What is Variable Cost?

A company’s variable cost are expenses that are proportionate to the volume of production. Variable expenses are used in calculating break even point.

An example of variable expenses are:

- Higher consumption of raw material with the increase in production volume.

- More workers are employed to get more output per day.

- With increased production, the price of packaging, storing, and warehouse cost are also higher.

- Similarly when there is low output, that will also result in less consumption of utilities like electricity.

The more goods a company produces, the higher would be the variable costs and with less production, the variable cost will also be less.

Businesses rely on variable cost accounting to determine the cost per unit produced of their products or services, which can help them make informed pricing decisions and evaluate the profit margin.

As an important aspect of cost accounting, variable costs can also help businesses forecast future expenses and help make adjustments to their operations to control costs.

Variable cost is a component of total costs which are incurred to create a product. Total cost can be calculated on “per piece” or “per unit” basis and can also be calculated in dollar terms and also for the whole order-size.

The average variable costs of a new project generally include raw materials, packaging costs, delivery, wages, etc.

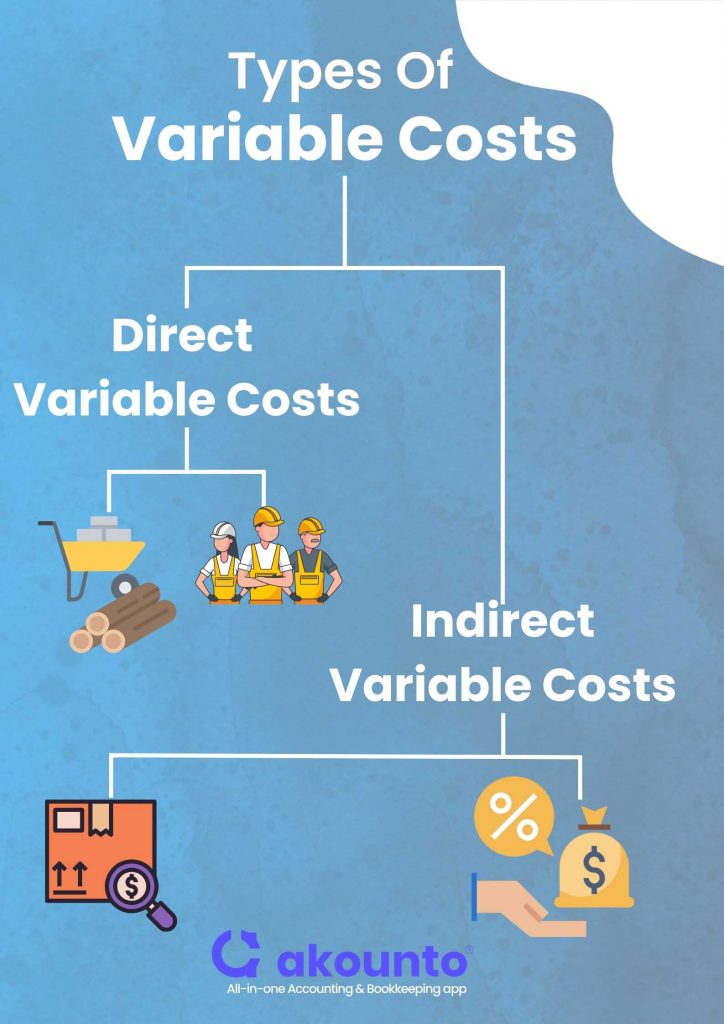

Types of Variable Costs

Direct Variable Costs

Direct variable costs are directly linked to the production or sale of a product or service, and the costs change per the changes in sales or production volume.

The direct variable costs are recorded in the cost sheet as a part of the COGS (cost of goods sold) and are deducted from revenue to calculate gross profit.

Example of direct variable costs

- Direct labor costs – refer to the wages and benefits paid to workers who are directly involved in producing goods and services, such as assembly line workers, machine operators, and technicians.

- The cost of raw materials – refers to the materials utilized in the manufacturing process, such as cloth, wood, steel, or plastic, to create the final product for a business. Businesses have to search, order, purchase, and maintain a stock of these raw materials.

Indirect Variable Cost

Indirect variable costs are expenses that fluctuate with changes in sales or production volume but cannot be not directly traced to a specific product or service. Businesses incur these costs to maintain their operations, and they are recorded as a part of operating expenses.

Examples of indirect variable costs:

- Packaging and shipping costs – are costs incurred in delivering the finished products to the customers. These may include variable expenses such as fuel expenses, packaging material for units produced, transit insurance, vehicle maintenance costs, unit sold, etc.

- Utility costs – are variable costs that may fluctuate with usage, such as water, gas, electricity, waste disposal, heating, sewage, supplies, materials for administrative purposes, etc.

- Sales commissions and other charges – A commission is a form of compensation awarded to salesmen based on sales generated by them. Fees and associated charges are based on the usage of a product or service—for instance, credit card transaction fees.

Variable costs generally increase based on the number of goods sold, transactions done, or orders processed.

Importance of Variable Cost

Having a solid understanding of a business’s variable cost per unit completed is important due to the reasons given below:

- Price determination: Businesses strive to set competitive prices for their goods or services to recover manufacturing costs and earn sales profits. To do this, they must account for variable and fixed costs. Performing variable cost analysis can help better grasp the input costs for production and what it needs to collect in revenue per unit to ensure a business is earning money.

- Break-even point determination: The break-even point is the point of production or sales at which a business’s total costs are equal to its total revenue, meaning there is no profit or loss. Businesses can leverage variable cost analysis to calculate exactly how many items are needed to see to break-even and the number of units they need to sell to earn a specific amount.

