Tax deductions reduce the taxable income and reduce the tax bill. Tax deductions can be claimed for loan interest, equipment, rent, insurance, utilities, etc. Tax deduction also known as “tax write-off” helps small business owners, self employed, sole proprietors, and partnerships to lower their tax liability.

To avail an expense deduction from the taxable income, there are IRS criteria which must be met in addition to keeping detailed and accurate records, itemized billings, payment records and authorisations, etc.

The deductible expenses can impact a businesses bottom line, but understanding and adhering to the IRS guidelines can be daunting to the uninitiated. A small business owner can leverage expenses like professional gees, vehicle use for an employee, wages paid, office expenses, etc. to optimize your tax liability. There are many industry-specific deductions that can offer additional financial benefits. Some examples of industry specific deductions are: hiring certain categories of employees, research and development expenditure, credits, deductions for opening a plant/ factory in a rural or semi-rural area, etc.

By availing deductions, it impacts the cash flow of a business and makes room to reinvest more into business growth.

Soniya Malik, Founder and CEO of Akounto, says:

”As a CEO, I've seen firsthand the transformative power of leveraging technology for financial management. I highly recommend investing in robust accounting software. These tools not only streamline your record-keeping but also provide invaluable insights into your business's financial health. Additionally, utilizing cloud storage solutions such as Google Drive, Dropbox, or OneDrive for storing digital copies of receipts, invoices, and other crucial documents can safeguard your records against loss or damage and ensure easy access when needed. Moreover, for new business owners, hiring a professional tax consultant is crucial. A tax expert can navigate the complexities of tax laws, ensuring accurate and timely filings while maximizing your deductions and credits. This strategic approach not only saves you time and stress but also optimizes your financial efficiency, allowing you to focus on growing your business."

Common Small Business Tax Deductions

Home Office Deduction

If your home is exclusively for business purposes or you are using a portion of your house for business purposes, then, home office deduction can significantly reduce your taxable income.

The IRS criteria to avail the home office deduction states that the condition o f”exclusive” and “regular” usage of the space as a principal place of business.

Exclusive and Regular Use:

- Exclusive Use: You can only claim that space which is solely used for business purposes, a corner of your living room/ dining room can qualify for this deduction but a kitchen table that is used for both home and business purposes cannot qualify for this deduction.

- Regular Use: If the business place is used twice or thrice a week, or used infrequently or not regularly then it cannot qualify for home office deduction. This does not mean that it should be used daily, but there should be a regularity.

Principal Place of Business:

- If you are working from multiple locations, then your home-office should be the main center of business operations, thereby becoming the principal place of business. It should be the place of control or guide or coordinating the whole business operations, thereby a place from where significant business activities are conducted.

Methods to Calculate the Deduction:

- Simplified Method:

- Simplified method results in a lower deduction as compared to the regular method. The simplified method for home-office deduction allows for $5 per square foot deduction of your home used for business, up to a maximum of 300 square feet. This method is straightforward and simple.

- Regular Method:

- In the regular method, you calculate the percentage of home area used for the business. Home office deduction in the regular method is calculated by dividing the area of the home office by the total home area. This method can also be apple to calculate other home-office related expenses like mortgage interest, utilities, repairs, and insurance​.

- Direct Expenses: Costs directly related to the business space, such as painting or repairs, are fully deductible.

- Indirect Expenses: Costs for maintaining the entire home, like utilities or rent, are deductible based on the percentage of the home used for business​.

- In the regular method, you calculate the percentage of home area used for the business. Home office deduction in the regular method is calculated by dividing the area of the home office by the total home area. This method can also be apple to calculate other home-office related expenses like mortgage interest, utilities, repairs, and insurance​.

Documentation:

- Record of home and office expenses

- All the receipts and bills received at home address but are related to business expenses.

- Proof of exclusive business use.

- Use IRS Form 8823 to file and claim home office deduction.

Vehicle Expenses

If you use your vehicle for business purposes, you can deduct related expenses from your taxable income. The IRS allows two methods for calculating vehicle expenses: the standard mileage rate and the actual expense method.

