What is the Specific Identification Method in Accounting?

The Specific Identification method is an inventory valuation method that includes recording and identifying each item in the inventory and its assigned cost.

Companies prefer this method to the average cost, FIFO, and LIFO methods as it allows a business to micromanage the inventory and track sales trends closely.

Companies can use different accounting systems to track inventory costs, but the ultimate goal is to record the individual inventory items and their purchase cost.

Managing inventory costs is a huge challenge for companies. A very high inventory level blocks the working capital, and there are risks of obsolescence, reduced future demand, increasing warehouse cost, etc.

At the same time, insufficient inventory means that in case of a sudden spike in demand, the company will not be able to increase production and take advantage of the business environment. In the worst-case scenario, there could be a stock-out situation when the demand is high.

Inventory management is one of the crucial functions of any organization. Smartly managing inventory can give the advantage of lead production and an optimized supply chain, thereby resulting in reduced cost of production.

This article discusses the details of the specific identification method, how it works, and its merits and demerits for a business with some examples.

How does a Specific Identification Method of Inventory Costing Work?

The specific Identification method works when items in an inventory are individually identified, such as with receipt dates, barcodes, or radio frequency identification tag (RFID). A detailed system of inventory records is required to track every purchased item, the exact cost, and the closing stock.

For a small business, a simple accounting system can work. For large businesses with extensive inventory management, this process can be time-consuming. And so, they will require a more in-depth and complex accounting system to keep an accurate record of different purchases.

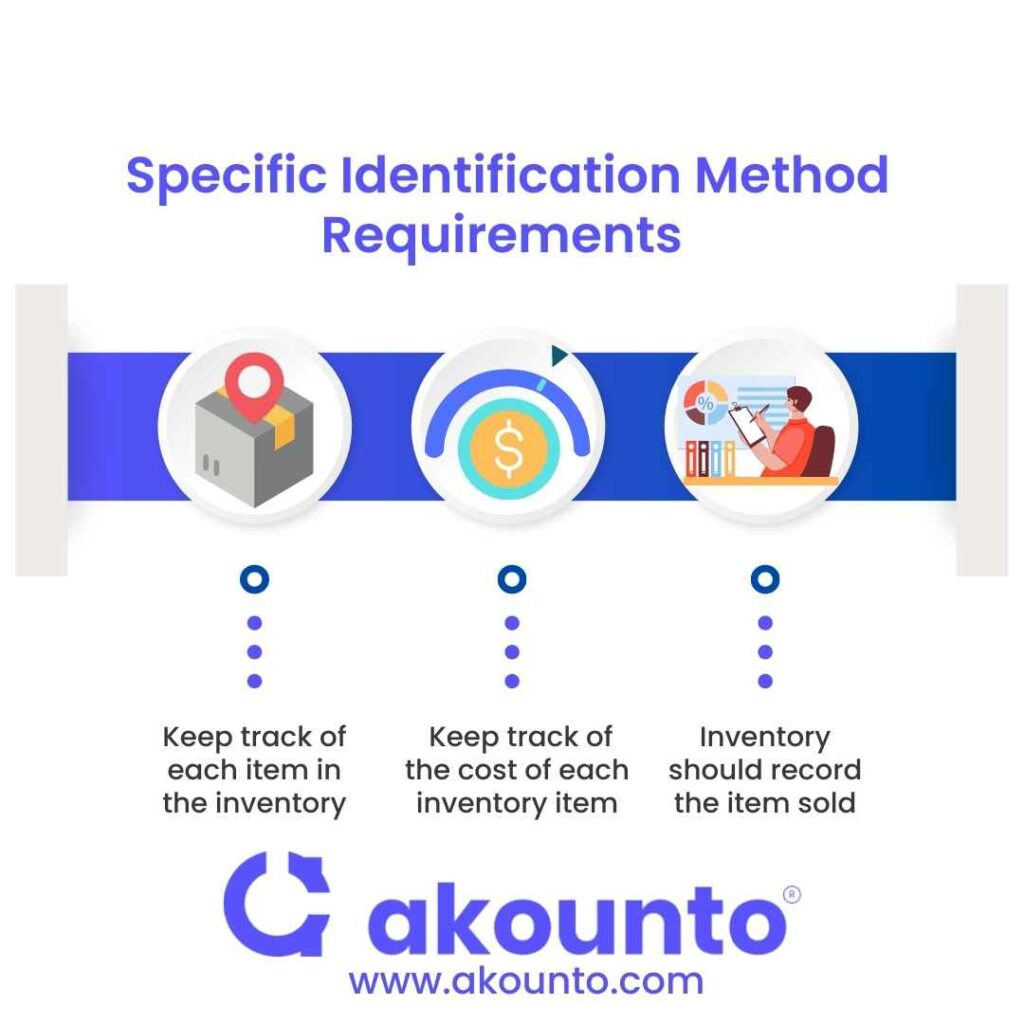

Specific Identification Method Requirements

An accounting system has to fulfill the following requirements to be called a specific identification tracking system:

- Keep track of each item in the inventory

The specific identification method should record every item in the inventory through serial numbers. Each serial number should be specific to the item, and it can be written on a metal or paper label on the product. Radiofrequency identification tags are the modern way of doing so.

