Introduction to Stockholders’ Equity

Stockholders Equity, often interchangeably used with shareholders equity, is a key financial metric that reflects the net value of a company. It represents the remaining assets that would be distributed to shareholders if all the company’s debts were paid off.

This metric is essentially the owners’ equity, the portion of the company’s assets that the equity holders, or shareholders, own outright. It’s calculated by subtracting total liabilities from the company’s total assets.

Owners’ equity is the value of the remaining amount of assets after deducting liabilities. It reflects the net worth attributable to the owners or shareholders of a company. While owner’s equity indicates the ownership interest

Stockholders equity is a critical component of a company’s balance sheet. It plays a significant role in financial analysis, offering insights into the company’s financial stability, operational efficiency, and potential for future growth. Understanding stockholders’ equity is crucial for both business owners and investors as it directly impacts investment decisions and strategies.

Significance of Shareholders’ Equity

Shareholders equity is a key financial metric that holds immense significance for businesses and investors alike. It serves as a clear indicator of a company’s net worth, providing insights into the company’s financial condition and operational efficiency.

One of the key components of shareholders’ equity is retained earnings. These are the net earnings that a company chooses to keep rather than distribute as dividends. Retained earnings are the funds retained and reflect the company’s net income that has been reinvested in the business, contributing to the growth and expansion of the company.

Paid-in capital, another crucial element of shareholders’ equity, represents the funds that shareholders have invested in the company. This includes the money received from the issuance of common stock. The higher the paid-in capital, the more capital the company has to finance its operations and future growth.

Shareholders’ equity is prominently displayed on the balance sheet, one of the key financial statements. It provides a snapshot of the company’s assets and liabilities, offering a comprehensive view of the company’s financial position.

The balance between the company’s assets, including current assets like cash and accounts receivable, and its liabilities provides a clear picture of the company’s net worth. This balance is crucial for the managing director and other decision-makers in the company to make informed strategic decisions.

In essence, shareholders’ equity reflects the company’s financial stability and ability to generate profits. It is a measure of the accumulated retained earnings and the company’s PAT (profit after tax), providing valuable insights into the company’s profitability and growth potential. Understanding the significance of shareholders’ equity is crucial for making informed business and investment decisions.

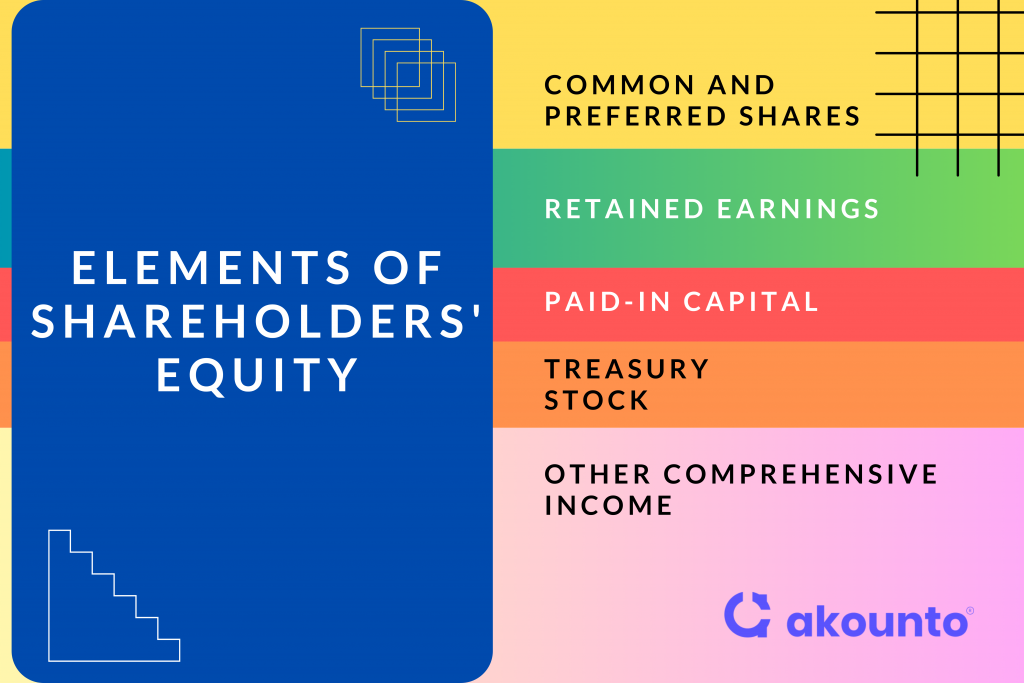

Elements of Shareholders’ Equity

Shareholders’ equity, a critical component of a company’s balance sheet, is composed of several key elements. These elements provide a comprehensive view of the company’s finances and its ability to generate profits and create value for its shareholders.