Standard Mileage Rate

- Multiply the business miles driven during the year by the standard mileage rate. For 2023, this rate is $0.655 per mile​.

- This method simplifies record-keeping as you only need to track the miles driven for business.

Actual Expense Method

- Track all costs associated with operating the vehicle, including gas, oil, repairs, tires, insurance, registration fees, and lease payments. Deduct the portion of these expenses that relates to business use​​.

- To use this method, maintain detailed records of all vehicle-related expenses and the percentage of time the vehicle is used for business.

Commuting vs. Business Use

- Only business-related travel is deductible. Commuting expenses between your home and your regular place of business are not deductible.

Record-Keeping

- Keep a log of your business miles, including the date, mileage, and purpose of each trip. This can be done manually or with an app that tracks mileage​​.

- Report vehicle expenses on Schedule C if you’re a sole proprietor.

“Optimizing your tax deductions is not just about saving money—it’s about reinvesting those savings back into your business for growth and innovation. Effective tax management can be a game-changer for small businesses.”

— Soniya Malik, CEO and Founder of Akounto.

Office Supplies and Equipment

Office supplies and equipment are essential for the day-to-day operations of a business, and their costs are fully deductible in the year they are purchased. These deductions help reduce taxable income and can include a wide range of items.

Office Supplies

- Examples of Deductible Supplies: Pens, paper, printer ink, postage, and other consumables used within the year​​.

- Record-Keeping: Maintain receipts and detailed records of all office supplies purchased to substantiate deductions during tax filing​.

Office Equipment

- Examples of Deductible Equipment: Computers, printers, furniture, and other long-term assets used in the business​​.

- Depreciation vs. Immediate Deduction: While small businesses can often deduct the full cost of equipment under Section 179 in the year of purchase, larger or more expensive items may need to be depreciated over several years. Section 179 allows for up to $1,080,000 in deductions for qualifying property​.

Software and Subscriptions

- Software purchases and subscriptions directly related to business operations are also deductible. This includes accounting software, project management tools, and other digital services.

Record-Keeping and Compliance

- Detailed documentation of all purchases, including invoices and receipts, is crucial.

- For larger equipment, records of the depreciation schedule and ensure compliance with IRS regulations​

Travel Expenses

Travel expenses incurred while conducting business activities away from the primary business location are deductible. These expenses can include transportation, lodging, and meals, provided they meet IRS guidelines.

Transportation

- Airfare and Public Transport: Costs for flights, trains, buses, and taxis used for business travel are deductible. Ensure to keep tickets and receipts as proof of travel.

- Personal Vehicle Use: Deductible using either the standard mileage rate or actual expense method if the vehicle is used for business travel.

Lodging

- Hotels and Accommodations: Expenses for overnight stays are deductible if the travel is for business purposes. The cost should be reasonable and not extravagant​.

- Documentation: Detailed records, including hotel bills and the business purpose of the trip.

Meals

- Business Meals: You can deduct 50% of the cost of meals during business travel. The meal must be directly related to the active conduct of business or associated with a business meeting.

- Record-Keeping: Save receipts and note the business purpose of the meal, the participants, and the topics discussed.

Incidental Expenses

- Other Deductible Expenses: Tips, dry cleaning, internet access fees, and other necessary expenses incurred during travel are also deductible​​.

- Travel Itinerary: Maintain a travel itinerary or log that details the dates, locations, and business purposes of each trip

Employee Salaries and Benefits

Employee salaries and benefits are significant expenses for businesses, but they are also fully deductible. Understanding what qualifies for deductions can help small business owners optimize their tax savings.

Salaries and Wages

- Deductible Salaries: Salaries, wages, bonuses, and commissions paid to employees are deductible as long as they are reasonable and necessary for business operations. The IRS requires that the compensation be for services actually rendered and not excessive​.

- Payroll Taxes: Employer-paid Social Security, Medicare, and federal unemployment taxes are also deductible​​.

