-end closing process. For example, every department must bring in their financial reports on a specific date, and then the reviewing and cross-checking should be completed within a particular deadline. Setting deadlines ensures the finance team is not wasting time and resources in unnecessary delays, and neither is the workforce burning out in frustration.

- Interdepartmental Communication: Effective communication on financial reporting matters can significantly improve the efficiency and efficacy of the month-end closing process.

- Streamline the Process: By streamlining the work process and defining team roles, the closing process for a specific accounting period can become more efficient, accurate, and timely. Team management software can be of help here too.

- Consolidate and Back up the Accounting Data: Consolidate and compile all the transactions in one place. Instead of keeping the data on paper, backing it up on digital accounting platforms is always better. Consolidation and backup will ensure that your business operations continue despite data loss.

Conclusion

The month-end close process involves reconciling the accounts of a business so that all the payable, receivable, accrual, and bank account balances add up. A month-end closing process is important for legal compliance, ease of tax filing, trust and authenticity of the shareholders, and for tracking internal operations of the business.

Akounto is here to be your accounting department and accelerate tasks associated with the month-end close process, closing accounts right by the closing date.