- Determine profit margins: The business’s gross margin, net income, and profits are calculated using a combination of fixed and variable costs.

- Separate fixed costs: Variable cost analysis can help separate variable and fixed costs by identifying the costs that change in proportion to changes in production, making it easier for businesses to understand their cost structure better and make informed decisions on the employment of resources, sales volume, and pricing for their profitability goals.

- Growth and expansion planning: Variable costs play an integral role in future planning and budgeting for a business. For instance, a company wants to double its output next year to scale revenue. It must be aware of the proportion of fixed and variable costs as a part of the total cost.

How to Calculate Variable Cost?

Formulae of Total Variable Cost

A company’s total cost (TC) is the sum of both the total variable costs (TVC) and total fixed costs (TFC). The simplest formula for calculating a company’s variable cost is;

Total Variable Costs Formula = TC – TFC

Alternatively, the variable cost can be calculated by summing up the cost of materials, direct labor, and other variable expenses.

Variable Costs = Total Cost of Materials + Total Cost of Labor + Other Variable Expenses

Here, the total cost of materials is the direct cost of the raw materials used in the production process. The total cost of labor is direct labor costs in the production process, such as wages, salaries, benefits, and payroll taxes. Other variable expenses include direct shipping costs, packaging, etc., which vary based on the level of production or sales.

Another formula to calculate the total variable cost (TVC) is:

Total Variable Cost Formula = Total Quantity of Output x Variable Cost per Unit of Output

Here the total quantity of output is the number of units produced by the business, while variable cost per unit of output is the cost incurred per unit produced.

The Formula of Average Variable Cost

Calculating the average variable cost is useful in assessing how variable costs are changing (if they are rising or falling) as the company continues to grow. It ensures there are no inefficiencies where the variable costs offset the benefit of higher output.

The formula to calculate the average variable cost (AVC) is:

Average Variable Cost Formula = Total Variable Costs / Total Quantity of Output

After calculating variable costs, businesses often apply them to conduct a break-even analysis of a firm.

Formula of Break-even Analysis

The formula to calculate the Break-even analysis is:

Break-even analysis formula = Fixed costs/Selling price per unit – Variable cost per unit

Numeric Variable Cost Examples

Example 1: Company A manufactures 100 shirts daily. Calculate the total variable cost of 100 units produced based on the data below.

- Cost of direct materials (cloth, buttons) per unit: $8

- Cost of direct labor per unit: $4

- Fixed costs (overhead) per unit: $2

Solution: First, find out the total cost of production per unit:

Cost of Direct material + Cost of Direct labor + Fixed Cost = 8 + 4 + 2 = $14

Next, calculate the variable costs by applying the Total Variable Cost formula = Total Quantity of Output x Variable Cost per Unit of Output

So, the variable cost of producing 100 shirts per day is => 100 x $14 = $1,400

Example 2: Company X expects to sell 10,000 units at $15 per unit. Calculate the break-even point. The direct material cost is $3, the direct labor cost is $2, and the fixed costs are $15,000 per year.

Solution:

Step 1: calculate variable costs by summing up the direct material and labor costs. We get => 3 + 2 = $5

Step 2: determine contribution per unit, which is the Selling price per unit – Variable cost.

We get => $15 – $5 = $10

Step 3: Apply the Break-even analysis formula = Fixed costs/Selling price per unit – Variable cost per unit.

The Break-even point of Company X is => 15,000/10 = 15,00

So, Company X will be in no profit or loss situation if it sells up to 1,500 units. But this quantity is enough only to overcome its fixed costs.

Selling beyond 1,500 quantities will help the firm earn profits. It will be equal to the contribution per unit for every additional unit sold beyond 1,500.

Variable Cost vs. Fixed Cost

Every business incurs two types of costs: fixed costs and variable costs.

Read this article for a comprehensive understanding of fixed and variable costs. Here are a few points for quick reference.

| Basis of Comparison | Fixed costs | Variable costs |

| Meaning | Fixed costs are expenses that do not change per unit of production | Variable expenses are directly related to each product a company produces or service it delivers. |

| Incurrence of cost | Fixed costs are definite and are incurred irrespective of whether the units are produced. | Variable costs are expenses incurred only when the units are produced. |

| Impact on profit | Higher production reduces fixed costs as the costs can be spread over larger units, resulting in a lower fixed cost per production unit. | There is no impact on the profit with the production level in case of variable costs. |

| Examples | Some common fixed cost examples are rent, property taxes, salaries, etc. | Variable cost examples include piece-rate labor, production supplies, credit card fees, etc. |

Tips to Effectively Manage Variable Costs for Small Businesses

- Supplier Discount: Businesses can ask suppliers for a discount by purchase volume. The larger the volume of raw materials, the bigger could be the supplier’s discount as they would be interested in this deal to earn profits.

- Set up a savings account: If you have smartly budgeted and ended up with a little extra post-sales, deposit the amount in a savings account. The business can draw from this money during the months when the business expenses are higher than usual.

- Invest in the production process: Carefully study the production process and see which processes the business can automate to improve efficiency. For example, chatbots can be deployed to answer customers’ FAQs.

- Compare actual spending to estimated costs: Monthly, compare your spending to your estimated costs. Note if you were over or under budget for each expense category. Then assess where you can shift some of your money over or even away from the variable expenses fund.

Wrapping Up

Variable costs are a good indicator of how the costs are changing to produce new items as the business grows. Understanding the nature of these costs and how they impact the current and projected revenue can help a business be better prepared to navigate the evolving market forces and redirect spending toward essential areas to achieve sustainability and long-term growth.

Get the latest accounting information at Akounto and explore how deploying our accounting software can unlock your business potential.