Employee Benefits

- Health Insurance: Premiums paid for employee health insurance plans are fully deductible. This includes coverage for medical, dental, and vision insurance.

- Retirement Plans: Contributions to employee retirement plans, such as 401(k) or SIMPLE IRA plans, are deductible. This includes both the employer’s contributions and administrative fees​.

- Other Benefits: Other deductible benefits include life insurance, education assistance, transportation benefits, and wellness programs. Ensure all benefits comply with IRS regulations to qualify for deductions​.

Contract Labor

- Independent Contractors: Payments made to independent contractors are deductible. If payments exceed $600 in a year, you must issue a Form 1099-NEC to the contractor and the IRS​.

Documentation and Compliance

- Record-Keeping: Maintain accurate payroll records, including payment details, employee information, and the nature of the work performed. Ensure compliance with IRS guidelines to substantiate these deductions​​.

- Form W-2: For employees, report wages and withheld taxes using Form W-2. For contractors, use Form 1099-NEC​​.

Depreciation of Assets

Depreciation allows businesses to spread the cost of tangible assets over their useful life, providing a valuable tax deduction over several years.

Basics of Depreciation

- Eligible Assets: Depreciable assets include machinery, equipment, buildings, vehicles, and furniture used in the business. Land is not depreciable​​.

- Useful Life: The IRS assigns a useful life to different types of assets, which determines the period over which the asset can be depreciated. For example, computers typically have a useful life of five years, while commercial buildings have a useful life of 39 years​​.

Depreciation Methods

- Straight-Line Depreciation: Straight line depreciation method spreads the cost evenly over the asset’s useful life and is the simplest and most common method​​.

- Declining Balance Method: This method accelerates depreciation, allowing larger deductions in the early years of the asset’s life. The double-declining balance method is commonly used for this purpose​.

Special Depreciation Options

- Section 179 Deduction: This allows businesses to deduct the full cost of qualifying assets in the year they are placed in service, up to a limit of $1,080,000 for 2023. This deduction is limited to the business’s taxable income and cannot create a net loss​.

- Bonus Depreciation: Businesses can take advantage of bonus depreciation to deduct a large percentage (currently 100%) of the cost of new and used assets in the year they are placed in service. This applies to assets like machinery, equipment, and furniture​​.

Documentation and Compliance

- Depreciation Schedules: Maintain detailed depreciation schedules for each asset, including the date of purchase, cost, and depreciation method used. This documentation is critical for accurate tax reporting and compliance​​.

- Form 4562: Use this form to report depreciation and amortization expenses to the IRS. Ensure all calculations are accurate and supported by proper documentation

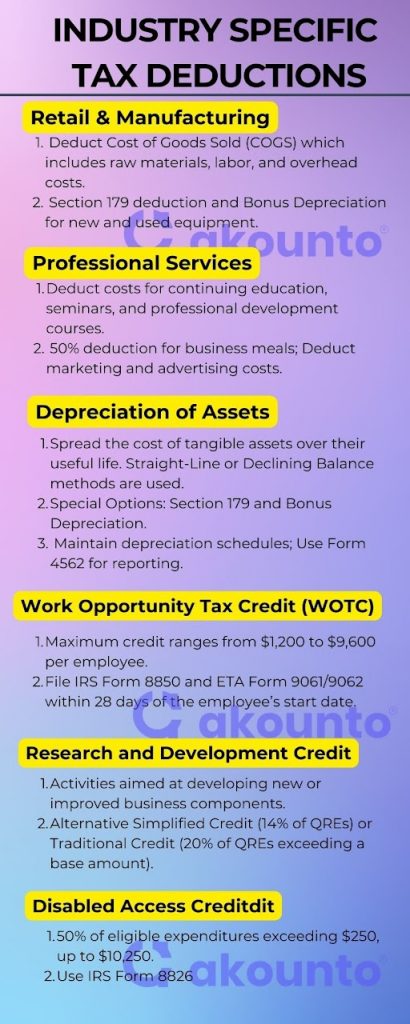

Specific Deductions for Certain Industries

Different industries have unique tax deductions available to them, tailored to their specific needs and operational expenses. Understanding these deductions can provide significant tax savings for businesses in various sectors, such as retail, manufacturing, and professional services.