- Keep track of the cost of each inventory item.

Each identification serial number should be associated with the assigned cost of the product. The specific identification method should be able to track the cost of each product so that it keeps a record of the sold items and the ones left.

- Inventory should record the item sold.

The specific identification method should automatically relieve the inventory of the cost of the items sold.

Advantages & Disadvantages

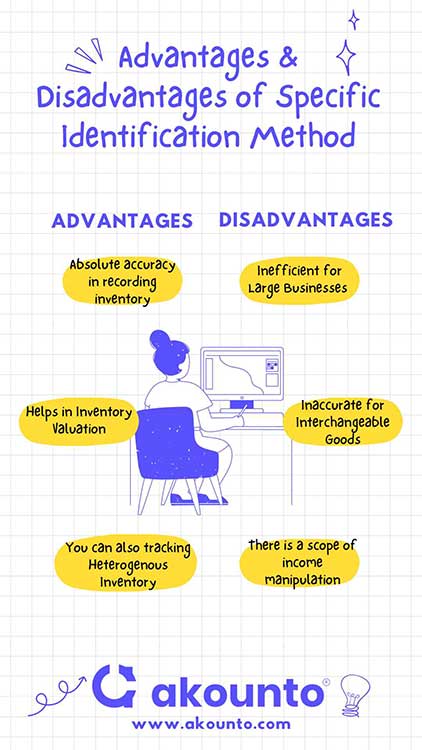

Advantages

- Absolute Accuracy

The most important advantage of the specific identification method for businesses is the high degree of accuracy in accounting. It records the exact number of items in the inventory, the cost of each product, and hence the business’s income, profit, and loss of revenue.

This method is especially important for small businesses, where the smallest number of items in the inventory and the smallest profit or loss make a considerable difference. Also, the specific identification method is more feasible and easily operable for small inventories.

- Inventory Valuation

Under this method, the company’s accounting records reflect the most accurate cost of the total inventory. Owing to the detail of the physical count, the specific identification method accurately calculates the ending inventory cost. Ending inventory valuation is extremely important for taxation and the monetary value of the goods left in the inventory.

- Tracking a Heterogenous Inventory

Accounting methods such as the average cost method better suit the inventories that track homogenous or identical sets of items. The specific identification method ensures each item is tracked individually, which is perfect for businesses dealing with heterogeneous goods.

Disadvantages

- Inefficient for Large Businesses

For large-volume inventories, keeping track of each item can be difficult, especially when a business moves huge volumes daily. Only a few purchased products in a large company’s inventory carry a tag or a serial identification number. This restricts the specific identification method to the high-value items, which can be tracked individually rather easily.

- Inaccurate for Interchangeable Goods

The specific identification method is especially inefficient for interchangeable goods. A serial number identification and tracking system cannot exactly evaluate the shipping and storage costs associated with such products.

- Income Manipulation

This accounting method places the inventory cost and the revenue generated side by side. The total inventory cost is then used for taxation and future business projections. A company can manipulate the year-end income by selling the cheaper items first. This will increase the inventory cost and reduce the Cost of Goods Sold (COGS), in turn reporting more income to the stakeholders and deferring taxes simultaneously.

Examples

1. A car dealer keeps track of every car on his lot. A specific identification system helps him as every car has a unique model, cost price, and sales price. He is hence able to draw exact lines on how much profit a certain model earned him and how much cost his business had to bear from the time the car entered the lot until its purchase.

2. Stock investors use this accounting method for tax harvesting. Let’s say an investor buys shares of a stock at three different prices. He conveniently sells some of them at a higher price and saves the profit. You can choose the highest buying price of your purchased stocks for taxation, reducing the taxable capital gains.

It is, without a doubt, stressful and time-consuming to track inventory when more important tasks of your business await you. Also, only an accounting expert can ensure minimum error. Akounto brings you the best accounting staff to provide professional bookkeeping services.

Sign Up with Akounto and get started with expert accounting services today!