Common and Preferred Shares

The first element of shareholders’ equity is the share capital, which includes common and preferred shares. Common shares represent ownership in a company and come with voting rights, allowing shareholders to have a say in corporate matters. Preferred shares, on the other hand, do not typically provide voting rights but offer a higher claim on earnings and assets. This means preferred shareholders get paid dividends before common shareholders.

Retained Earnings

Retained earnings are another significant element of stockholders’ equity. A company retains these net earnings after distributing dividends to its shareholders. Retained earnings, reflected in the income statement, are used to reinvest in the business or pay off debt, contributing to the company’s growth and financial stability.

Paid-in Capital

Paid-in capital, also known as contributed capital, represents the funds raised by the company from issuing shares. The excess amount over the par value of the shares that shareholders are willing to pay indicates the market’s confidence in the company’s future prospects.

Treasury Stock

Treasury stock refers to the shares a company has bought back from its shareholders. These shares are considered part of the stockholders’ equity but do not carry voting rights or pay dividends. Companies often buy back shares to increase the market value of remaining shares or prevent other companies from taking over.

Other Comprehensive Income

Other comprehensive income includes all changes to shareholders’ equity that are not a result of transactions with shareholders. These can include unrealized gains or losses from investments, foreign currency translations, and changes in the value of long-term assets.

In essence, stakeholders’ equity is a comprehensive measure of a company’s financial pulse, providing insights into its ability to raise capital, manage assets, and generate cash flow. Understanding these elements is crucial for making informed business and investment decisions.

Calculating Stockholders Equity

Calculating stockholders’ equity is a fundamental aspect of financial analysis, providing a clear snapshot of a company’s financial position. The formula for calculating stockholders’ equity is simple:

Total Stockholders Equity = Total Assets – Total Liabilities

The ‘Total Assets’ include both current and non-current assets. Current assets such as cash, accounts receivable, and inventory can be converted into cash within a year. Non-current assets, on the other hand, are long-term investments, such as property, plant, equipment, and other assets like patents and trademarks.

‘Total Liabilities’ encompass current liabilities, which are due within a year (like accounts payable), and long-term liabilities, such as loans and bonds payable.

A significant component of stockholders’ equity is ‘Retained Earnings.’ The retained earnings formula is:

Retained Earnings = Beginning Retained Earnings + Net Income – Dividends

‘Retained Earnings’ represent the portion of net income retained by the corporation rather than distributed to its owners as dividends.

Other elements that factor into stockholders’ equity include treasury shares and accumulated other comprehensive income. ‘Treasury Shares’ are the company’s shares that it has bought back. At the same time ‘Accumulated Other Comprehensive Income’ includes revenues, expenses, gains, and losses that have not been realized and are yet to be included in the net earnings.

The calculation of stockholders’ equity is typically detailed in a company’s annual report, providing investors and stakeholders with a clear picture of the company’s finances.

Examples

Example 1:

Question: Company A has total assets of $500,000 and liabilities of $200,000. What is the stockholder’s equity of Company A?

Answer: The stockholder’s equity of Company A can be calculated using the formula: Total Assets – Total Liabilities. So, the stockholder’s equity of Company A would be $300,000 ($500,000 – $200,000). This figure would represent the residual value or the assets remaining for the shareholders if the company were to pay off all its liabilities.

Example 2:

Question: Company B has a share capital of $100,000, retained earnings of $50,000, and treasury stock worth $10,000. What is the total equity or stockholders’ equity of Company B?

Answer: Company B’s total equity or stockholders equity would be calculated as Share Capital + Retained Earnings – Treasury Stock. Therefore, the stockholder’s equity of Company B would be $140,000 ($100,000 + $50,000 – $10,000).

These examples demonstrate how stockholders’ equity provides a snapshot of a company’s financial health, indicating the company’s net value from the shareholders’ perspective.

Book Value and Market Value of Shareholders’ Equity

The book value and market value of shareholders’ equity are two different ways to assess a company’s worth, each providing unique insights.

The shareholders’ equity book value is derived from a company’s financial statements. It is calculated by subtracting the company’s total liabilities from its total assets. This value represents the net assets that the shareholders would theoretically receive if all the assets were sold and all its debts were paid off. The book value is often considered a company’s intrinsic or ‘true’ value.

The market value of shareholders’ equity, known as market capitalization, is determined by the current stock market. It is calculated by multiplying the current market price of a company’s stock by the total number of outstanding shares. The market value fluctuates based on supply and demand dynamics in the stock market and reflects investors’ perceptions of the company’s prospects.

While the book value is based on historical cost and accounting principles, the market value is forward-looking and incorporates investor sentiment and future expectations. Both values are important for investors; the book value provides a baseline, while the market value offers insight into how the market perceives the company’s performance and potential.