Retail and Manufacturing

Businesses in the retail and manufacturing sectors have access to several industry-specific deductions that can help reduce their taxable income.

Inventory Costs

- Cost of Goods Sold (COGS): Retailers and manufacturers can deduct the cost of goods sold, which includes the cost of raw materials, labor, and overhead costs associated with producing or purchasing goods for sale. Accurate record-keeping of inventory purchases and sales is essential for calculating COGS​​.

Manufacturing Equipment

- Section 179 Deduction: Allows businesses to deduct the full cost of qualifying equipment and machinery purchased and placed in service during the tax year, up to a limit of $1,080,000 for 2023. This deduction is particularly beneficial for manufacturers investing in new machinery​.

- Bonus Depreciation: Businesses can also take advantage of bonus depreciation to deduct 100% of the cost of new and used equipment in the year they are placed in service. This applies to items like manufacturing machinery and equipment​ ​.

Utilities and Rent

- Utility Expenses: Costs for electricity, water, gas, and other utilities used in the manufacturing process are fully deductible. Keep detailed records of utility bills and the portion used for business purposes​.

- Rent: If you rent a facility for manufacturing or retail operations, the rent payments are fully deductible as a business expense​ .

Repairs and Maintenance

- Repairs and Maintenance: Costs incurred for repairing and maintaining manufacturing equipment and retail premises are deductible. This includes expenses for fixing machinery, painting, and general upkeep​.

Tax Forms

- Form 4562: Used to report depreciation and amortization expenses for equipment and machinery.

- Schedule C (Form 1040): Used to report COGS, utility expenses, rent, and repairs and maintenance expenses.

Professional Services

Professional services businesses, such as law firms, accounting practices, and consulting agencies, also have access to specific tax deductions that cater to their unique operational needs.

Education and Training

- Continuing Education: Costs for continuing education, seminars, webinars, and professional development courses are deductible if they maintain or improve skills required for the business. This includes tuition, registration fees, and associated travel expenses​​.

- Professional Publications: Subscriptions to trade journals, professional magazines, and other industry-related publications are fully deductible​​.

Client and Business Development

- Meals and Entertainment: Business meals with clients and potential clients are 50% deductible, provided the meals are directly related to the active conduct of business. Entertainment expenses are generally not deductible unless they qualify under specific IRS exceptions​.

- Marketing and Advertising: Costs for marketing, advertising, and promoting the business, including website development, social media advertising, and traditional media campaigns, are fully deductible​.

Professional Fees

- Legal and Accounting Fees: Fees paid to lawyers, accountants, and other professionals for services directly related to the business are deductible. This includes costs for tax preparation, legal advice, and financial consulting

Office Supplies and Equipment

- Office Supplies: Items such as paper, pens, printer ink, and other consumables used in the daily operations are fully deductible​​.

- Office Equipment: Depreciation of office equipment like computers, printers, and furniture can be deducted. Small businesses may also use Section 179 to deduct the full cost in the year of purchase​​.

Tax Forms

- Form 4562: Used to report depreciation and amortization expenses for office equipment.

- Schedule C (Form 1040): Used to report education and training expenses, meals and entertainment, marketing and advertising expenses, professional fees, and office supplies.

Work Opportunity Tax Credit (WOTC)

The Work Opportunity Tax Credit (WOTC) is a federal tax credit available to employers who hire individuals from certain targeted groups who face significant barriers to employment. This credit encourages workplace diversity and facilitates access to good jobs for American workers.

Eligible Employees

- Targeted Groups: These groups include qualified IV-A Temporary Assistance for Needy Families (TANF) recipients, veterans, ex-felons, designated community residents, vocational rehabilitation referrals, summer youth employees, food stamp recipients, Supplemental Security Income (SSI) recipients, long-term family assistance recipients, and qualified long-term unemployment recipients​​.

Credit Calculation

- Maximum Credit: The maximum tax credit ranges from $1,200 to $9,600 per employee, depending on the targeted group and the number of hours worked during the first year of employment.

- Percentage of Wages: Employers can claim a percentage of the first-year wages paid to these employees. Generally, the credit is 40% of the first $6,000 paid to the employee during the first year of employment for employees working at least 400 hours per year​​.

Documentation

- Forms Required: Employers must file IRS Form 8850, Pre-Screening Notice and Certification Request for the Work Opportunity Credit, and ETA Form 9061 or 9062 to the state workforce agency within 28 days of the employee’s start date to claim the WOTC.

- Certification: The state workforce agency must certify that the employee belongs to one of the targeted groups before the employer can claim the credit​.

Research and Development (R&D) Credit

The Research and Development (R&D) Credit, also known as the Research Tax Credit, incentivizes businesses to invest in innovation by offering a tax credit for qualifying research activities. This credit is designed to stimulate technological advancement and support the development of new products and processes.

Qualifying Activities

- Eligible Activities: Qualifying activities must be intended to develop new or improved business components, such as products, processes, software, techniques, formulas, or inventions. The activities must involve a process of experimentation and be intended to eliminate technical uncertainty​.

- Qualified Research Expenses (QREs): These include wages for employees engaged in R&D, supplies used in the R&D process, and a portion of contract research expenses​.

Credit Calculation

- Alternative Simplified Credit (ASC): Businesses can claim the ASC, which equals 14% of the QREs that exceed 50% of the average QREs for the three preceding tax years. If there are no QREs in the prior three years, the credit is 6% of the QREs for the current year.

- Traditional Credit: Alternatively, businesses can claim a credit equal to 20% of the QREs exceeding a base amount, which is determined based on a fixed percentage of the company’s average gross receipts for the prior four years​.

Documentation

- Forms Required: Use IRS Form 6765, Credit for Increasing Research Activities, to calculate and claim the R&D credit. Detailed records of all qualifying activities and expenses must be maintained to support the credit claimed​.

Disabled Access Credit

The Disabled Access Credit is a tax credit aimed at helping small businesses comply with the Americans with Disabilities Act (ADA) by making their facilities accessible to people with disabilities. This credit reduces the financial burden of improving accessibility.

Eligible Expenses

- Qualifying Expenses: Expenses that qualify for this credit include those incurred to remove barriers that prevent a business from being accessible to or usable by individuals with disabilities. This includes the cost of modifying facilities, acquiring or modifying equipment, and providing interpreters or other auxiliary aids​.

- Eligible Businesses: Small businesses with gross receipts of $1 million or less or 30 or fewer full-time employees can claim this credit​.

Credit Calculation

- Maximum Credit: The credit covers 50% of eligible expenditures that exceed $250 but do not exceed $10,250, resulting in a maximum credit of $5,000 per year​​.

Documentation

- Forms Required: Use IRS Form 8826, Disabled Access Credit, to claim this credit.

- Maintain detailed records of all qualifying expenses and ensure they meet the ADA requirements​.

Importance of Accurate Records

- Documentation of Expenses: Maintaining detailed records of all business expenses is essential for substantiating deductions. This includes receipts, invoices, and bank statements related to business transactions​​.

- Separation of Personal and Business Expenses: Keep personal and business expenses separate by using dedicated business bank accounts and credit cards. This helps ensure that only legitimate business expenses are deducted​​.

- Record Retention: The IRS recommends retaining records for at least three years from the date the tax return was filed or two years from the date the tax was paid, whichever is later. For certain situations, such as claims for bad debt deductions or worthless securities, records should be kept for seven years​.

Conclusion

Understanding and utilizing tax deductions can significantly lower your tax liability, providing vital savings for small business growth. Maintain accurate records, adhere to IRS guidelines, and consider professional advice to maximize these benefits and ensure compliance.