Future Financing and Shareholders Equity

Shareholders’ equity is crucial in a company’s future financing decisions. It is a key indicator of a company’s financial health and stability, which potential investors and lenders scrutinize before making investment or lending decisions.

A strong balance sheet, characterized by high shareholders’ equity, signals a company’s ability to generate profits and retain earnings. This increases the company’s attractiveness to investors and its capacity to secure loans at favorable terms.

A weak balance sheet, reflected by low or negative stockholders’ equity, may signal financial distress, making it difficult for the company to attract investors or secure loans. In such cases, the company may need to explore alternative financing options or strategies to improve its balance sheet.

In essence, shareholders’ equity is a barometer of a company’s financial strength, influencing its future financing opportunities and strategies.

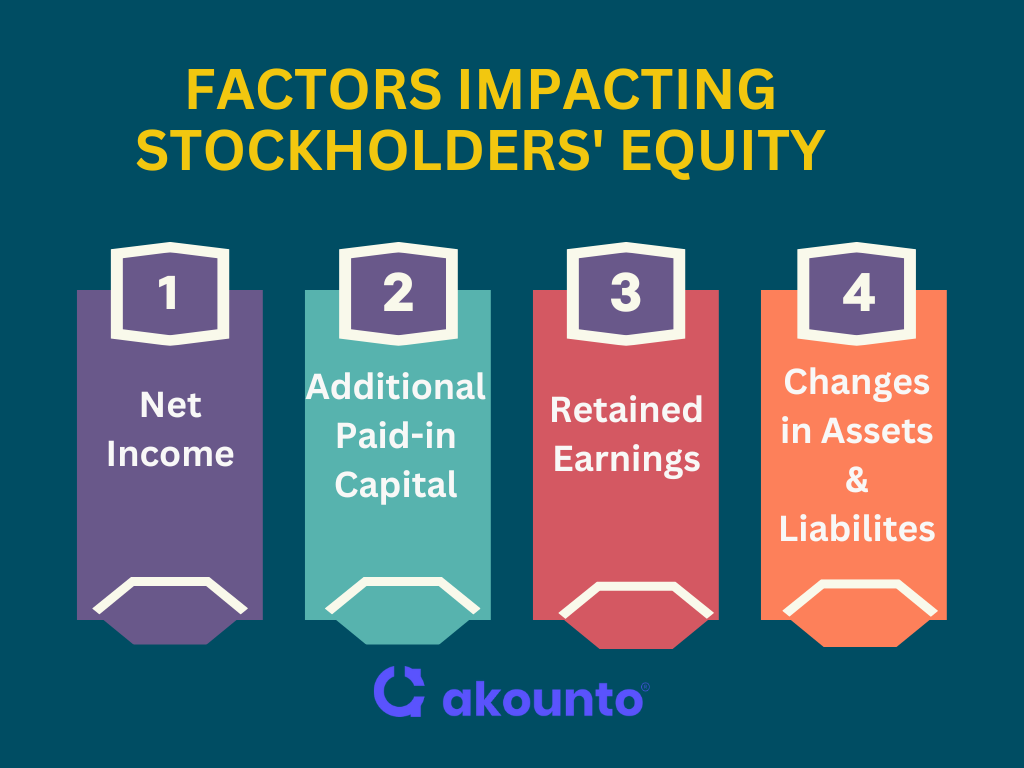

Factors Impacting Stockholders’ Equity

Net Income

Net income, the profit a company earns after deducting all expenses, taxes, and costs, directly impacts stockholders’ equity. A higher net income increases retained earnings, thereby increasing shareholders’ equity. Conversely, a net loss reduces retained earnings and stockholders’ equity.

Additional Paid-in Capital

Additional paid-in capital, the excess amount investors pay over the par value of shares, also affects stockholders’ equity. When a company issues new shares and raises more capital than the face value of these shares, it increases the additional paid-in capital and, consequently, the stockholders’ equity.

Retained Earnings

Retained earnings, the portion of net income not distributed as dividends, are reinvested in the business, contributing to stockholders’ equity. The more a company retains and reinvests its earnings, the higher its stockholders’ equity.

Changes in Assets and Liabilities

Changes in a company’s assets and liabilities also impact stockholders’ equity. An increase in assets or a decrease in liabilities boosts stockholders’ equity, while a decrease in assets or an increase in liabilities reduces it.

Conclusion

Stockholders’ equity is vital to a company’s balance sheet, offering key insights into its financial health. By understanding and analyzing this element on the balance sheet, stakeholders can make informed decisions about the company’s value, performance, and prospects.

All-in-one accounting software, Akounto, assists businesses in maintaining accounting records and generating useful financial reports for informed decision-making . To know more, visit our website today.